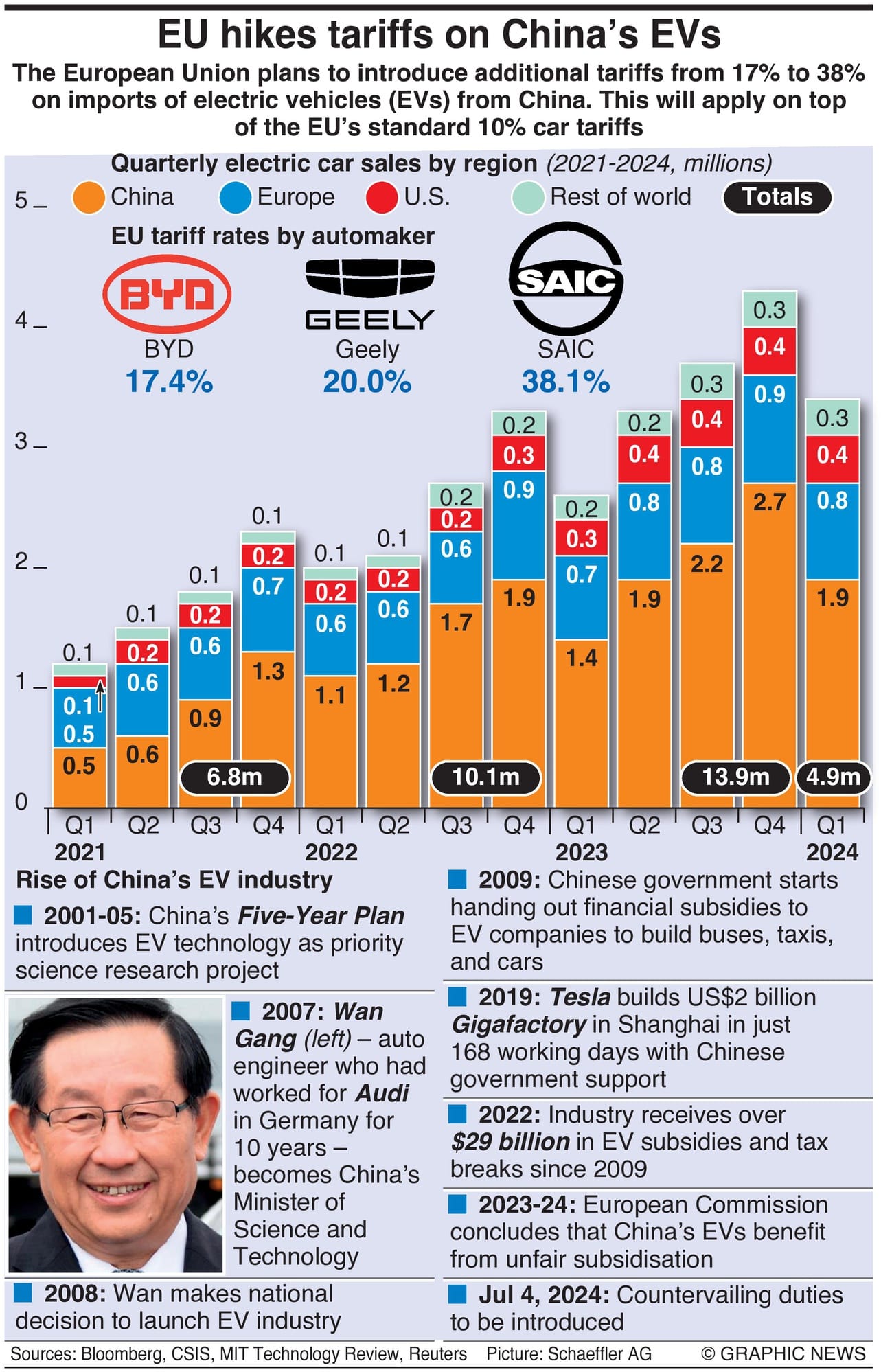

Efforts are underway to avert an all-out trade war between the EU and China following the European Commission's announcement of a steep tariff hike of up to 38.1% on Chinese-made electric vehicles, effective July 4th. Coming on the heels of a 102.5% tariff by President Joe Biden last month, and with Canada likely to follow, the Chinese EV industry is facing a watershed moment.

Chinese media has been quick to condemn the European Commission's move, terming it as "misguided" and a "thinly veiled excuse for protectionism." But, the EU and the rest of the world are actually playing catch up with a world leader in manufacturing and market for EVs.

According to Canalys, China, with a 55.5% share, is the largest EV market. By industry estimates, the country currently has an excess auto production capacity of approximately 10 million EVs. The top position was not attained by chance. It is the result of decades of state policy and systematic investment.

In a concerted effort to make the Chinese automobile industry competitive, reduce reliance on imported oil, and drastically cut down on air pollution that was making some of its largest cities inhabitable, Beijing created a roadmap and started investing in an emerging tech of the time – electric vehicles and allied sectors.

In 2001, China introduced EV technology as a priority science research project in the Five-Year Plan. Beijing offered subsidies and tax breaks and committed enormous resources to the sector. Within a decade, subsidies were extended to EV manufacturers for producing mass transit vehicles like buses in addition to cars. It is estimated that the EV sector received over 200 billion RMB ($29 billion) as subsidies and tax breaks from 2009 to 2022.

Beijing did not merely boost its manufacturing capacity or invest in tech research; parallelly, it nurtured a domestic market. For instance, Shenzhen was the first city to completely electrify its public bus fleet. As tech improved and prices moderated, citizens were offered incentives for opting for an EV, creating domestic demand. EV exports have also grown steadily. 37% of Chinese EVs were exported to EU member states in the first four months of the year alone.

Meanwhile, China remains the vital cog in EV manufacturing and supply chains. In the past decade, Chinese companies have switched to safer and cheaper lithium iron phosphate batteries (LFP) from lithium nickel manganese cobalt (NMC) types after narrowing the energy density gap between the two. China's possession of much of the world's refinery capacity for critical components like cobalt, nickel sulfate, lithium hydroxide, and graphite gives China and Chinese companies a distinct edge.

China is unlikely to take the tariff rise in its stride. The hike, over and above the EU's standard 10% car tariffs, will make Chinese-manufactured EVs far less competitive, price-wise. Incentives are already being offered. Beijing has offered to lower the existing 15% tariff on imported large-engine vehicles from EU countries, which will significantly benefit German automakers, according to Bloomberg.

As the world's second-biggest economy, China is in a position to impose retaliatory tariffs, which could devastate sectors ranging from food to machinery and automobiles to luxury items. Losing out on the growing Chinese market could severely impact the balance sheets of many EU companies.

The German Association of the Automotive Industry said, "The potential damage that could be caused by the measures now announced may be greater than the potential benefits for the European—and in particular the German—automotive industry."

It is believed that talks between Chinese Commerce Minister Wang Wentao and EU Trade Commissioner Valdis Dombrovskis will begin soon to discuss the matter. According to Chinese state media, Mr. Wang said, "If the EU is sincere, China hopes to start negotiations as soon as possible; if the EU insists on its own way, China will take all necessary actions to defend its own interests."

As things stand, the world is a deeply divided place. China, aligned with Russia in the Ukraine War, is seen as the opposition. While it is necessary to level the playing field, an ill-timed trade war could only worsen matters.