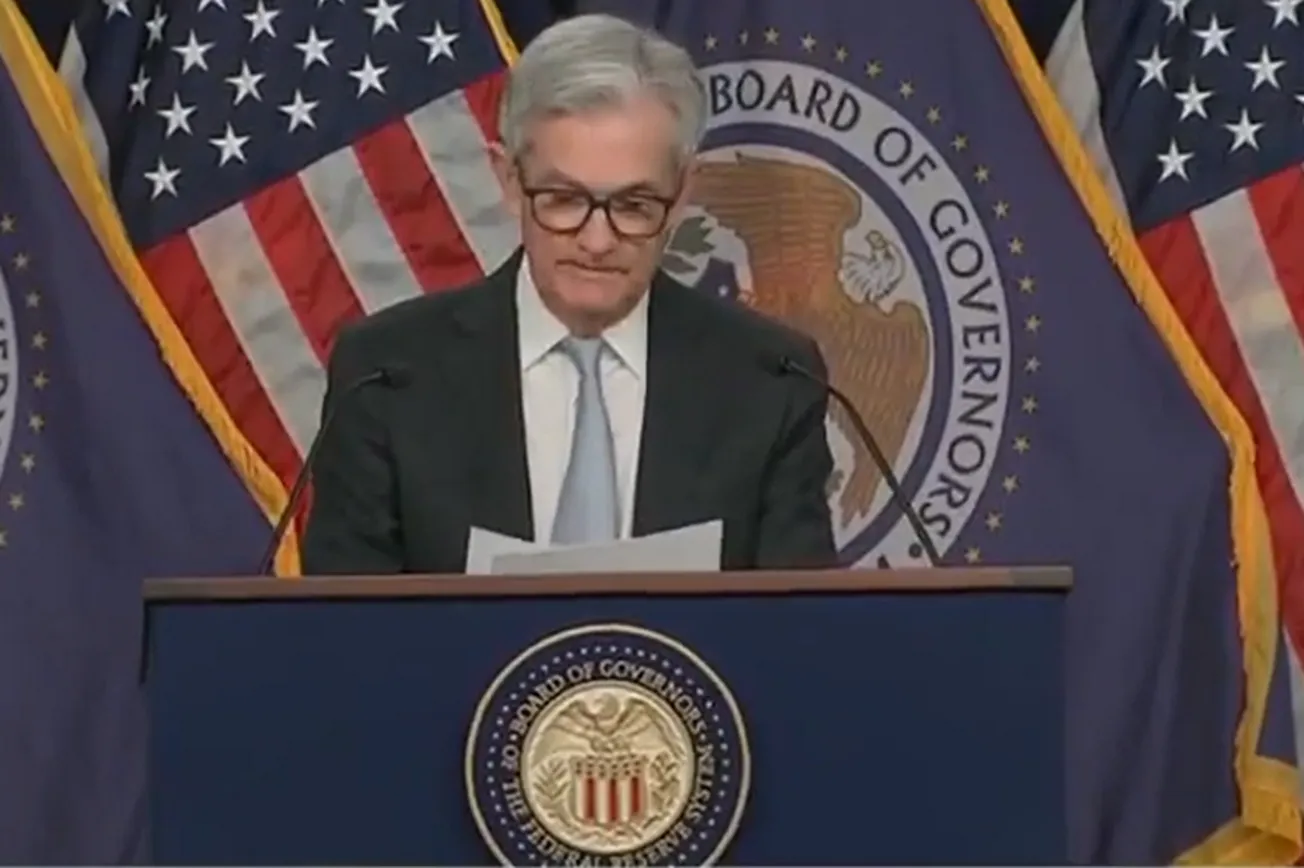

Today is Fed Day. The Federal Reserve comes out with its policy announcement on interest rates, which as everyone expected went up 75 basis points to 4 percent, and then Chairman Powell holds a press conference.

Now, you’ve probably never really thought about this, but I think Mr. Powell has a lot in common with the vice president, Kamala Harris. Both of them have a way with words — or, to put it another way, both of them construct what has been called “word salads.” In other words, they say a lot but no one has any idea what they mean.

Of course, Ms. Harris is in charge of nothing, and Mr. Powell is in charge of the nation’s money supply, so his word salad is a little more important than hers. If you ask stock market traders, though, they’ll tell you they didn’t get what he said, either. Earlier today, I went on with my friend Sandra Smith on Fox News. During the tease, the market was up more than 400 points, but by the time we got to the actual interview it had crashed to zero and then below zero, down about 150 as I recall.

So let’s begin our new approach to Fed watching, with a word salad from the vice president: “The Governor and I and we were all doing a tour of the library here and talking about the significance of the passage of time. Right? The significance of the passage of time. So, when you think about it, there is great significance to the passage of time in terms of what we need to do to lay these wires. ...”

Can anyone tell me what she said? Seriously. Alright, now let’s turn to Mr. Powell: “At some point, as I've said in the last two press conferences, it will become appropriate to slow the pace of increases as we approach the level of interest rates that will be sufficiently restrictive to bring inflation down to our 2 percent goal. There is significant uncertainty around that level of interest rates. Incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.”

So, that sounds tough, right? Plenty of Paul Volcker hair on Mr. Powell’s chest, no? Wait a minute, though. A little bit later, he said this: “So I would say as we come closer to that level, move more into restrictive territory, the question of speed becomes less important than the second and third questions. And that’s why I’ve said it the last two press conferences that at some point it will become appropriate to slow the pace of increases so that time is coming and it may come as soon as the next meeting or the one after that. No decision has been made.”

What did he just say? Kind of sounds like a step-down could happen as soon as next month — December. Well, that’s right away, isn’t it? Or maybe not until January? Or February? Or who knows when?

If it’s next month, December, it kind of sounds like Mr. Powell’s clipping some of those Volcker chest hairs off. Maybe taking a little off the monetary brake, know what I mean?

Meanwhile, interest rates are gyrating wildly, along with the Dow Jones.

As of now, we’re looking at a 900-point swing, thanks to Mr. Powell. Which is really a lot more damage than even Kamala Harris has wrought — though she’d probably like to have that kind of power, wouldn’t she?

Fact is, Mr. Powell, who is not a bad person and is probably trying as hard as he can to get through a tricky situation, should not go before the press and should not try to explain the unexplainable. Because the Federal Reserve models are highly inaccurate, with a terrible track record.

Remember last year? There was no inflation, then there was a teensy bit but it was transitory, then there was a lot more but it was still transitory, then finally the Fed banned the word “transitory” from its vocabulary. Now, let’s put some substance into this discussion.

The Fed has been raising its target rate and cutting back on money supply growth over the past six months. It got a late start, but, yes, it appears they are gaining on the ultimate goal, which is to get back to 2 percent inflation. Commodity market indicators are also pointing toward lower future inflation.

However, it’s also the case that once you let the genie out of the lamp, it’s pretty hard to get the toothpaste back in the tube. Pardon my mixed metaphors, but you know what I’m driving at.

Some inflation measures like the Cleveland Fed’s 7 percent year-to-year median CPI suggest inflation is more embedded in the economy. The official CPI is 8.2 percent; excluding food and energy it’s at 6.6 percent.

Supposedly, the Fed’s favorite indicator — called the PCE personal consumption expenditures price index — is 6.2 percent; excluding food and energy, 5.1 percent.

Meanwhile, the Cleveland Fed’s wage tracker shows a year-to-year wage increase of 6.7 percent and the most recent employment cost index for service sector employees, especially retail, leisure, and hospitality, is rising 7.7 percent.

Remember, the Fed’s so-called price stability target is 2 percent. All of these inflation stats are way over 2 percent. So, even though some leading inflation indicators are coming down nicely, other important current inflation numbers are not.

Thus, the Fed still has a problem, and so does the economy. Remember, yearly real wages for the workforce have been falling for 18 consecutive months.

So much of this whole inflation problem was created by the Biden Democrats — who insisted on out-of-control spending with their Green New Deal socialism, expanding entitlements (including Medicaid) with no work requirements, raising taxes (which damage the supply side of the economy), waging war on fossil fuels (which has caused higher inflation and declining growth), and actually telling us time and again that refined petroleum products that impact hundreds of everyday items for families sitting around kitchen tables will all be abolished because we’re going to end fossil fuels, which of course would jack up their costs even more.

You might call this insanity. Or, you might call this the no. 1 election issue.

That is why the cavalry is coming. In fact, the troops may be even larger than we thought.

From Mr. Kudlow’s broadcast on Fox Business News.

Larry Kudlow was the Director of the National Economic Council under President Trump from 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. and his radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.