Part I: The Case for Looking Forward

President Trump will address the nation tonight with a very important speech.

I sincerely hope he looks forward more than backward.

What do I mean by that?

He has a fabulous list of achievements in his first year. Most notably, closing the border and stopping illegal immigration.

Passage of the one big, beautiful bill, with its pro-growth supply side tax cuts, deregulation, “drill, baby, drill,” as well as other elements.

This was a major achievement.

Virtually single-handedly, he has changed the culture by pushing back all the woke nonsense and replacing it with traditional values. And most especially restoring God and religion.

He has also signed more than 200 executive orders, and for my money, the most important of them, got rid of President Biden’s far-left Green New Deal, climate change existential threat, nonsense.

He has also used his pen to deregulate many parts of the economy. And bolstered the development of AI.

He has developed a strong framework of peace in the Middle East. And of course he’s still working on Russia and Ukraine.

I think it’s a fabulous year one record. And I’m leaving out many other positive executive orders, including national security.

My point about looking forward, though, is that I’d like to see three-quarters of the speech predicting the fabulously optimistic economic outlook. And leave just one-quarter for the first year achievements.

If people disagree with me on this, including major Trump supporters, I understand, presidential speeches always have some difficulties figuring out how to prioritize their key points.

I have supported Mr. Trump on virtually everything he’s done, including his controversial reciprocal free and fair trade policy.

I think he’s spot on there, too. And there never was a 1930s-type trade war retaliation.

And the president’s making good deals all around the world. And he’s making a couple of $100 billion on tariff revenues.

I also want him to tell folks how great the economy is gonna be next year and beyond.

We’re already in something of a business boom from the tax cuts, and the 100 percent cost expensing. Factories are being built. That means more hiring, higher wages, and bigger take-home pay so people sitting around kitchen tables will have big smiles on their faces.

His “drill, baby, drill” has already caused a virtual collapse of oil prices and gasoline prices are falling down.

That means lower costs for hundreds of sectors in the economy.

That also means the inflation rate is gonna drop, could be several percentage points, and interest rates will follow inflation lower.

That means the economy will be so much growthier for all segments of the population, you could get 5 percent GDP with virtually no inflation.

Home prices and shelters are already moderating. Mortgage rates are coming down.

I’d like Mr. Trump to share his vision that reimagines American capitalism as a growth machine.

Attracting trillions of dollars from around the world because, yes, America is the hottest place in the world.

You know what? This is the Christmas season, and we could all use a boost in morale.

Mr. Trump is a great economic optimist. And I hope he would share that thought at some length with the rest of the country and for that matter, the rest of the world.

Part II: The Numbers Behind the Optimism

A lot of numbers came out today, as the government gears up after the shutdown.

One of the biggest themes in the jobs report for October and November was the continued restructuring of the economy, where President Biden’s big-government socialism is coming to an end. And President Trump’s re-privatization continues ahead.

So far this year, federal jobs have fallen by roughly 270,000, while private jobs have increased nearly 700,000.

Also related to Trump policies, native-born jobs are up some 2.7 million. While foreign-born jobs are down by almost a million.

It was a decent report, not a spectacular one. Unemployment went up, as federal workers searched for jobs. Importantly, though, wages for middle-class working folks are up about 5 percent year on year.

And that’s about twice the current inflation rate.

Hang on a minute, though: oil prices are now falling on an almost-daily basis. West Texas Crude prices have dropped to $55 a barrel currently from $80 a barrel at the beginning of the year.

Out there in the oil fields, incentives to “drill, baby, drill” are producing 13.8 million barrels a day.

American production is now running ahead of domestic demand. And sure enough, prices are falling.

Gasoline at the pump has dropped below $3 a gallon nationwide.

Oklahoma is the cheapest of the states at $2.30 a gallon. Crazy California, though, is at $4.35 a gallon. Climate regulations are the difference.

The bigger story, though, is how oil prices permeate every nook and cranny and virtually every price in the economy. Including food and groceries. And hundreds and hundreds of other items.

The dramatic decline in oil is going to push all the inflation indexes way down in the months ahead.

And that in turn will open the door for significantly lower interest rates.

Mr. Trump has always had a very energy-centric view of inflation.

His program to deregulate the economy, while providing important tax incentives to produce and invest, is paying off.

So, 5 percent wages in today’s jobs report, compared to 2 percent or even less future inflation, gives real wage affordability of 3 big percentage points, probably more than many working folks ever imagined.

Lawrence Kudlow is a Fox News Media contributor and host of both “Kudlow” on weekdays and the nationally syndicated “Larry Kudlow Show” each Saturday. This column is adapted from his monologues on “Kudlow.”

👉 Quick Reads

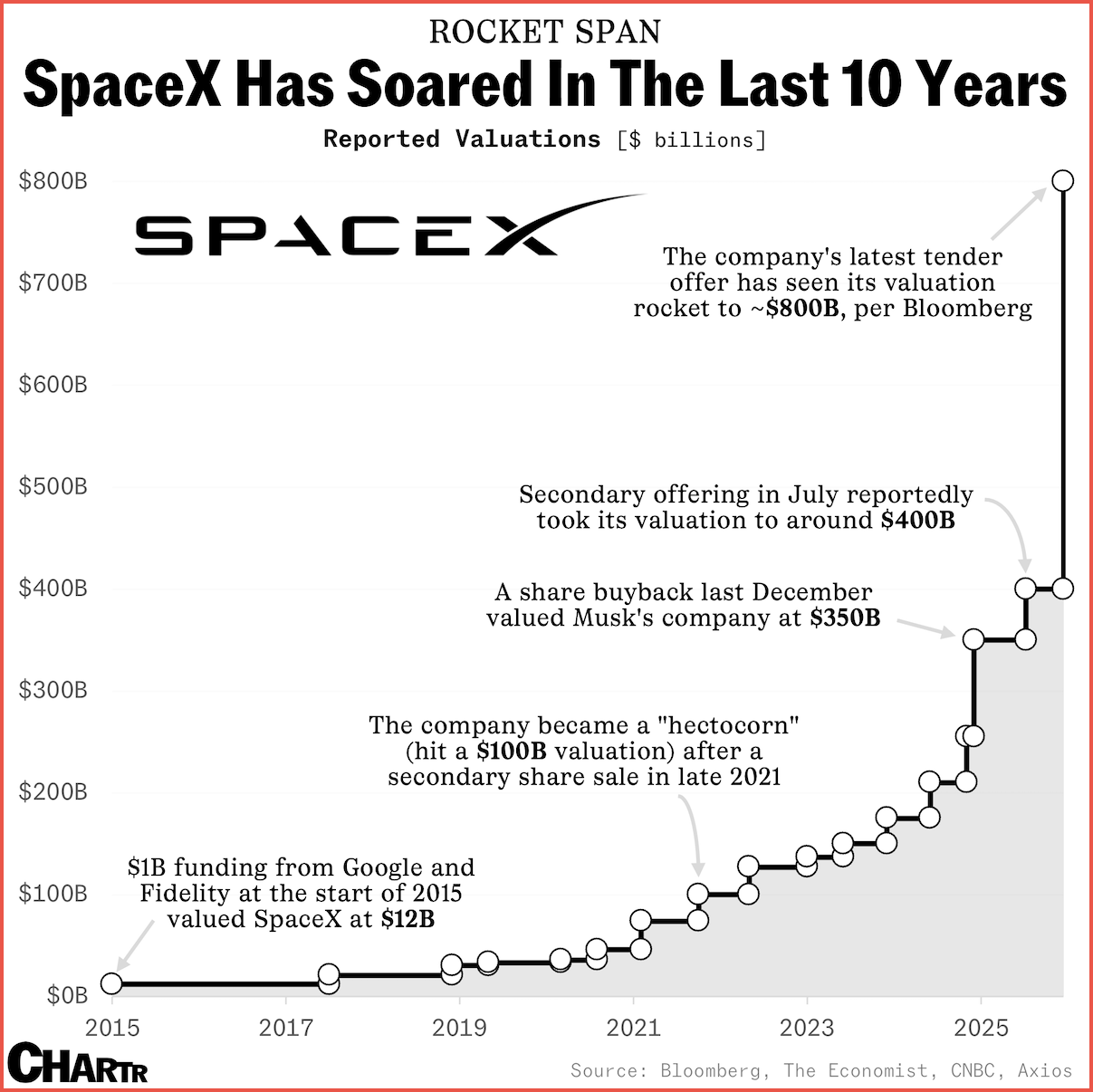

I. SpaceX’s Valuation Has Entered a New Orbit

From a $12 billion startup in 2015 to roughly $800 billion today, SpaceX’s reported valuation shows an extraordinary decade of growth.

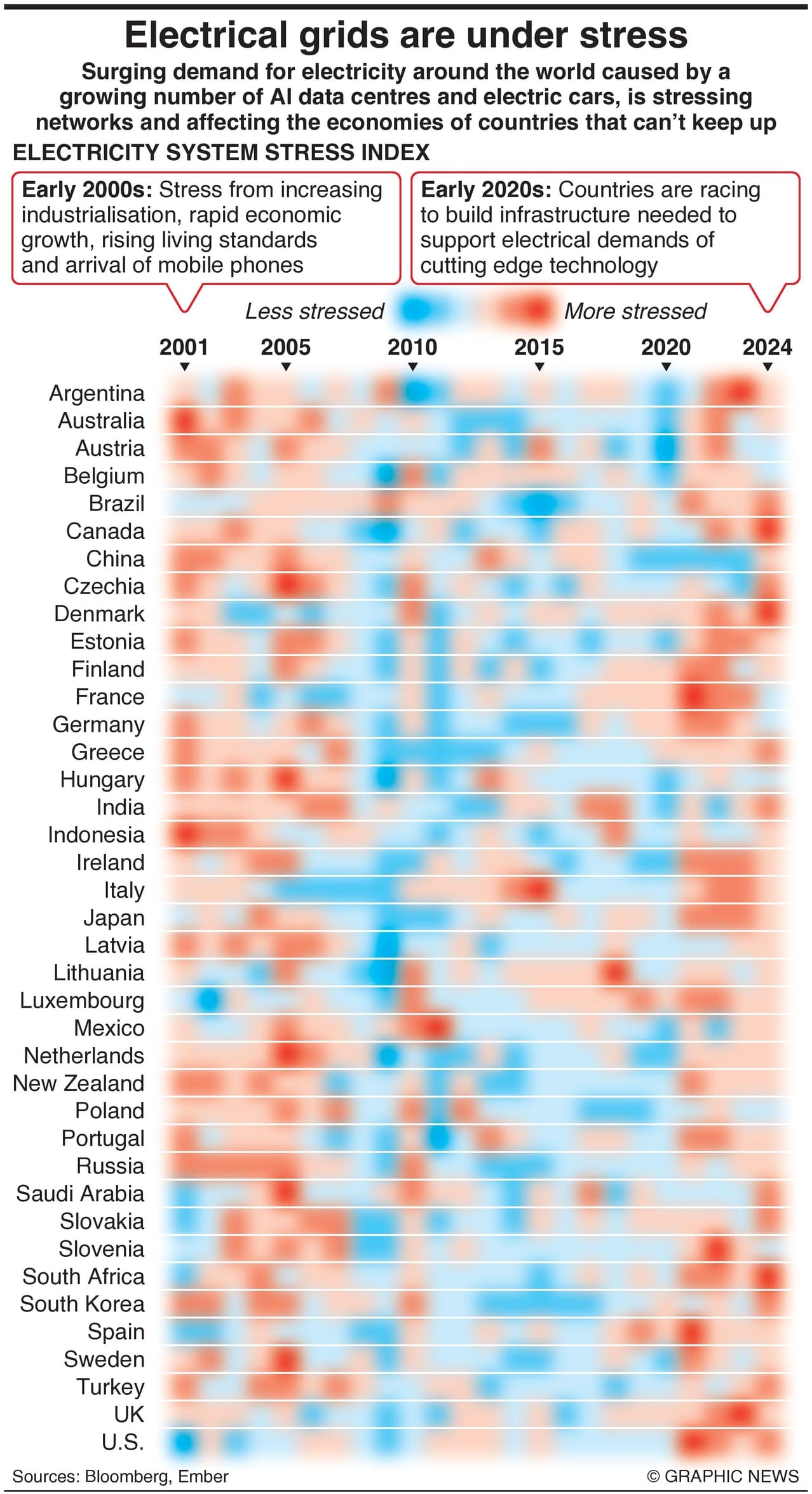

II. Cutting Edge Tech Stymied By Weak Electrical Supplies

Surging demand for electricity around the world, caused by a growing number of AI data centres and electric cars, is stressing networks and affecting the economies of countries that can’t keep up.

The TIPP Stack

Handpicked articles from TIPP Insights & beyond

1. ‘It’s The Economy, Stupid’: How A Political Meme Toppled A President And Could Do It Again—Victor Davis Hanson, The Daily Signal

2. Trump’s Inflation Trap—Daniel McCarthy, The Daily Signal

3. November’s Weak Jobs Report Pushes The Fed Toward More Monetary Stimulus—Ryan McMaken, Mises Wire

4. Flim Flam Theater Of Peace Talks On Ukraine—Moon of Alabama, Ron Paul Institute for Peace and Prosperity

5. The Rise Of The Isaac Accords: How Israel Is Redrawing South America’s Political Landscape—Freddie Ponton, Ron Paul Institute for Peace and Prosperity

6. Time For These Zionist ‘Pastors’ To Register As Foreign Agents—Jason Jones, Ron Paul Institute for Peace and Prosperity

7. The $100 Billion Question Nobody’s Asking: Why Are Taxpayers Funding Big Tech Contracts With Nothing To Show For It?—Evan Swarztrauber & Luke Hogg, The Daily Signal

8. Exposing Biden’s ‘Afghan Vetting Fiasco’—Virginia Allen, The Daily Signal

9. Mark Kelly Faces Escalated Review Of Alleged Misconduct From Pentagon—George Caldwell, The Daily Signal

10. House Investigates SPLC’s Profiting, Partisanship In Attack On Conservative Groups—Fred Lucas, The Daily Signal

11. Will The Republican Health Care Package Go Up In Flames?—George Caldwell, The Daily Signal

12. Pence-Connected Group Releases Report On Obamacare Funding Abortions—George Caldwell, The Daily Signal

13. Republicans Weigh In On Bill Banning Transgender Procedures— Jacob Adams, The Daily Signal

14. Erasing Masculinity Has Created A Generation In Crisis— Mark Hancock, The Daily Signal

15. What Happened To Climate Change?—Connor O'Keeffe, Mises Wire

16. FCC’s Brendan Carr Steps Into The Arena— Daniel R. Suhr, The Daily Signal

17. ‘FAKE NEWS’: Trump, Leavitt React To Susie Wiles Profile—Elizabeth Troutman Mitchell, The Daily Signal

18. An Economic Contagion—Mark Thornton, Mises Wire

19. The Next Economic Downturn Will Be Here Soon Enough—Vincent Cook, Mises Wire

From TIPP Insights News Editor

20. Congressional Report Urges Crackdown On China Ties In US Energy Research

21. Trump Escalates Pressure With Blockade Of Venezuelan Oil Tankers

22. Wuhan, Chinese Agencies Sue Missouri For $50 Billion Over Covid-19 Fallout

23. Japan Sees Sharp Drop In Chinese Visitor Growth After China Warning

24. Senate Passes $900 Billion Defense Bill, Sends NDAA To Trump

25. IEA Forecasts Record Coal Use In 2025 As US Demand Rebounds

26. Do Voters Trust Supreme Court To Do What’s Best For U.S.? Yes, But Just Barely: I&I/TIPP Poll

27. Warner Bros. Discovery Rejects Paramount’s $108 Billion Hostile Bid

28. Amazon In Talks To Invest $10 Billion In OpenAI, Report Says

29. Authorities Thwart Planned Attack In New Orleans, Ex-Marine Arrested

30. Trump Says White House Ballroom Could Cost Up To $400 Million

31. California Regulator Targets Tesla Over Alleged Autopilot False Advertising

32. Trump Wins Temporary Court Ruling On National Guard Presence In DC

33. Ray Dalio Backs Trump Accounts For Children With Major Donation, Joins Michael Dell

34. Oscars Leave ABC After Five Decades, Move To YouTube

📊 Market Mood — Thursday, December 18, 2025

🟩 Futures Up, Nerves Intact

Stocks edge higher on Micron’s upbeat outlook, but conviction remains fragile after four straight down days for the S&P and Dow.

🟧 CPI Is the Day’s Swing Factor

U.S. inflation data lands today. Headline and core CPI are expected at 3.0%, keeping pressure on a Fed already focused on a cooling labor market.

🟦 Micron Reignites AI Optimism

Micron forecasts blowout earnings as data-center demand surges. Management says it may meet only part of customer demand through 2026.

🟪 BoE Set to Cut

The Bank of England is expected to ease policy as U.K. inflation cools, standing out among mostly steady European central banks.

🟫 Oil Rises, Trend Still Weak

Crude ticks higher on Trump’s Venezuela tanker blockade, but prices remain on track for weekly losses amid surplus fears.

🗓️ Key Economic Events — Thursday, December 18, 2025

🟩 8:30 AM ET — CPI Inflation Data (Nov)

- Core CPI (MoM) – Underlying inflation trend, excluding food and energy.

- Headline CPI (MoM & YoY) – The market’s primary inflation gauge and a key driver of Fed policy expectations.

🟧 8:30 AM ET — Initial Jobless Claims

A timely snapshot of labor-market conditions following signs of rising unemployment.

🟦 8:30 AM ET — Philadelphia Fed Manufacturing Index (Dec)

A regional read on factory activity, offering early insight into broader manufacturing momentum.

editor-tippinsights@technometrica.com