The Federal Reserve (the Fed) sets the nation's monetary policy and has the dual mandate to pursue the economic goals of maximum employment and price stability. (Price stability means keeping inflation low and stable over the long run.)

Since March 2022, the Fed has been implementing a series of gradual interest rate increases. This strategy has led to 11 consecutive rate hikes, bringing its benchmark interest rate to 5.25%, the highest level in 22 years.

The M2 money supply measures the amount of money readily available in the economy, which reflects overall liquidity. It includes cash, checking deposits, savings accounts, money market accounts, and small certificates of deposit. During the COVID-19 pandemic, significant fiscal stimulus measures, including direct payments to individuals and extended unemployment benefits, led to a massive increase in the M2 money supply. This surge contributed to high inflation as more money chased the same amount of available goods and services.

Imagine the economy as a car cruising down the road. When inflation rises, the Fed applies the brakes by raising interest rates. This action makes it more costly for individuals and businesses to borrow money, leading to a decrease in borrowing. Consequently, fewer people take out loans for major purchases like homes and cars, and businesses scale back on new investments. The ultimate aim is to curb overall spending, stabilize the economy, and reduce inflation.

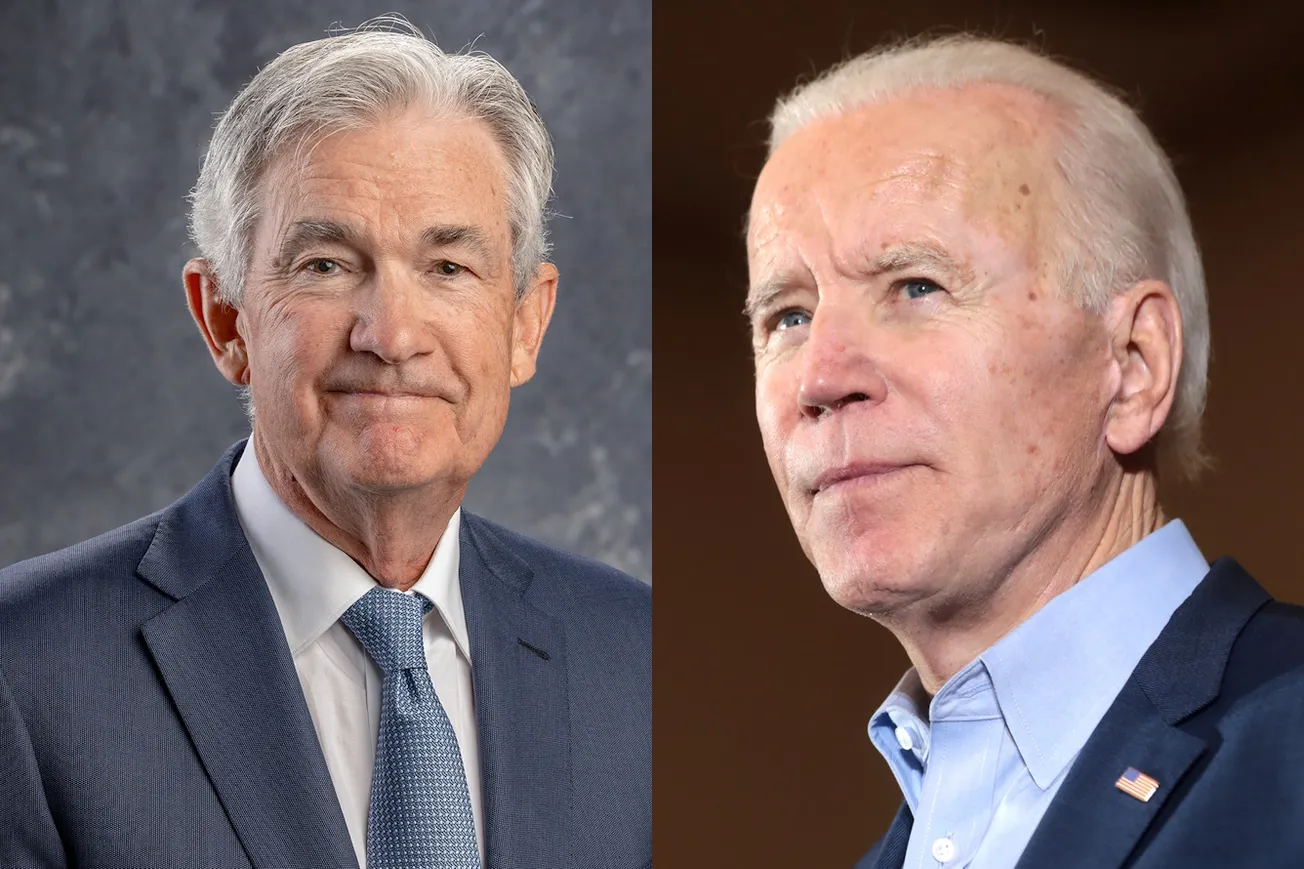

Speaking at the Federal Reserve’s annual Jackson Hole Economic Symposium in August 2022, Federal Reserve chairman Jerome Powell forewarned Americans that the central bank’s mission to tame inflation would result in “some pain” for U.S. households. Powell said: “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.”

Americans can relate to the pain. The warning has proven accurate, as data now reveal the effects of the 11 rate hikes, ranging from record-low home affordability to skyrocketing auto loan payments, high credit card interest rates, several bank failures, and a soft commercial real estate market.

Despite the 11 rate hikes, CPI inflation is still at 3.4%, with core inflation hovering around 3.6%. Many, including President Biden, have been hoping for a rate cut. However, in the face of such stubborn inflation, it is unlikely to happen in the near future. Election-year politics make things worse. By stating that he expects a rate cut this year, the President is telegraphing his expectations to the Fed.

The government influences the economy through its fiscal policy, which includes its spending and taxation decisions. When the government spends more on infrastructure projects, social programs, or stimulus checks, it presses the gas pedal, injecting money into the economy.

Would the Fed's hikes have been more successful if the nation's fiscal policy had been austere? Federal spending continues to inject money into the economy, maintaining pressure on M2 levels. This creates a tug-of-war where the government's fiscal policies counteract the Fed's attempt to cool the economy and reduce inflation.

Federal spending has increased massively in recent years, adding $6.8 trillion to the national debt under the Biden administration. Initially, the Fed printed money to cover the debt, causing high inflation. Later, the government had to borrow from the public, leading to higher interest rates. Printing more money and flooding the economy is like adding water to soup to serve more people, which has the thinning effect of devaluing the dollar's purchasing power and causing high inflation.

The ballooning federal debt, now at $34.6 trillion, adds another layer of complexity. For the current fiscal year, which began in October 2023, the U.S. will pay over $1 trillion in interest, more than the country’s defense budget. Most Americans are concerned about the sustainability of this trajectory. Many business leaders, such as JP Morgan CEO Jamie Dimon and Ray Dalio, the Chief of Bridgewater Associates, the world's largest hedge fund, are sounding wake-up calls.

In an interview last week, Dimon emphasized the need for the U.S. government to address its budget deficit before financial markets force a reckoning. Dimon said:

The sooner we focus on it, the better. At one point, it will cause a problem… the problem will be caused by the market, and then you’ll be forced to deal with it and probably in a far more uncomfortable way than if you dealt with it to start.

The spending spree has also driven up consumer price inflation. Dimon said:

Any country can borrow money and drive some growth, but it may not always lead to good growth, so I think America should be quite aware that we’ve got to focus on our fiscal deficit issues a little bit more, and that is important for the world.

President Biden wants a $7.3 trillion budget for the next year. As government debt increases, so do the interest payments. Further, investors might demand higher yields on government bonds due to the perceived risk of lending to a highly indebted government, raising borrowing costs across the economy. These payments can consume a significant part of the federal budget, limiting spending on other priorities, which means more borrowing, debt, and inflation. Washington must break the vicious cycle.

The interplay between the Fed's monetary policy, the government's fiscal policy, and the impact of ballooning government debt creates a complex economic landscape. To control inflation, the Fed raises interest rates to slow the economy. At the same time, ongoing government spending and rising debt levels can counteract these efforts, making it harder to achieve the desired outcomes. The high national debt further exacerbates this tug-of-war.

Monetary policy alone can’t fix the inflation situation without fiscal austerity. As long as Biden maintains a loose fiscal policy, inflation will persist. When combined with a slowing economy, also known as "the stag," we can expect inflation to transform into stagflation.