Part I. The Fed Must Chuck The Old Models

Now I’m going to leave the Minneapolis situation to President Trump and Tom Homan and others who know far more about it than I do.

All I wish to do is reaffirm my support for the police and law and order. And I want to reaffirm my opposition to left-wing groups who are constantly opposed to the police and law and order.

Instead, as Mr. Trump returned from Davos, I want to emphasize first that he is standing on top of the world, in terms of American achievements and influence.

And second, new numbers coming out today showing the American business investment boom continues to intensify.

In particular, the key category non-defense capital goods excluding volatile aircraft, which is really the core measure of business investment, is now up 9.9 percent at an annual rate for shipments over the past three months. Nearly double the 12-month rate.

And new orders are up 8.5 percent over the past three months, compared to 5.5 percent over the past year.

These investments cover machinery, equipment, computers, and electronics, among others.

I’m certain that this surge in what’s called capex is related to the 100 percent full cost immediate expensing embodied in the One, Big, Beautiful Bill, that was made retroactive to Mr. Trump’s inauguration back on January 20 of last year.

It’s another example of the success of the president’s policies. And this goes hand in hand with the pickup of industrial production, both consumer goods and business equipment.

And the spurt in GDP, which rose 3.8 percent annually in the second quarter, 4.4 percent in the third, and perhaps 5 percent in the fourth.

That’s right, there’s a Trump boom going on. And it’s based on his policies of tax cuts, deregulation, “drill, baby, drill,” and reciprocal free and fair trade.

People always say 70 percent of the economy is consumer spending, well that might be technically true, but they miss the fact that when you look under the hood, it’s actually business-to-business spending that drives the largest share of economic growth, simply because it’s businesses who hire the workers and it’s businesses who pay their wages.

You can’t have a strong consumer economy unless you have a healthy business economy. And that’s why the Trump policies are so foundational.

Advancing business investment is also helping to drive a productivity boom. As economist Ed Yardeni notes in his late newsletter, all that capital spending has been paying off by boosting productivity and profit margins.

Indeed corporate profits and margins are running at record levels, and that of course gives businesses the wherewithal to hire more and to pay higher wages.

So this whole sequence of tax incentives, business investment, productivity, profits, and wages is blowing up the so-called affordability problem. Basically it’s just good solid economic growth.

And finally, take-home pay rising roughly 4 percent is running well above the recent 1.6 percent core consumer price index or the 2.3 percent core personal consumption expenditures deflator. It’s worth about $2,000 for an average family.

So we surely don’t want any kind of government shutdown to get in the way of this Trump boom, which is the envy of the world.

And we surely do want a new Fed chairman who understands what Mr. Trump said at Davos, that economic growth does not cause inflation.

The old Fed models believe the economy can’t grow at 4 percent, 5 percent, or 6 percent. But instead must remain under 2 percent. Well, they’re wrong.

So the Fed chairman, Jay Powell, and many of his predecessors would tighten policy and stop the boom. They are wrong.

The old Phillips curve model — a phony trade-off between growth and inflation — should be mothballed.

We have a new world order of low taxes and deregulation, and falling energy prices and rising productivity, all stimulating a boom that is producing more factories and more goods at lower prices.

The new Fed chairman should embody the new Trumpian economy.

Kevin Warsh and Kevin Hassett understand Trumponomics. They can be independent, but still understand that the supply-side economic boom does not cause inflation.

No one can be sure, though, about Wall Streeter Rick Rieder, whose name has popped up for the Fed. I want to be fair here, but there is evidence that he donated to the George Soros “Act Blue” political campaign, and variously earmarked contributions to ultra-left-wing Democrats, like Senator Sherrod Brown, Congressman Hakeem Jeffries, Senator Jon Tester, or the never-Trumper, Governor Nikki Haley.

This doesn’t sound like Trumponomics to me. And if I’m wrong about this information, I’ll happily recant, but there is Federal Election Commission evidence.

Why not stay with the best? One of the two Kevins will do just fine.

Part II. Trump’s Growth Lesson For A Stagnant Europe

President Trump, in his blockbuster speech yesterday, told the Davos crowd that “the USA is the economic engine of the planet. And when America booms, the entire world booms.”

So reminiscent of Ronald Reagan. Including Mr. Trump’s tried and true observation that economic security at home is the fountainhead of national security abroad. Again, ditto Reagan.

I’ll tell you, if Ronald Reagan was the greatest president in the 20th century, right now Donald Trump looks like the greatest president in the 21st century.

That Davos crowd yesterday should have been sitting there taking copious notes on yellow legal pads, that they could go home and use to deliver some prosperity to their stagnant European countries, that haven’t grown in years and years. They’ve made every economic mistake in the book.

Confiscatory taxes, regulatory strangleholds, phony climate change, and unfair trade practices. Four years into the Ukraine war, the Europeans are still buying oil and gas from their supposed arch-enemy Russia.

And their extreme climate change policies nearly ended their industrial development. The most popular European economic policy today is bashing American companies, especially our tech companies through unfair trading practices, digital sales taxes, and the like.

Mr. Trump has completely rejuvenated American capitalism with his supply-side prosperity program of tax cuts, deregulation, “drill, baby, drill,” and reciprocal fair trade.

He may step on some toes to make a point for a year or so, on things like a 10 percent credit card interest rate, or jaw-boning defense companies, but Mr. Trump is a capitalist who believes in the incentive model of economic growth.

To quote my pal Art Laffer, if it pays more after tax, you will get more work. Or investment. Or risk taking. Or deregulating. Or putting the private sector back to work and stuffing the big government socialist model into tiny little moth balls.

Mr. Trump has always believed in rewarding success, not punishing it.

He knows, say, that today’s strong economic growth will be putting people back to work, building new factories, and producing more of virtually everything. And that can’t possibly be inflationary.

In fact, more production will bring inflation down. He knows that. He said it several times at Davos yesterday. And he’s made it clear that this old root-canal, no-growth, austerity model has to be scrapped and ended at the Federal Reserve with new people in charge.

Just a cursory look at the numbers released today enhanced the Trump boom.

For the three quarters of his second Presidency, the first year, last year, thus far, GDP is on a run rate of 4.4 percent and when all the other incentives including energy kick in this year, you could be running 5 percent, 6 percent, or 7 percent economic growth.

For some reason people don’t want to talk about it, but inflation is coming down.

The Fed’s allegedly most important indicator is the core Personal Consumption Expenditures Price Index deflator, which is now running at two tenths of a percent per month, or only 2.3 percent annually for the past three months.

Durable goods are running at 2 percent. And the obsessively feared tariff inflation has never materialized, even with modest Trumpian 15 percent tariffs that have already significantly reduced our trade deficit. Adding even more to economic growth.

You know, if the Europeans had any common sense, they would follow Mr. Trump’s economic lead, and bring prosperity to their people, because the truth is, the president is trying to save them from themselves.

Lawrence Kudlow is a Fox News Media contributor and host of both “Kudlow” on weekdays and the nationally syndicated “Larry Kudlow Show” each Saturday. This column is adapted from his monologues on “Kudlow.”

👉 Show & Tell 🔥 The Signals

I. Silver Reserves Are Concentrated In A Few Countries

Global silver reserves are heavily concentrated, with Peru alone accounting for more than one-fifth of the world’s total. Australia and Russia follow closely, while South America as a region holds roughly 30% of global silver reserves. The distribution highlights why supply dynamics, geopolitics, and regional mining policy play an outsized role in the silver market.

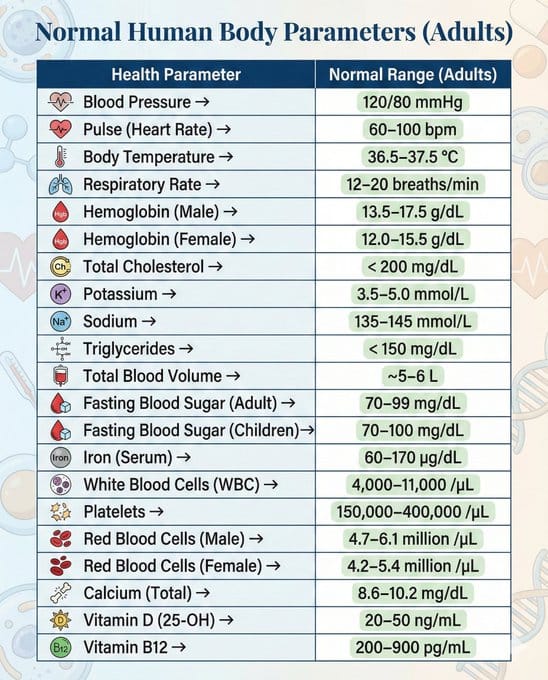

II. What “Normal” Looks Like For The Human Body

The chart summarizes commonly used reference ranges for adult vital signs and blood markers, including blood pressure, heart rate, body temperature, cholesterol, blood sugar, and key lab values. These ranges are benchmarks doctors use to flag potential issues, though what’s “normal” can vary by age, sex, health status, and context.

📊 Market Mood — Wednesday, January 28, 2026

🟩 Futures Firm Ahead of Fed Decision

U.S. futures edge higher as markets brace for today’s Fed rate decision, with policymakers expected to hold steady while signaling patience on the timing of the next cut.

🟦 Earnings Deluge, Big Tech in Focus

A flood of earnings culminates after the close with Meta, Microsoft, and Tesla—critical tests for the durability of the AI-driven rally and broader risk appetite.

🟨 Gold Hits Another Record as Uncertainty Lingers

Gold surges past $5,200 amid dollar weakness, geopolitical unease, and Fed uncertainty, underscoring persistent demand for safety even as equities grind higher.

🗓️ Key Economic Events — Wednesday, January 28, 2026

🟩 10:30 AM — Crude Oil Inventories

Weekly snapshot of U.S. oil supply conditions, influencing crude prices and energy-sector sentiment.

🟦 2:00 PM — Fed Interest Rate Decision

The Fed’s policy verdict is expected to hold rates steady, with markets focused on guidance around the timing of the next cut and Chair Powell’s tone.

editor-tippinsights@technometrica.com