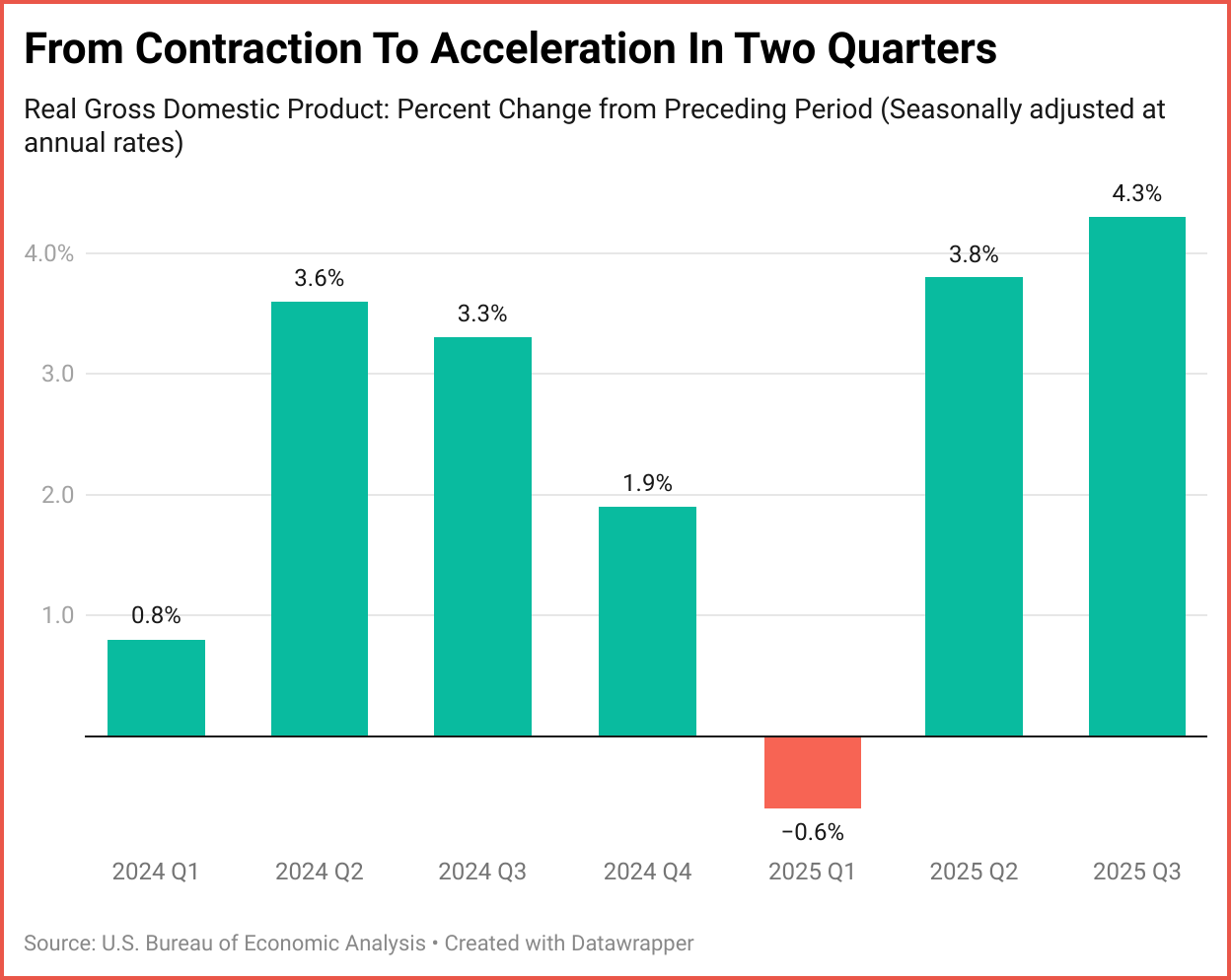

Today’s GDP report showed that real GDP grew at an annualized rate of 4.3% in Q3 2025 (July–September), accelerating from 3.8% in Q2 and marking the fastest pace in two years. The result significantly exceeded economists' expectations of roughly 3.2–3.3%, delivering a clear upside surprise.

This report provides a timely data point to reassess the economic assumptions that have shaped recent political forecasts.

The strength was driven primarily by robust consumer spending, which accelerated during the quarter and contributed meaningfully to growth, particularly among higher-income households. Exports rebounded sharply, rising 8.8%, while government spending, including defense, also increased. These gains more than offset softer areas such as private investment and lingering trade distortions tied to earlier tariff-related import surges.

Although the recent government shutdown delayed the report, it nonetheless paints a picture of economic resilience amid notable headwinds, including a cooling labor market and ongoing tariff uncertainty. Some economists caution that this pace may not be sustained into Q4, in part because pre-shutdown spending rushes and other effects may have temporarily boosted Q3 activity. Even so, the data make one point clear: the economy did not lose momentum as many expected. It regained it.

That conclusion matters because earlier in 2025, a growing number of economists and investors warned that the U.S. economy was drifting toward stagflation or recession. Those concerns were fueled by tariff uncertainty, a moderation in hiring, and fears that inflation might remain stubbornly high even as growth slowed. This report directly challenges that narrative for the period it covers.

Stagflation, by definition, requires stagnant or near-zero growth alongside elevated inflation. That condition is absent here. Far from stagnating, real output expanded vigorously at a 4.3% annualized rate — a pace fundamentally inconsistent with the historical stagflation episodes of the 1970s. Without stagnation, the label simply does not apply, particularly as inflation has continued to moderate toward the 2–3% range with core measures still above the Fed's 2% target.

The case for an imminent recession is similarly weakened. Recessions require contraction, typically consecutive quarters of negative growth. Instead, Q3 delivered acceleration on top of already positive output in prior quarters. This upside surprise pushes back against near-term recession calls and highlights how quickly slowdown fears can dissipate when the defining metric, GDP contraction, fails to materialize.

An updated GDP estimate is scheduled for January 22, 2026, and may incorporate additional refinements. For now, however, the message is clear. The economy regained meaningful momentum when many expected it to falter. That reality argues for restraint in overstretched diagnoses and keeps economic and policy discussions anchored in facts rather than fear.

The refreshed economic picture, with real GDP accelerating to 4.3% in Q3, reinforces the political case we made earlier this week: midterm backlash is most powerful when voters feel economic deterioration at their doorstep. When growth fails, inflation lingers, and job security weakens, voters grow anxious and are more likely to punish incumbents at the ballot box. But when the economy regains lift instead of stalling, those pressures ease. That matters because the typical midterm dynamic hinges on voters feeling that the economy is sliding, a condition that, for now, simply isn’t visible in the headline data. GDP alone doesn’t determine voter sentiment, but sustained growth reduces the kind of economic anxiety that typically fuels protest voting. In short, economic growth is a sine qua non for avoiding midterm backlash, but it is not sufficient on its own.

The latest GDP acceleration reshapes both the economic and political narratives. By taking a credible recession or stagflation scenario off the table, it weakens the economic grievances that typically power midterm punishment.

Catch up on today’s highlights, handpicked by our News Editor at TIPP Insights.

1. Russia Launches Massive Air Assault On Ukraine, Triggering Power Cuts

2. China Comic Convention Drops Japanese Content Amid Rising Tensions

3. Chinese Tech Giant Xiaomi Denies Military Links After US Pressure

4. Trump Administration Plans New Tariffs On Chinese Chips

5. Nvidia Plans H200 AI Chip Shipments To China After Trump Approval

6. US Bans New Foreign Drones, Dealing Major Blow To China’s DJI

7. US Seeks To Dismiss Asylum Claims, Deport Migrants To Third Countries: Report

8. Gas Prices Hit Four-Year Lows Ahead Of Holiday Travel Surge

9. US Economy Surges 4.3% In Q3, Beating Forecasts

10. Consumers Keep Spending As E-Commerce Drives Holiday Sales Growth, Data Shows

11. New Epstein File Release References Trump, DOJ Flags Unverified Claims

12. Ex-Senator Ben Sasse Says He Has Terminal Pancreatic Cancer

13. Trump Calls Epstein Photo Dump “Terrible” For Innocent Figures

14. Latest Epstein Documents Include Letter, Emails, Heavy Redactions

15. Shelved “60 Minutes” Segment Airs In Canada, Spreads Online

16. Wall Street Still Betting Big On AI Data Centers

editor-tippinsights@technometrica.com