‘You know, if you let me write $200 billion worth of hot checks every year, I could give you an illusion of prosperity, too.”

That was then-Democratic Sen. Lloyd Bentsen back in 1988 arguing that the Reagan boom was a myth because it was bought and paid for with deficit spending, then running about $200 billion a year.

What would Bentsen say today about an economy that – instead of blasting ahead at more than 4% a year at it was in 1988 – is barely eking out gains and appears headed to a downturn … despite the fact that President Joe Biden is writing $200 billion in hot checks every two months.

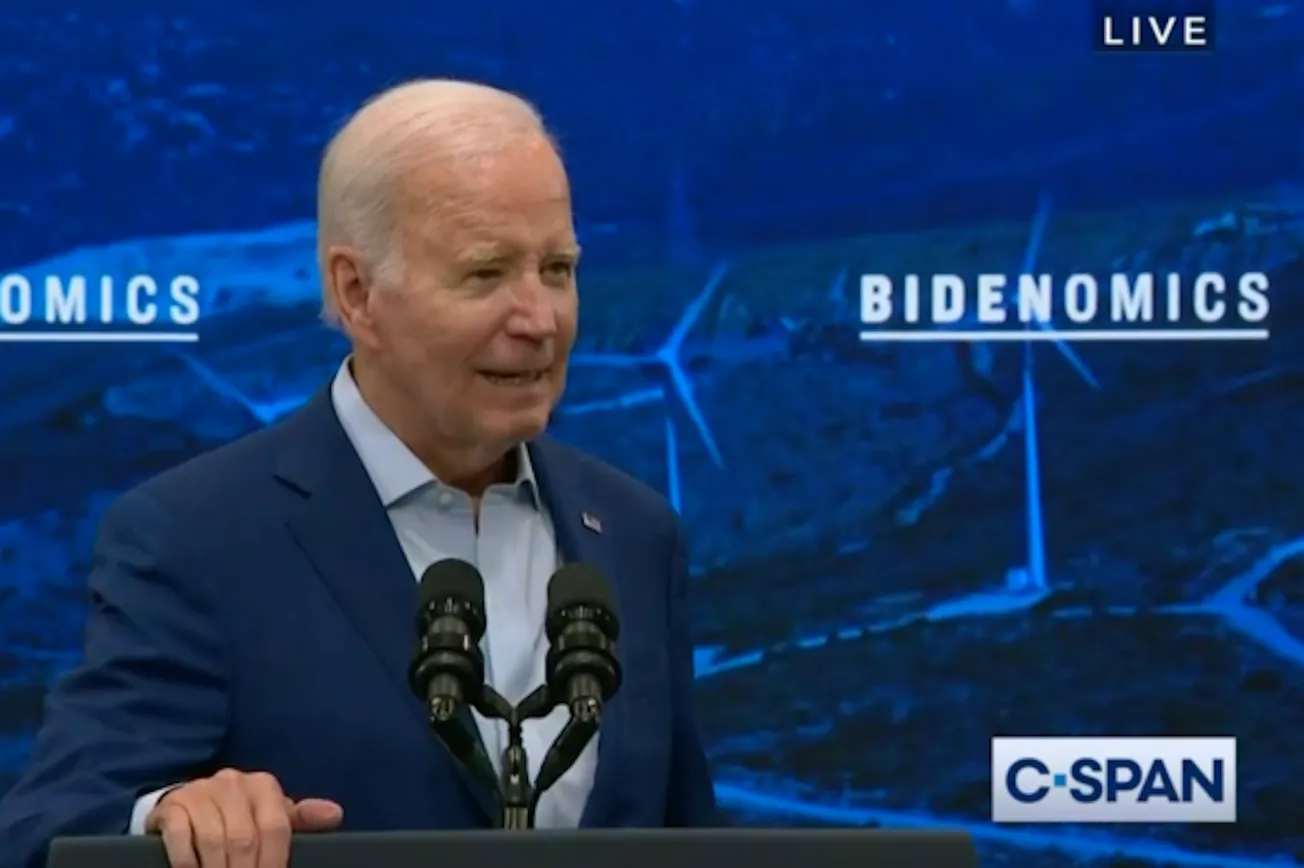

We know what Biden and his legions of sycophants in the “independent” media would say. The economy is doing great thanks to “Bidenomics.”

“The economy is growing and we’re lowering costs for families. That’s Bidenomics at work,” Biden said after the latest GDP numbers came out, which showed the economy growing 2.4% in the second quarter of this year. “This progress wasn’t inevitable or accidental — it is Bidenomics in action, growing the economy from the middle out and bottom up, not the top down.”

One week later, Fitch downgraded the U.S. credit rating from AAA to AA+.

The lower rating, Fitch said, “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’-rated peers.”

Fiscal deterioration over the next three years and a high and growing debt burden? Is this “Bidenomics in action”?

Look at the numbers and you see why Fitch is worried.

In 1988, when Bentsen was complaining about “hot checks,” the federal deficit was 3% of GDP. This year, under Bidenomics, the deficit will be twice that, and possibly higher. At the start of the year, the Congressional Budget Office predicted that the deficit for all of 2023 would be $1.4 trillion. By June it had already hit level and is now slated to reach $1.6 trillion, according to the Treasury Department.

Publicly held federal debt is close to 100% of GDP. When you add “intragovernmental” debt – which includes money owed to Social Security, Medicare, and other trust funds – the gross federal debt tops 120% of GDP. And the Congressional Budget Office says this number is slated to climb to 133% of GDP in a decade.

That’s “Bidenomics in action.”

Meanwhile, interest payments on the debt are exploding as the Fed hikes interest rates to counteract the inflation that Biden’s deficit-fueled “prosperity” unleashed, which will only accelerate the fiscal deterioration and add to the debt burden.

All this is bad enough. But Biden’s debt-fueled “prosperity” isn’t limited to the federal government. Everyone is living beyond their means these days, as real disposable income is lower today than it was two years ago.

The New York Federal Reserve reported on Tuesday that credit card debt shot up by $45 billion in the second quarter of this year and now tops $1 trillion for the first time ever.

Credit card delinquencies are up, too. Elizabeth Renter, data analyst NerdWallet, told CNBC this week that “Credit card delinquencies continue an upward trend, a growing sign that consumers are feeling the pinch of high prices and lower savings balances than they had just a few years ago.”

At the same time, families are increasingly tapping into their 401(k)s to cover the cost of living. Bank of America reports that the number of “hardship withdrawals” jumped 36% in the second quarter.

That’s “Bidenomics in action.”

Meanwhile, the administration is celebrating Bidenomics while the left churns out stories such as: “Biden Saved the Economy and Launched a New Age of Prosperity. Why Isn’t He Getting Any Credit?”

As Styx put it 46 years ago in their song “The Grand Illusion”:

“But don’t be fooled by the radio/

The TV or the magazines/

They show you photographs of how your life should be/

But they’re just someone else’s fantasy.”

— Written by the I&I Editorial Board