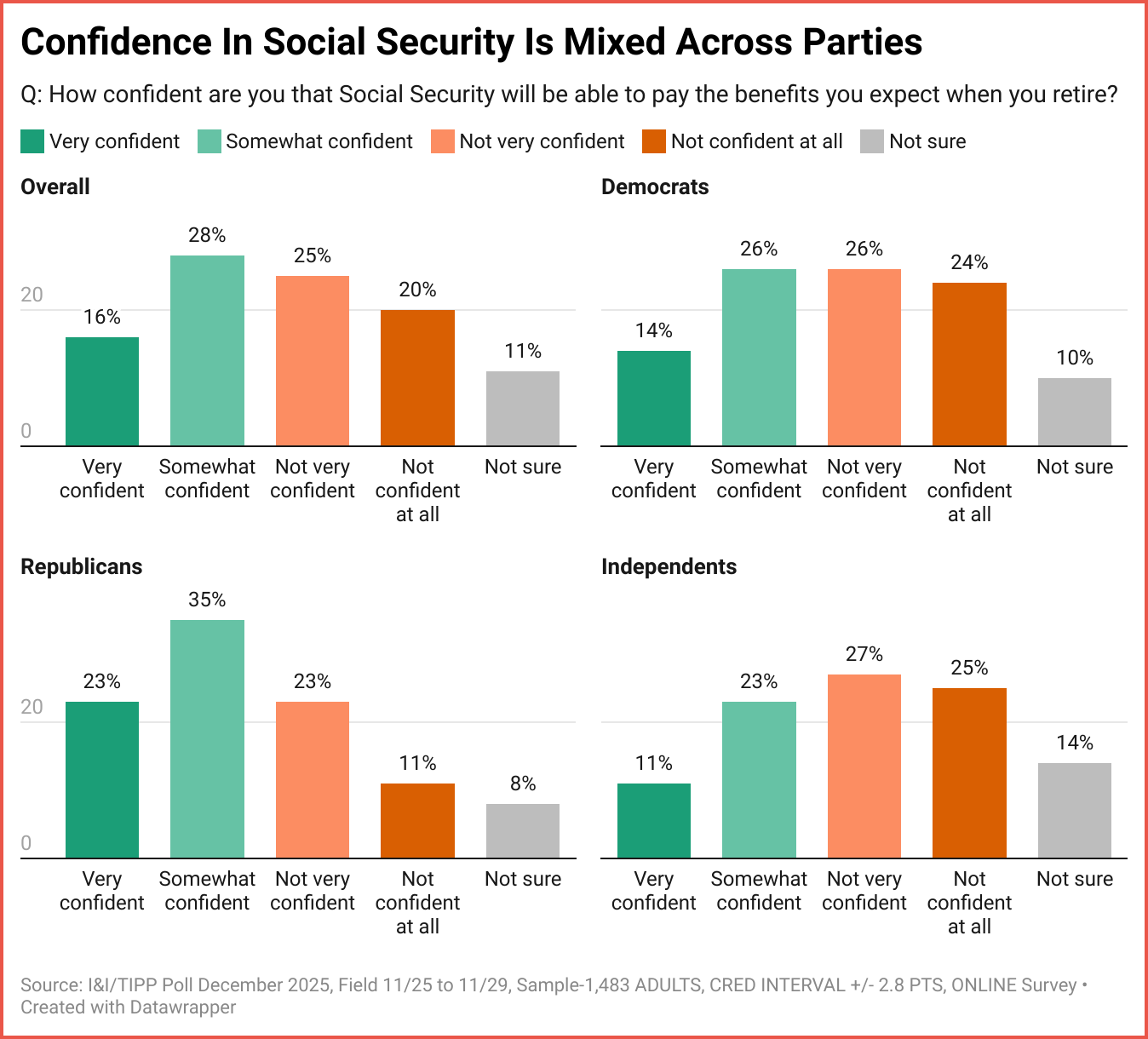

The end of the year is always a time for looking forward. For a large cohort of Americans, that means preparing for retirement and asking the inevitable question: “Can I rely on Social Security to pay the benefits I now expect when I quit working?” For roughly half, the answer is no, the I&I/TIPP Poll shows.

The online national I&I/TIPP Poll was conducted from Nov. 25 to Nov. 29, with 1,483 Americans responding. The margin of error is +/-2.8 percentage points.

Specifically, I&I/TIPP asked: “How confident are you that Social Security will be able to pay the benefits you expect when you retire?”

Voters aren’t very confident at all, it seems. Among those responding, 44% said they were either “very confident” (16%) or “somewhat confident” (28%), while 45% called themselves either “not very confident” (20%) or “not confident at all” (25%).

That’s a stunning vote of no confidence in a program that is now 91 years old.

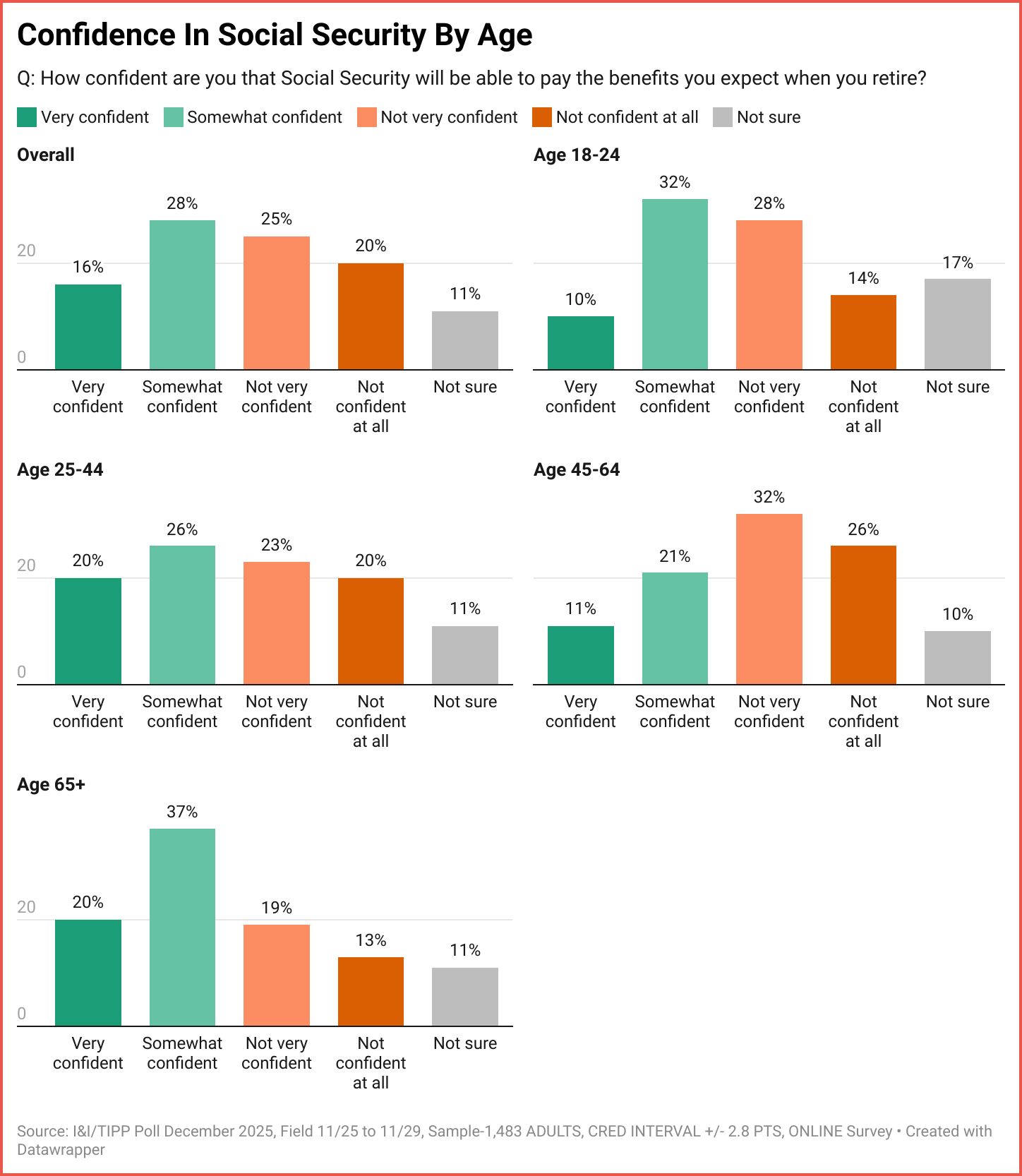

Not surprisingly, the age of poll respondents shapes how they answer the poll question

For example, those Americans in the 65-plus age group – that is, already mostly receiving benefits – remain fairly confident about Social Security’s prospect, with 57% calling themselves confident, while only 32% say they’re not confident.

But the least confident age group is those just below: 45 to 64 year-olds, among whom just 32% claim to be confident, while 58% say they’re not. That’s a clear sign of a generation of workers preparing for the worst from Social Security when they retire.

Meanwhile, 25 to 44 year-olds, those still in the beginning and middle years of their careers, see the Social Security crisis as something remote in time, likely to be ironed out: Fully 46% of this group is confident, compared to 43% that isn’t.

Perhaps influenced by their parents’ worried dinner-table conversations, the youthful 18 to 24 year old cohort is at the margin equally split: 42% confident, versus 42% not confident.

Clearly, Americans see a problem. They know it’s coming. But can they agree on how to solve it? Not quite.

I&I/TIPP asked respondents: “Which approach do you prefer to keep Social Security financially sound?”

The result: 49% picked “cut government spending in other areas instead”; 13% went for “raise payroll taxes”; 6% preferred “raise the retirement age”; another 6% leaned toward “reduce benefits for future retirees”; and 9% selected “no changes are needed.” A hefty 17% said they were “not sure.”

Looking at the numbers, it appears a significant reduction in the federal budget is the only answer that has broad political viability. None of the other choices rank very high among the preferences.

Both cutting benefits for future retirees and raising the retirement age get little backing. Even “cut government spending,” though popular, leads to a dilemma: Last year, Social Security consumed $1.5 trillion of all federal spending, or roughly 22.4% of the budget.

If nothing is done, big cuts will be required in order to keep retirement funds flowing.

The trustees of Social Security, in their 2025 outlook, estimated that by 2035 expected financial shortfalls would require either a 4.3% hike in payroll taxes for workers, or a 23% cut in benefits for recipients. Such cuts would double the poverty rate for elderly Americans.

Could cuts in government spending pay for expected shortfalls in Social Security? Yes. Social Security will spend an estimated $1.4 trillion this year on supporting retirees. That will grow to $2.4 trillion by 2035. After that, with the so-called trust funds depleted, Social Security cuts of about 23%, or $550 billion, kick in.

Since total federal spending in 2035 is expected to be $10.56 trillion, up from $7 trillion this year, paying for Social Security for one year would require cutting about $540 billion in annual spending from the budget. That’s a 5% cut, but more would have to be made as Social Security spending grows after that.

Doable? Sure, but when has Congress ever made sharp cuts in federal spending a priority, especially since four-fifths of the budget is now considered “mandatory”– not cuttable, in short.

Would Americans support opening up mandatory spending for cuts? Maybe, maybe not. Remember, Social Security is a big part mandatory spending, along with Medicare, and Medicaid, unemployment insurance and Supplemental Nutrition Assistance Program (SNAP), among other welfare programs.

And despite 9% in the I&I/TIPP Poll say “no changes are needed,” that’s completely not viable. The system will crash and burn, unable to pay retirees the amount promised, by 2032 or 2033, according to the Social Security system’s trustees. It’s just around the corner.

So it can be done, but difficult decisions must be made.

One viable alternative for keeping Social Security viable is private accounts. Over the pas 30 years, both major parties have at one time or another embraced the idea — including President Clinton, who, in his 1999 State of the Union, suggested “investing a small portion” of expected future budget surpluses into personal accounts.

President George W. Bush likewise backed private accounts, but dropped the idea when the 2008 financial crisis hit. Two years of huge market losses left many Americans shellshocked.

Since then, there’s been little noticeable political support for the idea.

And many Americans are wary of trying to manage investments, fearing bad market moves could make them poorer rather than richer — even though long-term gains on major stock market indexes average 6% to 8% a year. The popular S&P 500 index, for instance, has averaged 10.5% a year from its introduction in 1957 through 2024.

Meanwhile, the new “Trump Accounts” for children, which include a $5,000 tax-free annual limit for parents’ contributions and $1,000 from the government, have been described by Treasury Secretary Scott Bessent as a “backdoor for privatizing Social Security.”

“If all of a sudden these accounts grow and you have in the hundreds of thousands of dollars for your retirement, then that’s a game changer,” Bessent said. Australia’s so-called “Superannuation” system of saving for retirement has been suggested as a possible model for the U.S.

Will private accounts save Social Security? Or will across-the-board federal spending cuts save the day? Or will welfare recipients (mandatory spending) bear the brunt?

As the I&I/TIPP Poll shows, none of the proposed solutions have majority support. But that might change rapidly once Social Security’s financial insolvency becomes a hard reality, and not just a hypothetical debating point.

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past six presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

👉 Quick Reads

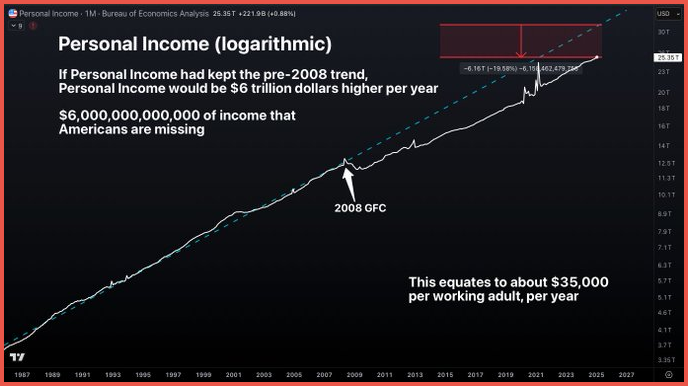

I. The $6 Trillion Hole In America’s Paychecks

If personal income had continued along its pre-2008 trend, Americans would be earning about $6 trillion more every year today — roughly $35,000 per working adult that never showed up after the financial crisis.

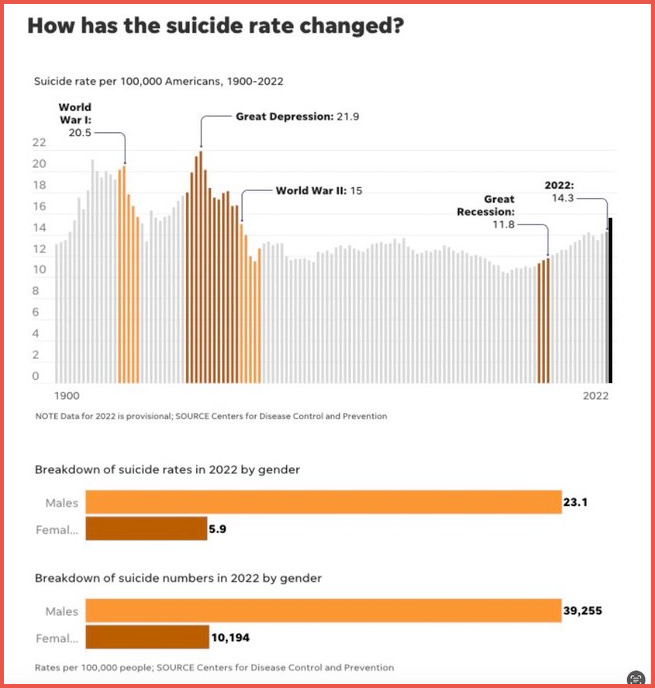

II. America’s Suicide Rate Is Back At Great Depression Levels

The U.S. suicide rate has climbed to its highest level since the 1930s, reaching 14.3 deaths per 100,000 people in 2022, with men accounting for nearly four out of five deaths — a quiet national crisis unfolding in plain sight.

If you or someone you know is struggling, the 988 Suicide & Crisis Lifeline is available 24/7 by calling or texting 988.

III. Late-Night TV Monopoly

From July through December 2025, America’s five biggest comedy talk shows booked 90 liberals and Democrats and just one conservative, leaving Republican officials completely absent and turning late-night into a near-total one-party echo chamber.

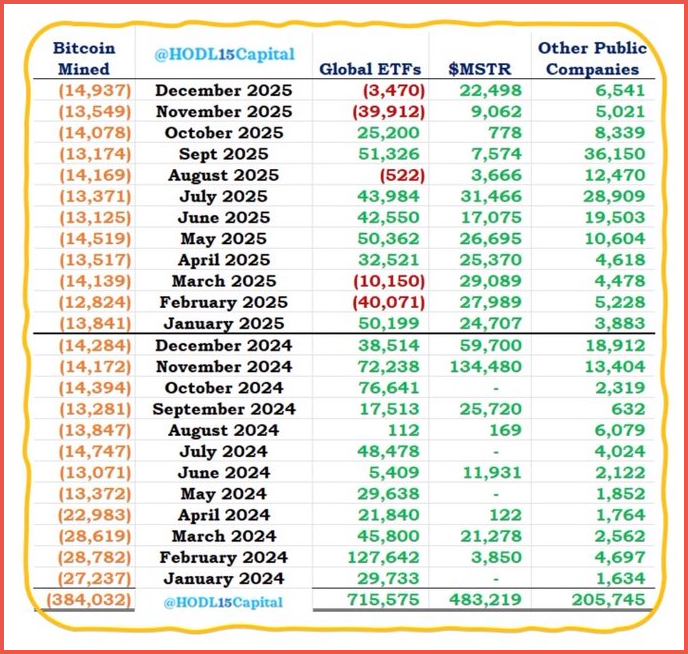

IV. Wall Street Is Buying Bitcoin Faster Than It Can Be Mined

Since January 2024, Bitcoin miners have produced about 384,000 new coins, but ETFs and public companies have bought roughly 1.4 million coins — more than three times the available new supply. That imbalance means institutions are not just participating in the market, they are steadily draining it, creating a structural shortage that did not exist in prior cycles.

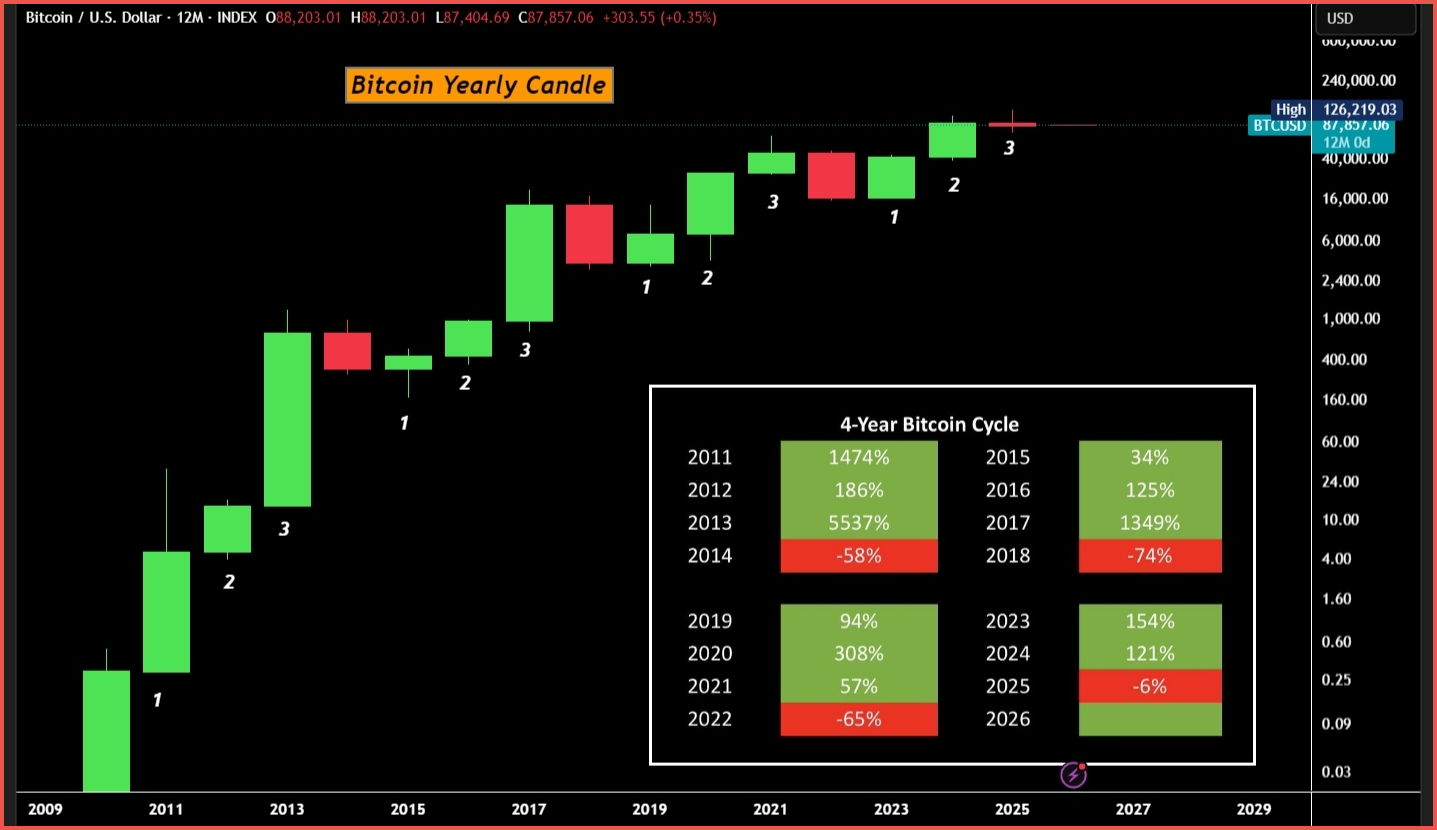

V. Bitcoin’s Old Rhythm Changed

For more than a decade, Bitcoin rose for three years and fell in the fourth, with huge rallies after every automatic supply cut — but in 2025 that pattern finally broke.

How to read this chart

Each bar is one year of Bitcoin’s price.

In every major cycle since Bitcoin began, the pattern was simple: prices climbed for about three years, then dropped hard in the fourth. The strongest gains usually came in the year after the system automatically reduced how many new coins could be created.

That rhythm repeated again and again. Until now.

In 2025, instead of extending the usual post-supply-cut rally, Bitcoin finished the year lower. For the first time, the old four-year rhythm failed.

This does not mean Bitcoin is weak. It means the market is changing. Instead of being driven mainly by its internal clock, Bitcoin is now moving with liquidity, interest rates, and institutional demand — like a grown-up financial asset.

📊 Market Mood — Friday, January 2, 2026

🟩 Futures Start the Year Strong

U.S. equity futures jump to open 2026, but strategists warn that Day-One moves rarely predict the year ahead.

🟧 Asia Opens With a Bang

South Korea and Hong Kong surge to record highs, led by strength in semiconductor stocks.

🟦 FTSE Breaks 10,000

Britain’s benchmark index crosses the symbolic milestone as mining shares rally.

🟪 Metals Bounce Back

Gold and silver rebound after last week’s pullback, reviving momentum from their historic 2025 run.

🟫 Crypto Firms, FX Calm

Bitcoin pushes back toward $90K while currency markets remain subdued.

🗓️ Key Economic Events — Friday, January 2, 2026

🟩 9:45 AM ET — S&P Global Manufacturing PMI (Dec)

A first read on factory activity to start the new year, tracking order flows, output, and supply-chain conditions across U.S. manufacturers.

editor-tippinsights@technometrica.com