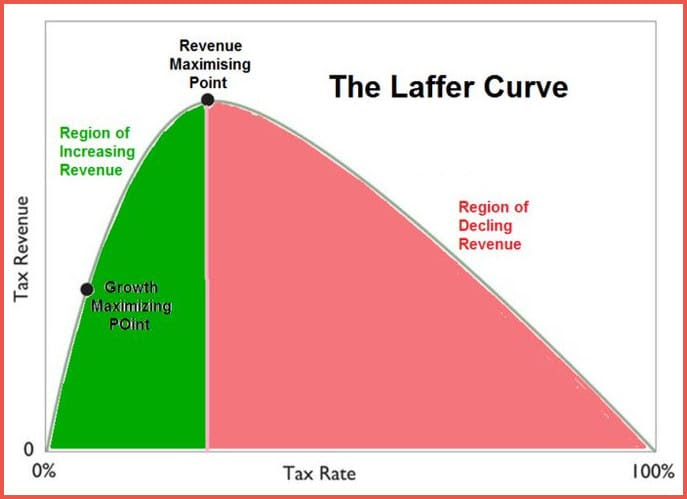

The Laffer Curve is a simple idea about how tax rates affect how much money governments actually collect.

Think of it this way:

- If the tax rate were 0%, the government would collect no taxes.

- But if the tax rate were 100%, people would have little reason to work, invest, or report income — because everything they earn would go to taxes. Revenue would again fall very low.

So somewhere between 0% and 100%, there must be a tax rate that brings in the most revenue. That relationship forms the curved shape shown above.

Why higher taxes don’t always mean higher revenue

At moderate tax rates, people continue working and investing, so raising taxes can increase government revenue.

But if taxes get too high, people may:

- Work less,

- Delay investments,

- Move money or businesses elsewhere,

- Or legally shift income to reduce taxes.

When that happens, the tax base shrinks, and total revenue can actually fall even though tax rates are higher.

Why economists still argue about it

Most economists agree the curve exists in theory.

The big disagreement is:

Where is the peak?

Are current tax rates below it, near it, or above it? The answer varies by country, time period, and type of tax.

Bottom line

The Laffer Curve doesn’t say all tax cuts raise revenue or all tax hikes hurt revenue. It simply says:

There is a point where taxes become high enough to discourage economic activity and reduce total collections.

And debates over tax policy usually center on where that point lies today.