In his Congressional testimonies this week, Federal Reserve Chairman Jerome Powell made headlines when he warned that the Fed was not yet done with raising interest rates. He also suggested that the pace of those rate increases may have to accelerate, although he didn't reveal what the Fed would do.

These two remarks had an immediate impact on financial markets. The dollar strengthened, anticipating higher yields on Treasuries. At the same time, stock market indices weakened, expecting that the Fed was practically engineering a recession to cool the hot employment market and the ever-rising inflation. One casualty was Silicon Valley Bank, a financial institution that counts tech companies, startups, and venture capitalists as its primary customers. The FDIC placed the bank into receivership as depositors made a run on their accounts.

But Powell's comments also took the oxygen out of other things that he said, statements that will have a far more significant impact on America. The government's addiction to deficit spending is increasingly costing taxpayers more, as the interest paid out on federal borrowing is becoming prohibitively expensive. The increase in interest expenses is not adding services to those Americans who need them the most; instead, it is a wealth transfer mechanism to buyers of Treasury bonds worldwide who become richer because of higher yields.

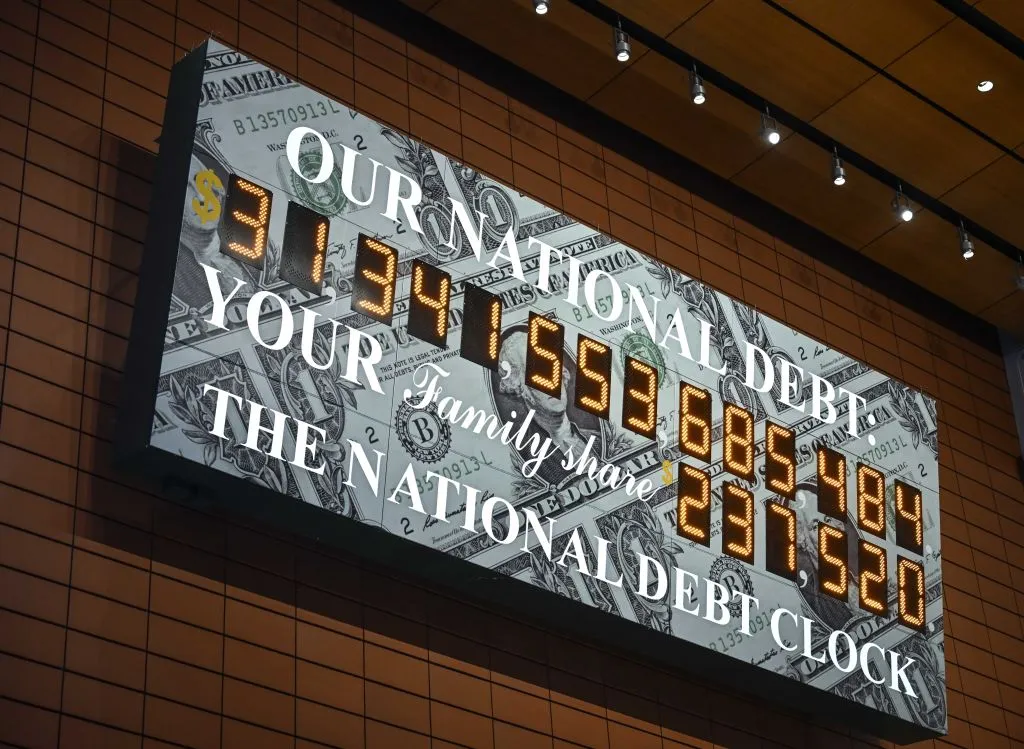

America now resembles a family accustomed to spending more than it earns, covering the difference by charging various credit cards, always leaving a balance on each card. As credit card interest rates increase, the family realizes that the balances are getting larger each month while getting little in return for the additional burden. Americans' total credit card debt is about $1 trillion; the government's debt is 31 times higher. According to the debt clock in the picture, each household is responsible for $237,520 of the national debt.

A year ago, the Biden administration was too busy complaining about the Georgia voter law and promoting additional deficit spending even to acknowledge inflation. Chairman Powell was not sure if he would be renominated. But the Federal Reserve Open Market Committee, recognizing that prices of everyday goods were rising with Russia invading Ukraine, decided to increase the Fed Funds rate for the first time in years in March 2022. It was a modest increase of only 25 basis points, bringing the target rate to 0.25% - 0.50%. The increase meant the federal government suddenly had to pay a small interest to service its enormous debt. It was paying practically nothing until then.

On May 5, 2022, the Fed announced a 50 basis points increase in its Funds Rate to bring it into a target range of 0.75% to 1.00%. The Fed also began tightening its balance sheet, stopping its quantitative easing policy altogether, and asking borrowers to return cash to the Fed when their securities matured. All actions were a rude assertion that the money supply was too loose and inflation was getting out of hand.

In this context, the Congressional Budget Office (C.B.O.) projected, in May 2022, its ten-year federal deficit numbers. For the ten-year period of 2023-2032, the C.B.O. estimated that the budget deficit would be a whopping $15.7 trillion, an average of nearly $1.57 trillion yearly in deficit spending to meet Biden's outrageous policy priorities.

The FOMC met four times in the next six months - in June, July, September, and November. Each time, the Fed announced a 75 basis point increase, unprecedented in modern times. On November 3, the Fed Funds target rate reached 4%. This meant that the Fed had substantially increased the cost of borrowing for the federal government to service its ever-increasing debt. In December and February, the Fed again increased rates, which stand at 4.75%, making the cost of debt servicing even dearer.

This week, the C.B.O. briefed the House about its latest deficit projections after considering the higher interest rates. The numbers are staggering. For the same period, 2023-2032, the ten-year deficit projections have now increased by an incredible $3.1 trillion to $18.8 trillion - in just nine months. Nearly 68% of this increase, about $2.1 trillion, can be traced to only one factor: the higher interest rate with which the government has to service its debt.

Bad as this news is for America, things are about to worsen. Powell indicated that the FOMC would likely continue increasing rates for the foreseeable future, making federal borrowing even more expensive than it is today: "It isn't that the (federal) debt today is unsustainable. It's that the path is unsustainable."

America must do something about this addiction and fast. President Biden's budget proposal sent to Congress on Thursday is unserious and reckless. Even the New York Times concedes that the budget cannot pass the Republican House. His $6.8 trillion plan proposes more of the same: increased social spending and higher taxes. This kind of thinking has brought America to our current mess.

The G.O.P. has a rare opportunity to tie the debt ceiling debate to extract significant budgetary concessions and change how Washington thinks. Everything should be on the table, including the ever-growing financial assistance to Ukraine, which today stands at $115 billion, with a projected $750 billion in Ukraine reconstruction costs, should the war stop immediately. This is on the heels of the Iraq war, which cost the U.S. over $1 trillion. America can no longer afford to fight someone else's war.

The government's excessive spending is responsible for 6.5% inflation. A recent TIPP Poll showed that nearly two-thirds of Americans think excessive spending undermines national security amid China's threat.

America can't sustain the current trajectory and must show fiscal austerity now to secure future generations.