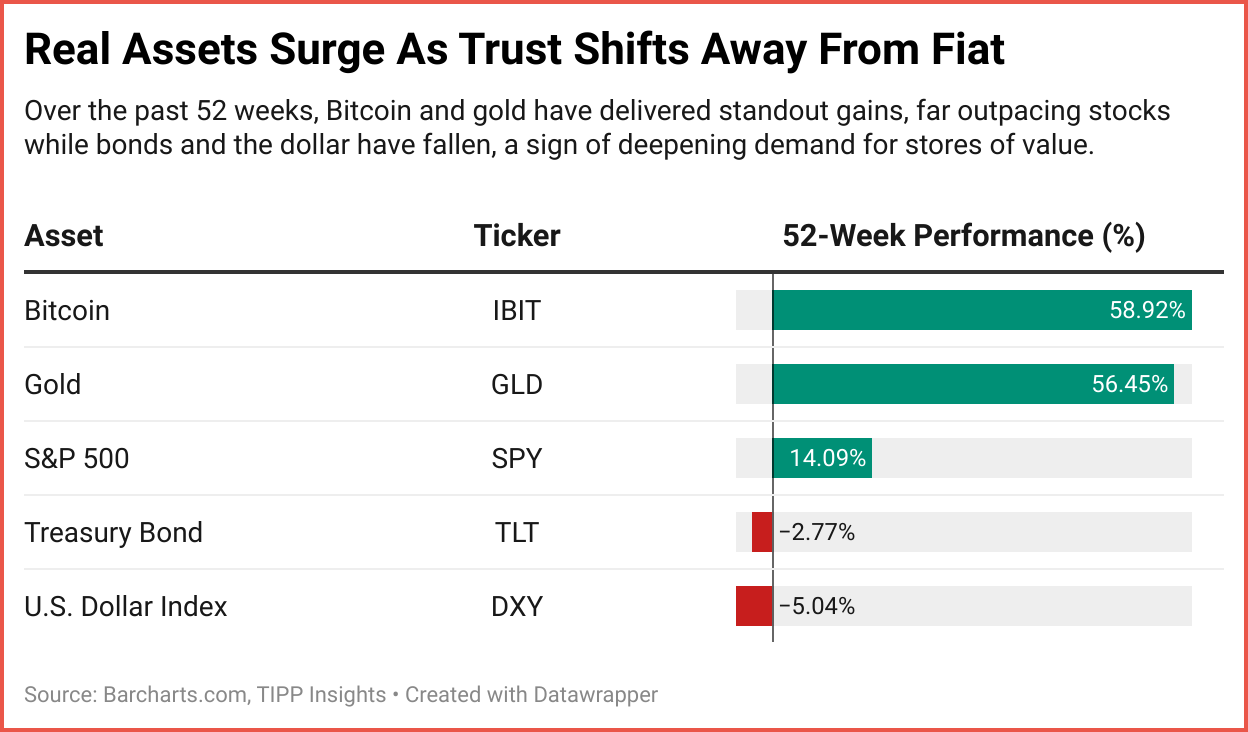

2025 has been nothing short of a golden year. Gold has rocketed more than 60% since January, smashing records and defying conventional wisdom. Some forecasts now predict that the price of gold could climb to $5,000 an ounce in 2026. But the real story isn’t just about price.

What’s going on beneath the surface?

In an era of persistent inflation concerns, gold is often seen as the public’s hedge — a timeless refuge against rising prices and eroding purchasing power. But a 60% surge goes far beyond a simple inflation story. Something larger is driving this rally.

Some of the usual explanations are certainly in play. Mounting trade tensions, geopolitical flashpoints, and fears of a slowing global economy have all driven investors toward traditional safe-haven assets. Central banks, wary of currency volatility and debt overhangs, have steadily increased their gold holdings. And retail investors, spooked by market swings, have poured into gold-backed ETFs at a record pace. In fact, ETF inflows surged 880% year-over-year in September alone, reaching $14 billion. This was the largest monthly total on record. That surge shows how quickly mainstream investors are shifting back toward gold as confidence in other assets wavers.

Yet even taken together, these factors don’t fully explain the magnitude or velocity of this year’s rally.

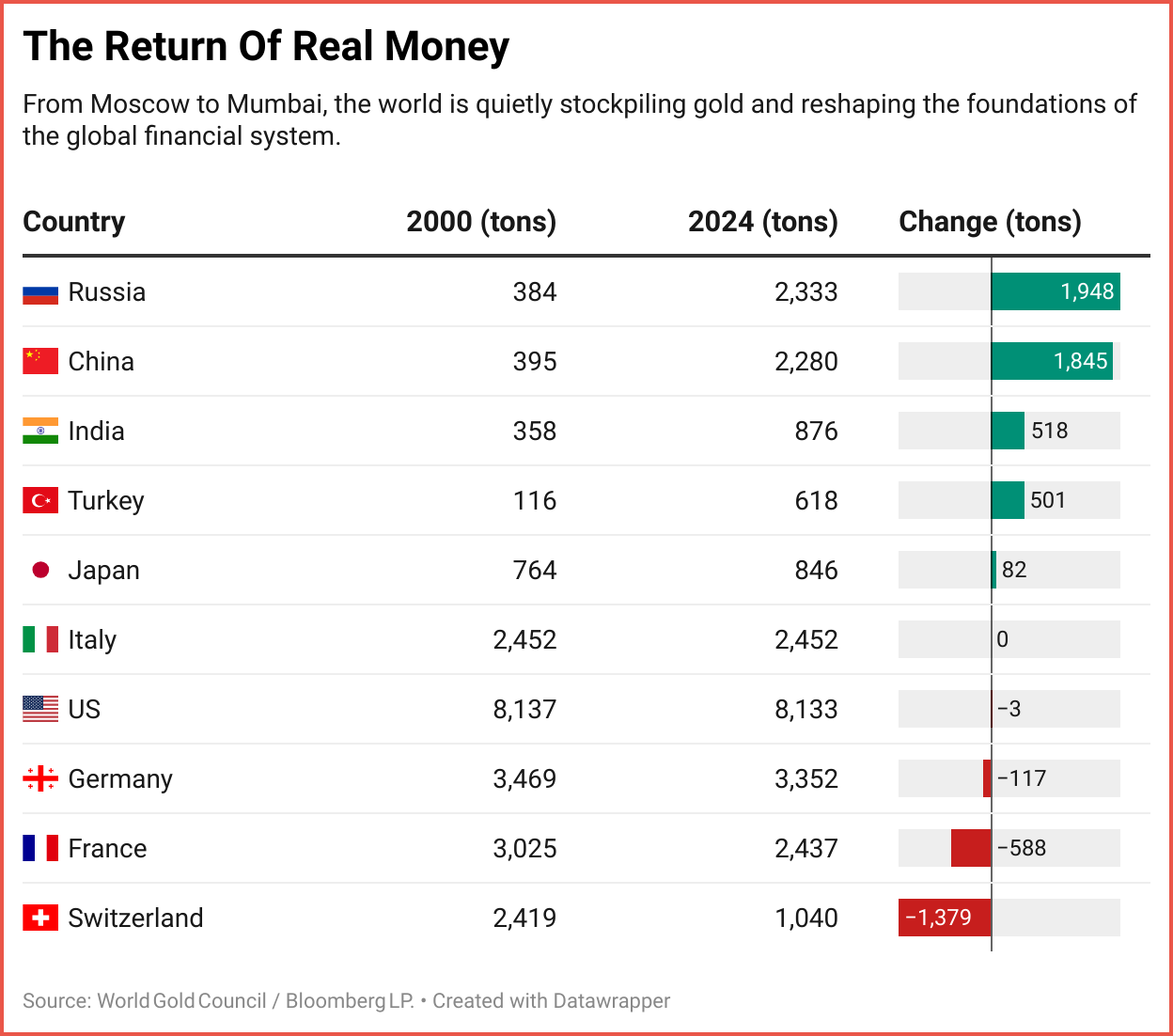

Something deeper is clearly at work. What’s unfolding now is more than an investment trend. It’s a strategic reshaping of wealth and power. Central banks, from Beijing and Warsaw to Ankara and Brasília, have been on an unprecedented buying spree, quietly shifting their reserves away from dollars and into hard assets. Central banks have been net buyers of gold for seventeen consecutive months. In August alone, they added nearly 20 metric tons, with Poland leading the charge.

China is also using gold for more than just safety. It sees the metal as a way to reduce the world’s reliance on the U.S. financial system. In recent years, Beijing has taken steps to make the Shanghai Gold Exchange an international center for buying, selling, and storing gold. It is inviting other countries to keep some of their gold there and even trade it in China’s currency, the yuan. These moves challenge the longtime dominance of places like London and New York, which have traditionally been the main hubs for global gold trading. Over time, this could give China more influence over how gold is priced and traded and help build a financial system that is less exposed to U.S. control or sanctions.

Beijing’s efforts show how gold is being used not only to preserve wealth but also to reshape the financial system itself. The metal is evolving from a passive reserve into an active tool of economic influence.

Some analysts even believe the U.S. government itself may be quietly buying gold. They argue that the strength, speed, and persistence of this year’s rally look less like typical investor demand and more like the hand of a major sovereign buyer. While there’s no official confirmation, the very fact that such speculation exists underscores how strategic gold has become once again, not just for emerging economies but possibly for Washington itself.

Weakening confidence in printed money is driving a renewed embrace of gold as an insurance policy for uncertain times. In today’s world, currencies are often wielded as political tools, and nations are seeking ways to shield themselves from external pressure and policy risk. Much of this demand is also driven by countries seeking to reduce their reliance on the U.S. dollar in cross-border trade and payments.

India has been fascinated with gold for centuries. Women have traditionally prized 24-carat jewelry, and brides are often adorned with gold at their weddings, not just for beauty but as a form of financial security. Many families still tell stories of how that gold, passed on to a bride, later paid for her children’s education or supported her through difficult times after her husband’s death.

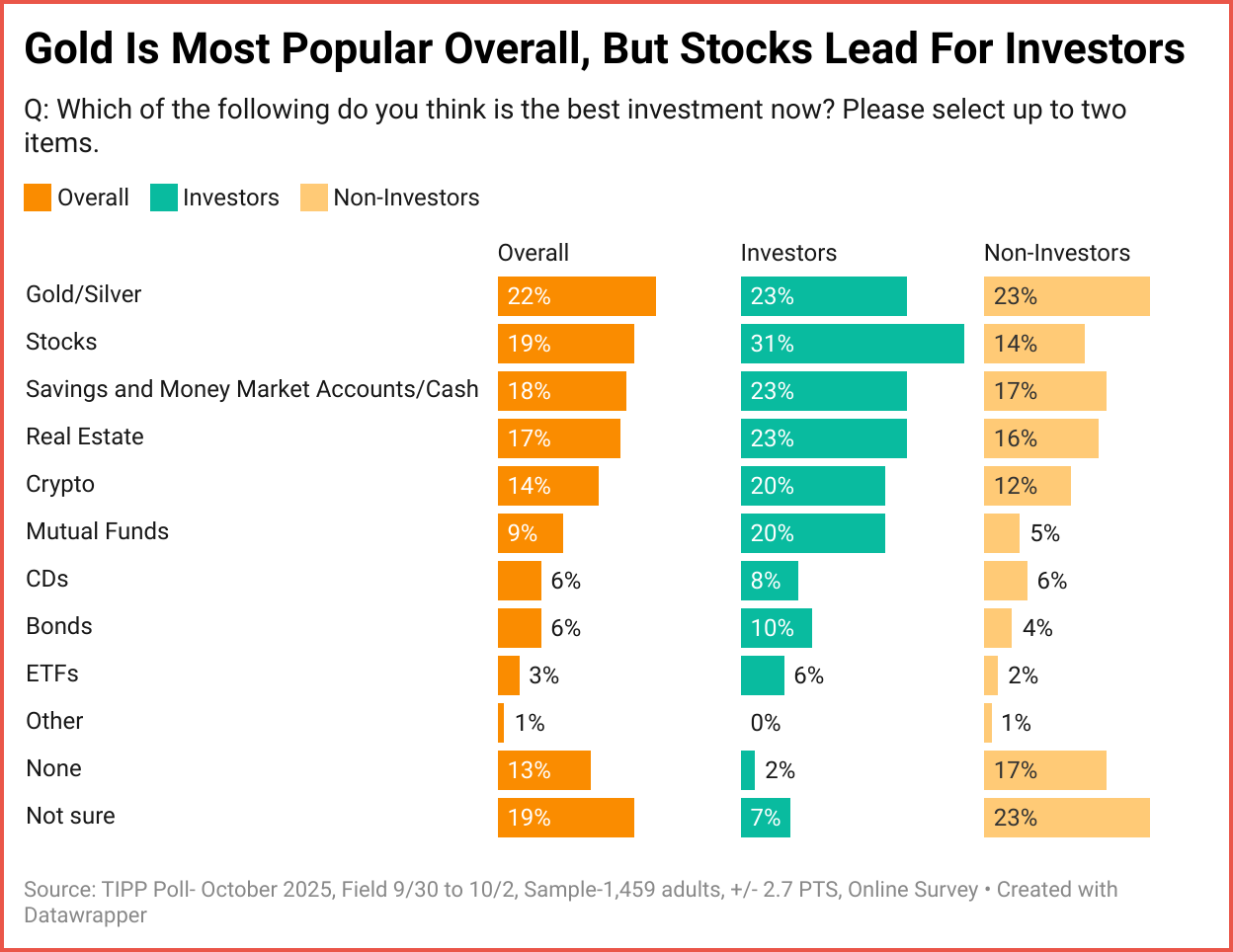

Americans’ views on investing show a similar pattern. In a TIPP Poll completed earlier this month, gold and silver rank as the most trusted option overall, while stocks remain the preferred choice for active investors. The chart below shows how those preferences differ between investors and non-investors.

This public trust shows that gold’s appeal is not just historical or institutional. It still shapes financial decisions today and reinforces why governments and central banks treat gold as a strategic asset.

Even the United States, long the architect and chief beneficiary of the dollar-based system, now faces a profound question about how it values its own gold. America holds the world’s largest official reserve: 261.5 million troy ounces, or more than 8,000 metric tonnes. Yet on the federal balance sheet, that hoard is still valued at just $42.22 per ounce, a figure set in 1973. At that price, the reserve is worth only about $11 billion.

At today’s market price of roughly $4,250 per ounce, the same gold is worth more than $1.1 trillion. That massive gap is no mere accounting quirk; it represents latent financial power that, if revalued, could offer Washington meaningful fiscal breathing room without raising taxes or issuing new debt.

Major financial institutions are taking notice of this changing landscape. Bank of America recently raised its forecast for gold to $5,000 by 2026, citing strong central-bank demand and record inflows into gold ETFs. Veteran strategist Ed Yardeni believes the metal could climb to $10,000 before the decade is out. Even JPMorgan CEO Jamie Dimon, usually skeptical of assets that don’t produce income, said that in today’s environment, owning gold “makes sense” and could prove “semi-rational” for investors. He suggested that gold could reach $5,000 or possibly $10,000 in the current environment.

Even inside the Federal Reserve, the conversation is starting to change. A recent paper by one of its economists explored what would happen if the United States revalued its gold reserves to reflect today’s market price. The study estimated that such a move could unlock value equal to about 3% of America’s GDP, potentially giving Washington extra room to manage its debt without raising taxes or borrowing more. The paper didn’t suggest that revaluation is certain or easy, but the fact that it’s being discussed at all shows how seriously policymakers are rethinking gold’s role in the financial system.

The shift back to gold is about more than just price. It reflects a deeper change in how the world thinks about storage of value, money, and power. For decades, the U.S. dollar has been the king of the global financial system. But rising U.S. debt, weaker trust, and new political and economic rivalries are starting to challenge that position.

In this environment, gold is regaining importance because it is simple, stable, and not controlled by any single country. It cannot be printed or devalued, and it is not affected by sanctions or central bank decisions. Even as digital assets like Bitcoin grow, many governments and investors still see gold as the safer, more reliable store of value.

As strategist Ed Yardeni put it, “Bitcoin may be digital gold, but gold is physical bitcoin.” — scarce, trusted, and beyond the reach of central banks. That comparison captures why, even in a digital era, the world’s oldest store of value still commands unmatched credibility.

What we are seeing now is not just a market rally; it is a larger realignment. Nations, central banks, and investors are preparing for a future where trust in paper money is weaker and hard assets matter more. That is why gold is moving back to the center of the financial conversation, not as an outdated relic, but as a foundation for what comes next.

Russia’s experience shows why gold is more than just an investment. It can also serve as a financial lifeline. After Western governments froze hundreds of billions of dollars in Russian reserves following the invasion of Ukraine, Moscow relied on its large gold stockpile to keep its economy stable. Because the gold was held inside the country, it could not be seized or blocked, and its rising value added extra support. China has paid close attention to that lesson. It has been steadily reducing its U.S. Treasury holdings and adding gold to its reserves for eleven straight months. Even now, gold makes up less than 9% of China’s reserves, compared with a global average of about 20%, which means it still has plenty of room to buy more.

That lesson has far-reaching implications. As more nations rethink how they hold and protect reserves, gold’s role is expanding beyond a simple hedge against risk.

These moves could eventually change how the global financial system works. If more central banks start storing their gold in Shanghai, trading it in yuan, and using it to back their own currencies, the world could shift toward a system with more than one major financial center. Gold would no longer be just a safety asset. It would become the backbone of a new network of trade and reserves that operates outside U.S. influence. That shift would take time, but it shows how deeply gold’s role is changing.

All these forces point to a deeper truth about money and value. They reveal why societies keep returning to gold whenever trust in paper promises begins to fade.

As Ludwig von Mises observed, value is not something that exists inside gold or any object by itself. It is created by how people respond to their circumstances, and today, that response is a shift back to something tangible and trusted in an uncertain world.

Whether its price rises to $5,000 in 2026 or goes even higher, one thing is clear: gold is once again playing a central role in how the world protects its wealth and plans for the future.

🧠 TIPP Investing Weekly

Week Ending: October 17, 2025

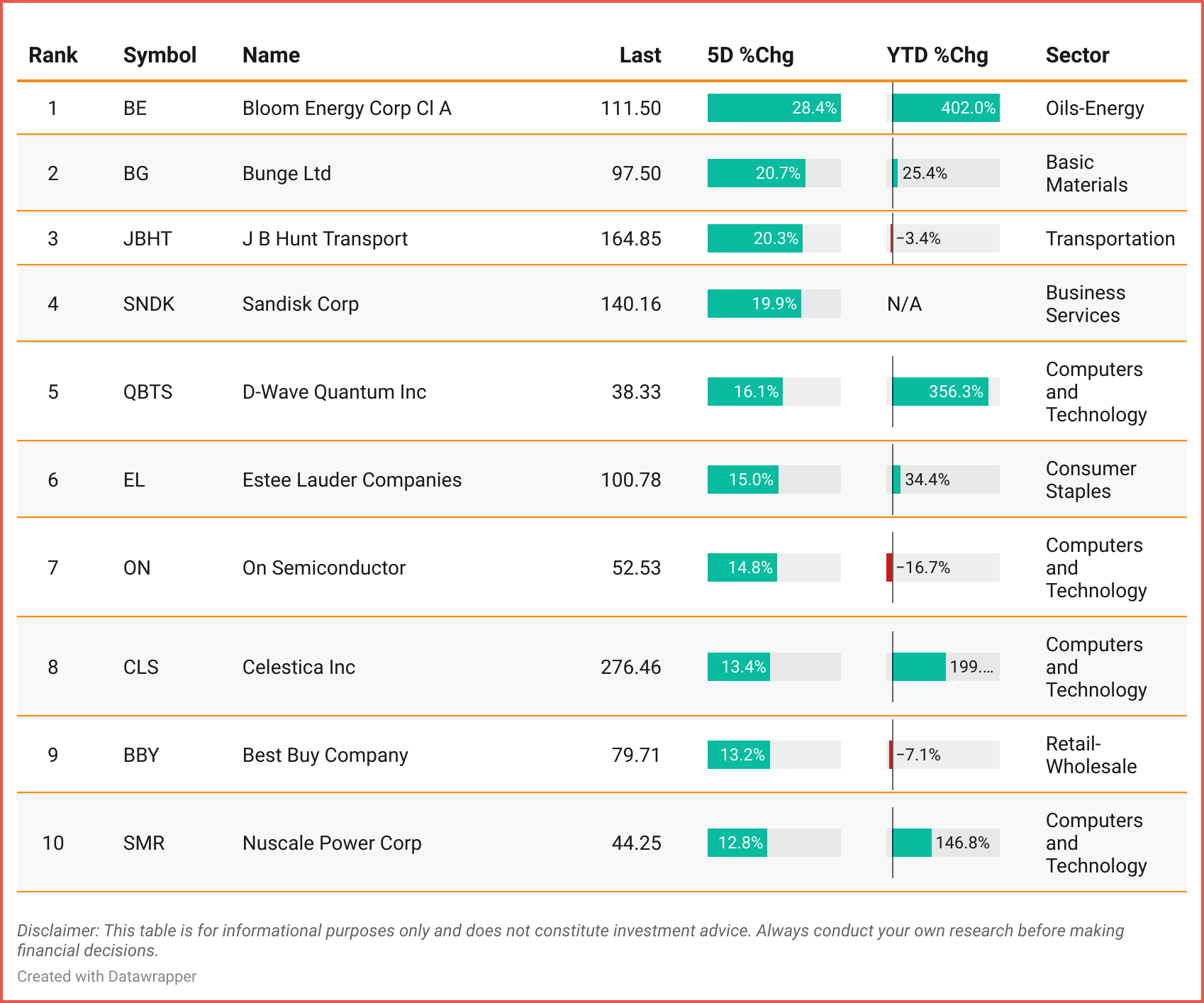

The Hot 10 Stocks 🔥

A data-driven look at the week’s 10 best-performing stocks — all trading above $20 with over 1M in volume.

Tickers: BE | BG | JBHT | SNDK | QBTS | EL | ON | CLS | BBY | SMR

🔍 Stock to Watch: BE

Bloom Energy Corporation, based in California, generates and supplies renewable electricity to residential, commercial, and industrial users.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.

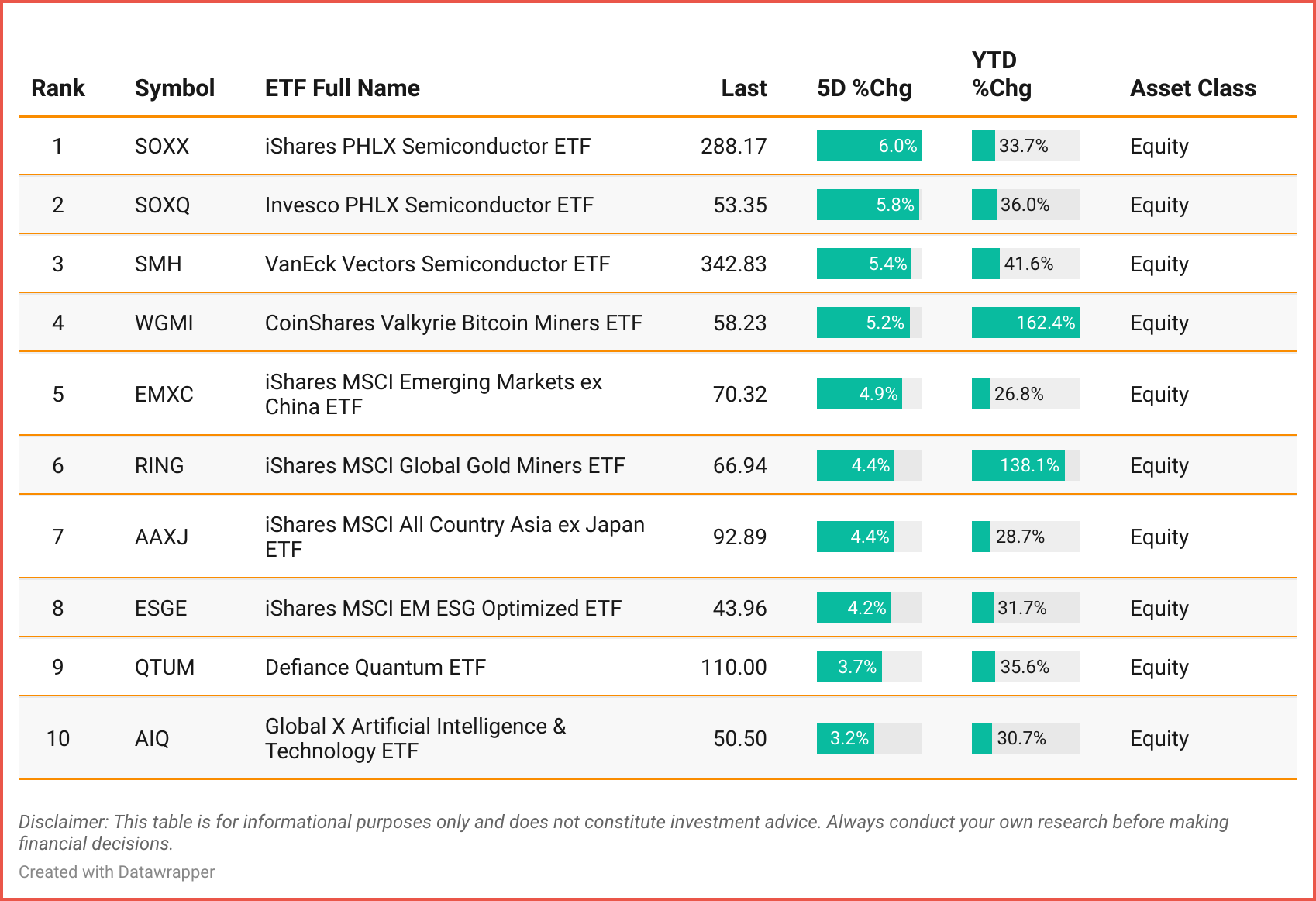

The Hot 10 ETFs 📈

A data-driven look at the 10 best-performing ETFs, all above $20 in price, with over 300K in average volume and $ 250 M+ in assets.

Tickers: SOXX | SOXQ |SMH | WGMI | EMXC | RING | AAXJ | ESGE | QTUM | AIQ

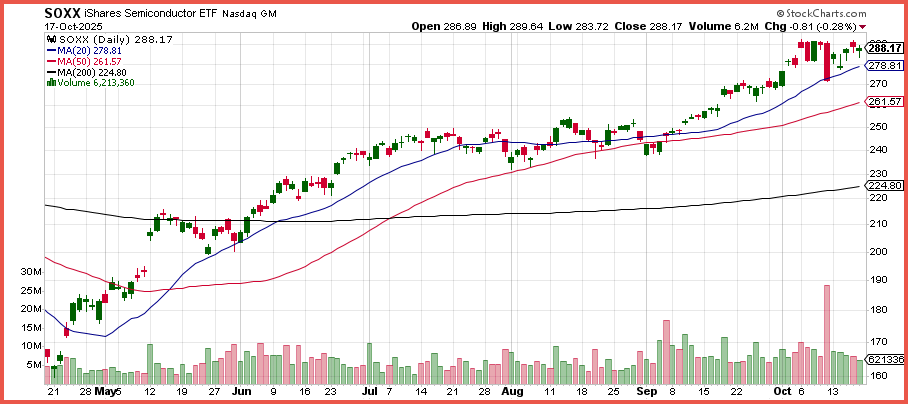

📈 ETF to Watch: SOXX

The iShares PHLX Semiconductor ETF tracks the performance of U.S. semiconductor stocks, following the PHLX SOX Semiconductor Sector Index.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

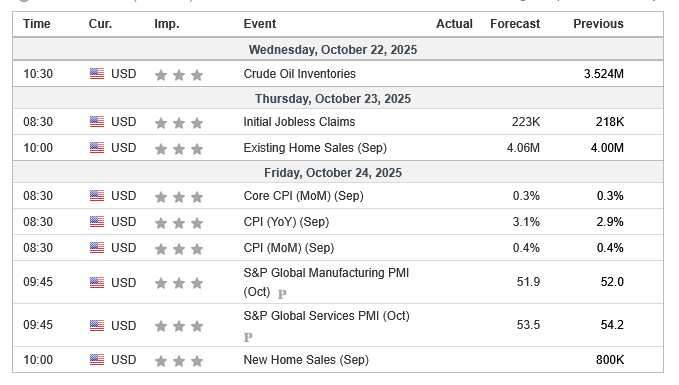

📅 Key Events This Week