Can a joyous presidential campaign by Kamala Harris alleviate Americans' financial stress? Memo to the media: Absolutely not.

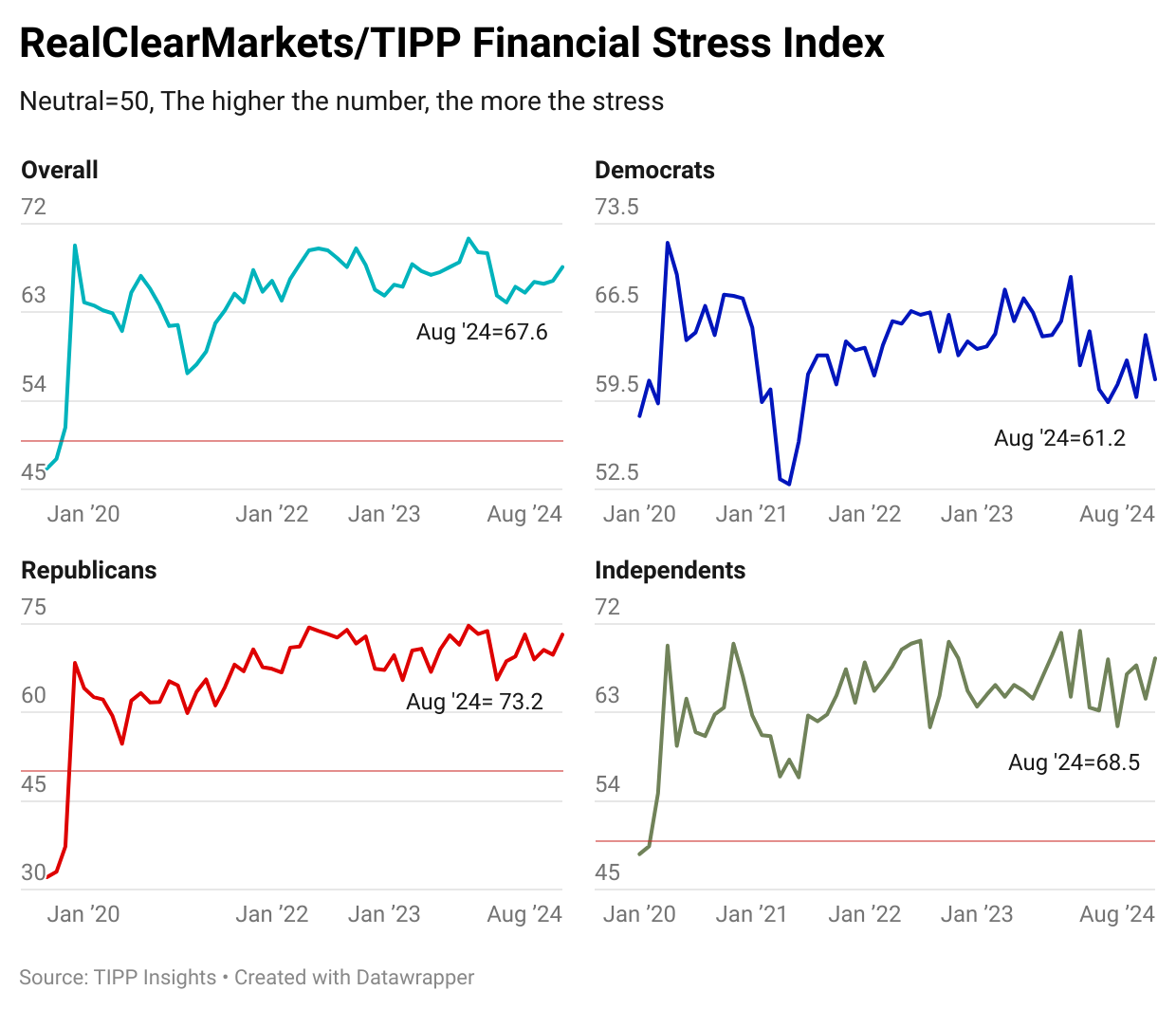

The RealClearMarkets/TIPP Financial Stress Index, the only monthly metric tracking Americans' financial stress, reached an eight-month high of 67.6, marking the highest reading for 2024.

The Index accurately indicates Americans' financial concerns about paying bills and making ends meet. Consumer spending drives two-thirds of the economy, and when people are financially stressed, they are hesitant to spend money.

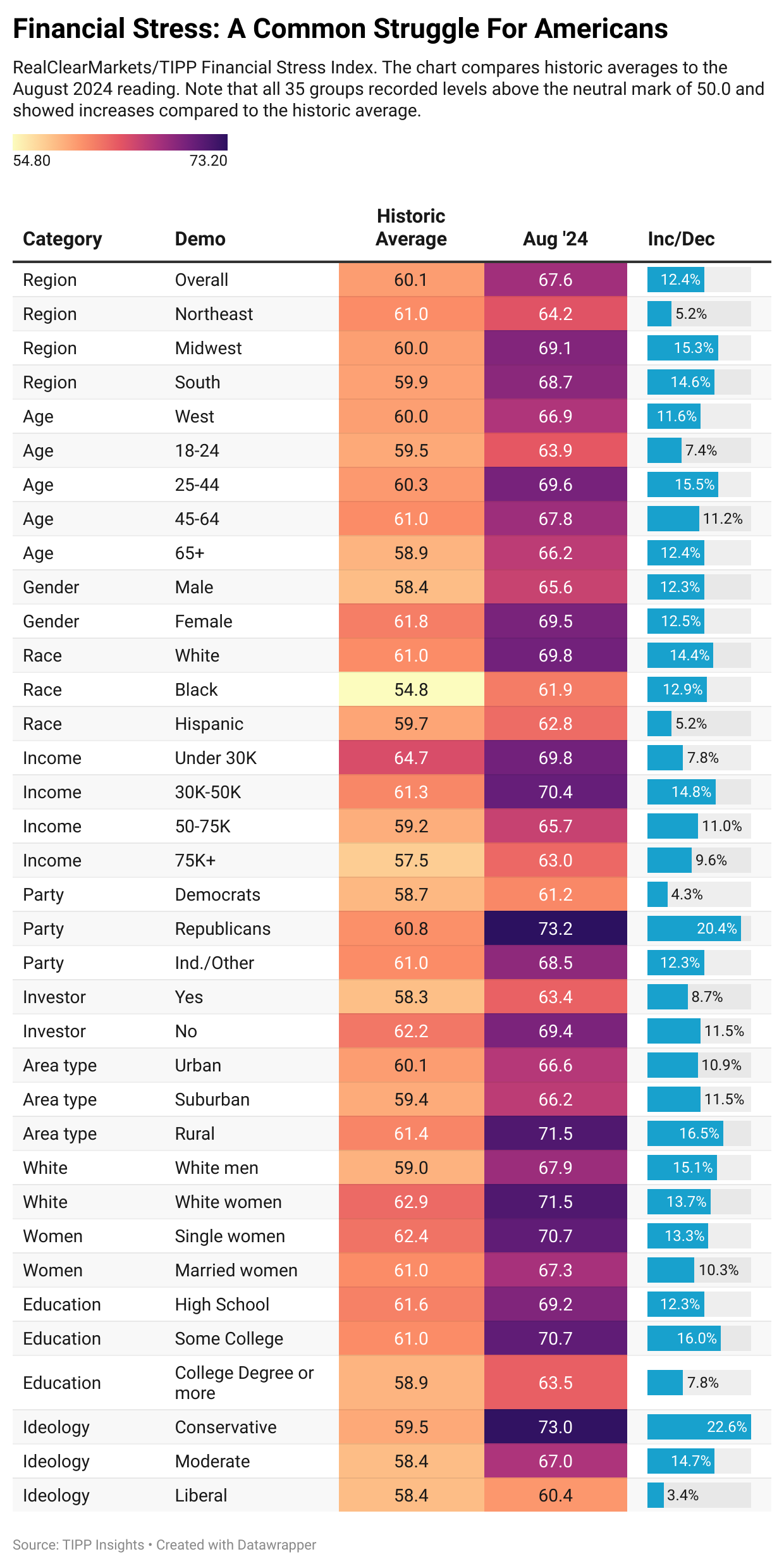

Of the 35 demographic categories we monitor, a staggering 26 (75%) are currently grappling with heightened stress levels, which are a significant 10% above their historical averages. The data shows that financial stress is a pervasive problem affecting all demographics.

Regrettably, the media's focus seems elsewhere, with scant coverage of this dire scenario. Instead, they are preoccupied with portraying a rosy picture of the current administration.

We can’t believe it—while 24% of Americans are skipping meals because they can’t afford them due to high food prices, here are the headlines we’re seeing instead:

- Harris Used to Worry About Laughing. Now Joy Is Fueling Her Campaign - New York Times

- Harris and Walz seize on joyful message in contrast to darker Trump themes - Washington Post

- Pramila Jayapal: 'Radical Joy' Is Centered In Kamala Harris Campaign - Forbes

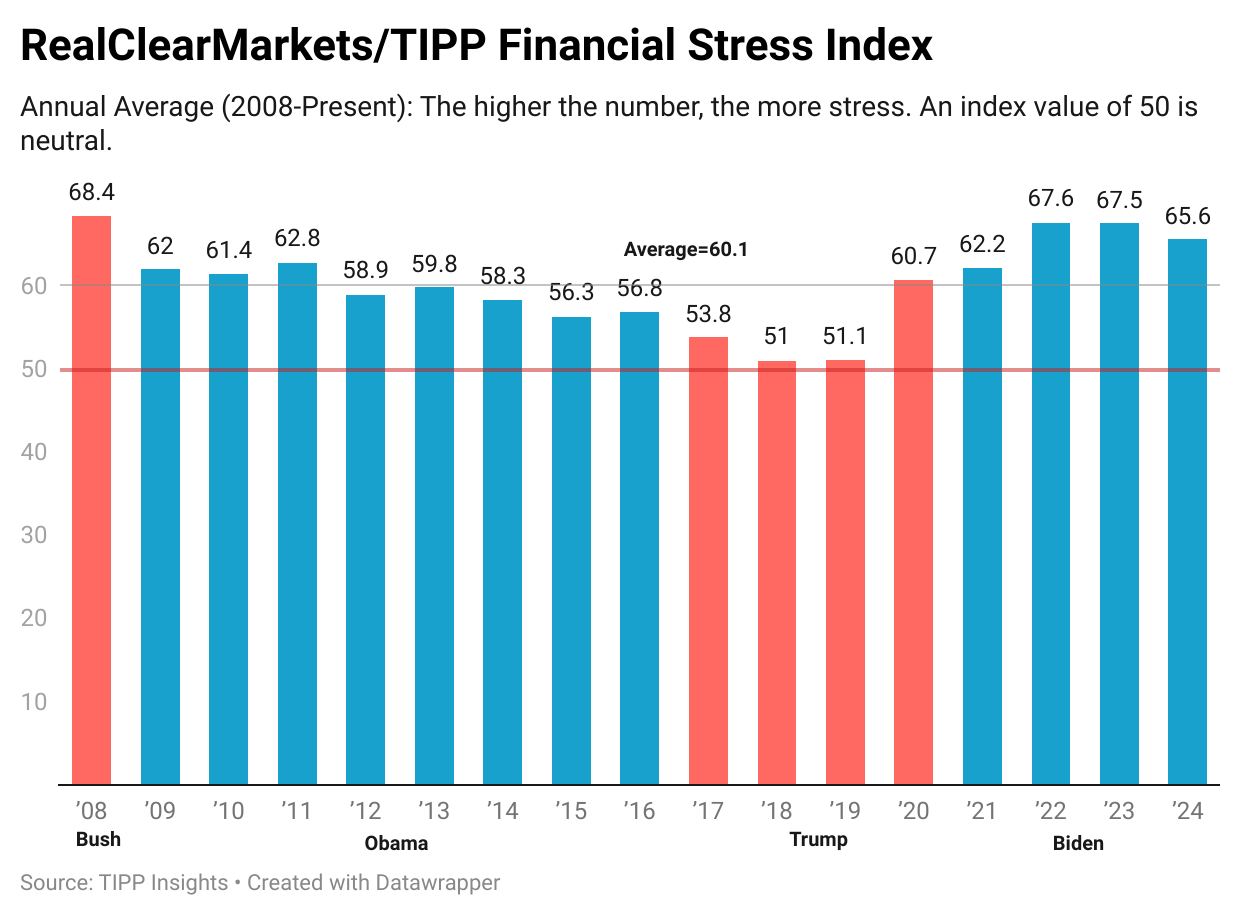

TIPP began tracking financial stress in December 2007. The average financial stress under President Bush, from December 2007 to January 2009, was 67.8.

Objectively speaking, President Biden has been the worst president in terms of financial stress, with an average of 65.8 over 43 months, compared to 54.4 under Trump and 59.4 under Obama.

Financial stress is not just a number on a chart. It can lead to serious health issues such as insomnia, weight gain or loss, depression, anxiety, relationship difficulties, social withdrawal, and physical ailments such as headaches, gastrointestinal problems, diabetes, high blood pressure, and heart disease.

We computed the stress index from responses to the questions: Thinking of your personal finances, compared to the past three months, do you feel more stressed these days, less stressed these days, or feel the same level of stress?

The Index ranges from 0 to 100; the higher the number, the more stress. A reading of 50.0 is the neutral point.

On a concerning note, the August reading of the RealClearMarkets/TIPP Financial Stress Index is 67.6, greater than the three-month moving average of 66.6, reflecting acceleration. Persistent Bidenflation, layoffs, and job insecurity exacerbate financial stress.

The chart below shows that financial stress impacts all Americans, irrespective of their party affiliation. Republicans (73.2) have the highest stress levels, while Democrats' stress level is 12.0 points lower (61.2). Independents’ stress level is between the two at 68.5, 0.9 points higher than the overall 67.6.

By The Numbers

The table below shows the Index's historical averages, the August readings, and the differences across demographic groups. All 35 demographic groups exhibit stress, with readings above the neutral level of 50.0. Of the 35 demographic categories, 26 (74%) experience stress, 10% higher than their historical average.

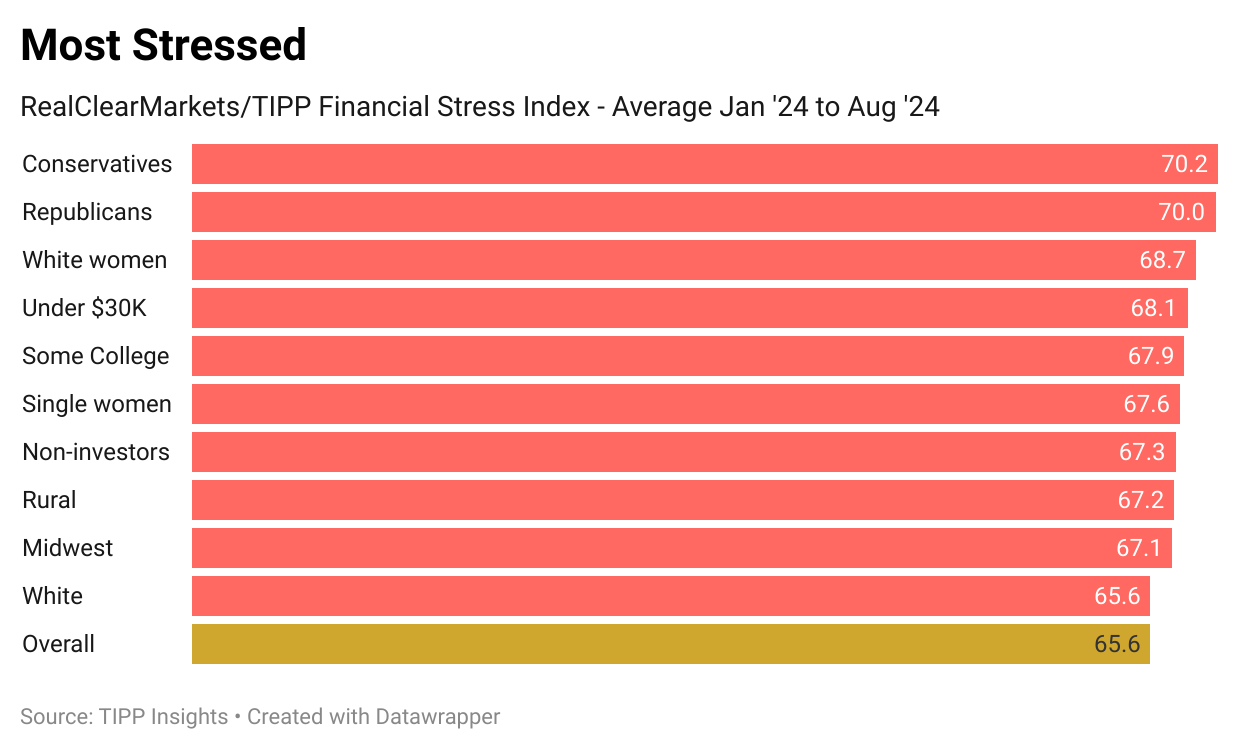

Here are the ten demographic groups with the highest stress levels, based on the average over eight months of 2024. Conservatives, Republicans, and white women are the most stressed groups, followed by those under $30K households.

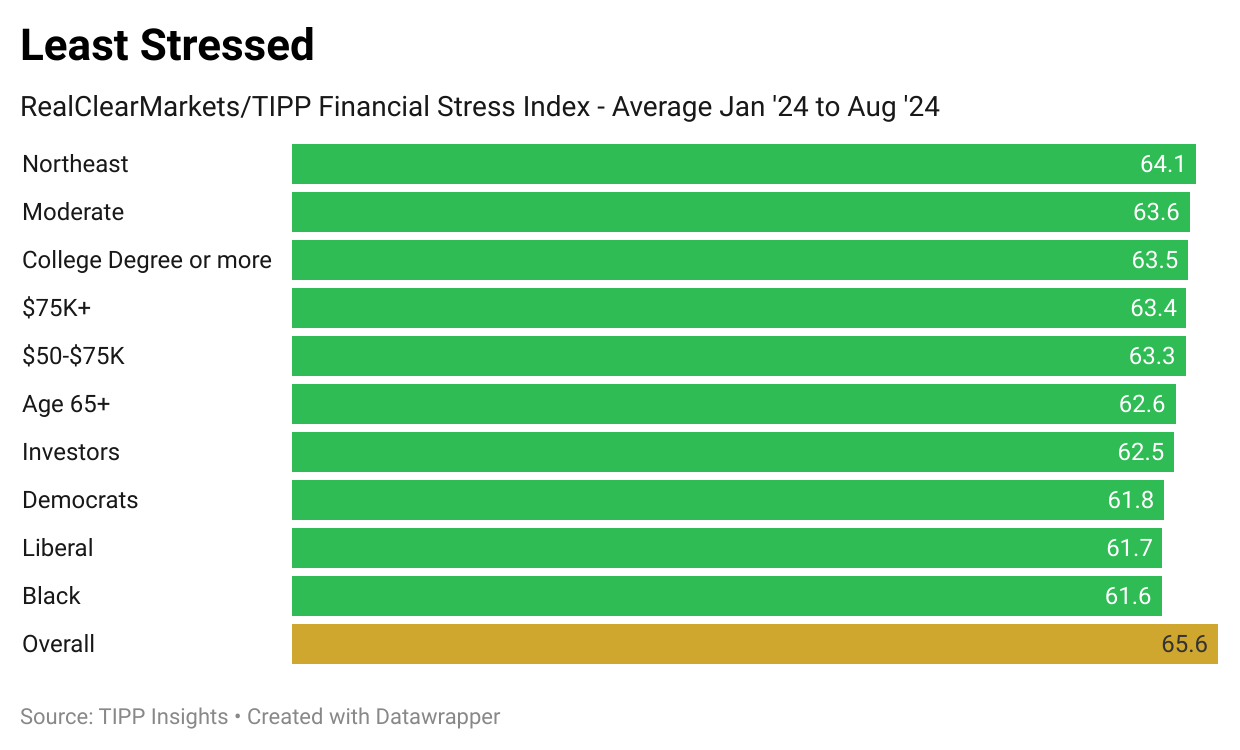

The chart below shows the ten demographic groups with the least stress based on the average over the eight months of 2024. The groups experiencing the least stress are Northeast, moderates, those with college degrees or more, followed by households with an income of $75K or more.

Cause Of Stress

Most Americans are stressed because their wages have not kept pace with price increases.

Under President Biden, real wages have declined by 1.8%. According to government data, average hourly earnings for all employees dropped 1.8% to $11.18 in June 2024 from $11.39 in January 2021 when Biden took office. Nominal wages represent the amount of money one earns without considering changes in the cost of living. On the other hand, real wages consider inflation and measure the purchasing power of wages.

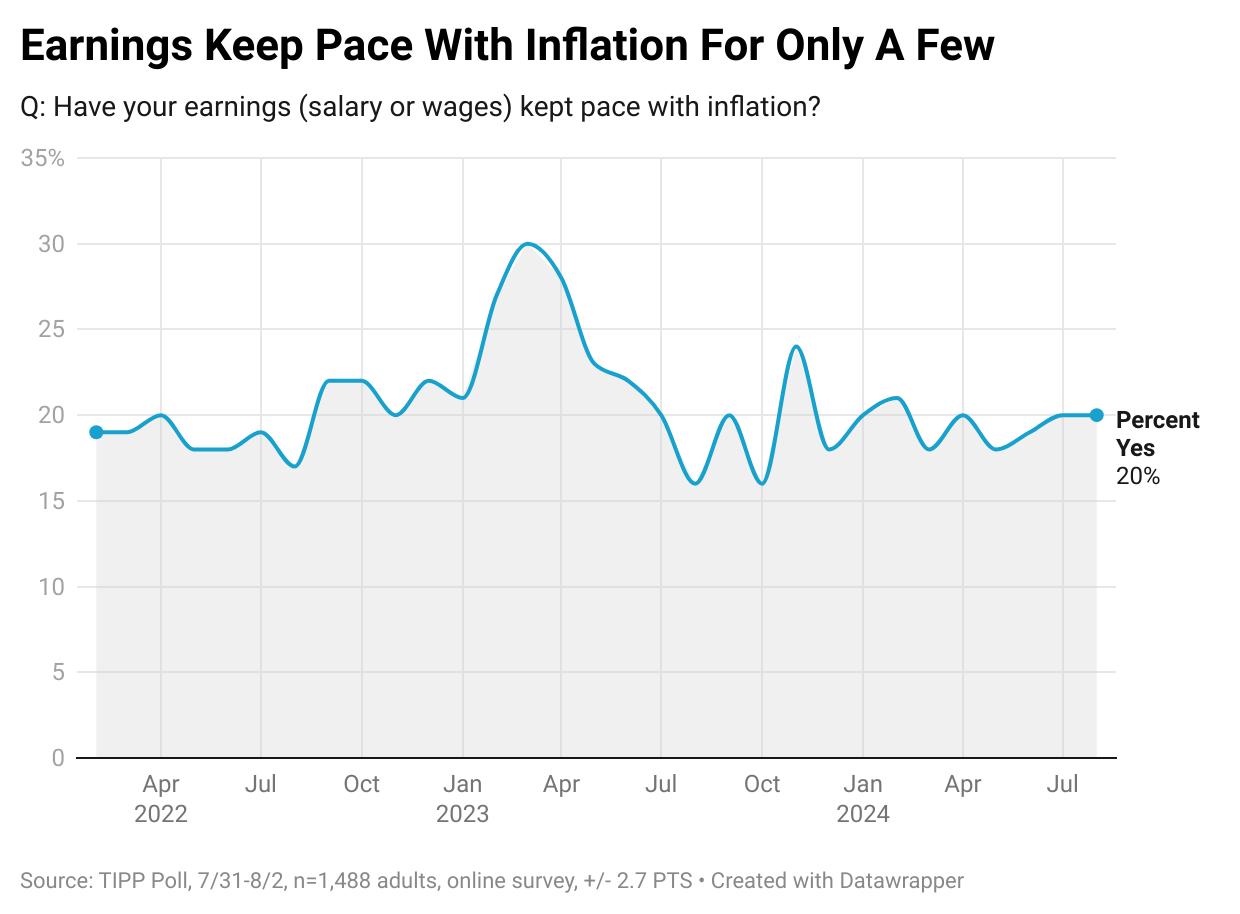

In the latest TIPP Poll completed in early August, only 20% of Americans say their earnings have kept pace with inflation.

Americans are increasingly turning to credit card debt to make up the shortfall. According to TransUnion, the average balance per consumer is $6,329, a 4.8% yearly increase. On Tuesday, the Federal Reserve Bank of New York reported that Americans now owe a record $1.14 trillion on their credit cards.

Financial Hardships Hit Lower-Income Households Hardest

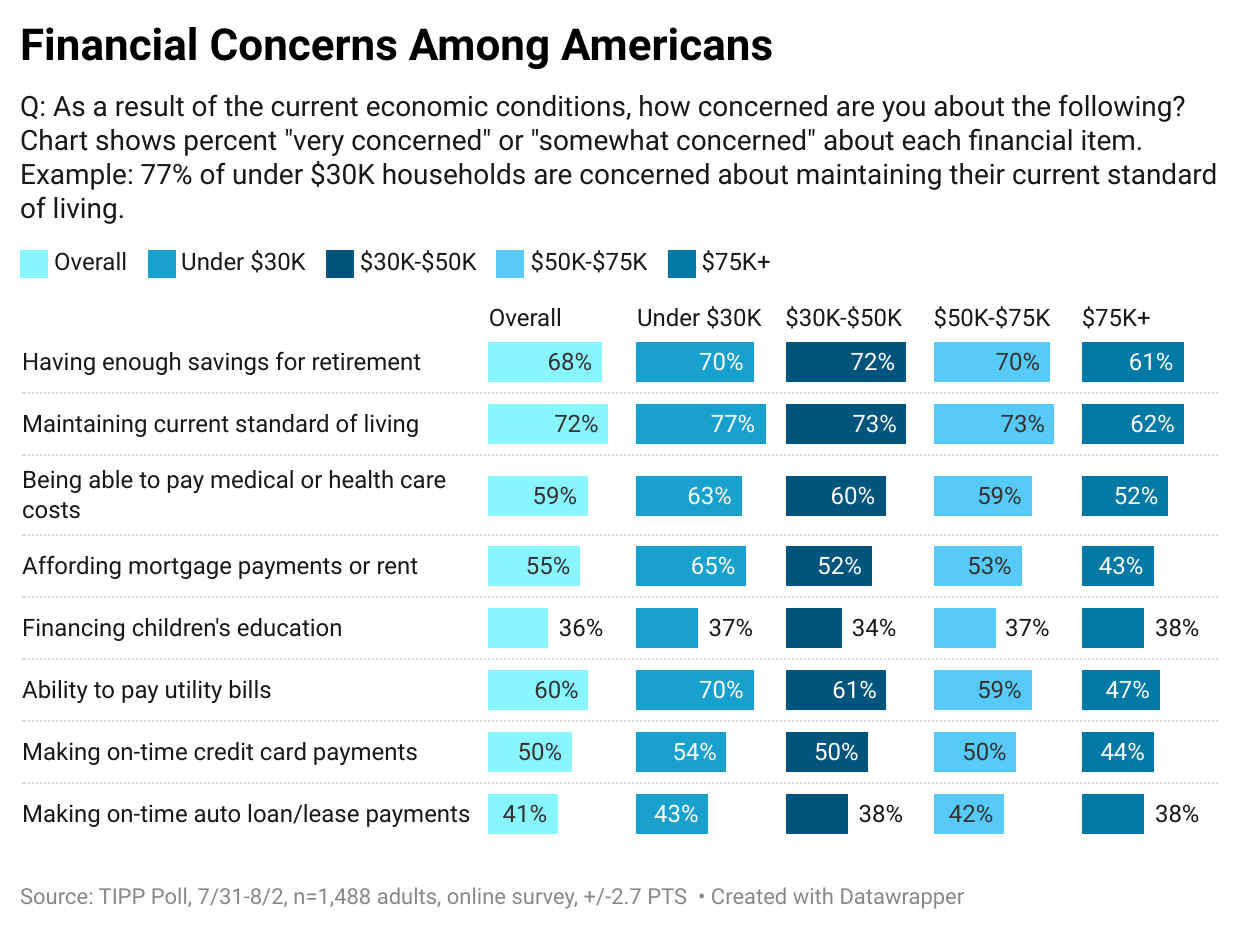

In the current economy, Americans struggle to make ends meet. The chart below describes their struggles: More households in the lower income bracket face hardships than higher-income households. For example, 70% of households with under-$30K income are concerned about paying their utility bills compared to 61% for $30K-$50K, 59% for $50K-$75K, and 47% for $75K.

Diverse Strategies To Manage Higher Food Costs

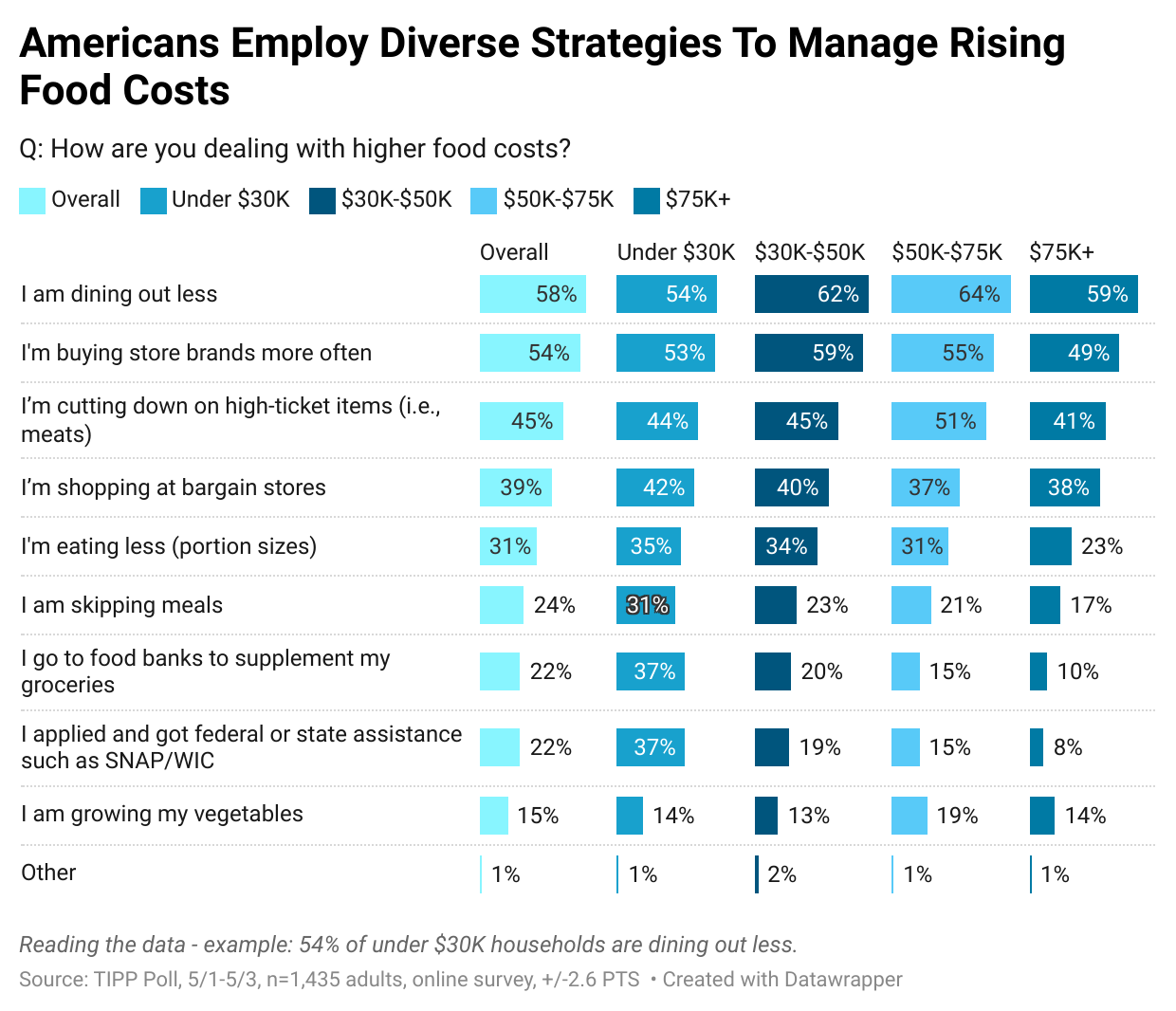

Americans are struggling to adjust to higher food costs. The chart below reveals some shocking statistics.

- 58% are dining out less

- 54% are buying store brands more often

- 45% are cutting down on high-ticket items (i.e., meats)

- 39% are shopping at bargain stores

- 31% are eating less (portion sizes)

- 24% are skipping meals

- 22% go to food banks to supplement groceries

- 22% have applied for federal or state assistance

- 15% are growing vegetables

Biden’s Handling Of The Economy

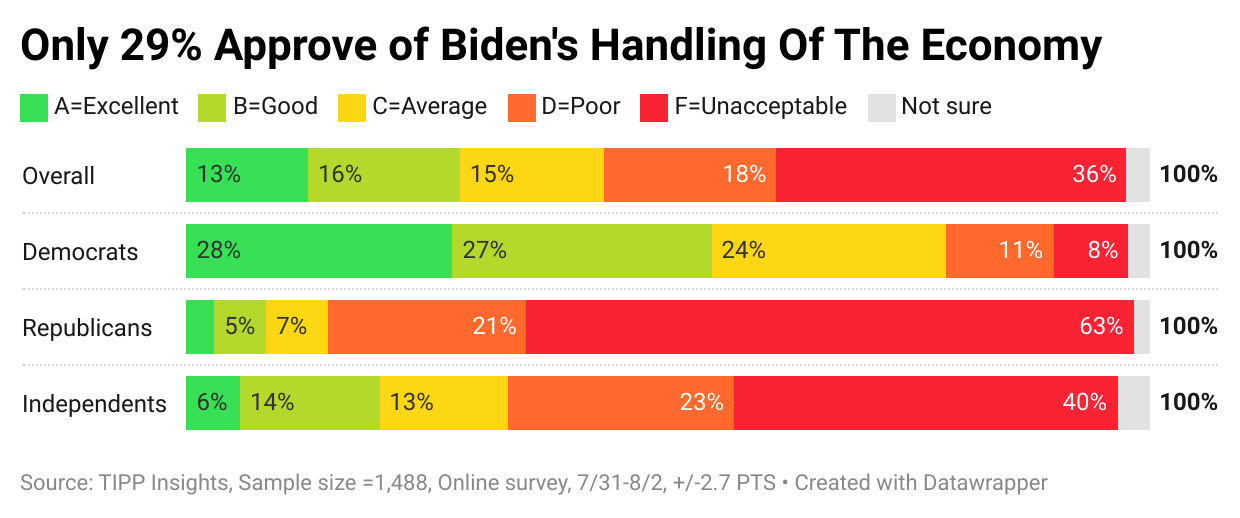

In the latest TIPP Poll taken in early August, most Americans (54%) give Biden a failing grade (D or F) on his handling of the economy. Only 29% give him an A or B.

Among Democrats, half (55%) give him positive grades, 19% believe he deserves failing grades, and another 24% rate his performance as average (C).

In contrast, Republicans are much more critical, with 84% expressing dissatisfaction with Biden's handling of the economy.

Meanwhile, independents also express their disappointment, with 63% giving failing grades, 20% giving good grades, and 13% rating Biden’s performance as average.

The recent manufacturing data reflect that the economy will likely slow down. Combined with unyielding inflation powered by Biden’s wasteful spending, inflation will likely persist for the foreseeable future. Americans must brace for an extended period of stagflation. We don’t enjoy being the bearers of bad news. However, we would rather not sugarcoat the situation or find scapegoats.