The ruling class narrative has been this: January 6, 2021, threatened to demolish democratic norms.

But the real institutional attack?

It came years earlier—and not in a riot of ruffians. It took place in a high-rise office, carried out by men in suits who spoke the vernacular of national security.

On January 6, 2017, President-elect Donald Trump sat for a national security briefing at Trump Tower. James Comey, John Brennan, James Clapper, and Mike Rogers walked in with the gravitas of public servants fulfilling their constitutional duty.

But it wasn’t a briefing. It was a setup.

They delivered a single, carefully selected piece of absurd opposition research—the “salacious” detail from the Steele Dossier—and presented it privately to the president-elect with the full weight of the US intelligence community. Within hours, CNN broke the story. BuzzFeed published the full dossier. The political operation was underway.

It wasn’t just a leak. It was a handoff.

They tagged him — you’re it — and passed him a political grenade. Pulled pin, live fuse. The goal wasn’t just exposure—it was detonation. Trump wasn’t merely under suspicion; he became radioactive. Anyone who got too close risked catching the fallout.

Breitbart Saw It Coming

Years earlier, Andrew Breitbart warned of a growing power structure—one not led by a candidate, but by the convergence of media, bureaucracy, and culture into a single, unaccountable machine. “The media is no longer a watchdog,” he wrote. “It’s a narrative machine.” This nefarious machine does not need to hold shadowy meetings of co-conspirators. Instead, their interests align, and their perverse incentives make their dishonest tactics clear.

At the time, it sounded alarmist. But what happened at Trump Tower wasn’t a glitch – rather, it was the system functioning exactly as intended.

The Tonya Harding Strategy

This op wasn’t opposition. It was sabotage—Tonya Harding politics. Smile in public, swing the crowbar backstage.

Obama and his team didn’t try to block his inauguration. They wanted him to enter office hobbled—branded by scandal, boxed in by legal threats, and tarnished by suspicion before he ever stood on the Capitol steps. It was the political version of kneecapping him before he took the ice.

Why did they fear him?

Because he threatened to expose:

- Revolving doors between media, bureaucracy, and intelligence

- National security choreography used as political theater

- The unspoken club rules of bipartisan self-preservation

He wasn’t corruptible. He was disruptive.

To the system, that wasn’t just inconvenient—it was an emergency.

Independent. Data-driven. Subscriber-supported. Join TIPP Insights → $99/year.

From Information Op to Operating System

This wasn’t a one-off. It was a prototype. Trump Tower was the opening move in a broader play—one that depended on aligned media, compliant tech, politicized prosecutors, and risk-averse Republicans.

The network behind it wasn’t just institutional. It was also social. These players serve on the same boards, hire each other’s spouses, and move seamlessly from agency to anchor desk to think tank. It’s not a conspiracy—it’s choreography. Everyone knows their step.

The Real Insurrection

In the Sabotage music video, the Beastie Boys dressed as 1970s TV cops, mocking the performance of authority. That’s what the Trump Tower meeting was: a performance. A ritual of legitimacy disguising a political hit.

The real insurrection didn’t happen at the Capitol. It happened four years earlier, when elite institutions protected Permanent Washington from scrutiny.

This wasn’t chaos. It was sabotage—planned, televised, and rewarded.

Now comes the reckoning.

Steve Cortes is president of the League of American Workers, a populist right pro-laborer advocacy group, and senior political advisor to Catholic Vote.

He is a former senior advisor to President Trump and JD Vance, plus a former commentator for Fox News and CNN.

Want the full story? Browse our Russiagate archive for deep analysis and missed truths.

Original article link: Cortes Investigates | Link to Part 1 | Russiagate

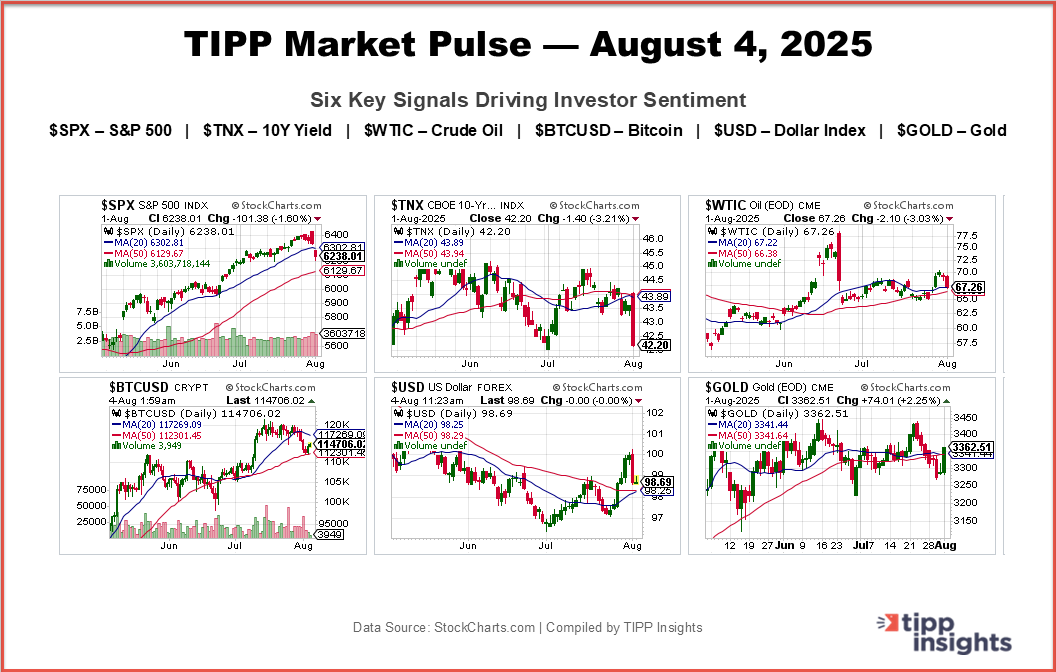

TIPP Market Brief – August 4, 2025

Your Morning Snapshot

📊 Market Snapshot

- S&P 500: ▼ 6238.01 (1.60% )

- 10-Year Yield: ▼ 4.220%, (14 basis points)

- Crude Oil (WTI): ▼ $67.26 (3.03%)

- Bitcoin (BTC):▲ $114,706.02

- US Dollar Index (USD): ▼ 98.69 (0.00)

- Gold: ▲ $3,362.51 (2.25%)

Bigger Charts: $SPX | $TNX | $WTIC | $BTCUSD | $USD | $GOLD

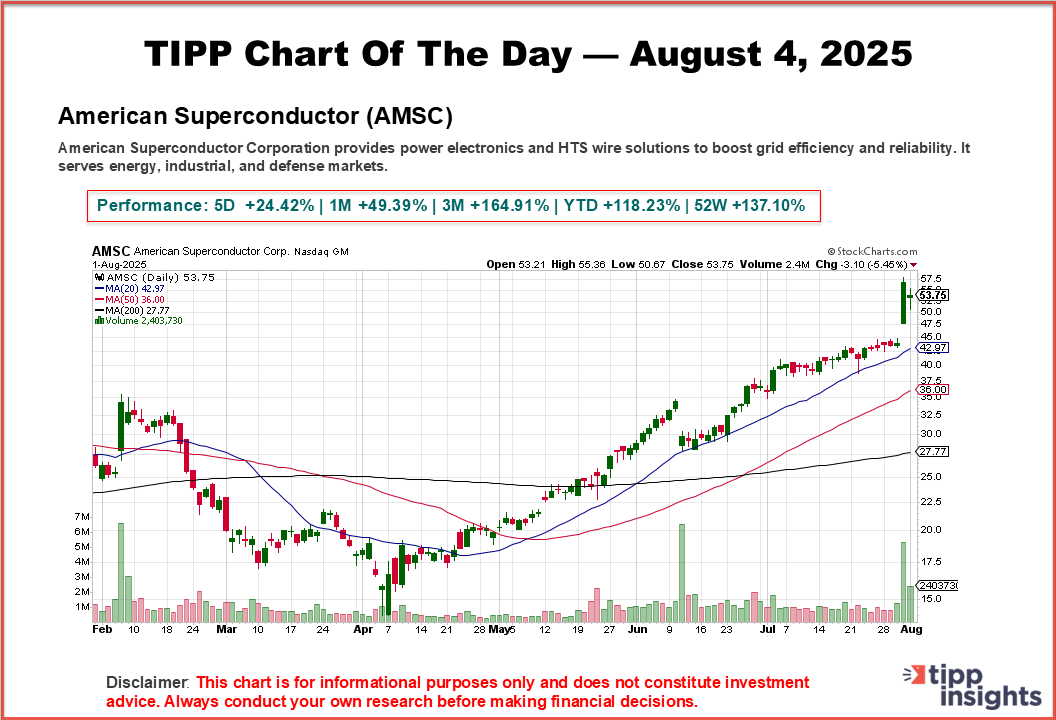

📈 Featured Stock

Our pick for today’s featured stock

📰 News & Headlines

Why American Superconductor Rocketed Higher Today—Billy Duberstein, The Motley Fool

American Superconductor (AMSC) Shares Skyrocket, What You Need To Know—Jabin Bastian, StockStory

⭐Recent Featured Stocks

Western Digital Corp (WDC) (8/1)

Bloom Energy Corporation (BE) (7/31)

Credo Technology Group Holding Ltd (CRDO) (7/30)

Newegg Commerce Inc (NEGG) (7/29)

Robinhood Markets, Inc. (HOOD) (7/28)

Dollar Tree Inc (DLTR) (7/25)

Symbotic Inc (SYM) (7/24)

Power Solutions International, Inc. (PSIX) (7/23)

Palantir Technologies Inc. (PLTR) (7/22), (4/30)

Talen Energy Corporation (TLN) (7/21)

Cameco Corp (CCJ) (7/18)

Unity Software Inc (U) (7/17)

TTM Technologies (TTMI) (7/16)

More here

🧠 Macro Insight

🟩 Futures Edge Higher on Rate Cut Hopes

Markets rebound after Friday’s sharp selloff, buoyed by expectations of a Fed rate cut following weak July jobs data and downward revisions. Trump’s tariff hike and dismissal of the statistics bureau chief add political uncertainty.

🟨 Solid Earnings Continue to Buoy Sentiment

Strong corporate results, especially in AI-focused tech, offset macro jitters. Meta and Microsoft impressed last week; this week’s focus turns to Caterpillar, McDonald’s, and Disney.

🟥 Berkshire Hit by Kraft-Heinz Write-Down

Buffett’s Berkshire Hathaway saw Q2 profit plunge to $12.4B on a $3.76B Kraft-Heinz loss and lower insurance premiums. BNSF gains and $344B cash pile offer some cushion.

🟧 OPEC+ to Hike Output in September

Oil holds steady despite OPEC+ announcing a 547K bpd production increase. The move completes the rollback of earlier supply cuts.

🟦 Gold Slips After Friday Surge

Gold prices cool slightly after jumping 2% on Friday. Traders eye the metal as a hedge in a potential rate-cut environment. Bitcoin also steadies above $114K.

📅 Key Events Today

🟦 Monday, August 4

No major economic events scheduled.