The New York Times ran a story about student borrowers seeking loan discharges.

For generations, borrowers had to file a separate lawsuit, enduring a costly, stressful process with no guarantees. But after Biden's Departments of Justice and Education announced a politically charged shift, the vast majority of student debtors seeking bankruptcy discharges are now receiving them.

The November 2022 Biden "reforms" have ignited a fundamental debate about fairness in American policy, as changing the rules midstream creates unfair winners and losers based purely on timing.

Millions of Americans who graduated in the 1990s, 2000s, and 2010s faced a bankruptcy system where conventional wisdom held that student loans were virtually impossible to discharge. These borrowers made life-altering decisions based on that understanding.

They postponed buying homes, delayed having children, worked second jobs, and sacrificed career opportunities to meet their loan obligations. They did so believing they had no alternative, that their student loans would follow them to the grave unless repaid in full. Many succeeded in paying off their loans through sheer determination and sacrifice, forgoing the financial flexibility and life choices available to those unburdened by such debt.

Student loans are fundamentally different from ordinary consumer debt; unlike virtually every other loan, educational loans require no collateral, no creditworthiness verification, and no meaningful underwriting.

An eighteen-year-old with no credit history, no assets, and no income can borrow six figures for education. No bank would make such a loan under normal circumstances. The system works only because taxpayers, through the federal government, guarantee these loans and absorb the risk.

American society invests in its youth by providing access to education financing that the private market would never offer, trusting that education will transform borrowers into productive citizens capable of repaying their loans. It is an intergenerational compact in which one generation invests in the next, believing in a collective bet that education creates value for both the individual and society.

Unlike a car that can be repossessed or a house that can be foreclosed, once conferred, a degree cannot be reclaimed if the borrower fails to pay. It is why, for generations, student loans occupied a special category in bankruptcy law—one shared only with debts arising from fraud, tax evasion, and willful injury to others.

Related

They Took Over Student Loans—And Stuck You With The Bill, Rajkamal Rao, TIPP Insights

Thanks to Biden, now comes a new cohort of borrowers who, facing similar or even lesser financial distress, can access bankruptcy relief that was unavailable to their predecessors. The earlier generation's sacrifices suddenly appear not as necessary hardships nobly endured, but as unnecessary suffering that could have been avoided had they been born a few years later.

The situation creates a legitimate grievance: Why should I have foregone a decade of financial security when my neighbor, under identical circumstances, can discharge the debt?

According to recent empirical research by Professor Jason Iuliano, published in the American Bankruptcy Law Journal, the Biden reforms have increased the success rate for student loan discharge to 87%, making relief substantially more achievable than in previous decades.

Between 2011 and 2024, more than three million student loan borrowers filed for bankruptcy, yet only 7,293—a mere 0.2%—filed adversary proceedings to request a discharge. For every 500 student loan borrowers in bankruptcy, 499 gave up without seeking relief.

Professor Iuliano argues that had the millions of Americans who suffered and paid their loans back been able to test the courts, they would likely have received relief. The "certainty of hopelessness" standard that courts supposedly required was more myth than reality. The actual barrier wasn't the legal standard—it was misinformation, attorney reluctance to take these cases, and a widespread cultural narrative that discharge was impossible. But showing why borrowers were discouraged is not the same as proving that today’s outcomes are just.

The Left has repeatedly told us that wealthy individuals employ sophisticated tax lawyers, havens, and expert accountants to hide income from taxation - and doing so is morally wrong. Under this moral standard, how can it be right for student loan borrowers to make the legal case for discharge when they might otherwise be able to pay their loan obligations off, or when poor decisions led them to be in the bind they were in? Why should taxpayers subsidize such behavior?

The Times story discusses the case of Amy Howdyshell, a 43-year-old licensed practical nurse in Virginia, who recently had more than $78,000 in federal student debt dismissed, largely accumulated at a for-profit college for a business degree she never received. She claimed she had to abandon all of her credits at the for-profit college (because her college would not release her transcript for transfer) and was forced to complete her degree at another institution, paying for it herself.

A student in Virginia facing wrongful withholding of her transcript by a for-profit college—despite having paid tuition and completed the required academic work—has several potential legal remedies. For-profit colleges in Virginia are regulated by the State Council of Higher Education for Virginia (SCHEV). Howdyshell's college participated in federal Title IV aid programs, making federal rules applicable. Wrongful withholding (with no outstanding debt) violates institutional policies, state regulations, and federal consumer protection laws, as it may constitute an unfair or abusive practice.

Howdyshell’s case illustrates how the revised DOJ posture now permits relief in circumstances that would almost certainly not have succeeded a decade ago. The policy question is not about any individual borrower’s character, but about a system that now produces radically different outcomes for people separated only by timing.

Howdyshell told The Times that, because of the student debt relief, she can now save for a down payment on a home or make progress toward her retirement savings. "Now I have the financial freedom to pursue my dreams of homeownership," Howdyshell said. "It was a scary process but worth the gamble."

Her story highlights the moral hazard that arises when rules governing a public lending system are rewritten after one generation has already borne the full cost.

The debate over student loan discharge is not about compassion versus cruelty. It is about whether a society can quietly rewrite the terms of a public contract and still expect citizens to trust the system. When the rules change only after one generation has already paid the full price, fairness becomes a matter of timing, not responsibility.

👉 Quick Reads

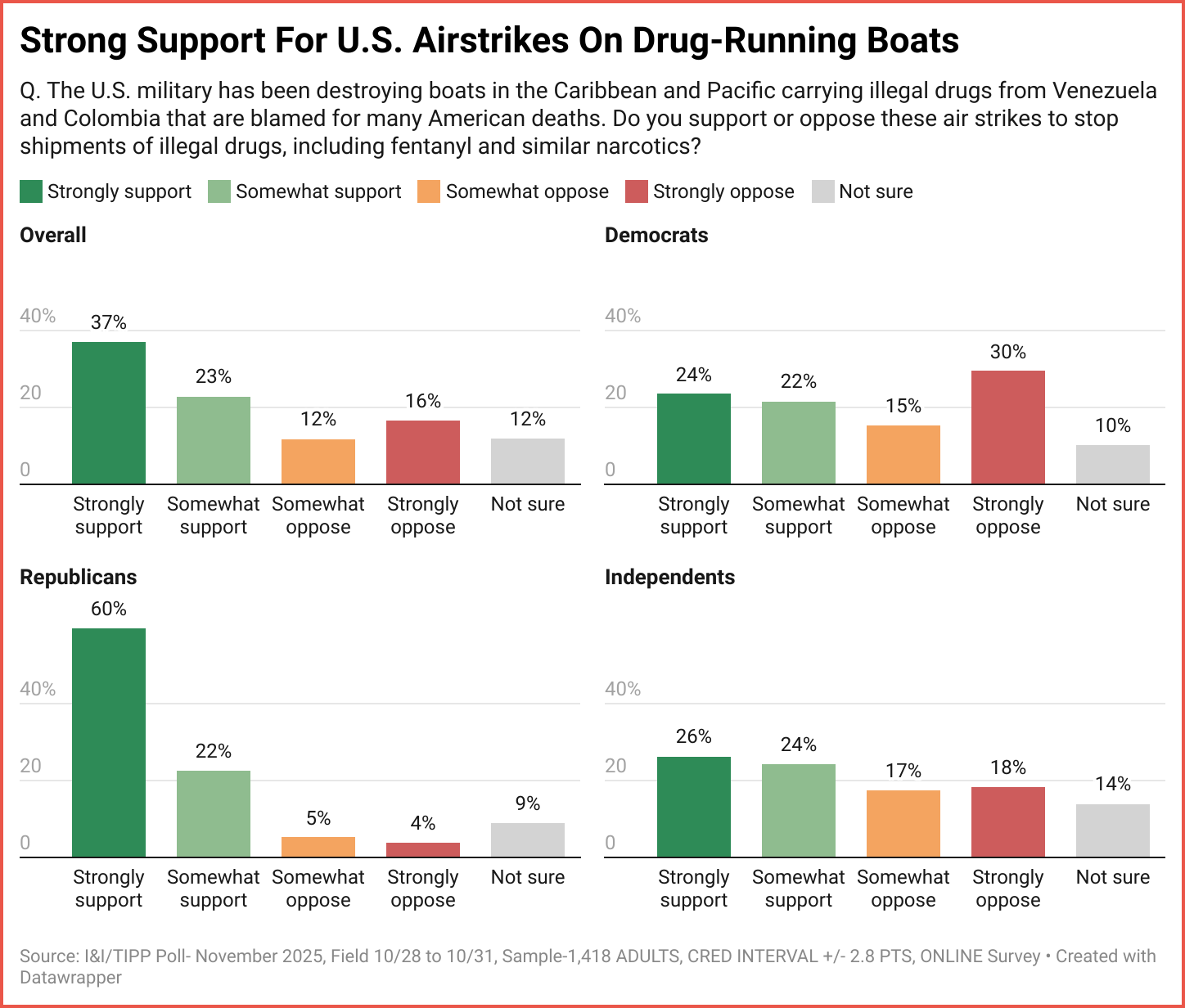

I. Voters Back U.S. Airstrikes On Drug Smuggling

A clear majority of Americans support U.S. airstrikes on drug-running boats carrying fentanyl and other narcotics, with 60 percent of Republicans strongly in favor, while Democrats are more divided, making this one of the rare national-security issues where public opinion cuts sharply along party lines.

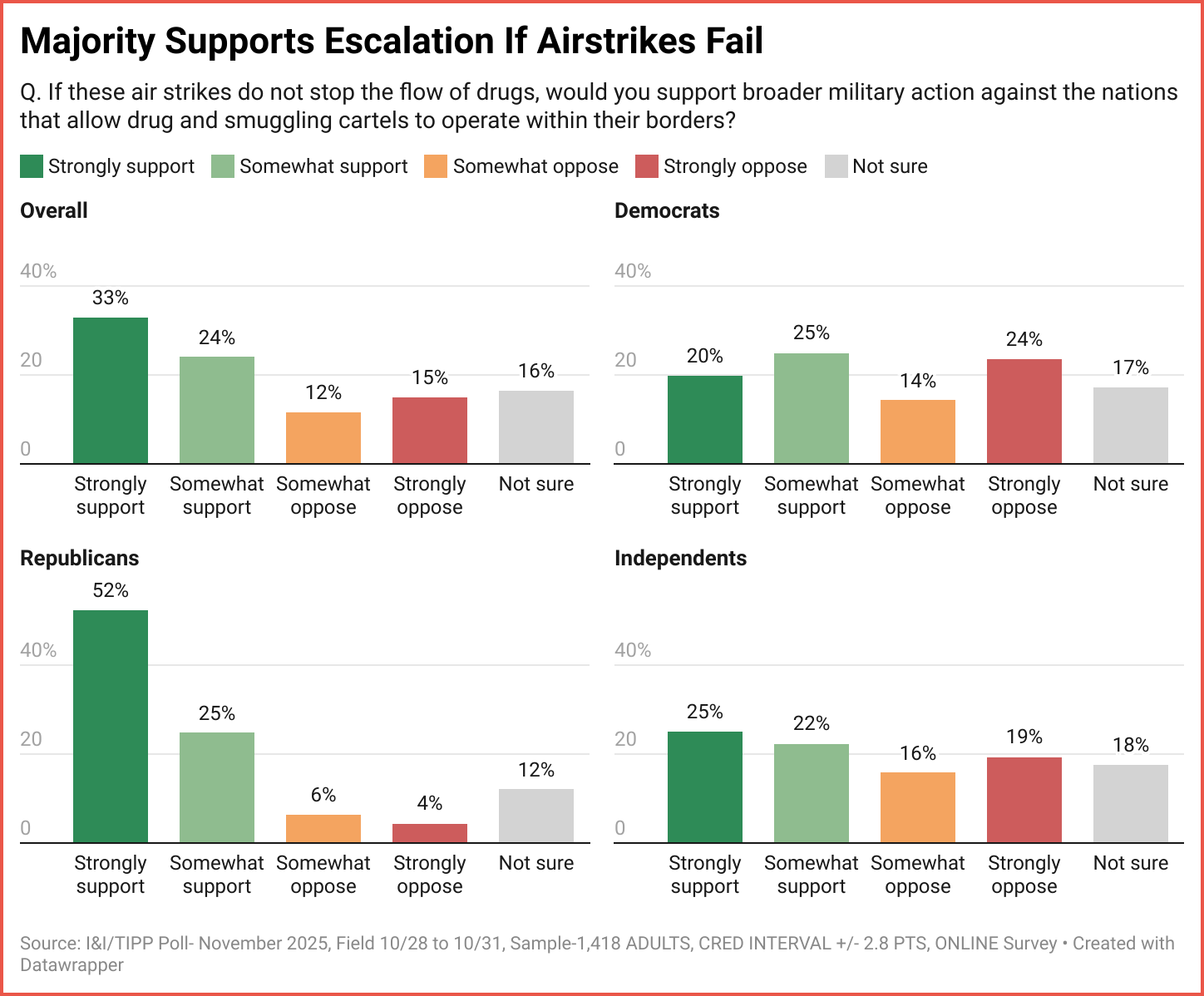

II. Voters Want Escalation If Drug War Fails

If current airstrikes do not stop the flow of fentanyl and other narcotics, a majority of Americans support broader military action against countries that allow cartels to operate — including more than three-quarters of Republicans and a plurality of independents, showing public patience is wearing thin.

editor-tippinsights@technometrica.com