No question about it: Americans are hurting from the surging inflation that began early in President Joe Biden’s first term and that has persisted ever since. Indeed, as the latest I&I/TIPP Poll shows, a large majority of Americans now say the sharp rise in inflation has caused them financial hardship.

With inflation running at an average annual rate of 8% last year and 4.7% the year before, Americans are feeling the pinch.

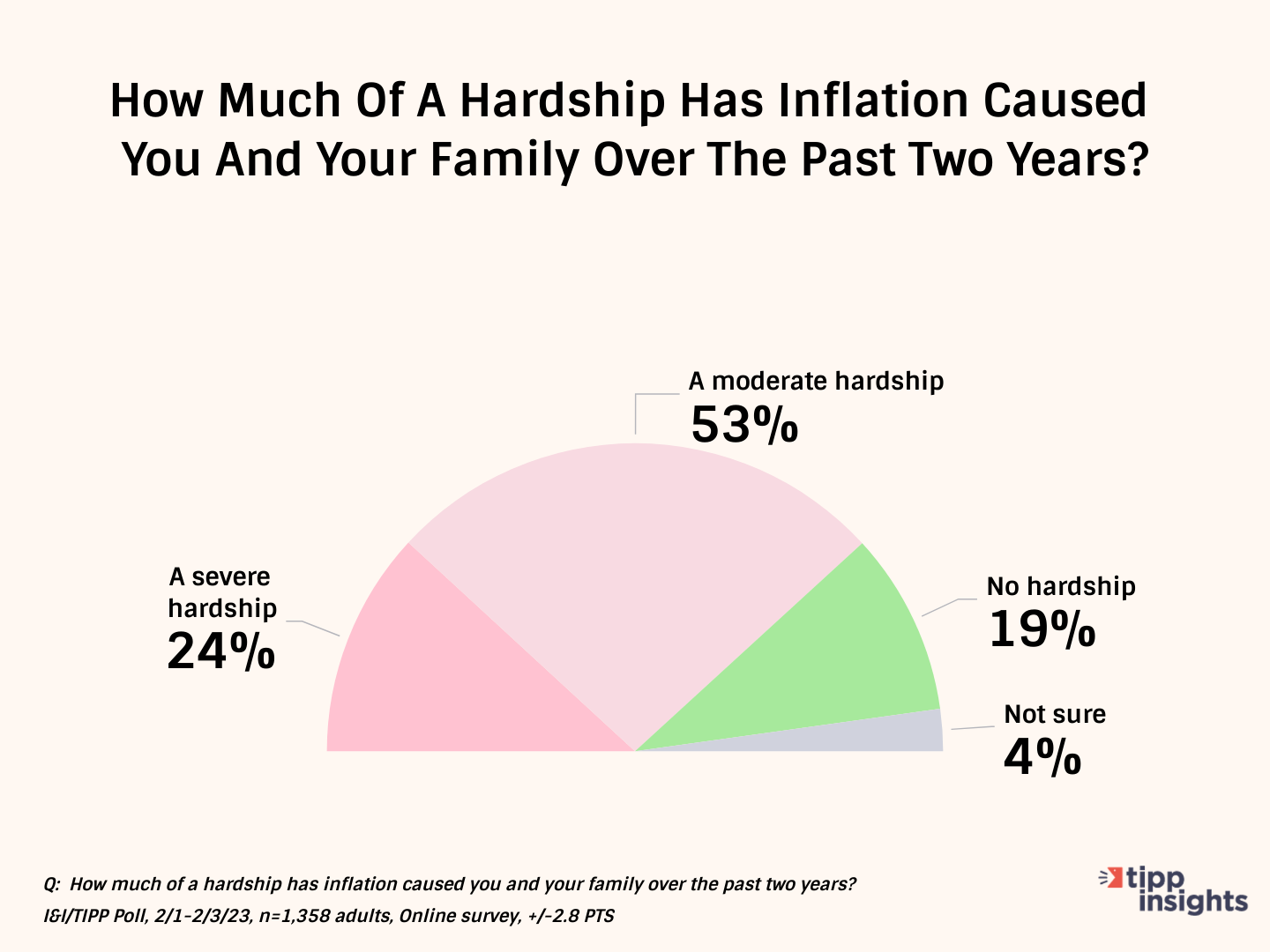

In this month’s online I&I/TIPP Poll, taken Feb. 1-3 from 1,358 adults across the nation, we asked the following question: “How much of a hardship has inflation caused you and your family over the past two years?”

Respondents were given four possible responses: “A severe hardship”, “A moderate hardship,” “No hardship,” or “Not sure.” The poll’s margin of error is +/-2.8 percentage points.

The answer came back loud and clear: 77% said inflation is causing their family hardship, versus just 19% who said it isn’t and only 4% who said they aren’t sure. Of those who said they are suffering from inflation, 24% called it “severe,” while 53% termed it “moderate.”

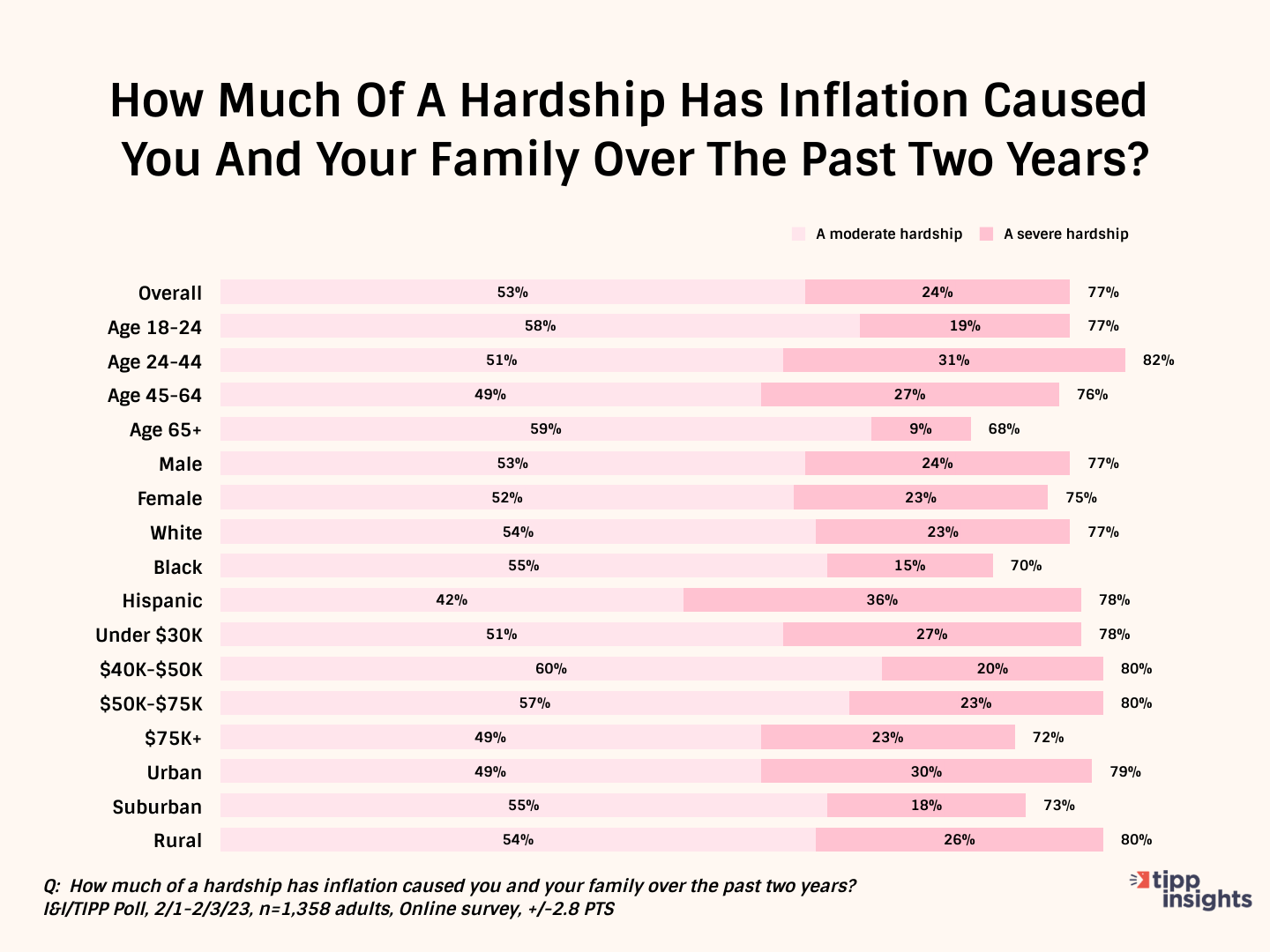

Most notable was the unanimity across all groups. Among the 21 demographic groups tracked regularly by TIPP, only those over 65 years of age came in below 70%, at 68%. Every other group was at 70% or higher.

This was one poll where Republicans, Democrats and independents all see eye-to-eye, with 75% of Democrats, 81% of Republicans, and 75% of independents saying they suffer the wrath of out-of-control inflation.

Whites (77%), blacks (70%), hispanics (78%), male (77%) and female (75%), those who earned under $30K a year (78%) and those who earned $50K-$75K a year (80%), urban dwellers (79%) and suburban dwellers (73%) and rural dwellers (80%) all feel the pinch.

When it comes to inflation, apparently, there are no parties, genders, classes, or races. Only pain.

Home sales have tanked as mortgage rates more than doubled, with annualized sales of new homes are off nearly 40% from 2020.

Meanwhile, home heating, gasoline and other energy costs have jumped sharply, averaging a 23% monthly gain in 2022, along with grocery prices, up 11% on the year. One egregious example: Due to shortages of baby formula, which have driven prices sharply upward as supplies stay tight, stores now routinely keep baby formula under lock and key.

Even fast-food chains and other restaurants have jacked up prices 8.3% in the last year just to keep up with hikes in the minimum wage, rising rents and increased transportation costs.

As EJ Antoni, research fellow in regional economics with the Heritage Foundation’s Center for Data Analysis, noted last month:

The overall price level declined 0.1% last month but increased 6.5% in 2022, a year which saw four-decade-high inflation. Even as the increase in the CPI slows, many consumer staples remain highly elevated compared to the start of the Biden administration: eggs are up 189.9%, ground beef 21.1%, gasoline 44.3%, electricity 21.3%, transportation services 19.5%, and housing 11.8%.

Perhaps the most notable statistic for how inflation hurts average people is real wages, or wages adjusted for inflation. Over the last year, they fell 1.6%. So the average American is losing the fight against inflation as it erodes our standard of living by the day.

Antoni’s analysis shows that “the average family has effectively lost $7,400 in annual income” since the onset of the inflation surge two years ago, a disaster for most American families.

Which explains why more than three-quarters of all Americans in the I&I/TIPP Poll now claim “hardship” from inflation.

How did this happen after decades of slow or negligible inflation? It was no accident.

Here’s Forbes’ pithy summation:

As the pandemic eased in 2021, Covid vaccines became widely available and the economy began reopening in fits and starts. At the same time, supply chain bottlenecks started piling up everywhere.

Take these factors, add in thousands of dollars in direct stimulus payments to tens of millions of Americans throughout 2020 and 2021, and you had a recipe for big, broad-based price gains throughout the U.S. economy.

In addition to Biden and the Democrat-led Congress’ trillions of dollars in “stimulus,” the Fed’s glaring policy mistakes also deserve mention as a cause of our current inflation mess.

The data tell the story. For the first two months of 2021, inflation was rising by less than the Fed’s 2% annual inflation target.

But in March, inflation jumped to a 2.6% rate, the first time in 11 months above the Fed’s 2% target. It didn’t stop. By the end of 2021, inflation ran hot at a 7% rate.

Yet, in June 2021, even as inflation hit 5.4%, Fed Chairman Jerome Powell continued to stick to the Fed’s talking points about inflation being “transitory.”

Five months later, as inflation hit 6.8%, Powell changed his tune. “We will use our tools to make sure that higher inflation does not become entrenched,” he told Congress in November 2021.

But it wasn’t until March 2022 that the Fed approved its first rate hike in three years, and then only by a quarter-point. Markets then expected 2% fed funds rate by the end 2022. Instead, as inflation roared, the Fed panicked and jacked the funds rate to 4.50% at year end.

Earlier this month, Powell announced a quarter-point rate hike, taking the funds rate up to 4.75%, while also asserting that the economy’s “disinflationary” process had begun.

Inflation’s hardship was thus government-made, despite assertions that “corporate greed” or the Russian-Ukraine war were to blame. It remains to be seen whether Biden, Congress and the tardy Fed will slay the inflation dragon.

I&I/TIPP publishes timely, unique and informative data each month on topics of public interest. TIPP has been the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. During his four decades of journalism experience, he served as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Hey, want to dig deeper? Download data from our store for free!

Want to understand better? We recently wrote an explainer that sixth graders can understand. Everyone can benefit from it. Milton Friedman's Priceless Lessons On Inflation