By Larry Bell, via CFACT.org | March 5, 2024

Federal and state energy policies, now pushing electric vehicles on a reluctant public, are running in conflict with other social and environmental restrictions banning vital materials and component imports.

As consequences, U.S. and European auto companies are racing into Chinese rare earth monopoly and other supply traps posing inevitable economic and national security threats.

American EV consumers who ride along will be left in a ditch along with dealers who lack essential inventory and profitable markets.

This is already occurring.

U.S. customs officials have seized thousands of German Volkswagens over a single part made in China’s Xinjiang region, believed to be in violation of the Uyghur Forced Labor Prevention Act (UFLPA), which requires importers to provide evidence that their goods were not produced with forced labor in order to avoid penalties.

The German company is a joint venture partner with Chinese-owned SAIC Motors, which owns a factory in Xinjing’s capital, Urumqi.

Volkswagen was previously linked to such a violation when the German newspaper Handelsblatt reportedly obtained photographs showing Uyghur workers in military uniforms during the three-year construction of a car-testing track.

As reported in the Financial Times, U.S. authorities have also impounded and are investigating luxury brands produced by Porsche, Bentley, and Audi over suspected UFPLA violations involving electronic components, resulting in delivery delays of uncertain length.

A recent Human Rights Watch report has also warned that carmakers, including Tesla, General Motors, Volkswagen, and Toyota, are failing to ensure they aren’t using aluminum produced by Uyghur forced labor.

Aluminum is used extensively in EV manufacture as a mileage economy measure to compensate for heavy battery weight.

Whereas Tesla owns a factory in Shanghai that builds cars for both Chinese and international markets, they had reportedly tracked its supply chain back to the mining level without evidence of forced labor.

Then, factor in influences of new and existing environmental regulations influencing rare earth mining and processing for batteries, which represent a major EV cost

Biden administration’s anti-drilling and pro-EV policies have made America increasingly dependent on rare earth minerals mined for those batteries under atrocious slave labor and environmental conditions bureaucrats ignore.

China controls a stranglehold monopoly of about 80% of the global supply, with Congo a 90% source of vital cobalt.

As a consequence, Mountain Pass in California, the sole remaining operational U.S. rare earth mine that lost two years of production due to a 2016 bankruptcy, incredulously continues to send its mined ore to China for processing.

Expect those battery costs to escalate in concert with increased global demands for nickel — a primary component of lithium-ion cathodes — having already risen over six years from $10,336 per metric ton in August 2016 to $16,104 currently.

Purchasers should consider that, with a Tesla battery typically costing about $10,000, their resale price will likely have to be significantly higher than that of a comparably aged and sized internal combustion model in similar condition.

Also, expect that on the resale end, an average on-the-road 12-year-old used EV will be on its second or third new battery before an owner can sell it.

Ford, Toyota, Volkswagen, Honda, Nissan, and Subaru have meanwhile all had to adjust new model sales prices upward due to the scarcity of semiconductors, a supply condition that will only become more precarious if and when government-mandated EV numbers multiply.

Currently, despite huge auto investments and government subsidies, this isn’t happening.

As reported in The Wall Street Journal, in September of last year, it took retailers over two months to sell an EV, compared with around a month for gas-powered vehicles and only three weeks for a gas-electric hybrid.

Falling demand and rising prices have prompted Ford to cut previously planned 2024 production of its F-150 electric truck in half after losing $60,000 on each EV sold while also pausing construction of a $3.5 billion battery plant in Michigan.

Facing similar realities, General Motors has said it will delay opening a planned large EV truck factory in Michigan by a year, citing a need “to better manage capital investments while aligning with evolving EV demand”.

This slowdown and resulting industry business losses are occurring both despite and in addition to generous $7,500 federal tax credit subsidies offered as EV incentives to reluctant buyers and jacked-up costs for gasoline models consumers truly want to keep vehicle manufacturers financially afloat.

Consequentially, China isn’t the only EV supply chain threat.

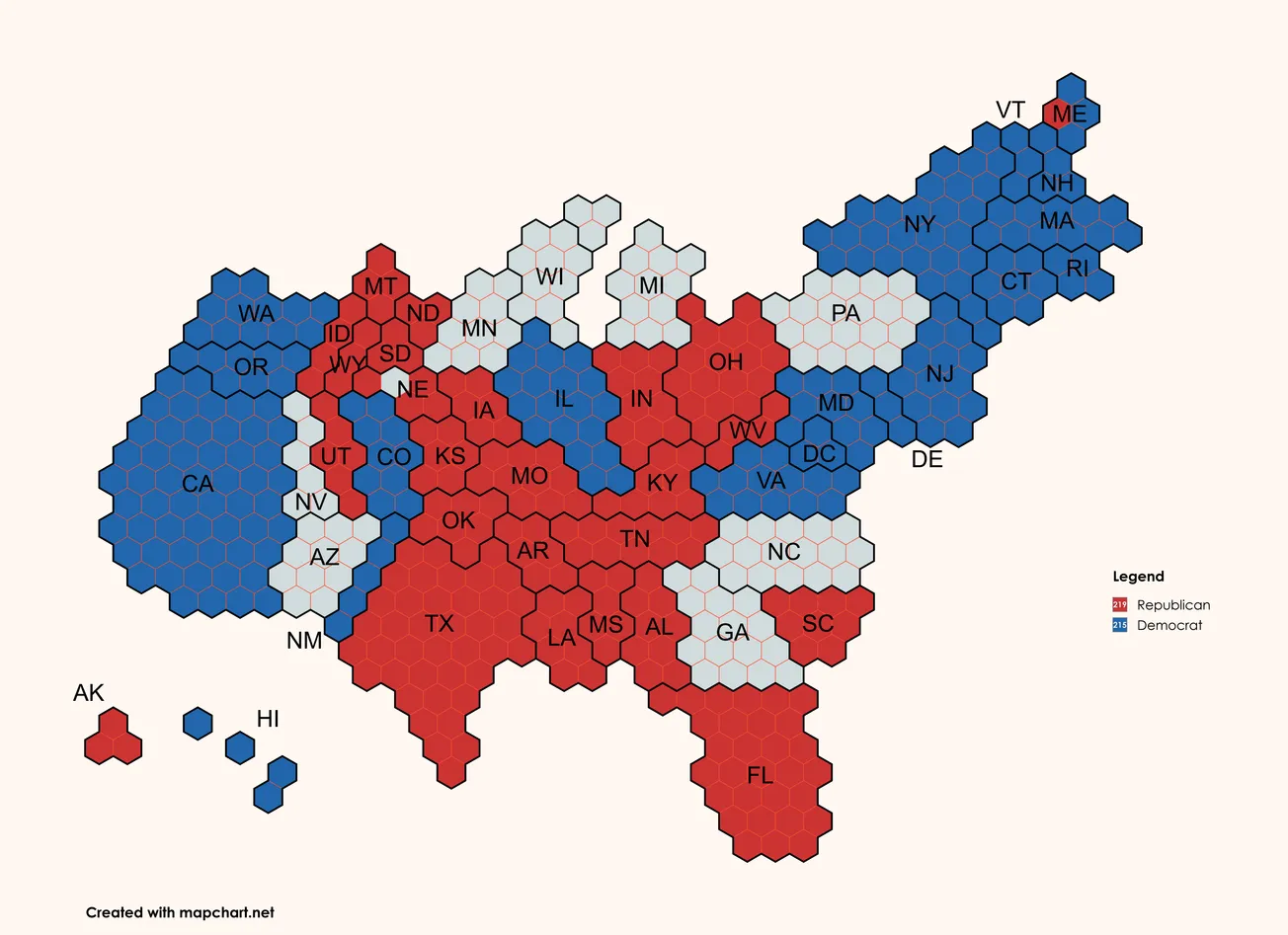

A 2024 political climate change returning the presidency and Congress to Republican control will hopefully replace that EV subsidy supply chain with free market choices that will end the greatest threat of all — Biden and Beijing’s influence over what we buy and drive.

Larry Bell, a CFACT Advisor, heads the graduate program in space architecture at the University of Houston. He founded and directs the Sasakawa International Center for Space Architecture. He is also the author of "Climate of Corruption: Politics and Power Behind the Global Warming Hoax."

This article by Larry Bell originally appeared at NewsMax