The United States Treasury Department contains within its vast alphabet soup of agencies and divisions an obscure office about which most Americans know very little.

The Office of Foreign Assets Control (OFAC) administers and enforces economic sanctions programs against countries to accomplish foreign policy and national security goals. In a 2021 paper, the Treasury reported that an incredible 9,421 sanctions designations were active, a 933% increase since 9/11, as American administrations, both Republican and Democrat, have used sanctions as a primary diplomatic weapon.

Twenty-two countries face American sanctions of some kind or intensity. They include Afghanistan, some Balkan regions, Belarus, Burma, some nations in Central Africa, Cuba, the Democratic Republic of the Congo, Ethiopia, Hong Kong, Iran, Iraq, Lebanon, Libya, Mali, Nicaragua, North Korea, Somalia, Sudan, Syria, Venezuela, Yemen, and Zimbabwe. OFAC says that the sanctions programs vary in scope, with some being broad-based and oriented geographically. Others are "targeted" (i.e., counter-terrorism, counter-narcotics) and focus on specific individuals and entities. For example, America has sanctioned many Chinese military companies.

Most countries against which America directs its ire are relatively small economies with little geopolitical impact other than in their immediate neighborhoods. Their trade figures are negligible, although several countries, being oil-producing nations such as Iran, Iraq, or Venezuela, can help tip oil prices.

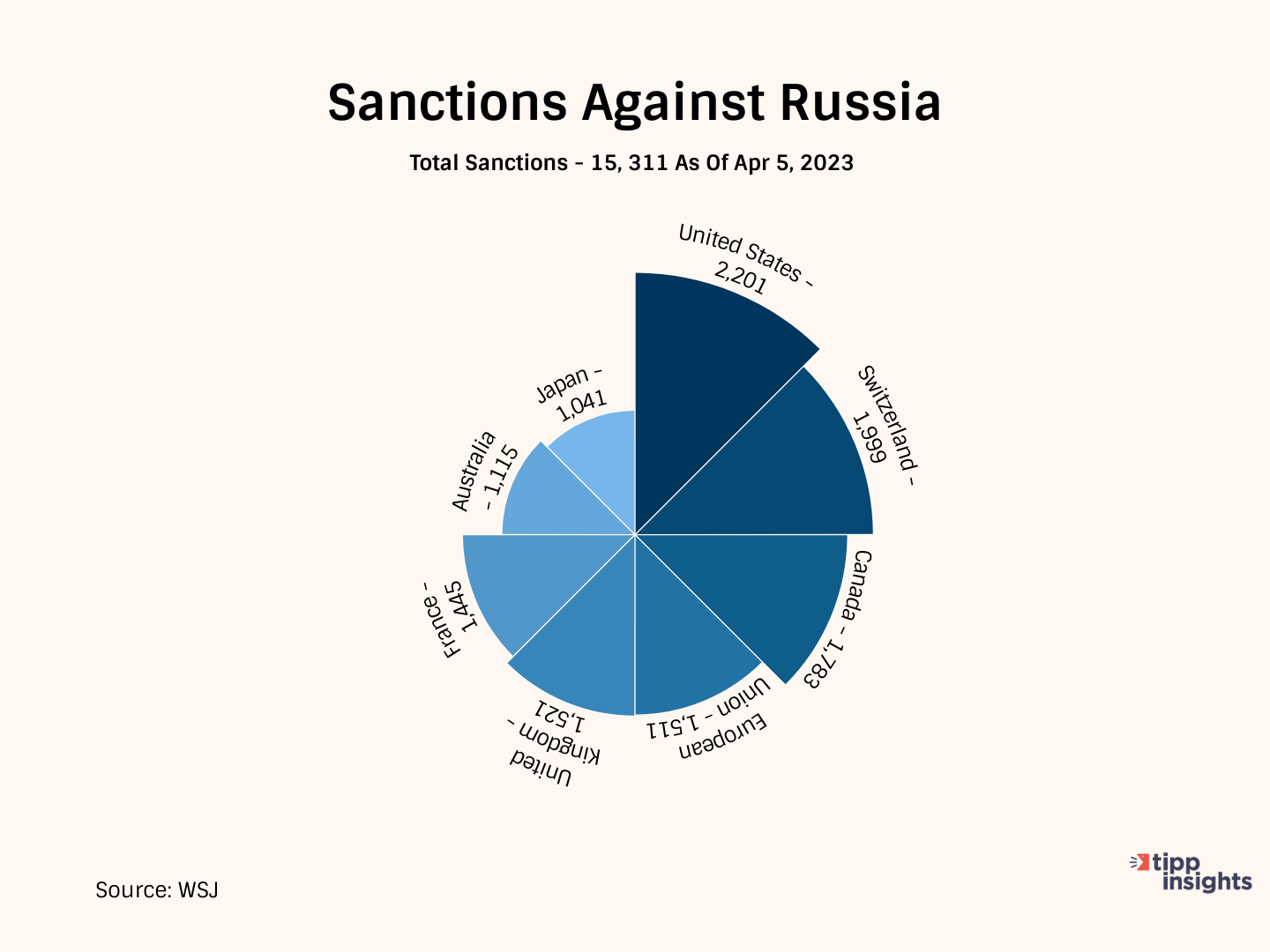

Since Russia's war on Ukraine, the mandarins in America's Neocon movement, seeking to destroy Russia without committing US troops to the effort, decided to employ OFAC to sanction Russia, an unprecedented move. The Biden administration knew it could not dent Russia by itself, so it built a coalition of 30 nations to impose sweeping sanctions, export controls, and other economic measures to make it harder and costlier for the Kremlin to obtain the capital, materials, technology, and support it needs to sustain its war of aggression. The liberals in Biden's inner circle also knew that building such a coalition of European nations would be a strong political statement against former President Trump, who often riled against Europe for not doing much to defend itself. Senior Treasury officials have taken over 80 trips to 31 countries to coordinate these international sanctions.

Never before has a great power like Russia been sanctioned on this scale. A year after the Russian invasion, a Treasury report shows how the US government has led a full-scale economic war, including enacting price caps to hurt Russia's most profitable sector - oil. The West has immobilized about $300 billion of Russian Central Bank assets. It has also blocked or frozen tens of billions of dollars of sanctioned Russian assets in financial accounts and economic resources.

Impact on Russia. Have these sanctions, along with nearly $200 billion in arms shipments to help defend Ukraine, prolong the war, and weaken the Russian military been effective? The answer is yes. But the collective measures have amounted to a minor fender-bender, at best, rather than engineering a crash of Russia's economy.

The EU noted that according to the World Bank, the International Monetary Fund (IMF), and the Organisation for Economic Cooperation and Development (OECD), Russia's gross domestic product (GDP) in 2022 dropped by 2.1%. Its 2023 GDP is forecast to decline by 2.5% in the worst-case scenario (OECD) or by 0.2%, according to the World Bank. In contrast, the IMF expects the Russian economy to grow in 2023 by 0.7%, a remarkable estimate considering Russia's isolation.

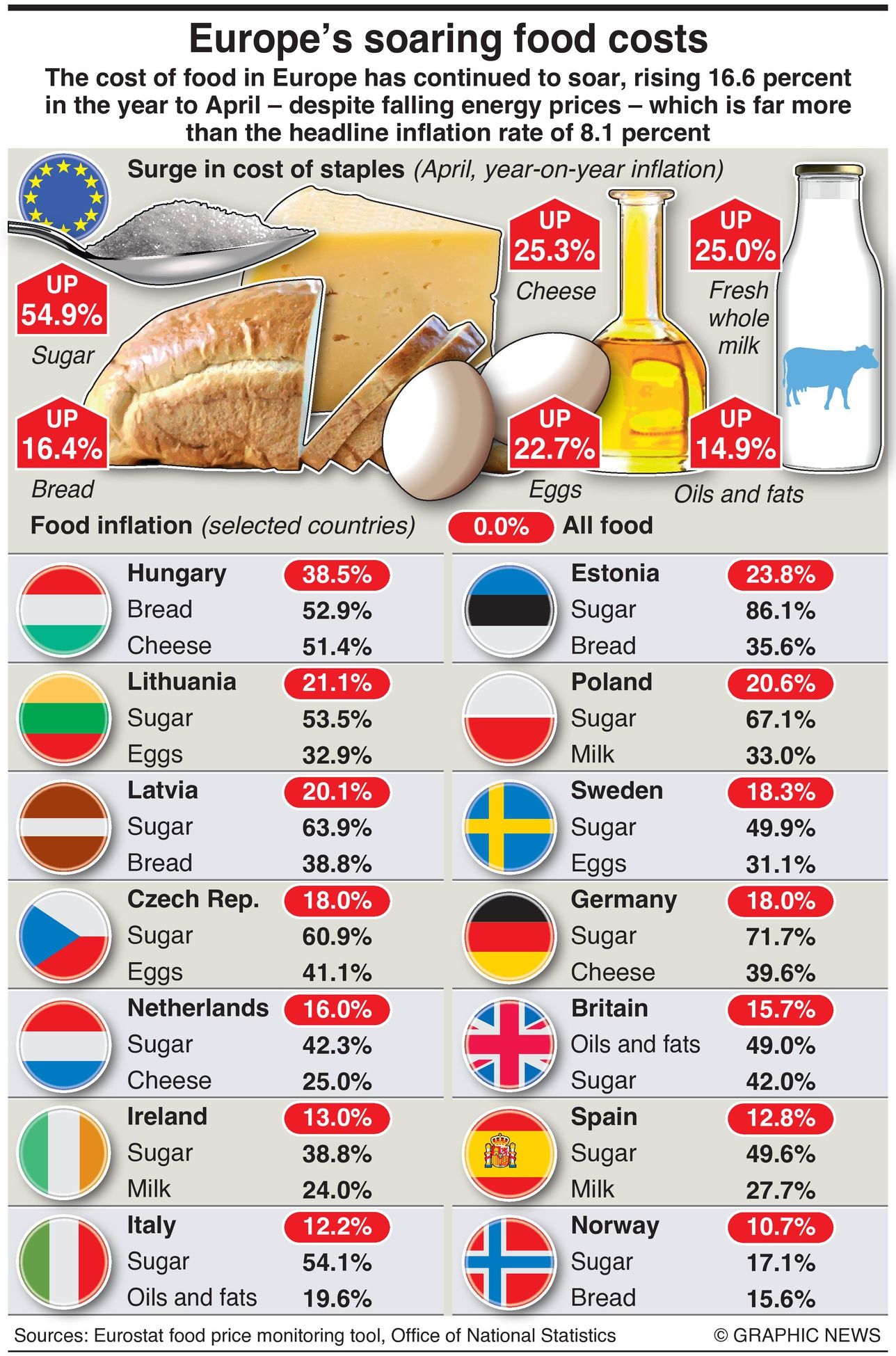

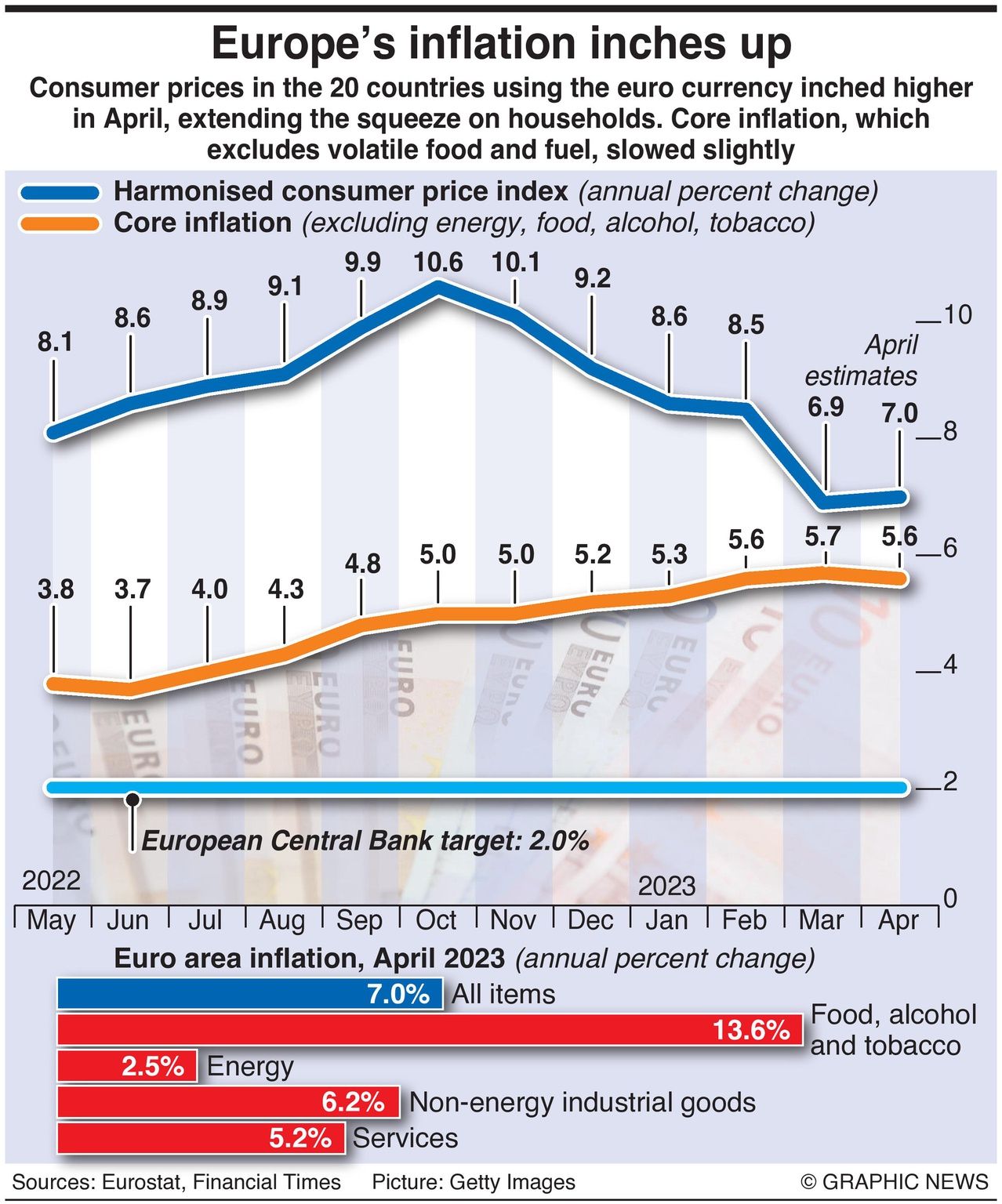

The sorry truth is that Western sanctions have hurt the West as much, if not more, than their intended target.

Germany is now in a recession. According to the BBC, persistent inflation, primarily brought about by restricting Russian energy exports, has helped push Germany into recession in the first three months of the year. The economy contracted by 0.3% between January and March, following a 0.5% contraction in the last three months of last year. Two successive quarters of negative growth indicate a recession.

The UK may be heading towards a recession. Stubborn core inflation could see the Bank of England (BoE) increase interest rates to a peak of 5.5%. Though down from 10.1%, inflation remained stubbornly high at 8.7% in April, with core inflation at its highest since 1992 and food prices rising alarmingly quickly.

Inflation in the US continues to be an issue. The US inflation measure most closely watched by the Federal Reserve rose 4.4% year-on-year in April, official figures showed Friday, reversing a recent slowdown and raising the chance of another interest rate hike in June.

Western policies to contain Russia through economic sanctions have been a disaster at the street level. We have noted several times that inflation-led labor strikes, having gripped Germany, the UK, and now the US, risk exacerbating inflation as workers demand and receive raises which will chase after goods and commodities in short supply as Russia is sidelined.We fear that things will get a lot worse before they get better.

Like our insights? Show your support by becoming a paid subscriber!