By John Hugh DeMastri for Daily Caller News Foundation

The Federal Reserve is likely to further slow its historically aggressive pace of interest rate hikes at its Wednesday meeting as inflation cools, but consumers will still feel the pinch of higher interest rates, according to economists who spoke with the Daily Caller News Foundation.

The Fed is likely to hike interest rate hikes by just 0.25 percentage points after its Wednesday meeting, setting the range for its target federal-funds rate to between 4.5% and 4.75%, due to slowing inflation, The Wall Street Journal reported. Although consumers may see some relief from inflation as a result of the Fed’s rate hikes, they might give back some of those gains as heightened interest rates drive up borrowing costs, Heritage Foundation economist E.J. Antoni told the DCNF.

“Consumers first experienced the pain from inflation and are now being inflicted with higher borrowing costs from higher rates,” Antoni said. “Thus, the Fed gets you coming and going when it comes to its schizophrenic interest rate policy. This is a perfect illustration of why the Fed should be allowing interest rates to seek their natural level instead of indirectly targeting an inflation rate by directly targeting an interest rate.”

The Fed’s rate hikes — designed to blunt economic activity and reduce consumer demand in a bid to limit inflation — have already pushed up the cost of credit card loans, car loans, mortgages and more, according to CNBC.

“The good news is that the worst is over,” Yiming Ma, an assistant finance professor at Columbia University Business School, told CNBC. While inflation remains well above the Fed’s 2% target at 6.5% through December, pressures keeping up prices have “come down substantially and the pace of rate hikes is going to slow,” Ma told CNBC.

On the other hand, while the worst of inflationary pressures may have passed, the economic contraction caused by aggressive interest rate hikes will likely lead to a recession, Peter C. Earle, economist at the American Institute for Economic Research, told the DCNF.

“Consumers may see prices broadly continue to decline, but with interest rates at a level that is slowly shrinking the money supply, they’ll also see a slowing in the economy,” Earle said. “The price of aggressively attacking inflation is almost always a recession, whether mild or deep.”

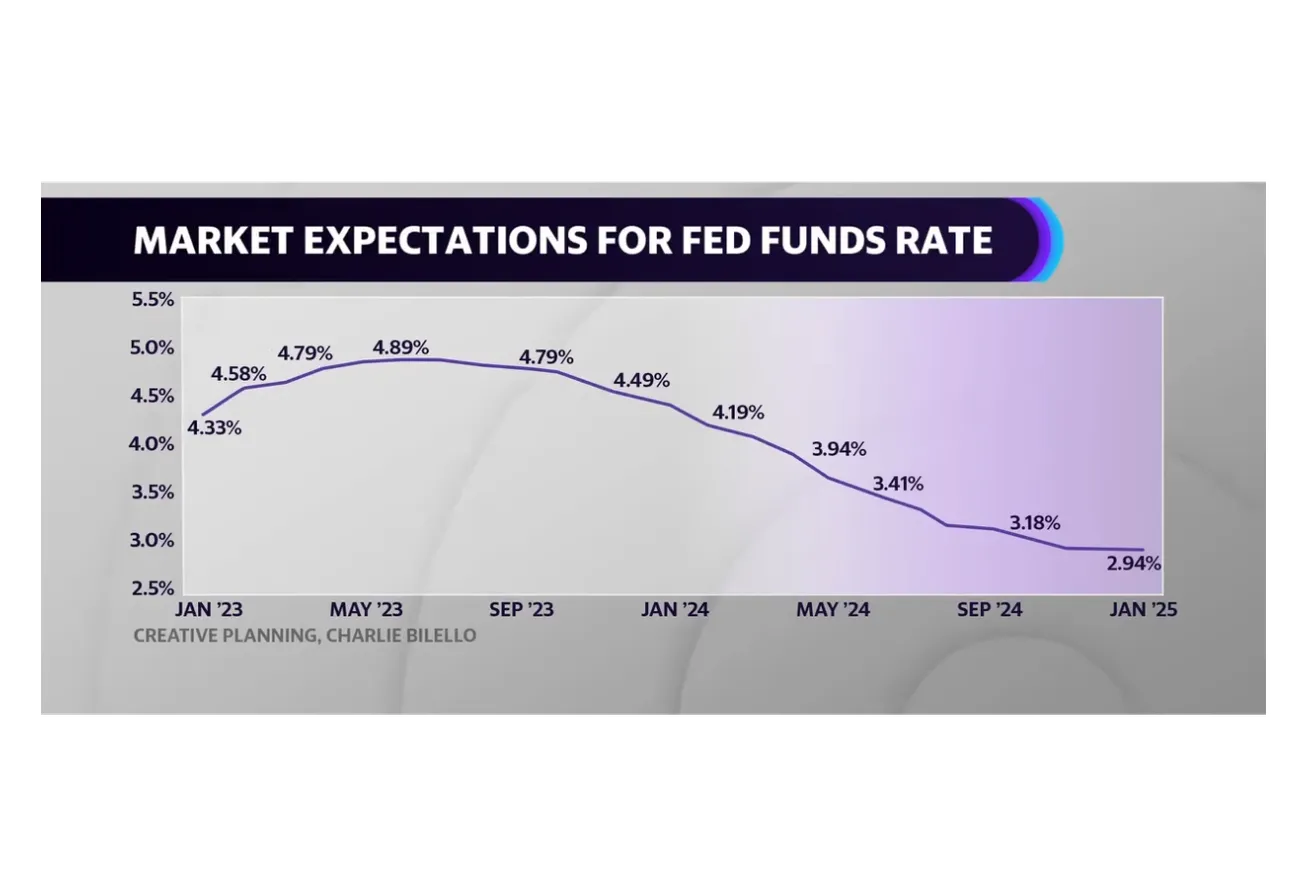

Fed Chair Jerome Powell, in a Dec. 14 press conference, said that heightened rates will likely result in the unemployment rate rising to just over 4.5%, from its current level of 3.5%, as the economy weakens. Some investors believe the Fed will cut rates when recession hits worse than it anticipates, Bloomberg reported.

Regardless of whether the Fed opts to cut rates, both Earle and Antoni cautioned against adjusting interest rates to achieve economic goals.

“Large financial institutions in the money markets are anticipating either that the Fed will lower rates because of a recession, or if there is no recession, to jump-start growth,” Earle said. “Moving the short-term interest rate target around to engineer macroeconomic outcomes is an inexact since full of unintended consequences and trade-offs, and it would be better if those rates were driven by markets instead of central planning.”

Original article link