As of Friday, September 5, 2025, the average 30-year fixed mortgage rate dipped to 6.29%, the lowest in 11 months. The decline comes as markets brace for the Federal Reserve to announce a rate cut in the coming weeks. While the prospect of cheaper borrowing costs has fueled optimism, affordability remains under severe pressure: national home prices are still elevated, and median incomes fall well short of what’s needed to buy in most states.

Homeownership has long been a cornerstone of the American Dream. It is not just a symbol of stability and pride, but also one of the surest ways to build wealth and climb the social ladder. Unfortunately, multiple factors have converged in recent years, making entry into the residential market out of reach for many.

Americans, especially those looking for their first home, find it extremely difficult to find something that suits their needs and fits their budget. Rising home prices, stagnant wages, and limited inventory have forced many to put off their dreams of owning a home. The sharp increase in housing costs, driven by a combination of factors such as low interest rates, high demand, and a shortage of homes available for sale in the past decade, has prevented many from entering the housing market. The volatile job market, rising living costs, and increased student debt have thwarted or significantly delayed the younger generations’ plans to buy a home.

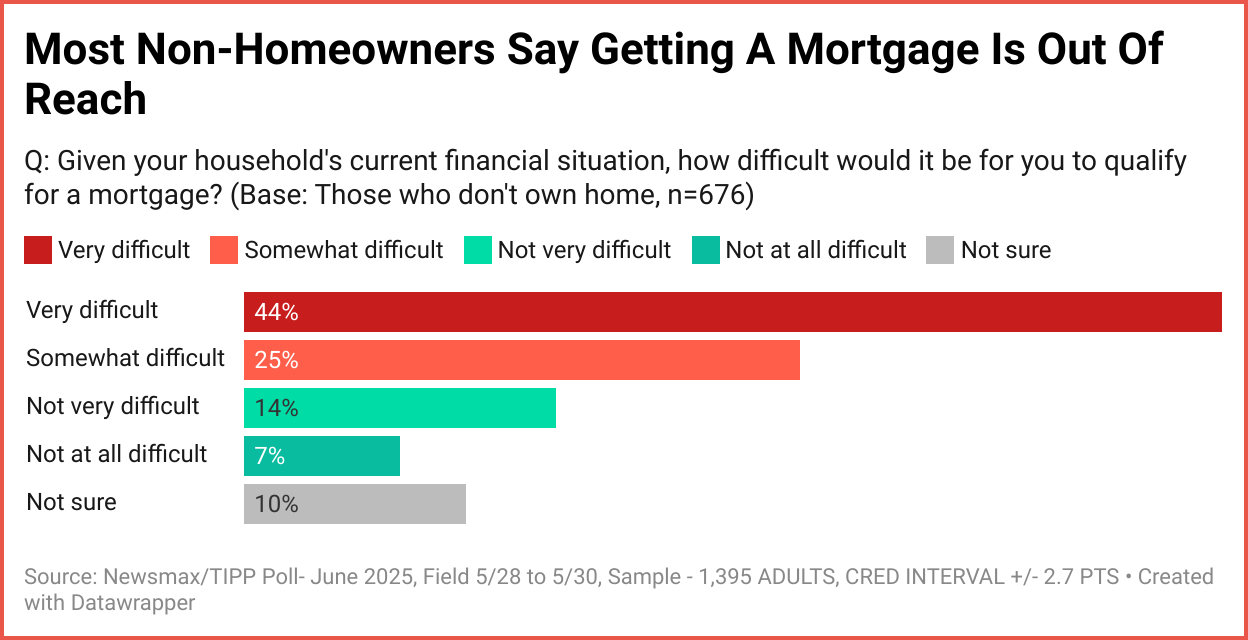

Our recent survey underscores what many families already feel daily: homeownership is harder to reach than ever before. To understand the scope and depth of the situation, Newsmax/TIPP Poll conducted a nationwide survey. The results paint a grim picture: Americans dream of owning a home, but for many, it remains out of reach.

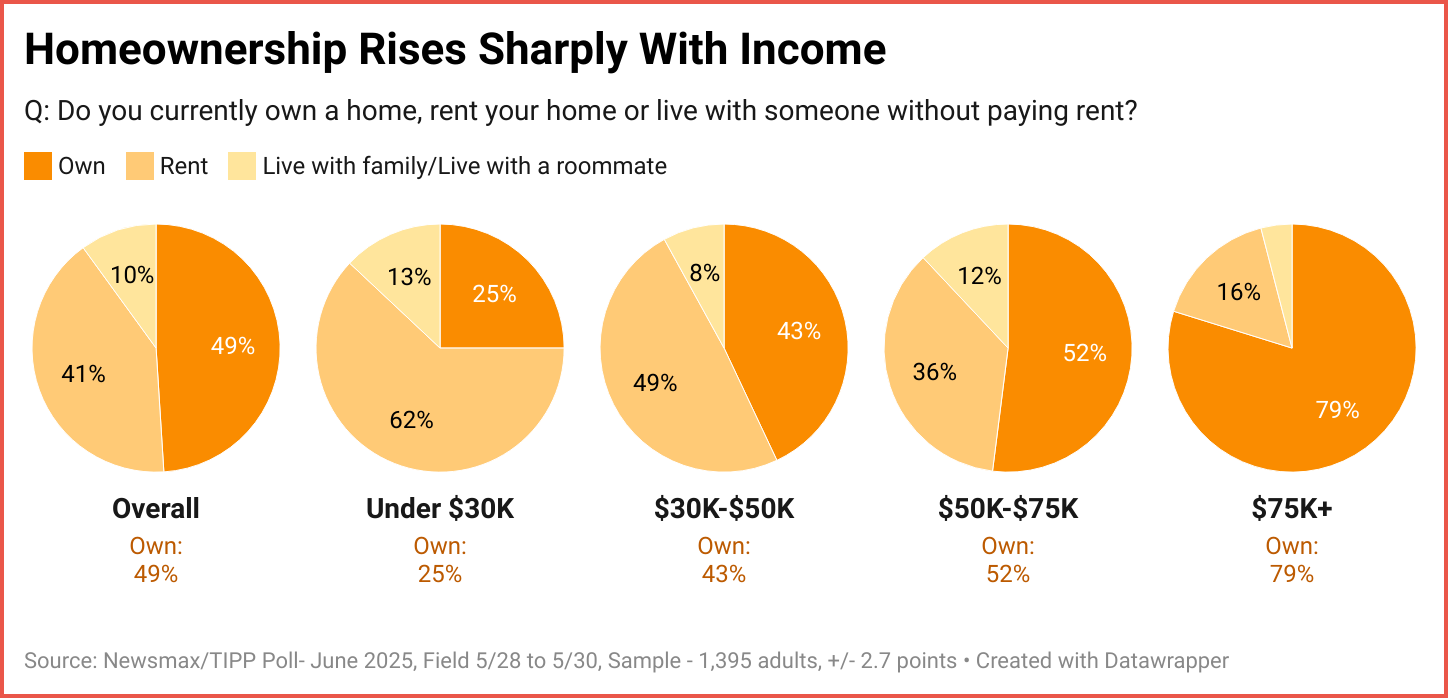

About half (49%) of those who participated in the survey already owned a home. Two-fifths (41%) were currently renting and a tenth lived with family or had a roommate. While half of the respondents owning a home presents a pleasant picture, the fact is, home ownership is directly related to income. For instance, 79% of the $75K-and-above income bracket owned a home, while only a quarter of those in the below $30K income group did. The wide disparity points to the difficulty faced by average American households in accessing the housing market.

While renting is the only option left to many, it often burdens the household budget without the long-term benefits of owning property. When Americans are forced to rent well into their 30s and 40s, the wealth gap between homeowners and non-homeowners continues to widen.

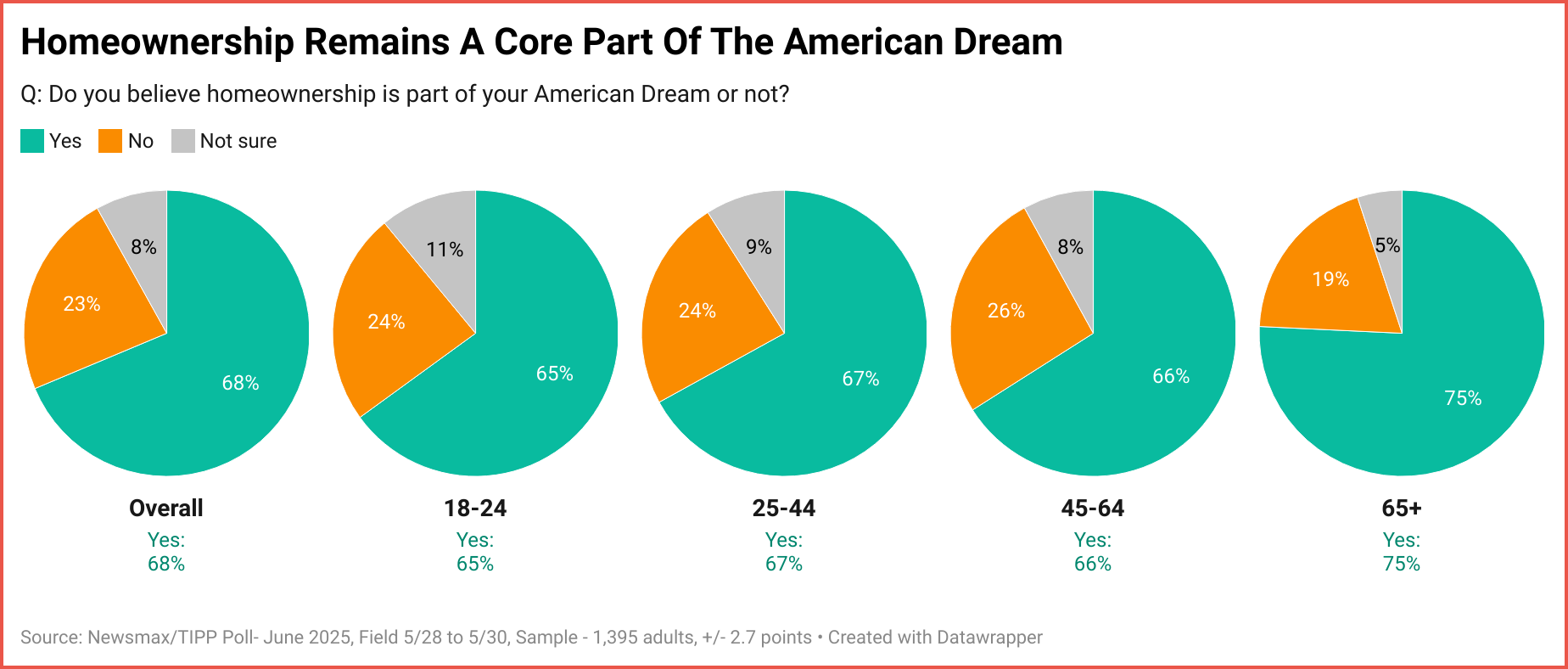

A clear majority of the Newsmax/TIPP Poll survey respondents indicated that owning a home was indeed part of their American Dream. The generational gap does not seem to have affected this particular issue, with only a 10-point difference between the youngsters (18–24-year-olds) and seniors.

Interestingly, the survey found that the desire to own a home is directly correlated with income levels. While 83% of the top income bracket ($75k+) considered it part of their American Dream, the numbers fell to 57% among the below 30k income bracket, clearly denoting the difficulty faced by those with lesser means looking to purchase a house.

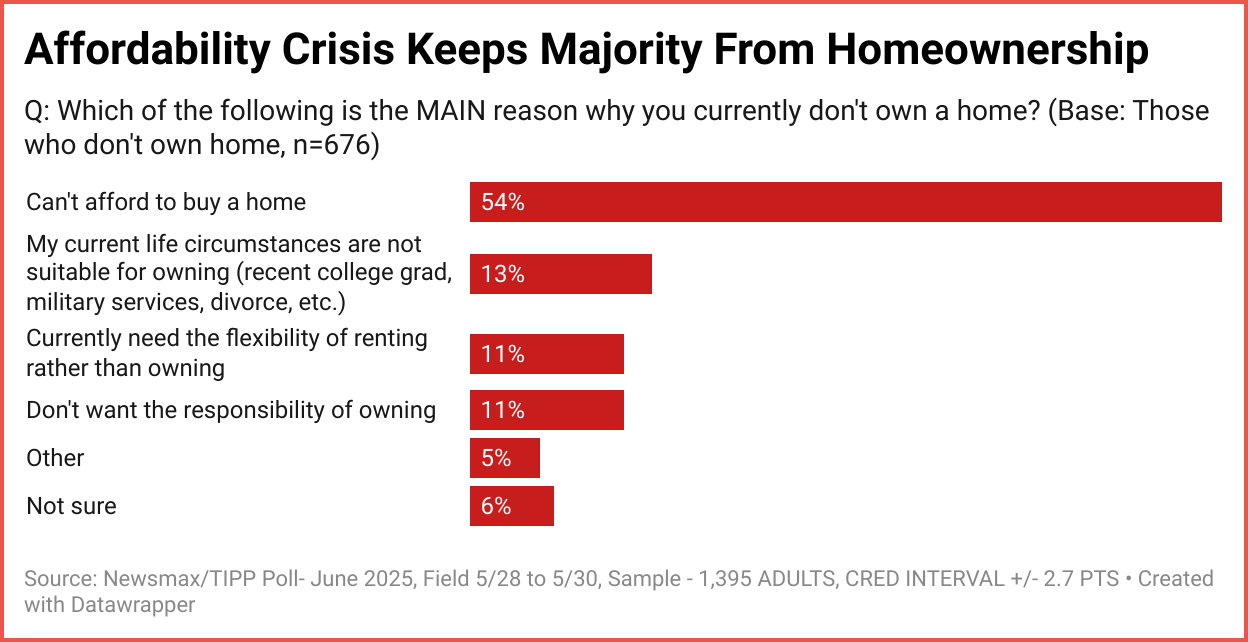

The lack of affordable housing, skyrocketing prices, and the wide demand-supply gap have forced many individuals and families to put off buying. The inability to buy in an area of their choice has trapped many in low-income areas, limiting access to better schools, job opportunities, and safer neighborhoods. The high prices and steep down payments keep more than half of those who took part in the survey from becoming homeowners.

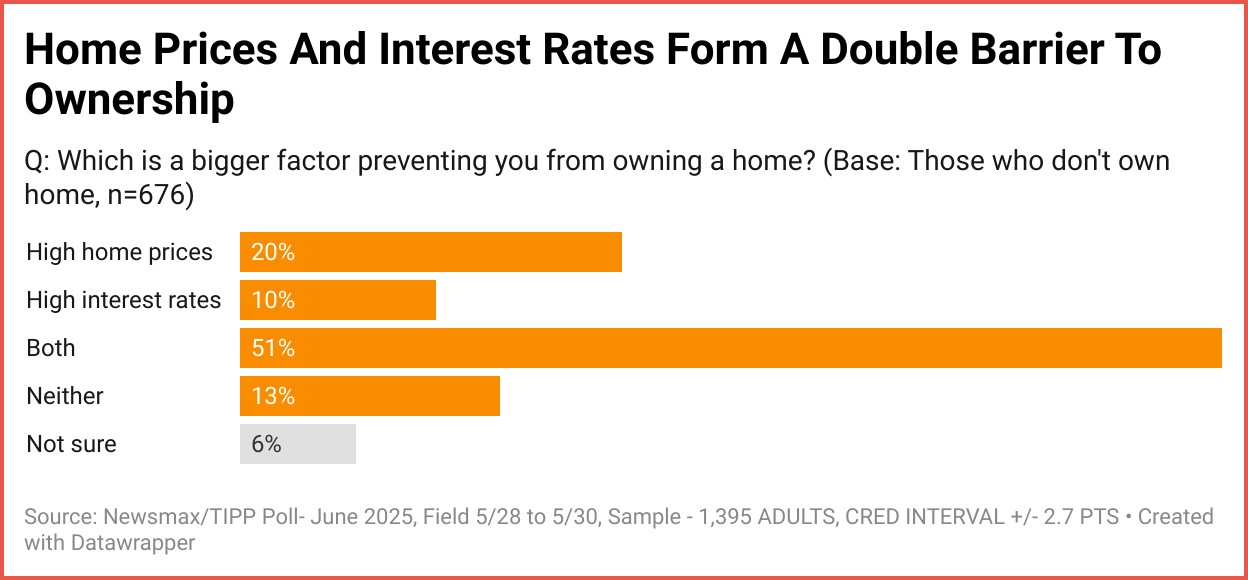

High interest rates create a double whammy. With high inflation leading to skyrocketing living costs, the threat of a recession, and stagnant wages, many cannot commit to long-term mortgage payments at current rates.

💡 Like this analysis?

Get exclusive TIPP Poll insights for just $99/year.

Unfortunately, not just the viability of a mortgage in the long run is dissuading many households. A significant portion of those who participated in the Newsmax/TIPP Poll stated that, given their current financial situation, it would be extremely difficult to qualify for a mortgage.

The current trend could destabilize American society in the long run. If a chunk of the population remains locked out of the housing market, the generational transfer of wealth will be increasingly skewed toward the affluent and further exacerbate wealth inequality. A shrinking middle class and little leeway for social mobility would have a detrimental effect on the economy as well as the social fabric of the country. Unless economic policies and political will correct the course, owning a home will become a privilege reserved for a select few and tarnish a core pillar of American life.

The Fed’s expected rate cut could bring further relief to mortgage borrowers, lowering monthly payments and unlocking pent-up demand. But unless more homes are built, cheaper financing may simply reignite bidding wars and push prices even higher. For millions of families, the American Dream of homeownership will depend not just on the Fed’s next move. It will also hinge on whether policymakers can finally close the supply-demand gap that keeps so many locked out of the market.

🧠 TIPP Investing Weekly

Week Ending: September 5, 2025

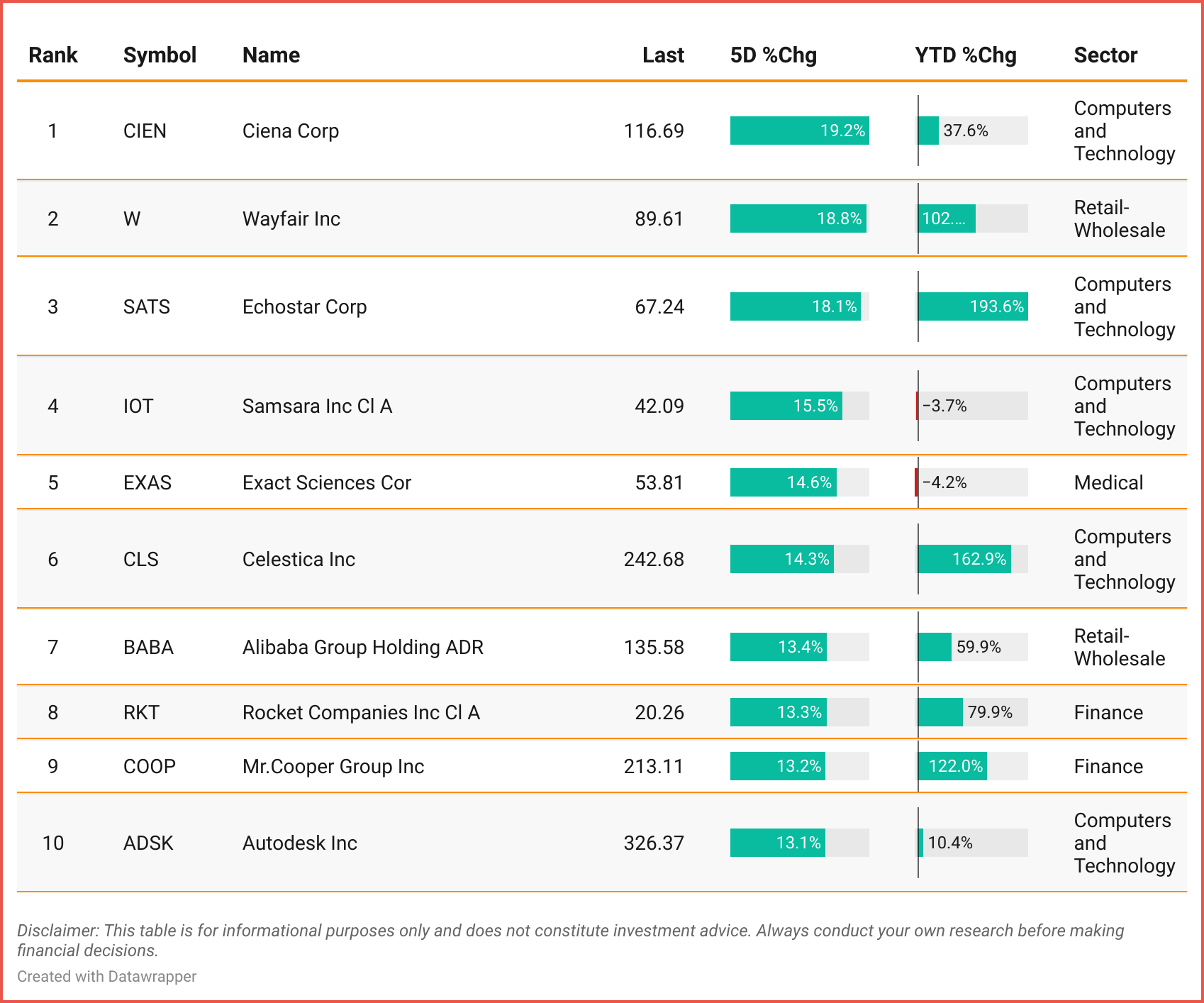

🧾 Top 10 Stocks This Week

A data-driven look at the 10 biggest winners, all above $20 and 1M in volume.

Tickers: CIEN| W | SATS | IOT | EXAS | CLS | BABA | RKT | COOP |ADSK

🔍 Stock to Watch: CIEN

Ciena Corp. provides optical networking equipment, software, and services through four segments: Networking Platforms, Platform Software & Services, Blue Planet Automation, and Global Services. Its portfolio spans optical transport, packet switching, analytics, and cloud-native automation tools.

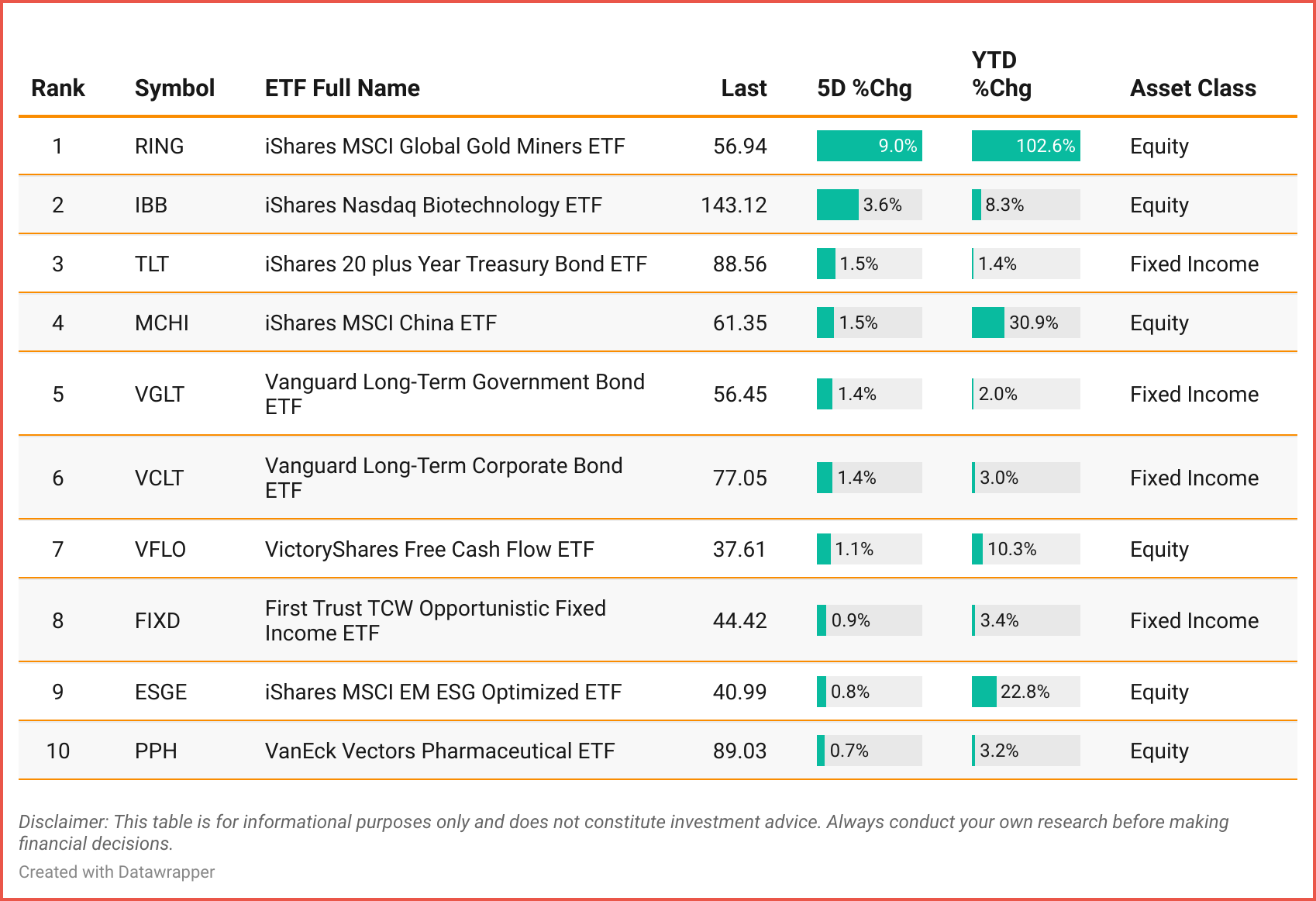

📊 Top 10 ETFs This Week

A data-driven look at the 10 best-performing ETFs, all above $20 in price, with over 300K in average volume and $ 250 M+ in assets.

Tickers: RING | IBB | TLT | MCHI |VGLT |VFLO|FIXD |ESGE |PPH

📈 ETF to Watch: RING

iShares MSCI Global Gold Miners ETF tracks global equities of companies primarily engaged in gold mining.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events This Week

🟧 Wednesday, September 10

08:30 – Producer Price Index (PPI) (Aug)

Wholesale inflation measure.

10:30 – Crude Oil Inventories

Weekly change in U.S. crude stockpiles.

13:00 – 10-Year Note Auction

Investor demand for government debt.

🟨 Thursday, September 11

08:30 – Core CPI (MoM) (Aug)

Consumer inflation excluding food & energy.

08:30 – CPI (YoY) (Aug)

Annual inflation rate.

08:30 – CPI (MoM) (Aug)

Monthly consumer inflation.

08:30 – Initial Jobless Claims

Gauge of new unemployment filings.

13:00 – 30-Year Bond Auction

Investor demand for long-term Treasuries.