The Democratic Party’s faithful are whistling past the graveyard, hoping with all their might we’ll avoid an economic slide. As a matter of general economics, we’re already in a recession. And it looks like things will soon get worse, not better.

“We hope we can have what they say, ‘a soft landing,’ a transition to a place where we don’t lose the gains that I ran to make in the first place for middle-class folks, being able to generate good-paying jobs and — expansion,” President Joe Biden told CBS’ 60 Minutes last month.

Good luck with that, Mr. President. Even members of your own party think it’s hogwash.

As economist Larry Summers, who advised both Presidents Bill Clinton and Barack Obama, said last week, a soft landing is “really quite unlikely.” We agree, as do most economists of our acquaintance.

Indeed, looking at the repeated economic policy mistakes made by Biden, or whoever now is really calling the shots in the White House, and the far-left Democrat-led Congress, it’s hard not to conclude that the economy’s set for a mighty fall.

Four trends stand out:

Stock and housing market declines. The stock market’s epic plunge has destroyed an estimated $11 trillion in wealth this year alone, while home prices, after peaking in June, have fallen sharply as interest rates jump above 6%. As home equity shrinks in a weakening housing market, consumers’ ability to borrow against their homes will also shrink.

What economists call “the reverse wealth effect” is now in play, meaning consumers and investors are likely to spend a lot less in the coming months.

Why is this happening? The federal government’s $5 trillion COVID spending binge, which the Fed enabled by keeping rates low; a $1.1 trillion “infrastructure” spending program; followed more recently by the laughably named Inflation Reduction Act, which will waste another $1 trillion or so before it’s done all of its damage.

All told, federal spending is up $9 trillion since 2021, an unparalleled increase. Now, with inflation roaring, the central bank is desperate.

Fed rate hikes. Federal Reserve Chairman Jerome Powell has made it abundantly clear that he will not be stuck with the blame for a chronic inflation problem, with the Fed’s preferred inflation measure, the Personal Consumption Expenditures deflator, now over 6% — well above the target of 2% that the central bank considers “price stability.”

And by the way, consumer price inflation, which average people watch, is now above 8%, a 40-year high.

Powell has now ratcheted up official rates from just north of zero in March to the current 3.25%. And he warns he’ll keep going if necessary. “We will keep at it until the job is done,” Powell said in late September. “I wish there were a painless way to do that. There isn’t.”

So, the Fed’s telling you: Expect more pain.

And you’ll soon be getting it, because every 1% of interest rate hikes boosts federal payments on our $31 trillion national debt by about $300 billion a year. Are you ready for a tax hike? It’s coming.

Soaring energy prices. This week, Biden launched what CNN called a “furious, last-ditch wide-scale effort” to get OPEC+, including Russia, to pump more oil at a time of soaring prices. Recall that Biden earlier called Saudi Arabia, OPEC’s defacto leader, a “pariah state.”

It didn’t work. After CNN reported that OPEC would likely cut output by more than 1 million barrels per day when it met Wednesday in Vienna, the organization, in what can only be called an act of spite, decided to decrease output by 2 million barrels per day.

As a result, winter is going to be cold and very, very expensive as energy costs soar due to foolish green policies that reduce energy supply just when we need it most. Now, thanks to Biden’s economically damaging restrictions on domestic oil producers to appease the Dems’ extremist “Green New Deal” wing, we’ve gone from producing more oil than we need to begging OPEC to boost its output.

As any economist will tell you, the last six recessions have all been preceded by big jumps in oil prices. This time will be no different.

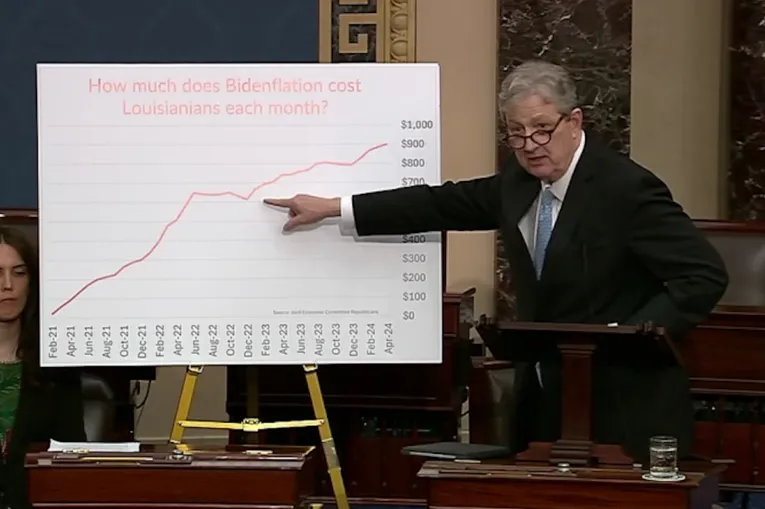

Plunging incomes. A new report from the Heritage Foundation shows the damage done by Bidenomics to the average American family. It tells us “the average American has lost the equivalent of $4,200 in annual income under the Biden administration because of inflation and higher interest rates.” Inflation is to blame for $3,000 of that; higher interest rates the rest.

“This financial catastrophe for American families is the direct result of a president and Congress addicted to spending our money, combined with a Federal Reserve compliantly enabling this addiction by printing more dollars,” the report said, noting that incomes rose by $4,000 during the tax-cutting and deregulating Trump years.

So buckle up. It’s going to be a bumpy ride, with the chances of a soft landing now being next to nil.

If Biden really wants some solid advice, he needs to look no further than former CKE CEO and Trump Labor secretary nominee Andy Puzder.

“So, what could Biden do to reverse the results of his thus far disastrous economic policies?” he asked recently in an op-ed. “Simply, we need to reduce demand, increase supply, and inflation will subside. It’s not like this is a mystery.”

Indeed it’s not. “Reduce demand” simply means cut back government’s obscene spending binge. And “increase supply” means cut taxes and deregulate.

By the way, this is a time-honored strategy that President Ronald Reagan proved works, and that congressional Republicans are now trying to revive. If given a chance, it will work again. Sure, a hard crash might be all but inevitable. But it’s never too late to create the next American boom.

— Written by the I&I Editorial Board