President Donald Trump has, by many accounts, had one of the most successful first years of any presidential term. And yet, his favorability ratings among voters has barely budged. Why? Support from independents and Democrats has weakened, the latest I&I/TIPP Poll shows.

This month marks the first year of Trump's return to the White House. How is he doing?

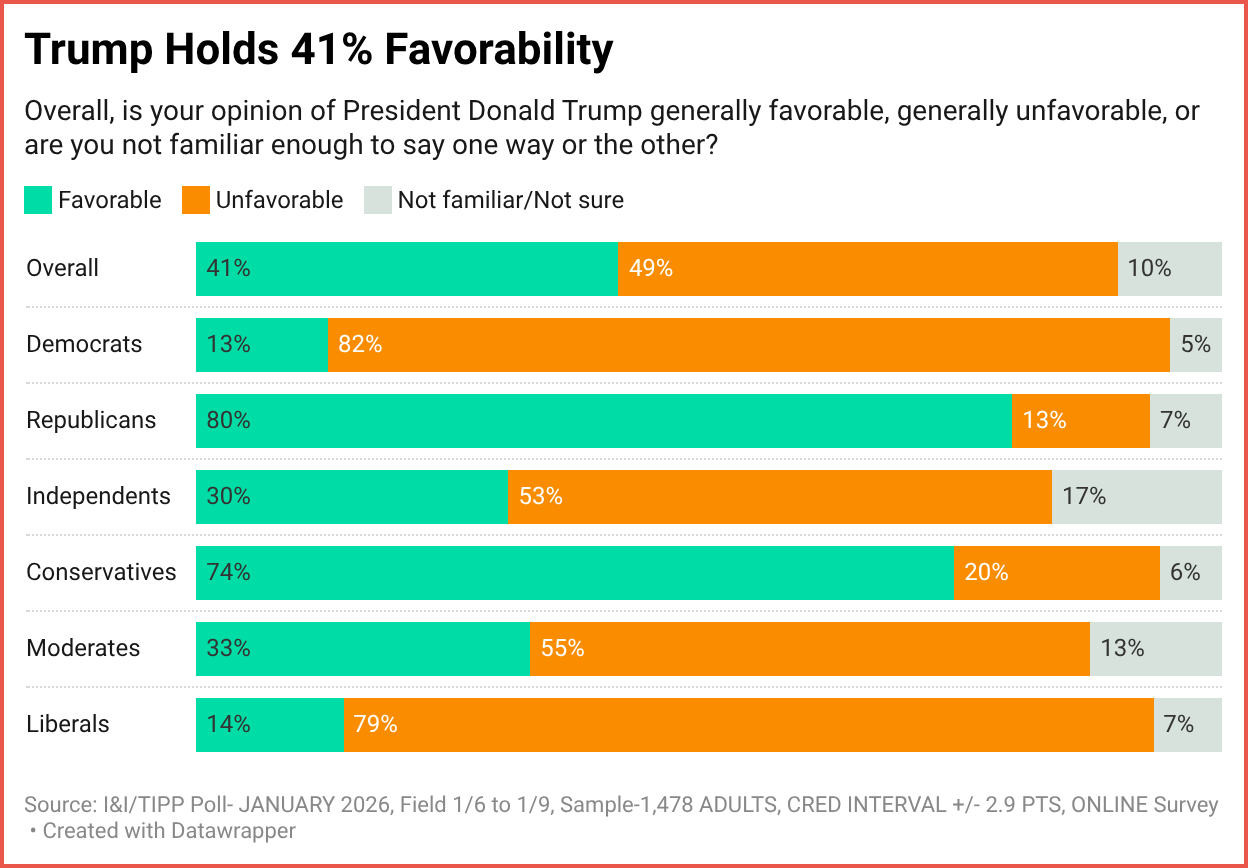

Each month, I&I/TIPP ask a random sample of Americans the following question about presidential leadership: "Overall, is your opinion of Donald Trump generally favorable, generally unfavorable, or are you not familiar enough to say one way or the other?"

In the latest national online I&I/TIPP Poll, taken from Jan. 6 to Jan. 9 by 1,478 adults, Trump's overall favorability fell to 41%, down from 44% in December, while his unfavorability rating rose to 49%, up from 47%. As such, Trump's net favorability jumped from minus-3% in December to minus-8%.

A comparison with the data from last March, which captured all of Trump's first month back in office, shows little progress. In March 2025, Trump's favorability overall favorability stood at 47%, while his unfavorability stood at 43%, for a net positive rating of plus-4%.

Over that time, Trump's political backing has weakened among independents and Democrats, but also with the GOP, though to a much less degree.

In March 2025, Trump's favorability ratings stood as follows: Democrats (18% favorable, 76% unfavorable); independents (39% favorable, 47% unfavorable); and Republicans (84% favorable, 9% unfavorable).

By comparison, January 2026's data have softened somewhat compared to last March's data: In January, it was Democrats (13% favorable, 82% unfavorable); independents (30% favorable, 53% unfavorable); and Republicans (80% favorable, 13% unfavorable). No gains at all over the year.

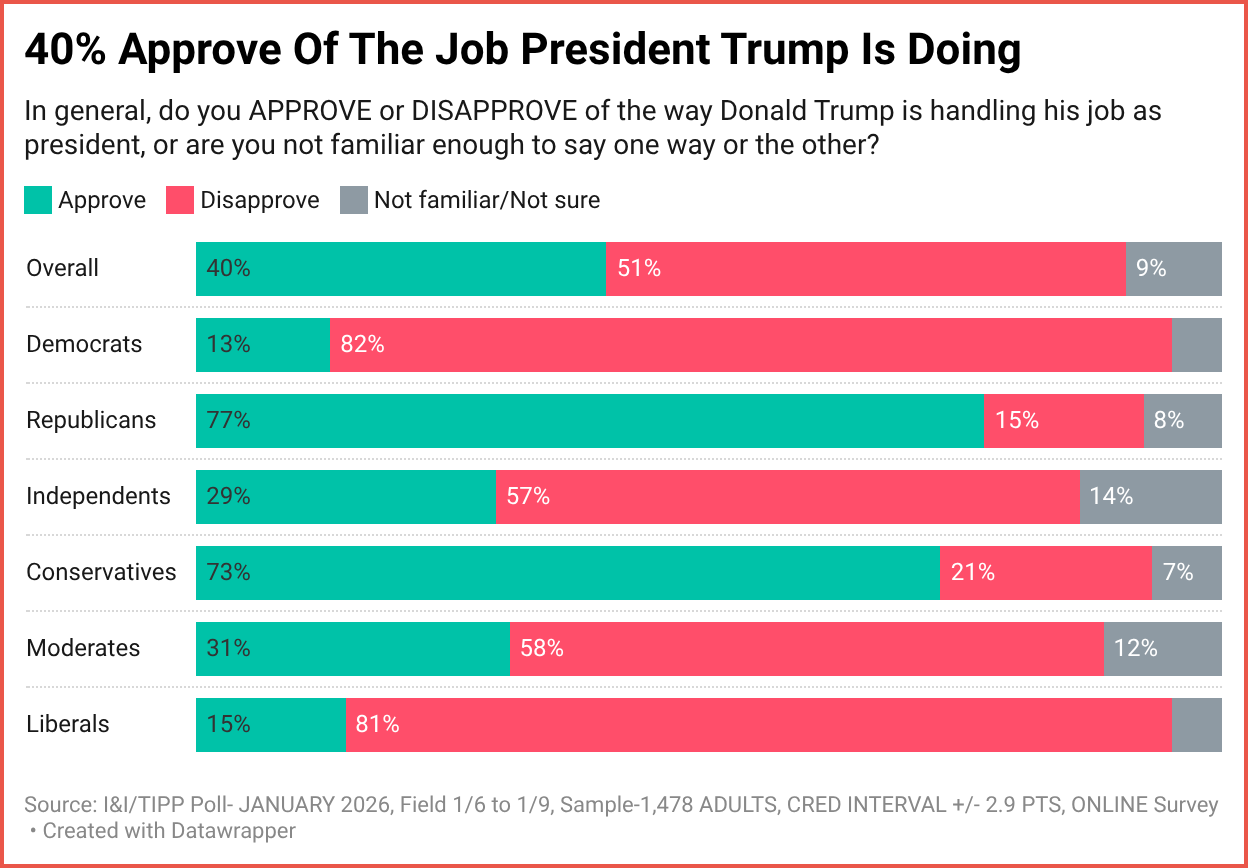

Each month, I&I/TIPP also asks a second, closely related question: "In general, do you approve or disapprove of the way Donald Trump is handling his job as president, or are you not familiar enough to say one way or the other?"

Once again, as Trump enters his second year in office, the approval ratings for handling his job have weakened a bit.

In January of this year, Trump received an overall approval rating of 40%, vs. a disapproval rating of 51%. For last March, Trump garnered a 46% approval rating, compared to a 43% unfavorable rating.

And, once again, it was across the board, though his approval ratings again didn't decline as much among Republicans as they did among Democrats and indie voters.

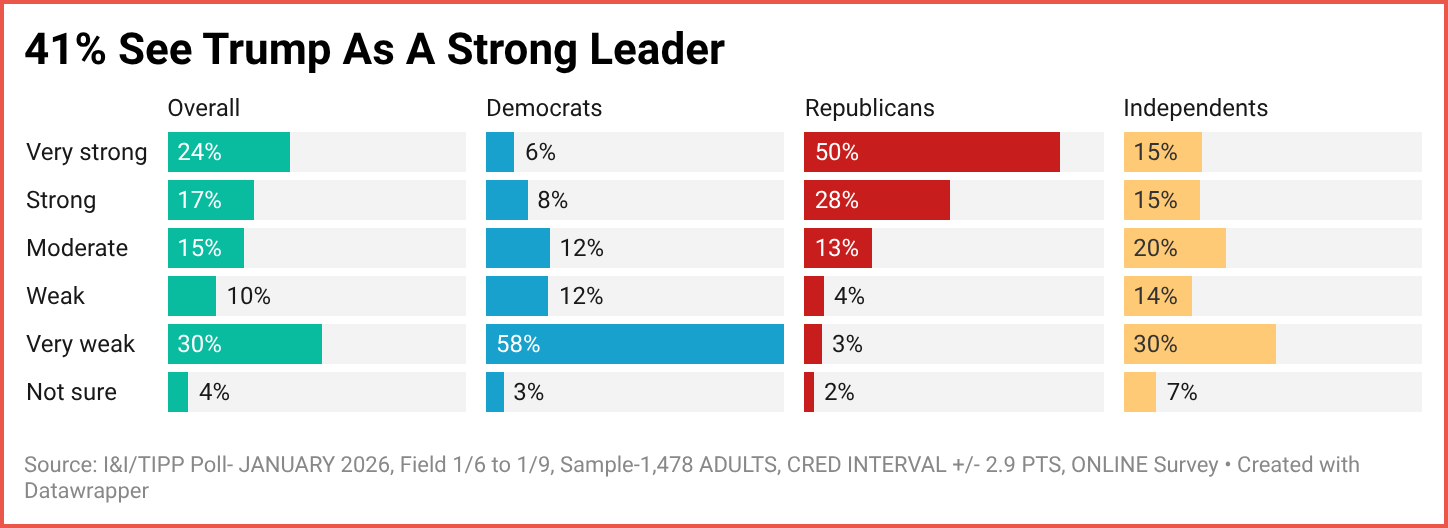

OK, but what about strength of leadership? President Joe Biden suffered an erosion of support in his latter years in office largely because Americans (and members of his own party) saw him as weak, infirm and ineffective in performing his official presidential duties.

The same can't be said of Trump.

Each month we ask a third question: "How would you describe the leadership that President Trump is providing for the country?" In January, voters still see Trump as strong.

For the first month of 2026, 41% described Trump's leadership either as "very strong" (24%) or "strong" (17%), while 40% described it as either "weak" (10%) or "very weak" (30%). Those numbers are little changed from the month before.

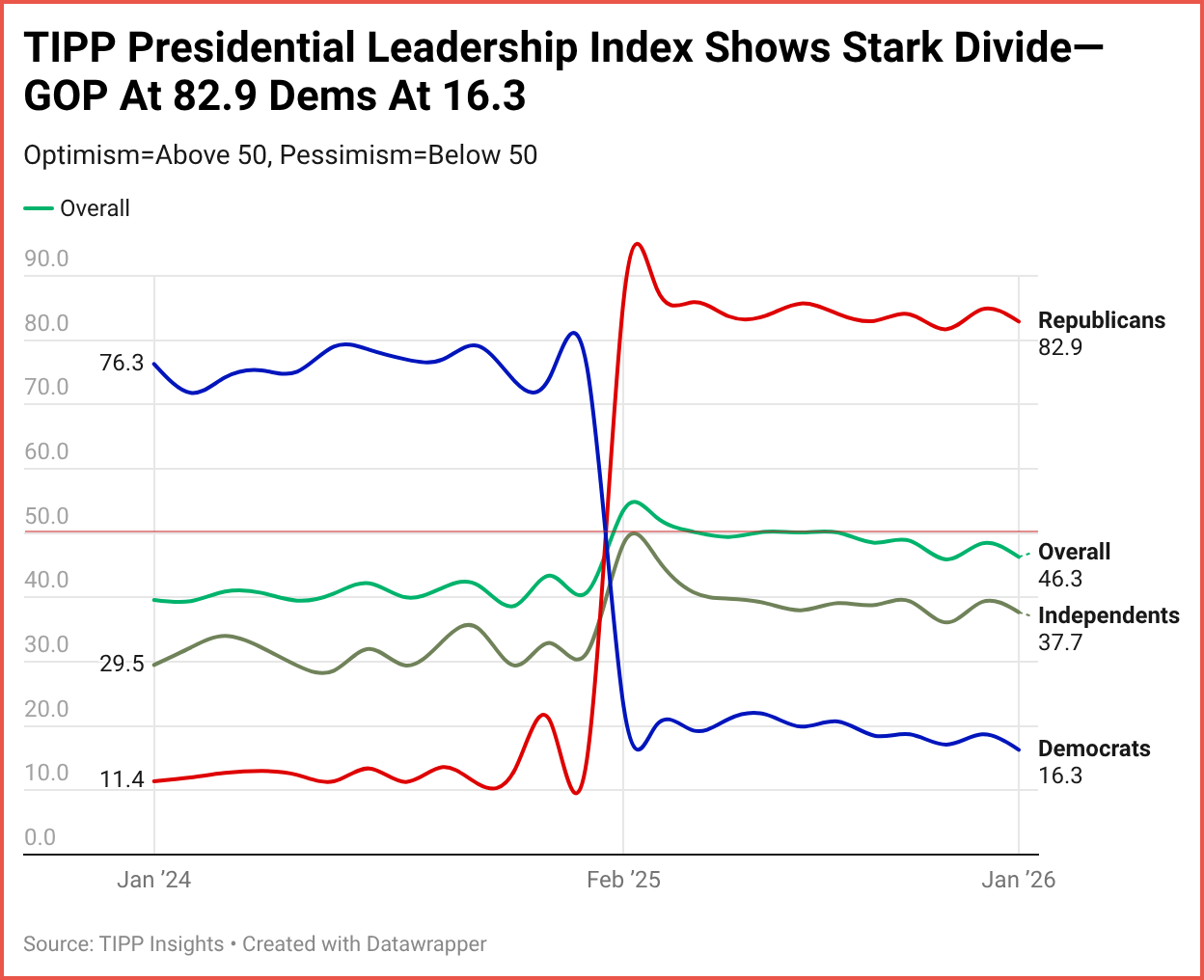

(Below: The TIPP Presidential Leadership Index measures public sentiment over time by combining three components: favorability, job approval, and presidential leadership. The index ranges from 0 to 100, with readings above 50 indicating optimism and below 50 signaling pessimism. In January, the overall index stood at 46.3 (Dec=48.4, Nov=45.9, Oct=48.8), with Republicans most optimistic at 82.9 (Dec=84.8, Nov=81.7, Oct=84.0), Democrats least at 16.3 (Dec 18.7, Nov=17.1, Oct=18.7), and independents in between at 37.7 (Dec=39.3, Nov=36.1, Oct=39.4).

Gold standard in polling — the only national pollster to get six presidential elections right. Talent on loan from God. Subscribe now → $99/year

The truth is, Trump is the most hyperkinetic president in postwar history – and possibly ever – when it comes to new policy initiatives. Hardly a week goes by without major announcements.

Just since Jan. 1, Trump has: Used the U.S. military to oust Venezuelan dictator Nicolas Maduro; threatened to intervene in Iran if the mullahs in charge kill protesters; proposed a 10% cap on credit-card interest rates; announced he is withdrawing support from more than 30 United Nations programs; moved to ban Wall Street purchases of individual family homes; and approved $200 billion in purchases of mortgage bonds to drive down mortgage rates.

That's one week.

Whether one agrees with these policies or not, Trump can't be accused of being a "do-nothing" president. But is he moving too fast? That might be one reason why his favorability and approval ratings have inched down, both in the I&I/TIPP Poll and others.

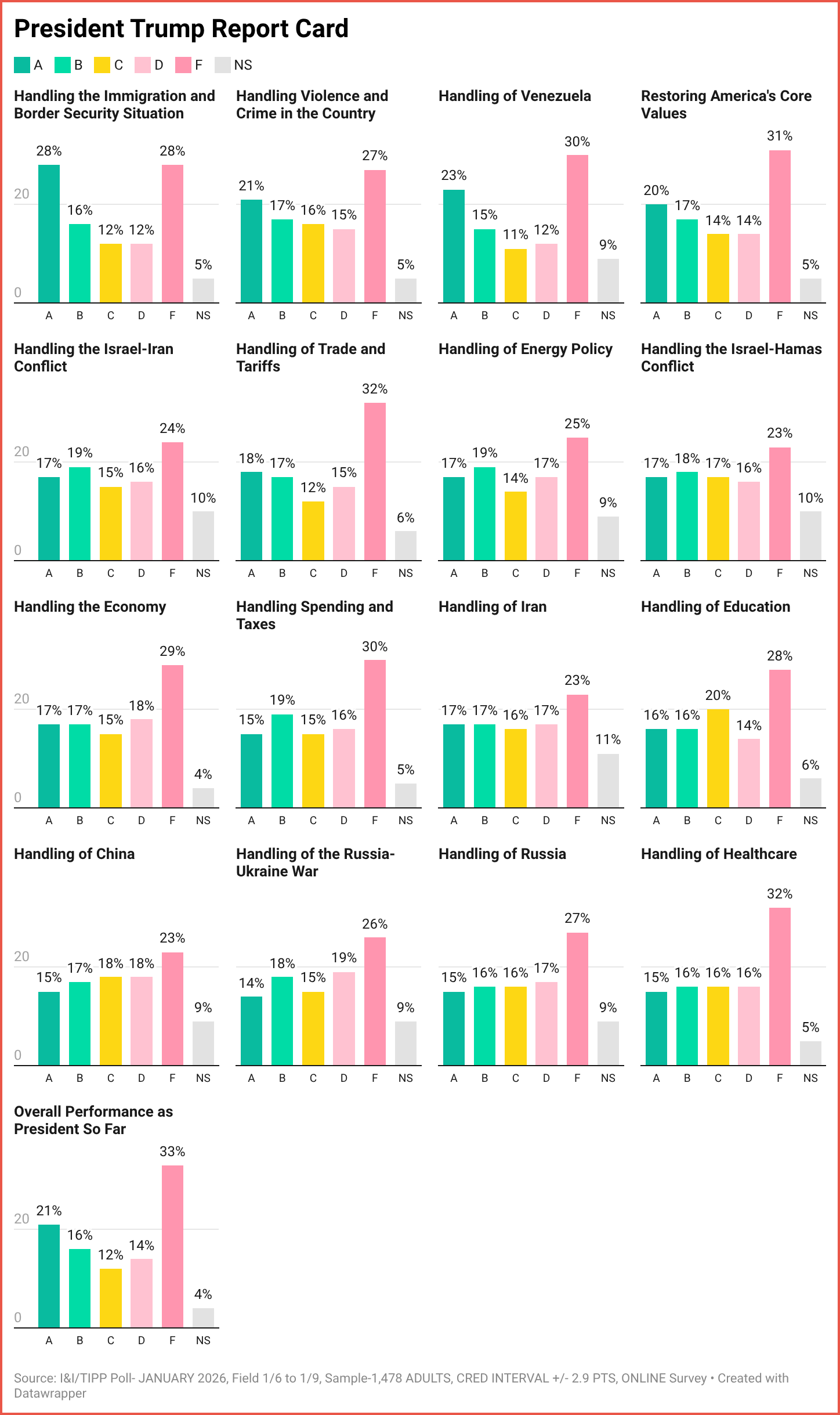

And he continues to get good grades – in the familiar A, B, C, D, F grading system used by U.S. schools – from Americans on individual policy areas.

Overall, Trump gets 38% A's and B's for his policies. No one would be surprised to find out that his best grades come from his own party: 74% of GOP respondents gave him top grades. Just 11% of Democrats and 26% of independents did.

Trump's best grades specifically included "Handling the immigration, border security situation" (53%), "Handling Venezuela" (48%), "Handling violence and crime in the country" (47%), "Handling of Energy Policy" (46%), "Handling the Israel-Iran conflict" (45%), and "Handling the Israel-Hamas conflict," "Restoring America's Core Values" and "Handling of Trade and Tariffs", all at 44%.

Worst scores? "Handling of Healthcare" (37%), "Handling of Russia" (38%), and "Handling of China" and "Handling of the Russia-Ukraine war," the latter two at 40%.

Given the current party-based political rifts, it's probably safe to say that 2026, with its mid-term elections, will be a make-or-break year for Trump, a politically polarizing figure, and the GOP. And both the 2026 vote and Trump's favorability ratings will be greatly influenced by whether Trump is seen as a success or failure by a majority of Americans.

A big part of that shift, of course, will be determined by the economy.

With three interest rate cuts by the Fed already on the books in 2025, and likely more on the way, the economy might already by showing its power: according to the Atlanta Federal Reserve's Jan. 9 "GDP Now" estimate for 2025's fourth quarter, GDP expanded at a 5.1% rate in the final three months of the year.

Housing is already showing renewed signs of life as interest rates drop. The Treasury Department's decision to buy $200 billion in mortgage bonds should help keep mortgage rates low for the entire year. Existing-home sales are already rebounding as rates drop.

None of these, of course, is a cure-all. But with average monthly inflation down from 2.8% year-over-year in 2024 to 2.5% in 2025, and real wages growing once again after declining during President Biden's term in office, 2026 could be the best year for the economy in a decade.

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past six presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

👉 Quick Reads

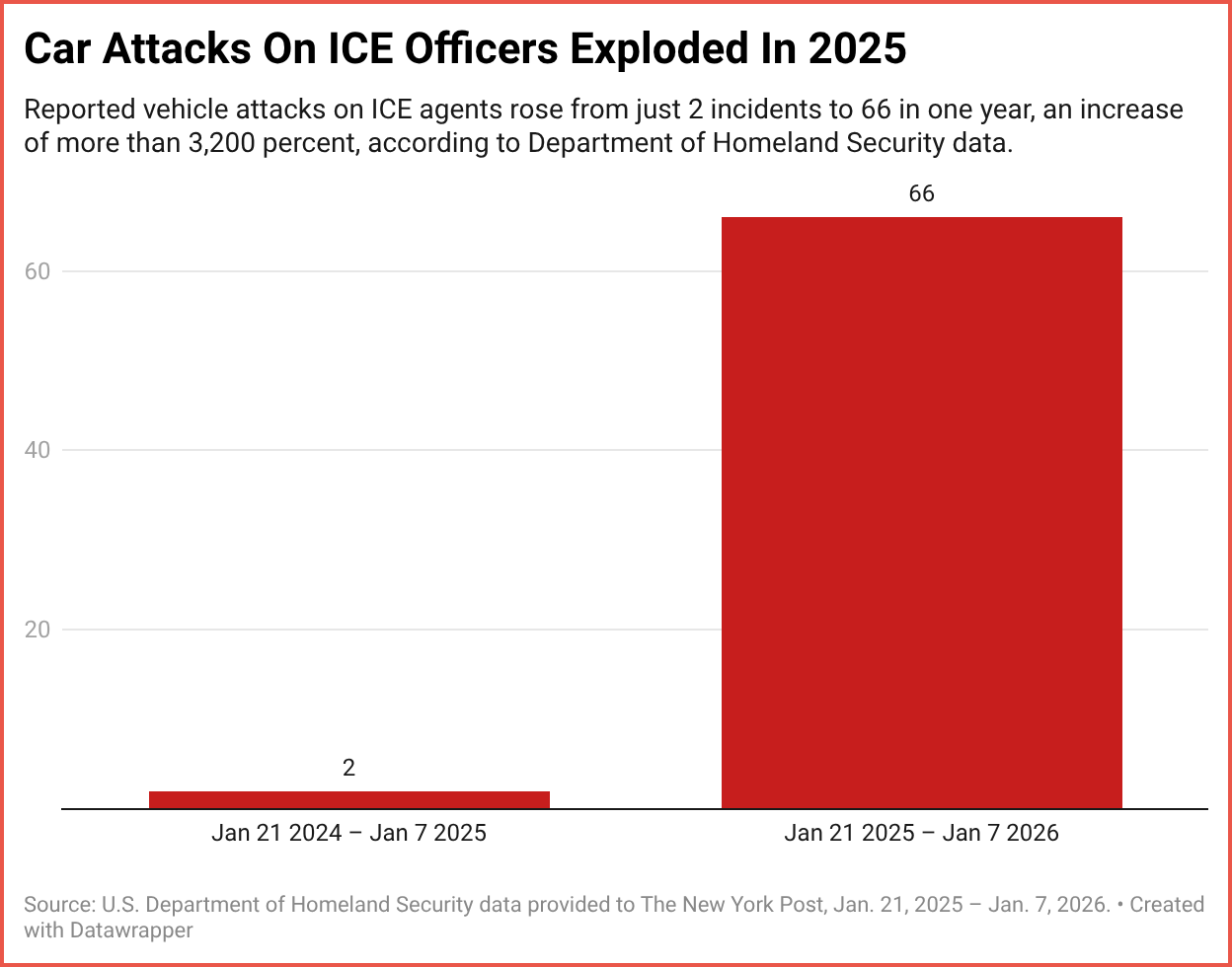

I. Car Attacks On ICE Officers Exploded In 2025

According to Department of Homeland Security data, reported vehicle attacks on ICE agents jumped from just two incidents to 66 in a single year, a surge of more than 3,200 percent.

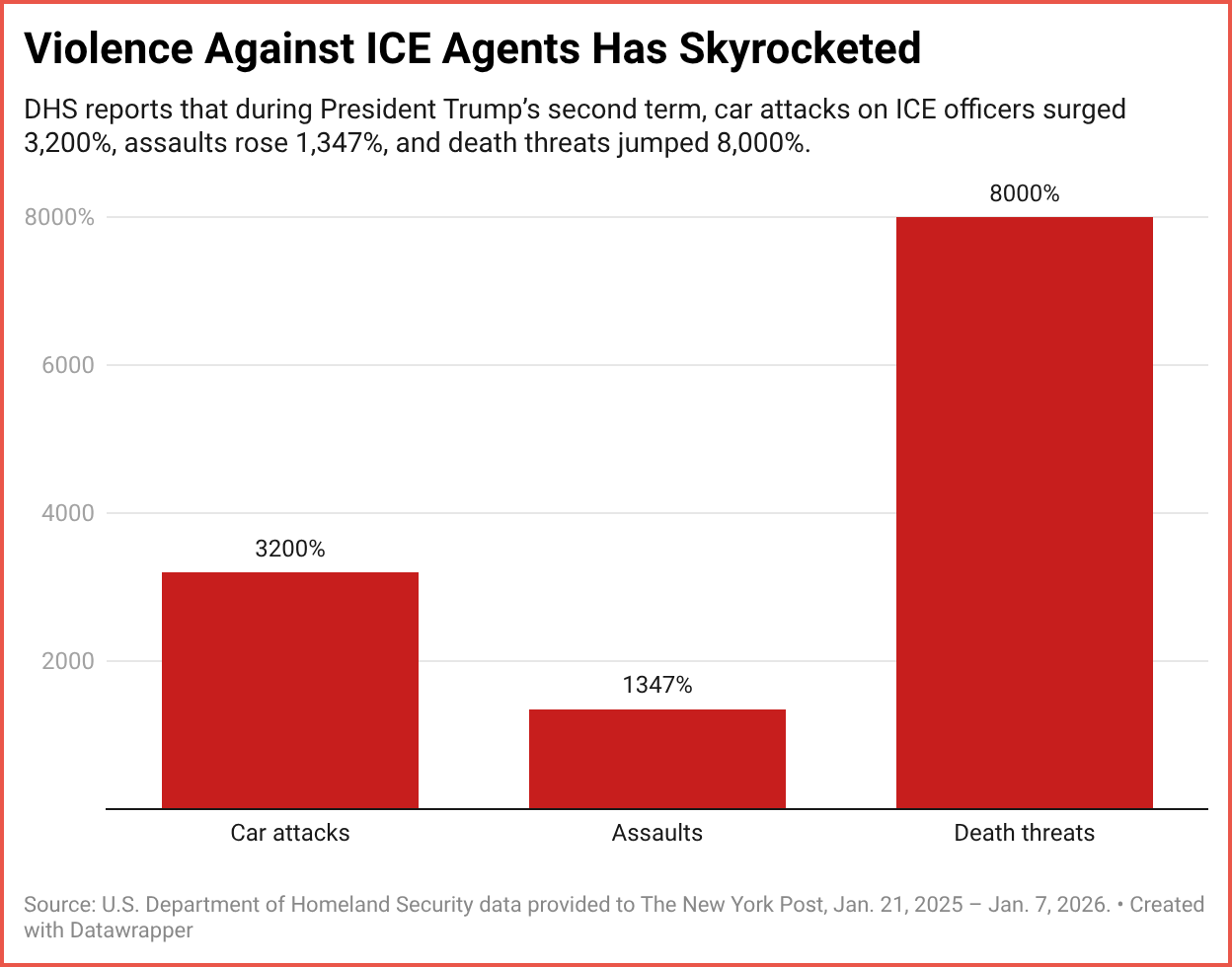

II. Violence Against ICE Agents Has Skyrocketed

During President Trump’s second term, DHS reports a 3,200 percent rise in car attacks, a 1,347 percent increase in assaults, and an extraordinary 8,000 percent jump in death threats against federal immigration officers.

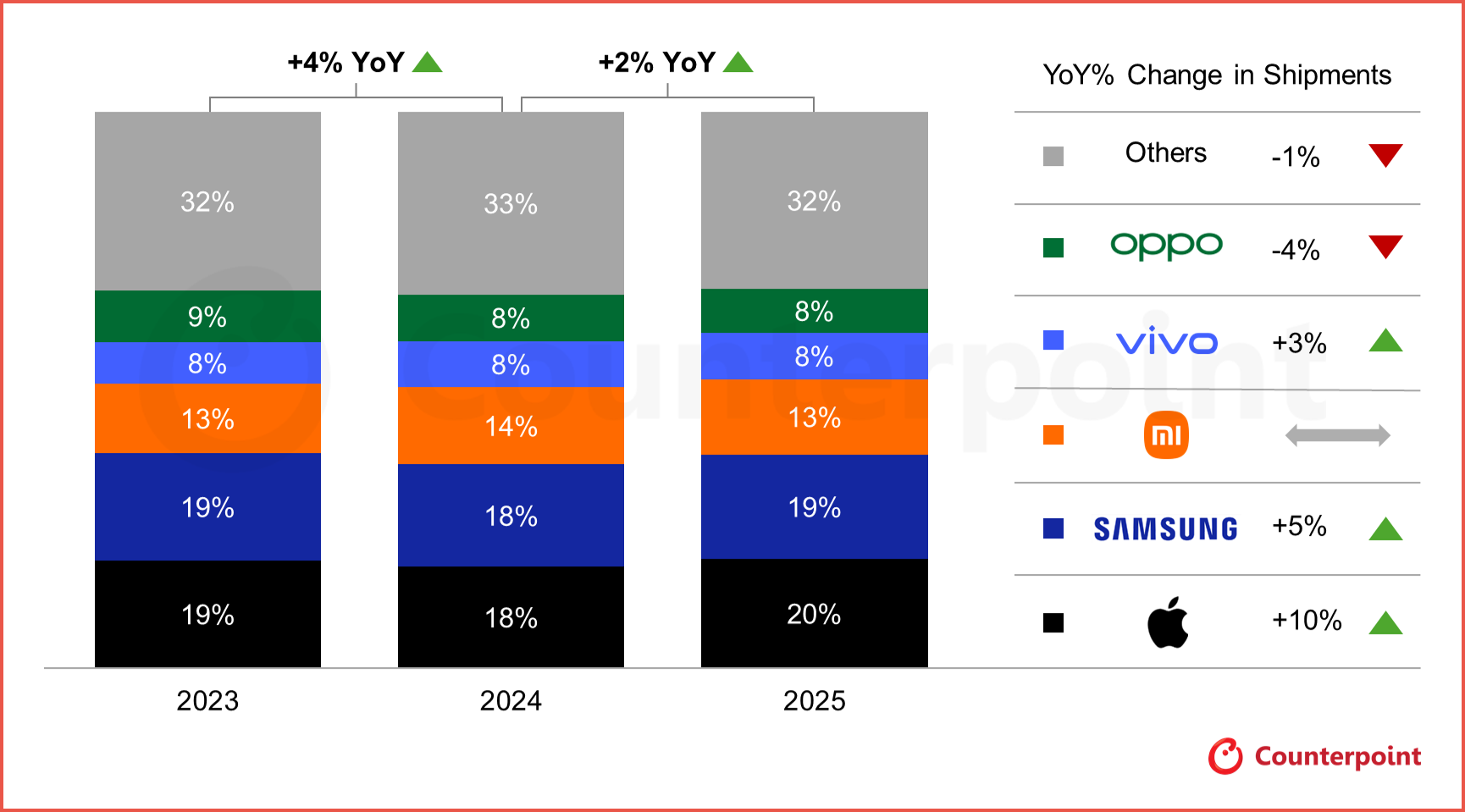

III. Apple Takes The Global Smartphone Crown

In 2025, Apple became the world’s top smartphone brand with a 20 percent global market share and 10 percent year-over-year shipment growth, the fastest among the top five manufacturers, as premium demand and strong sales in emerging markets pushed the iPhone ahead of Samsung for the year.

📊 Market Mood — Monday, January 11, 2026

🟩 Futures Slide on Fed Turmoil

U.S. futures drop as investors return to markets rattled by new questions over the Federal Reserve’s independence.

🟧 Powell vs. Washington

Chair Jerome Powell alleges a politically motivated DOJ probe, reigniting fears of White House pressure on monetary policy.

🟦 Gold Jumps, Dollar Slips

Safe-haven demand lifts gold sharply while the dollar weakens amid rising institutional uncertainty.

🟪 Oil Holds With Iran Unrest

Crude consolidates after last week’s rally as protests in Iran raise supply-risk concerns.

🟫 Apple Tops Smartphones

Apple takes the global market lead in 2025, though rising memory costs cloud the outlook for 2026.

🗓️ Key Economic Events — Monday, January 11, 2026

🟧 1:00 PM ET — 10-Year Treasury Note Auction

A closely watched sale that can influence bond yields, the dollar, and broader risk sentiment.

editor-tippinsights@technometrica.com