Thanksgiving is truly one of my favorite holidays. It is the quintessential American history story, celebrating the first harvest of our earliest settlers. It’s an optimistic story, and one of the reasons I love that history so much is I am an optimistic person who always believes in the greatness of the soul and the founding of America.

Yet I have to depart from the optimism script for just a bit. Looking at the economy, I see a number of important leading indicators that are all pointing to recession. We may already be in a recession, or not, but next year is looking like a deeper downturn.

There’s a way out of this mess, and I’ll get to that in a few moments, but first some straightforward empirical factoids. I begin with a huge drop in the conference board’s leading economic indicators.

This is an old-fashioned but highly accurate forecasting tool. It includes interest rate spreads, consumer expectations, manufacturing, stock prices, building permits for new homes, and other measures. There are 10 in all and the rate of change is plunging.

Second, a more controversial indicator, called M2 — which is an inadequate measure of the nation's money supply, but still something to pay attention to. Pioneered by a great Nobel laureate, Milton Friedman, this is a monetary interpretation of the economy that tells us about future inflation and growth.

For 20 years, M2 was basically growing modestly and had something to do with 2 percent average inflation. Not everything, but something to do with low inflation.

Then we come to the craziness of the last two years, with a massive increase in federal spending that led to equally massive money printing by the Federal Reserve.

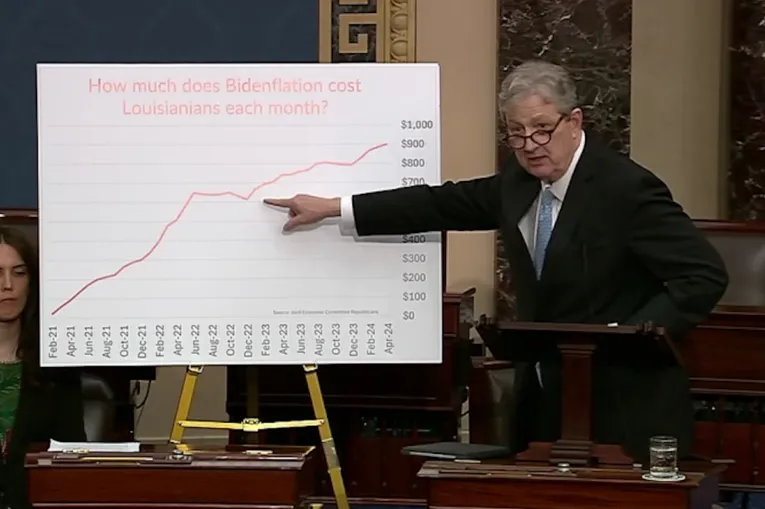

This was the single biggest mistake by President Biden. It moved the inflation rate to about 10 percent from 1 percent. Real wages have fallen 18 consecutive months. That’s the soft underbelly of the Biden economy.

Now, as the Fed makes its belated correction for its own prior mistakes, the American economy is in great jeopardy. This all could’ve been avoided, but it wasn’t avoided. And now here we are, with the threat of a difficult downturn next year. One that actually began this year.

Friedman argued that inflation is too much money chasing too few goods — and, oversimplifying only a bit, Uncle Sam created the money, and then overregulation, tax increases, and of course the war against fossil fuel production created tall barriers to the production of goods.

Yes, we had a Covid-related supply-chain hangover, and, yes, Vladimir Putin invaded Ukraine, but the bulk of this mess was homegrown based on the policies of big-government socialism and central planning on a grand scale.

Besides the leading indicators and the money supply, I would just add: The bond market has been turned on its head, with short-term rates now much higher than long-term rates.

A very useful recession-forecasting model was developed years ago at the New York Fed, and it has a very high degree of accuracy.

Basically, when the 3-month Treasury bill rate exceeds the yield on the 10-year Treasury bond, the probability of recession one year hence goes higher and higher. The 3-month T-bill is now 4.3, and the 10-year Treasury is near 3.8. This is a very alarming sign.

There are a lot of other indicators I could point to, including a housing recession and a major slowdown in manufacturing, but I don’t want to get any deeper in the weeds than I have to.

No model is perfect, but I will suggest that keeping an eye on the leading economic indicators, M2, and the Treasury yield curve gives everyone a pretty decent sense of where we’re headed. Inflation will come down however slowly, but the recession may be very difficult.

Again, ever the optimist, I say we should be able to do a lot better in the future regarding federal economic policies than we have done in the last two years.

You’ve heard this before from me, but first we should immediately open the spigots to produce more oil and gas by allowing permitting, pipelining, refining, etc. That will reduce prices and promote jobs and growth.

John Kerry's COP-27 Green New Deal, socialist, redistributionist climate reparations plan to bribe poorer countries not to use oil and gas is dumber than dumb. Mr. Biden closing down coal plants all across America is dumber than dumb. New EPA regulations and taxes on clean-burning natural gas is even dumber than dumb, if such a thing is possible.

Then, we need to re-impose work requirements on the able-bodied receiving government assistance, which succeeded 25 years ago in reducing welfare spending and leading to a balanced budget. Also, we need to make President Trump’s supply-side business tax cuts permanent.

And then, we need to rein in the Biden regulatory assault on all businesses — a policy that has literally strangled the economy. At the end of the day, we'd have less money chasing more goods. Inflation would crash and the economy would soar.

We’ve done this in the past and we can do it in the future. It’s time to act like stewards of economic prosperity and to replace utopian socialist schemes that cause recession and impoverishment wherever they are implemented.

I know we can right the ship. Happy Thanksgiving. Gobble, gobble, gobble.

From Mr. Kudlow’s broadcast on Fox Business News.

Larry Kudlow was the Director of the National Economic Council under President Trump from 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. and his radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.

Please share with anyone who would benefit from the tippinsights newsletter. Please direct them to the sign-up page at:

https://tippinsights.com/newsletter-sign-up/