Conventional wisdom says the party in power always loses the House in the midterms.

But history repeats itself only when conditions also repeat. And in 2026, it may not.

Americans vote with their pocketbooks. When prices stop rising, paychecks stretch further, and jobs feel secure, voters don’t feel the urge to “send a message.” They stick with what’s working.

That’s the ground conditions heading into 2026.

Let us start with the basics. There is no visible recession risk on the horizon. Inflation is easing, not accelerating. Employment remains steady. Wages are rising faster than prices. It is not an overheated economy on the brink, and that matters politically.

Economic growth is picking up again. After a slower 2025, growth is expected to rebound toward 2% or higher in 2026, driven by higher productivity and continued AI adoption across industries. It’s more than enough to support job creation and rising incomes. For voters, it translates into fewer layoffs, steadier hours, and a sense that the economy is moving forward, not backward.

Inflation, the real villain of the past few years, is also losing its grip. Projections show inflation continuing to moderate through 2026, providing ongoing relief at the pump and grocery store. It is reassuring to households. When grocery bills stop jumping, and rent increases slow, voters feel relief. Even if prices don’t fall outright, stabilization itself is a political win.

The labor market tells a similar story. Unemployment is expected to hover around the mid-4% range, with only modest movement. That kind of stability keeps consumer spending intact and anxiety low. People don’t vote angrily when they feel secure in their jobs.

Most importantly, purchasing power is finally improving. Nominal wages are still rising, around 3.5% year over year. Crucially, wages are now outpacing inflation. Real earnings have turned positive, especially for blue-collar workers. It may not feel dramatic, but it’s meaningful. For the first time in a while, working Americans are moving slightly ahead instead of falling behind.

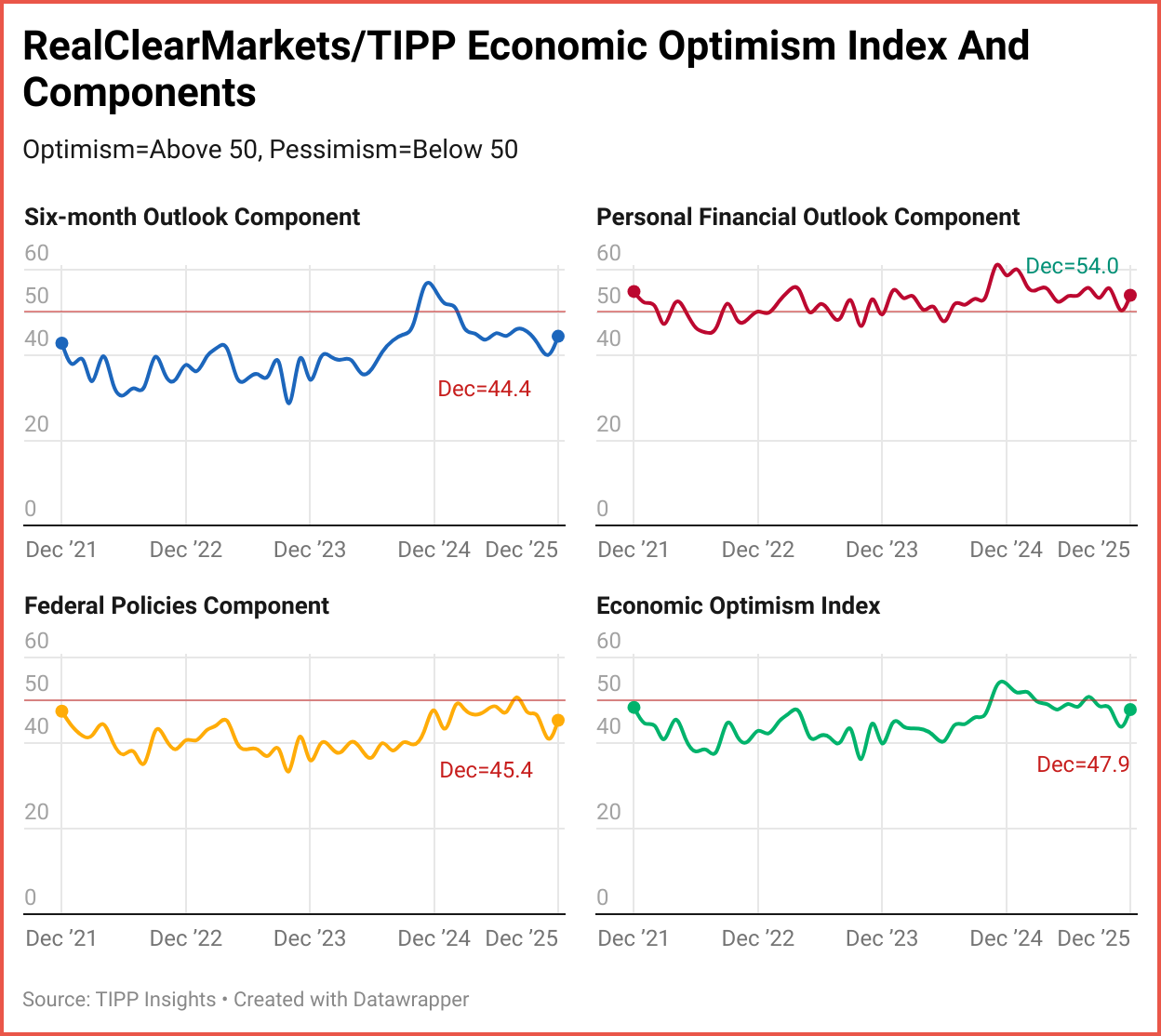

Consumer confidence is beginning to lift. The RCM/TIPP Economic Optimism Index posted its strongest monthly gain in months in December, with all three components improving. While it is still early and sentiment remains below neutral, rising confidence reduces the urge for protest voting and sets the mood that often carries into election years.

Recent data help explain why that improvement is likely to continue. Wages for middle-income workers are now rising, approaching 5% year over year—well above current inflation and likely future inflation. At the same time, energy prices are falling sharply. Oil prices have dropped this year, gasoline prices are now below $3 a gallon nationally, and U.S. energy production is running ahead of domestic demand. Because energy costs feed into nearly every price in the economy, this decline is likely to push inflation lower in the months ahead, reinforcing gains in real wages.

Layer on top of that targeted tax relief on tips, overtime, and Social Security income, and now you have something even more tangible. Early in 2026, millions of households are likely to see noticeably larger refunds or smaller tax bills. Voters remember who was in charge when their refund got bigger.

Taken together, these forces create a political environment that midterm models aren’t built for. The usual anger isn’t there. The sense of economic betrayal hasn’t taken root. And without that frustration, the instinct to punish the Party in power weakens.

None of this guarantees Republican success in 2026. Politics is never that simple. But it does mean the standard assumption that the GOP must lose the House simply because it’s a midterm deserves serious rethinking.

A steady economy wins elections quietly. And in 2026, the economy may turn out to be the GOP’s strongest ally.

👉 Quick Reads

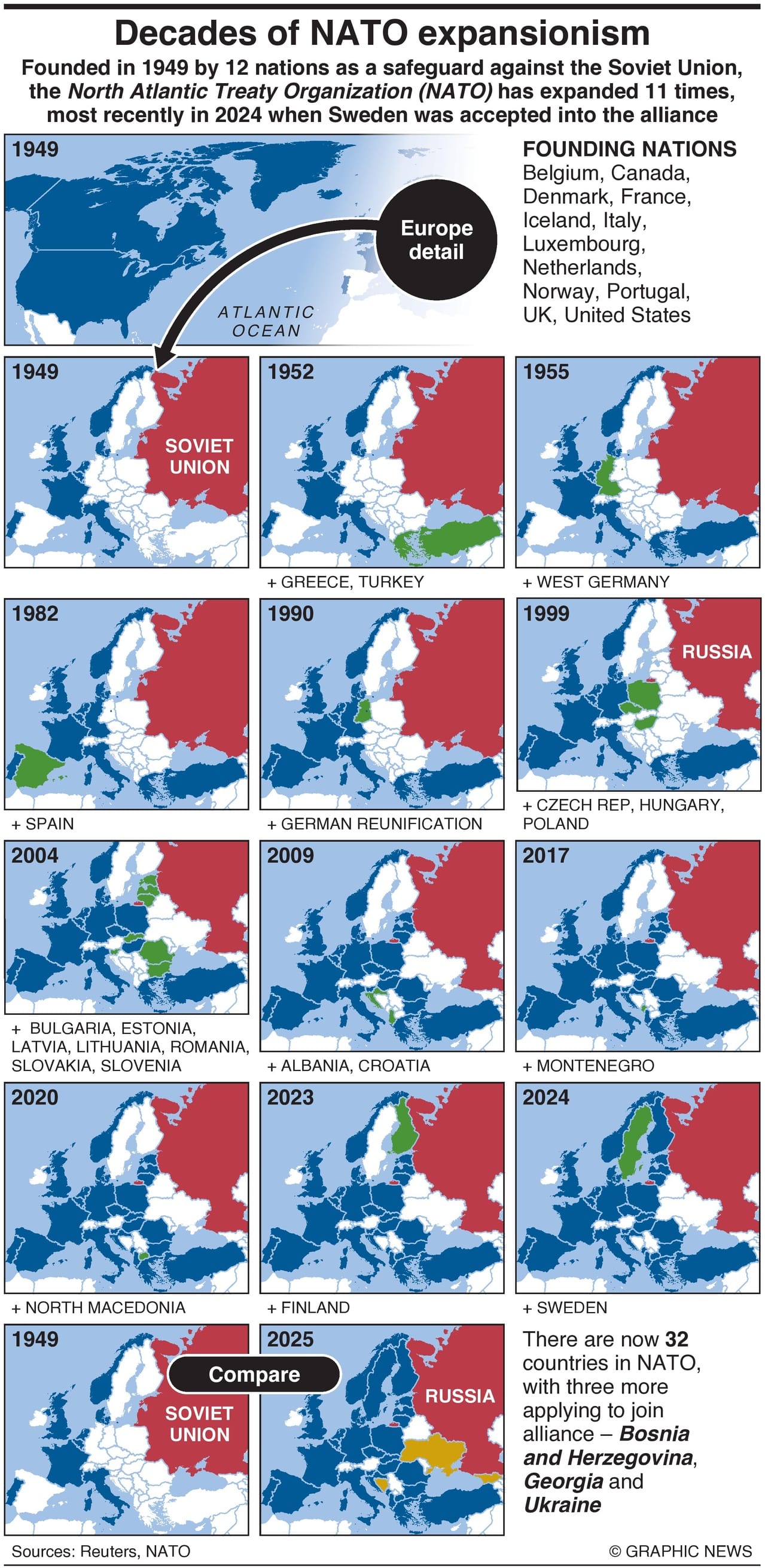

I. Putin Faults NATO Expansion for Conflict

In answer to a question posed by the BBC, Vladimir Putin says talk of Russia planning to attack Europe is “nonsense”, adding, “... if you don’t cheat us like you cheated us with NATO’s eastward expansion”.

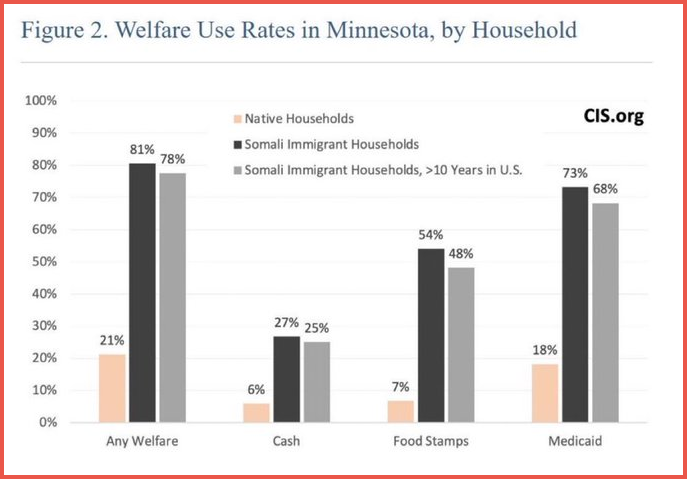

II. Welfare Participation in Minnesota by Household Type

A breakdown of welfare use shows large gaps between native households and Somali immigrant households, including those residing in the U.S. for over 10 years.

📊 Market Mood — Monday, December 22, 2025

🟩 Tech Rebounds, Risk Creeps Back

Asian equities rally as investors rotate back into technology after AI-driven selling pressure eased.

🟧 Japan Bonds Under Fire

Japanese government bonds slide again after the BOJ’s rate hike, with yields at multi-decade highs and the yen weakening.

🟦 Metals Hit Records

Gold, silver, and copper surge to fresh highs on geopolitics, supply constraints, and expectations of lower U.S. rates.

🟪 Oil Firms on Venezuela Tensions

Crude rises as Trump intensifies a blockade on Venezuelan exports, adding to supply risks.

🟫 Santa Rally or False Calm?

With few catalysts ahead, markets debate whether a year-end rally holds—or gives way to holiday volatility.

🗓️ Key Economic Events — Monday, December 22, 2025

No Events Scheduled

editor-tippinsights@technometrica.com