After years of inflation shocks and policy-related uncertainty, the U.S. economy may finally be on the cusp of a growth cycle. Rising investment commitments and renewed business confidence are creating expectations of stronger expansion in the coming months.

At such a pivotal moment, economic leadership matters. With Treasury Secretary Scott Bessent guiding fiscal policy, attention now turns to monetary policy, where the Federal Reserve under Jay Powell has struggled to provide clear direction. President Trump’s nomination of Kevin Warsh to lead the Fed is, therefore, a welcome move. Warsh understands that sustainable growth and price stability must go hand in hand, making him a strong choice at a critical moment for the American economy.

Remarks Warsh delivered months before his nomination are now widely circulated following the market reaction to his selection and show his long-standing concern that the Fed’s oversized balance sheet has helped embed inflation across the economy.

▶ WATCH: Warsh on How the Fed Fueled Inflation

At the Reagan National Economic Forum, Warsh argues inflation has hurt Americans without assets the most & calls for a smaller Fed balance sheet. Read the transcript and watch the video →

Warsh, a former Federal Reserve governor during the 2008 financial crisis, says the central bank drifted from its core mission and that the inflation surge was not an accident but the result of policy choices.

“Inflation is a choice,” he wrote last year, criticizing the Fed’s policy decisions that allowed price pressures to surge after the pandemic.

Warsh thinks the Fed expanded its role beyond traditional monetary policy, becoming what he calls “a general-purpose agency of government.” Programs such as massive bond purchases and emergency lending, originally intended for crisis situations, became routine tools. The result, he argues, is a bloated balance sheet and distorted markets.

In his view, the Federal Reserve should stick to monetary policy and financial stability, leaving debates over climate policy, industrial strategy, and social initiatives to elected officials rather than central bankers.

When economists talk about the Federal Reserve’s “balance sheet,” they mean the huge pool of government and mortgage bonds the Fed bought by creating new money, especially during crises like 2008 and the COVID-19 pandemic. Those purchases injected trillions of dollars into the financial system, keeping markets functioning and borrowing costs low. Critics argue that the balance sheet grew too large, resulting in excess liquidity and contributing to inflation. Shrinking the balance sheet simply means the Fed permits those bonds to run off or sells them, gradually removing excess liquidity and returning monetary policy to a more normal stance.

As Warsh bluntly puts it, inflation’s lasting damage comes when price increases become “embedded” across the economy.

The Federal Reserve’s balance sheet, which was under $1 trillion before the 2008 financial crisis, grew to about $4.5 trillion in the years that followed as the Fed worked to stabilize the economy, then surged again to nearly $9 trillion during the pandemic. Even after recent reductions, it remains at roughly $6.5 trillion.

Flooding the lake doesn’t lift all boats. It sinks them.

Warsh argues that the Fed should gradually roll back the massive crisis support it provided to financial markets, while still allowing interest rates to decline if economic conditions warrant. In his view, policy should shift away from rescuing markets in emergencies and return to normal-rate policies that directly help households and small businesses.

He also contends that inflation results from excessive money creation and government spending, rather than from strong economic growth, echoing economist Milton Friedman’s view that inflation occurs when the money supply grows faster than the economy’s ability to produce goods and services.

Warsh has also emphasized the importance of a strong and stable dollar, arguing that currency stability helps restrain inflation, attract investment, and reinforce America’s economic leadership in global markets.

He believes powerful forces, particularly technological advances, will likely keep prices under control in the years ahead. Improvements driven by artificial intelligence and higher productivity, he argues, can help raise wages and living standards without necessarily causing inflation.

Underlying his thinking is a concern about credibility. “The Fed’s greatest asset is its institutional credibility,” Warsh has said, warning that once public confidence erodes, restoring it is not easy.

He also rejects the idea that central bank independence means unlimited discretion. “The Fed is not independent from the government. It is independent within government,” he has argued, meaning independence must be earned through discipline and adherence to its mandate.

If confirmed, Warsh would likely push for a leaner, more rules-based Fed, less willing to intervene in markets, and more focused on price stability and long-term growth. Such an approach may reassure inflation-weary Americans, but could also create tensions with policymakers who prefer easier money and expansive fiscal policy.

For markets and households alike, a Warsh-led Fed would signal something simple but consequential: a central bank returning to basics after years of experimentation and restoring confidence in the process.

As Warsh argues, restoring discipline at the Fed is essential. A golden age cannot be built on easy money. It requires sound money.

👉 Quick Reads

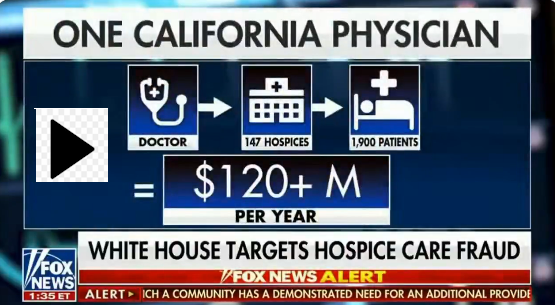

I. Shocking Report Exposes Massive Hospice Billing Irregularities In L.A. County

A new investigation highlights alarming figures tied to home health and hospice billing in Los Angeles County. According to the report, 18% of all U.S. home health care billing reportedly comes from L.A. County alone, while nearly 2,000 hospice agencies operate there — more than 36 states combined and about 30 times the total in Florida or New York.

The report also cites cases including one doctor billing roughly $120 million in a single year while claiming to oversee about 1,900 patients, and clusters of hundreds of hospice providers listed within just a few miles, sometimes operating out of strip malls, vacant lots, or unmarked buildings raising serious concerns about oversight and possible fraud in government-funded health programs.

II. Job Growth Since Pandemic Varies Widely Across States

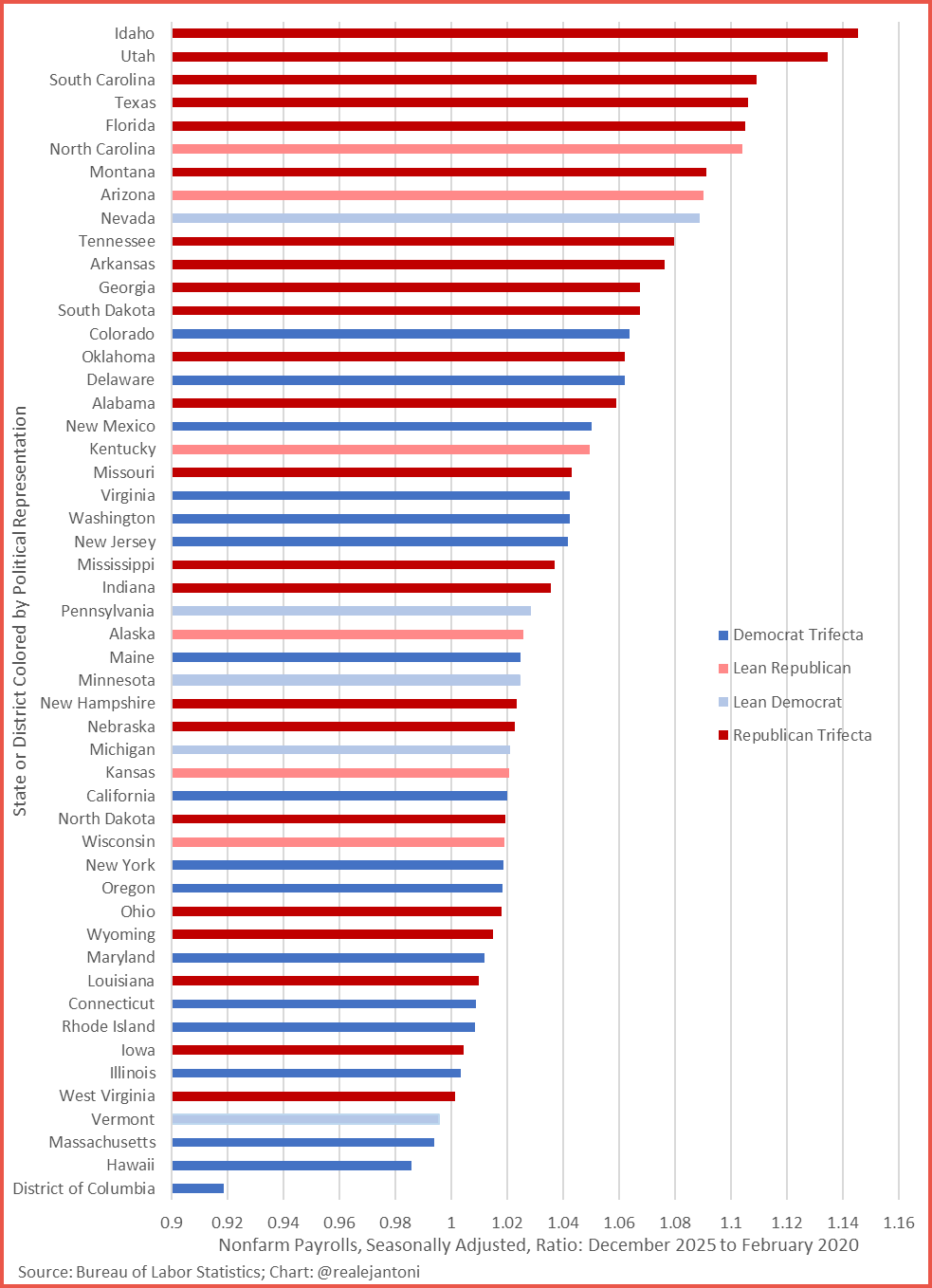

New data comparing employment levels to pre-pandemic figures show large differences in job recovery across U.S. states. Several states — led by Idaho and Utah — have added 10% or more jobs since early 2020, while others are still close to or below their pre-pandemic employment levels.

The chart highlights how job growth has been uneven, reflecting differences in population shifts, industry mix, and state economic conditions.

📊 Market Mood — Monday, February 2, 2026

🟥 Futures Slide to Start the Week

U.S. futures fall as investors brace for a heavy week of earnings and key economic data, including Friday’s jobs report.

🟨 Metals Selloff Jolts Sentiment

Gold drops below $5,000 and silver extends last week’s historic plunge as profit-taking and a stronger dollar shake risk appetite.

🟦 Warsh Nomination Lifts Dollar, Raises Policy Questions

Trump’s Fed chair pick Kevin Warsh boosts the dollar and fuels debate over whether future balance-sheet moves could tighten financial conditions.

🟩 Earnings Flood Incoming

Disney headlines a busy earnings week, with over 100 S&P 500 companies reporting, while AI investment returns remain under scrutiny.

🟧 Oil Drops as Iran Risks Ease

Crude tumbles after Trump signals progress in talks with Iran, easing fears of supply disruption despite OPEC+ holding output steady.

🗓️ Key Economic Events — Monday, February 2, 2026

🟧 09:45 AM — S&P Global Manufacturing PMI (Jan)

A timely snapshot of U.S. factory activity, offering early signals on production, orders, and business conditions.

🟨 10:00 AM — ISM Manufacturing PMI (Jan)

The most closely watched gauge of U.S. manufacturing health, tracking demand, employment, and production trends.

🟦 10:00 AM — ISM Manufacturing Prices (Jan)

Measures price pressures faced by manufacturers, an important input for tracking pipeline inflation trends.

editor-tippinsights@technometrica.com