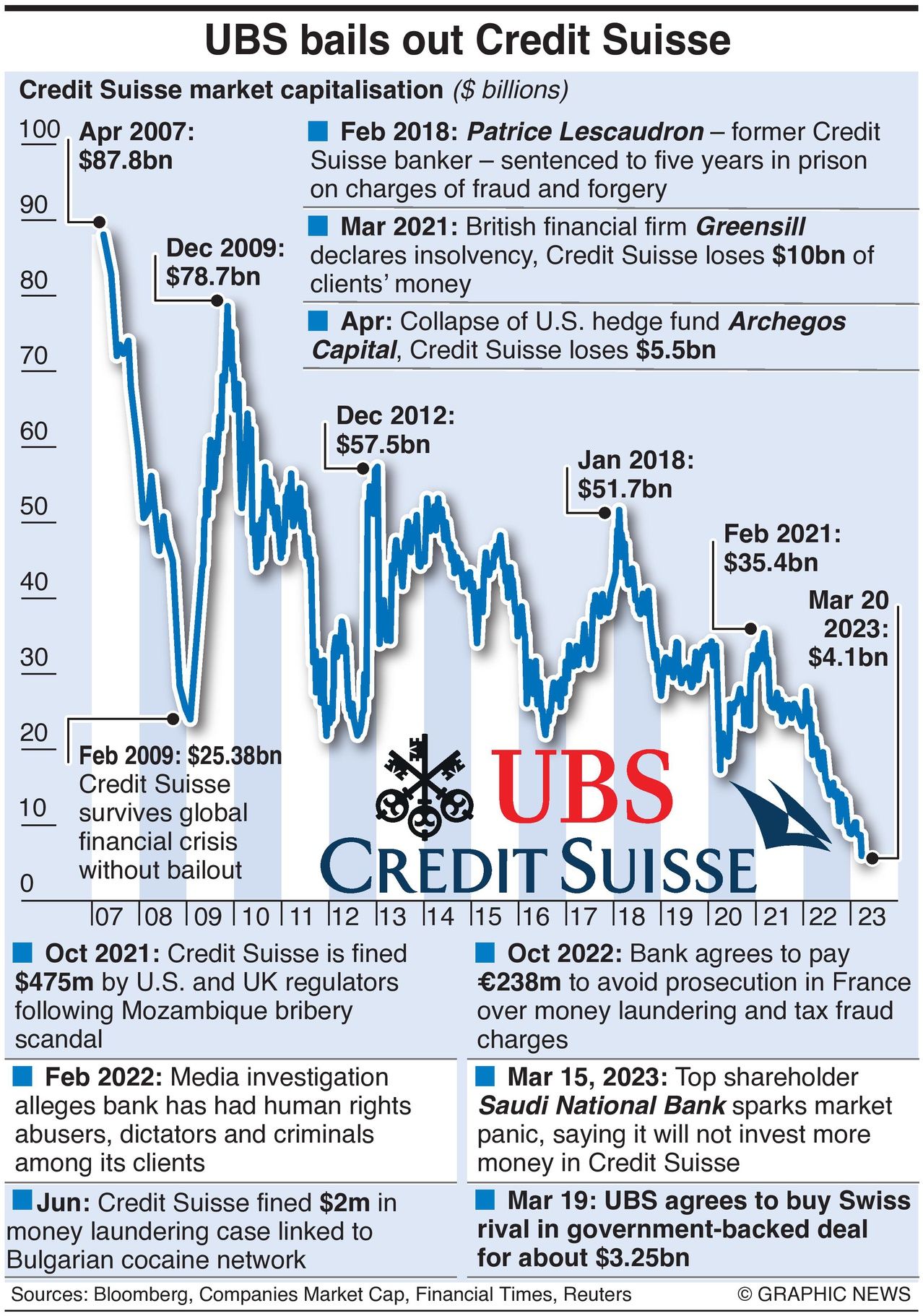

Global bank shares took another beating on Monday (March 20, 2023) despite a UBS takeover of embattled Swiss rival Credit Suisse for $3 billion Swiss francs ($3.25 billion) -- just four percent of its value in December 2009.

The government-brokered deal came after days of market upheaval following the collapse of two U.S. lenders -- Silicon Valley Bank and Signature Bank.

Credit Suisse’s demise was a long time coming, with years of scandals, multi-billion dollar losses, and leadership changes.

In June 2022, the bank paid $2 million in fines after failing to prevent money laundering by a Bulgarian cocaine trafficking gang.

A Bermuda court ruled in March that former Georgian Prime Minister Bidzina Ivanishvili and his family are due damages of more than half a billion dollars from Credit Suisse as a result of a long-running fraud committed by a former banker, Pascale Lescaudron.

A Swiss court convicted Lescaudron in 2018 on charges of fraud and forgery.

Comments by Saudi National Bank -- Credit Suisse’s main shareholder -- that it would not invest more money in the bank sparked market panic and the emergency takeover by UBS.