Cryptocurrencies were originally devised as an alternative digital currency, free from government manipulation – but in so doing, neither can they be protected or audited.

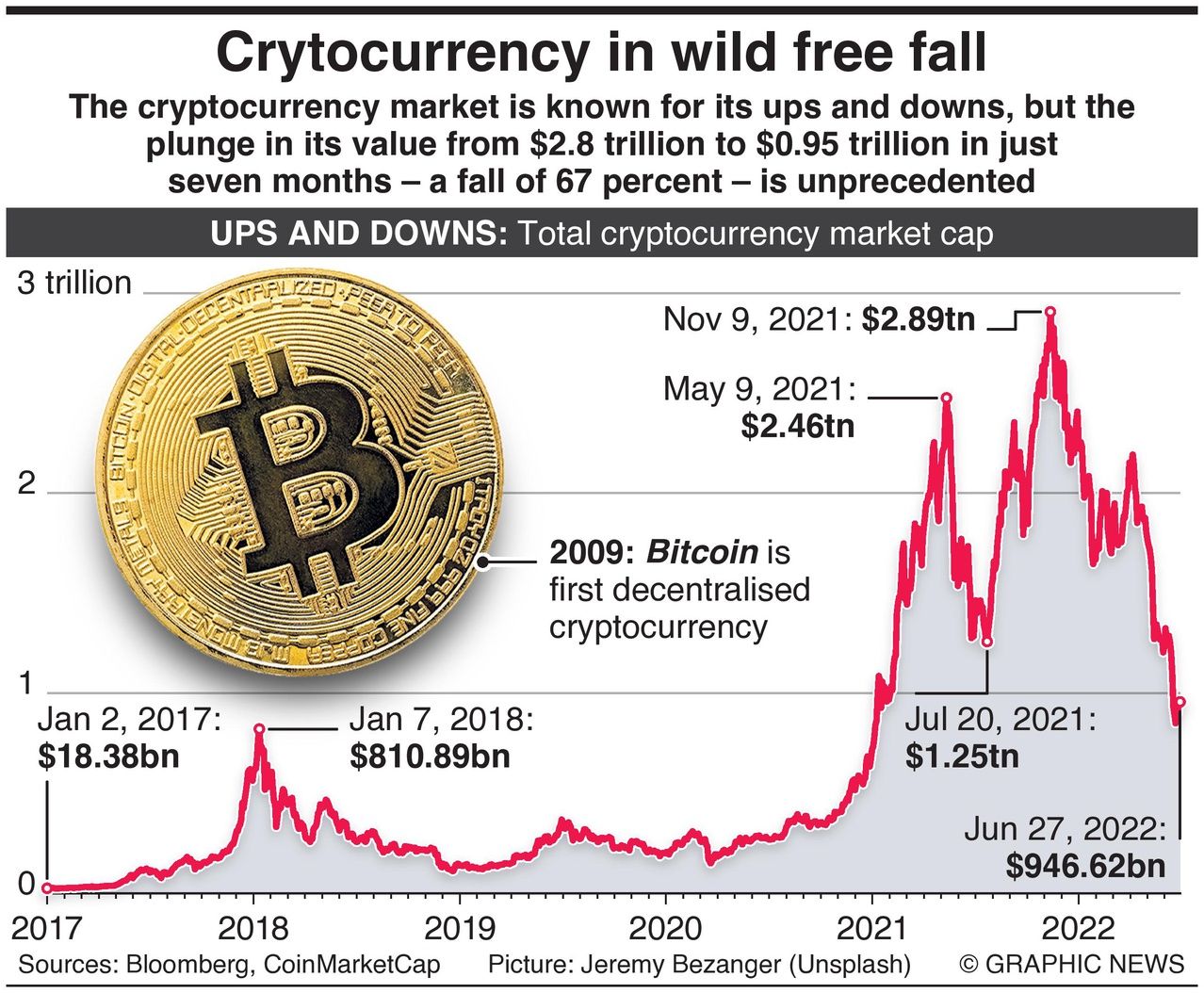

Bitcoin was the first decentralized cryptocurrency, released as open-source software in 2009.

Since then, more than 9,000 other cryptocurrencies – known as altcoins — have come to market, becoming ever more popular with small, less knowledgeable investors looking for get-rich-quick schemes.

By November 9, 2021, the market capitalization of cryptocurrency had seen some major drops – known as “crypto winters” (or “bear markets” in regular business parlance) – but had survived them all to reach a record high of $2.89 trillion.

It was not to last.

As of June 27, 2022, a toxic mix of greed, an emphatic belief its value could only rise, bad news cycles, and rising interest rates has sent the crypto market into free fall, with its value now down two-thirds to $0.95 trillion.

Sadly, those small investors, who bought at very high prices, and are now dealing with very low prices, are being wiped out, with many losing their life savings.