- Bidenflation at 18.0% erodes Americans’ purchasing power

- Annualized Bidenflation steady at 5.9%, nearly double the CPI

- Core prices are stubborn at 3.8%

- RELATED: Blame Washington, Not Grocery Stores, for Food Price Hikes

- RELATED: Government Gets Fatter As Americans Rack Up Record Credit Card Debt

Inflation is essentially the result of excessive Federal Reserve money printing and government spending, thereby expanding the money supply, which leads to prices rising and effectively acts as a hidden tax on everyone.

The dark reality of Bidenomics is 18.0% inflation under the President’s watch, which is 5.9% on an annual basis. When he took office, inflation was at just 1.4%. Since March 2021, it has stayed above the Federal Reserve's 2% target for 36 consecutive months.

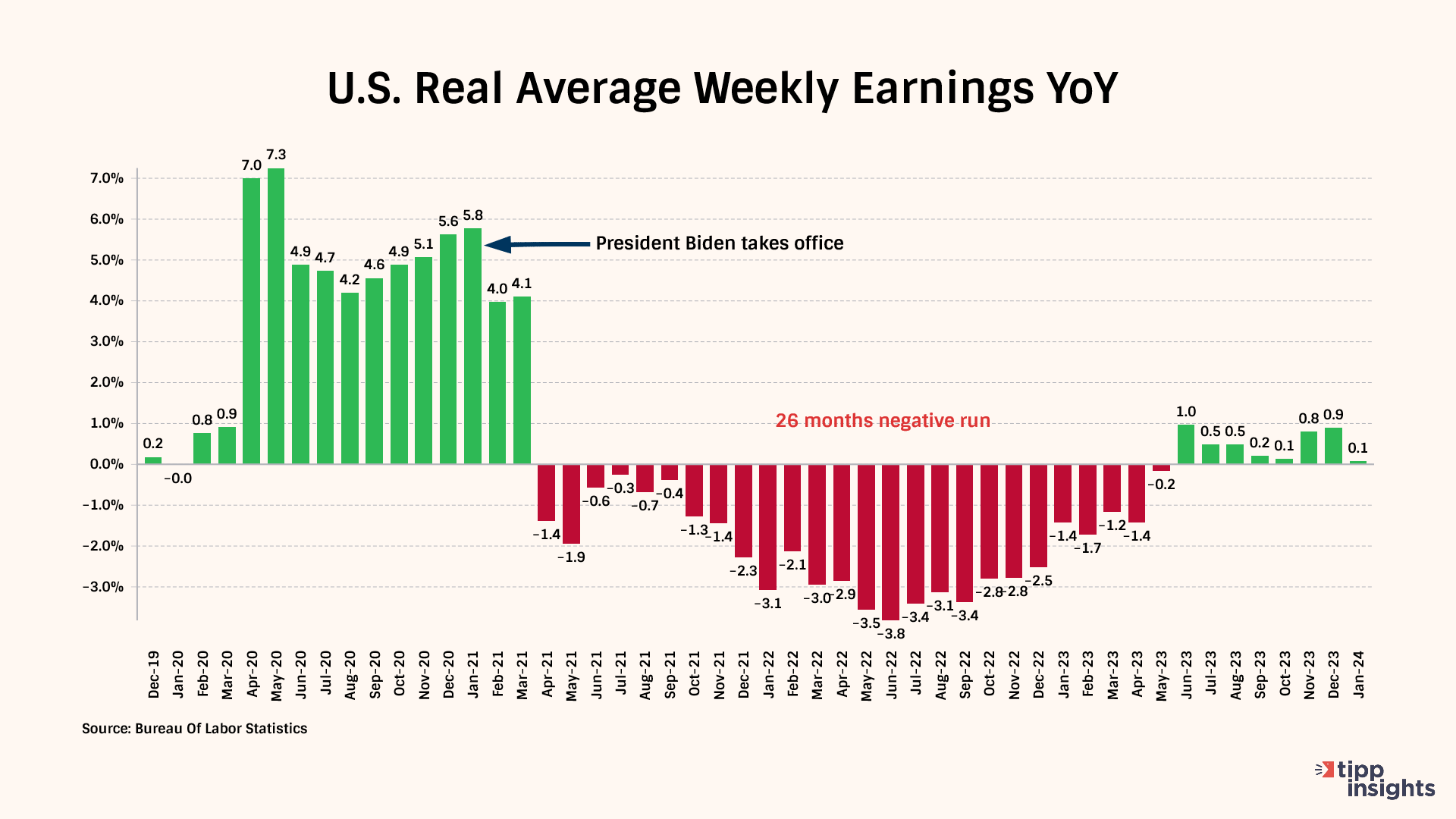

Average hourly earnings for all employees dropped 2.5% to $11.11 in February 2024 from $11.39 in January 2021 when Biden assumed office.

Further, amid ongoing layoffs and employers cutting costs, salaries are under pressure. For example, a 2023 ZipRecruiter report on pay trends showed that 48% of 2,000 U.S. companies surveyed lowered pay for certain roles. According to Indeed data, U.S. wage growth for advertised roles climbed to 9.3% year-over-year in early 2022, but it has since fallen to 3.6% in January 2024 due to reduced demand.

In short, prices have increased by 18.0%, while real wages have declined by 2.5%. To put it differently, people now need 20.5% more income than they had in January 2021 to maintain their living standards. According to some estimates, Americans need an extra $11,400 yearly to make ends meet.

How do Americans make up the shortfall?

Tap into retirement savings. The Wall Street Journal reported this week that many Americans are withdrawing from their retirement savings, with the share of people who withdrew from their 401(k) for financial emergencies climbing to a record high in 2023.

Take up a second job or return to work from retirement. The Labor Department reported that 8.13 million Americans had multiple jobs in January, up from 7.87 million a year earlier. Their share of the U.S. workforce is 5.1%, up from 5% a year before. One in eight retirees is considering returning to work in 2024, mainly due to the impact of high prices and dwindling savings.

Use credit cards. Credit card debt has climbed 40% over the past two years and is near $1.1. trillion. For example, Discover’s credit card customers are carrying $102 billion in balances on their credit cards, up 13% from last year. The charge-off rates and 30-day delinquency rates have also climbed.

Due to entrenched inflation without corresponding real wage growth, most Americans (60%) live paycheck to paycheck. A quarter (24%) have nothing set aside for financial emergencies.

Bidenflation and the Fed's eleven rate hikes to reduce inflation have made housing unaffordable for many people and caused displacements. According to CBRE data, the average monthly payments on a new home soared to $3,322 in the third quarter of 2023. This marks a sharp 90% increase from late 2020 when it stood at just $1,746 before Biden took office. Rising rent and the end of pandemic-era protections are contributing to the homelessness crisis.

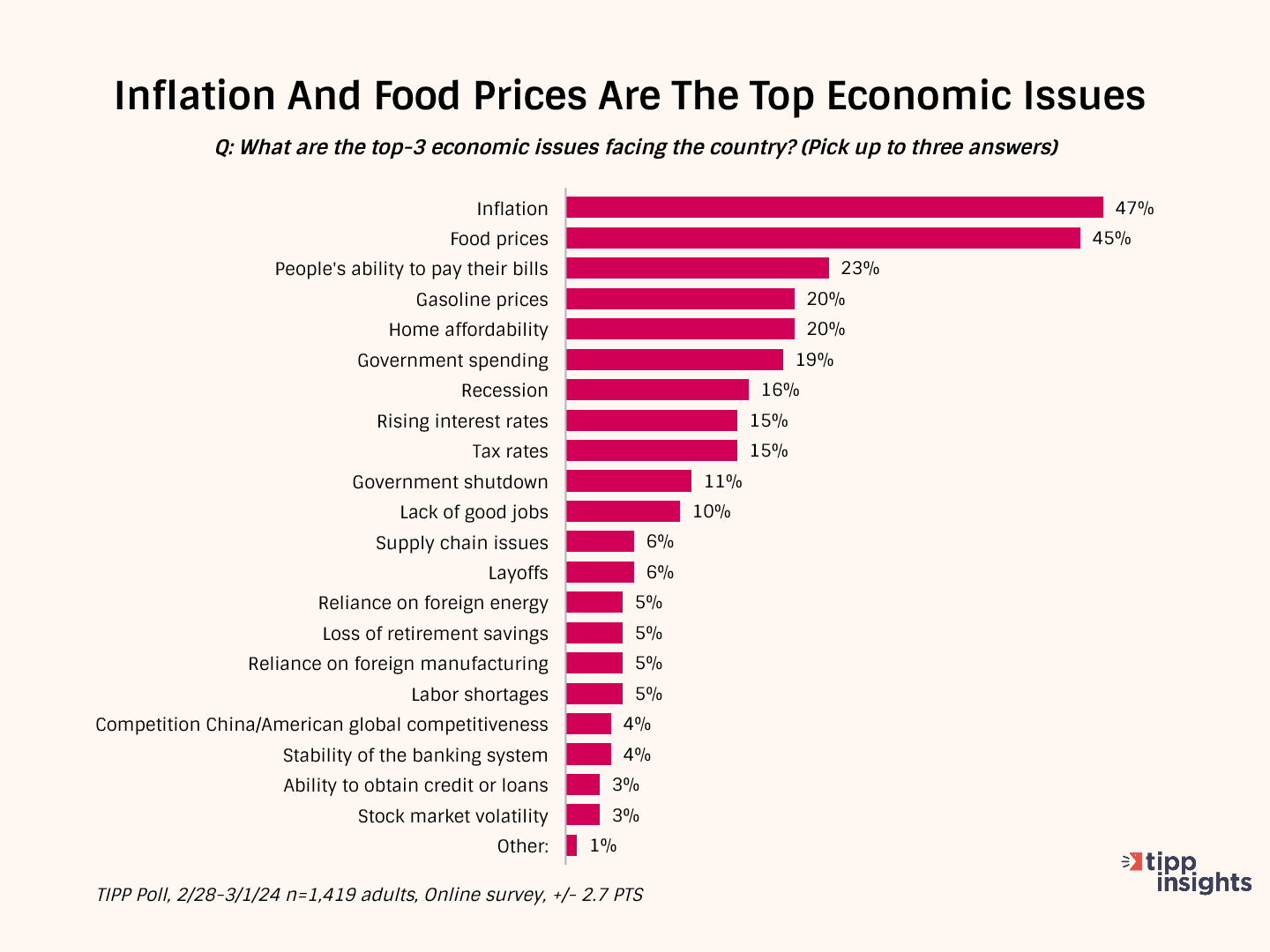

Therefore, it is no surprise that inflation and food prices emerged as top economic issues among Americans in a recent nationwide TIPP Poll.

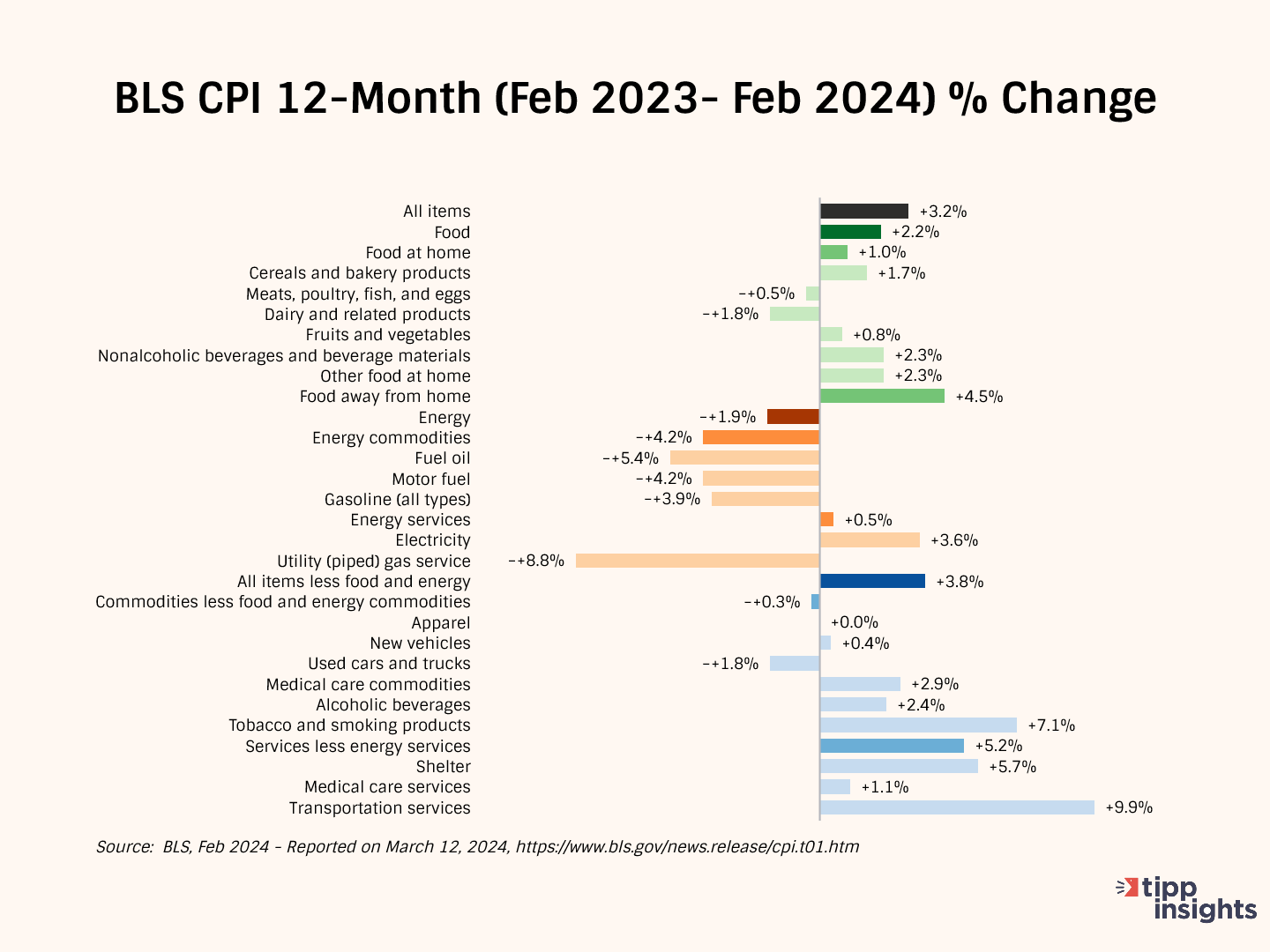

CPI Report

The government's Consumer Price Index (CPI), released on Tuesday, showed a 3.2% year-over-year price increase from February 2023 to February 2024.

The CPI rate had declined steadily for 12 consecutive months from a 40-year high of 9.1% in June 2022 to 3.0% in June 2023. In July, it broke that run and increased to 3.2%. Since then, it has moved sideways in the 3.1% to 3.7% range.

After adjusting for seasonality, the CPI increased by 0.4% between January 2024 and February 2024. In the same period, Food prices held steady, Energy prices rose by 2.3%, and All items except food and energy (Core) increased by 0.4%.

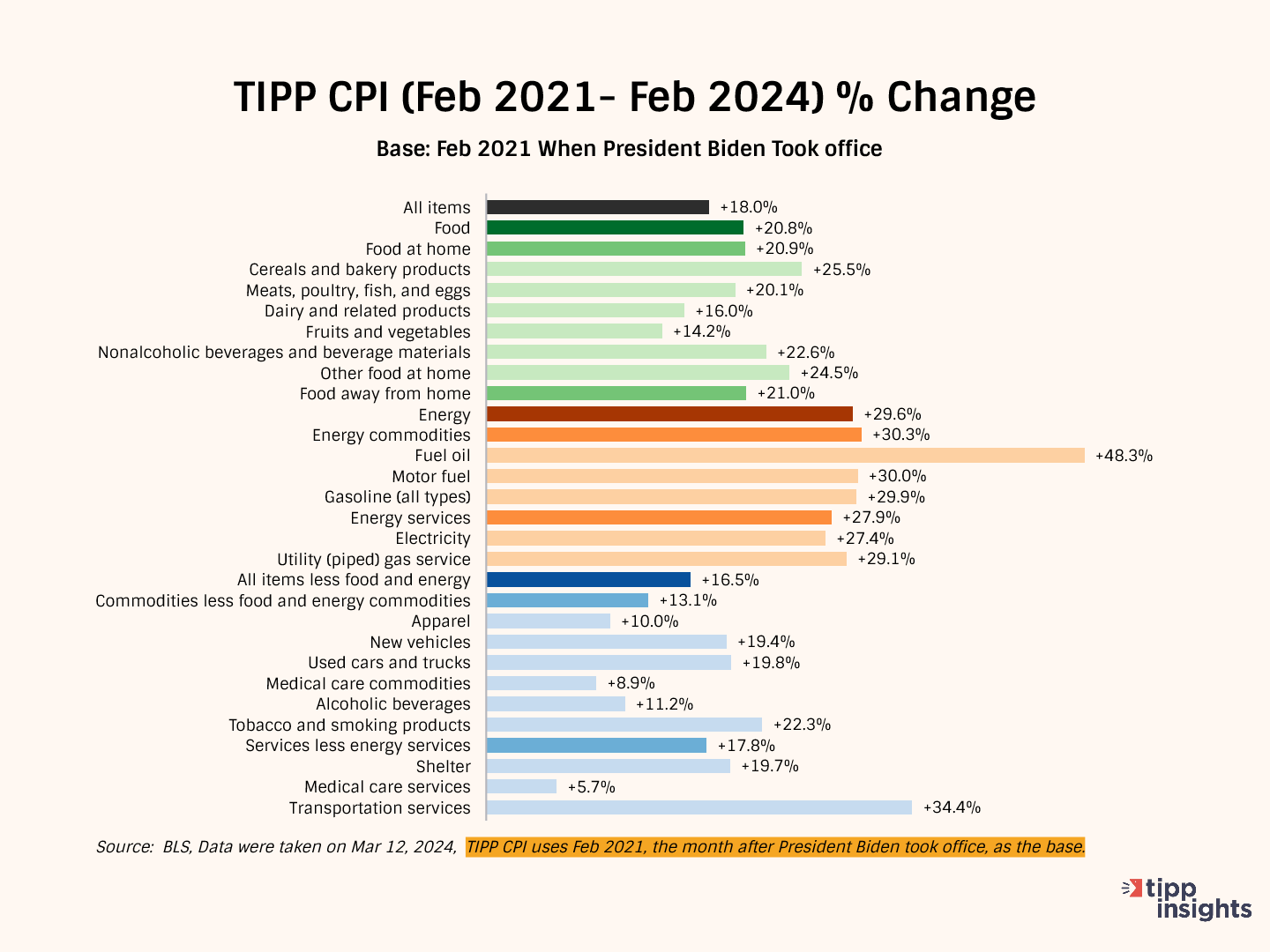

TIPP CPI

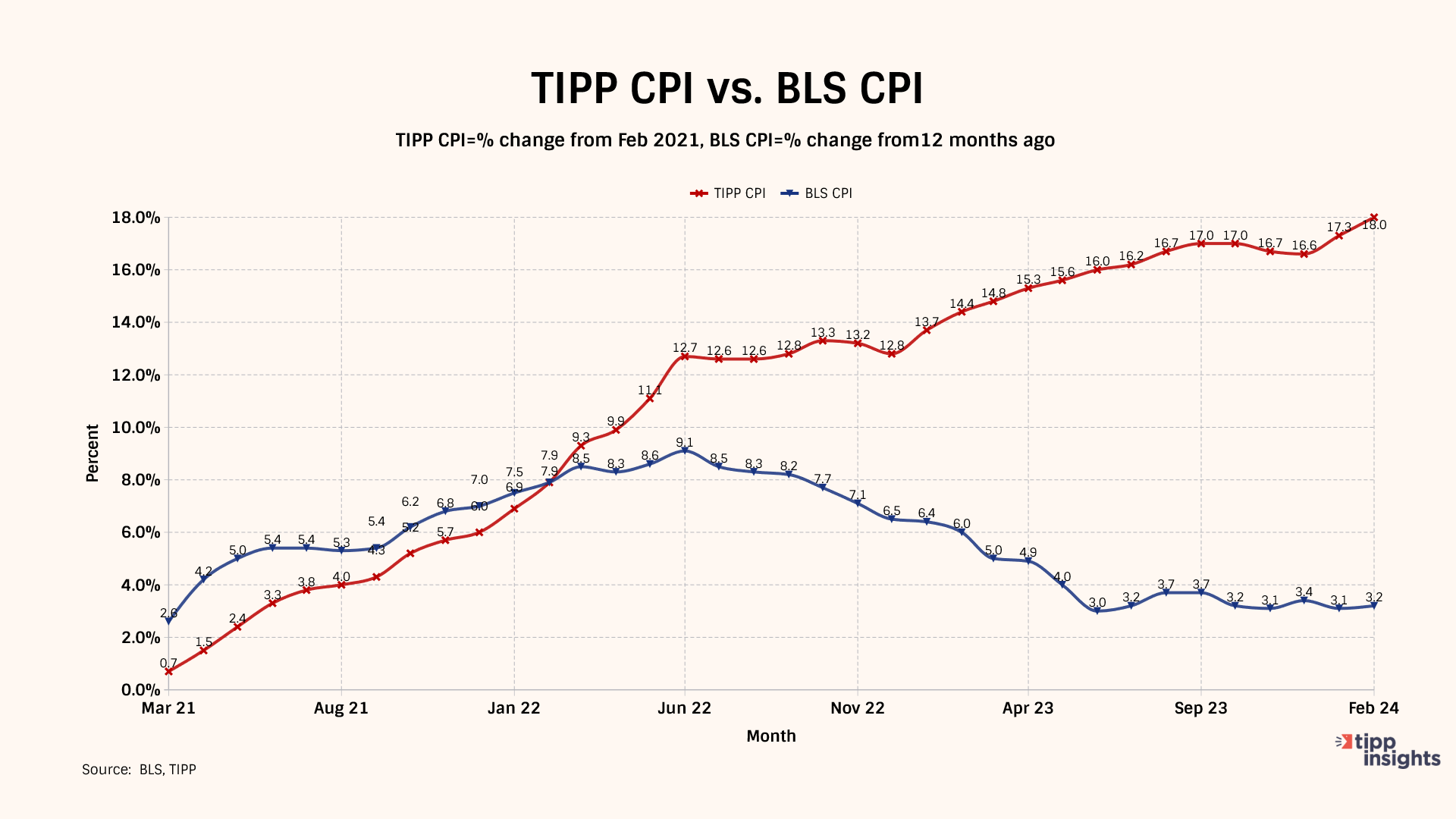

We developed the TIPP CPI, a metric that uses February 2021, the month after President Biden's inauguration, as its base to measure the rate of change. All TIPP CPI measures are anchored to the base month of February 2021, making it exclusive to the economy under President Biden's watch.

What is the motivation behind the TIPP CPI?

The BLS CPI rate doesn't accurately capture Americans’ inflation struggles. The official BLS CPI year-over-year increases will compare prices to already inflated bases in the coming months, and these statistics could mask the full impact. Further, the media and some economists frequently use the low CPI rate to present a rosy economic outlook supporting Biden’s policies.

In contrast, the TIPP CPI rate offers a clearer understanding of Americans’ economic challenges under President Biden. We use the relevant data from the Bureau of Labor Statistics (BLS) to calculate the TIPP CPI, but we adjust the period to Biden's tenure. When discussing the TIPP CPI and the BLS CPI, we convert the index numbers into percentage changes to better understand and compare them. CPIs are like index numbers that show how prices affect people's lives, similar to how the Dow Jones Industrial Average reflects the stock market.

Bidenflation, measured by the TIPP CPI using the same underlying data, increased to 18.0% in February. It was 17.3% in January, 16.6% in December, and 16.7% in November.

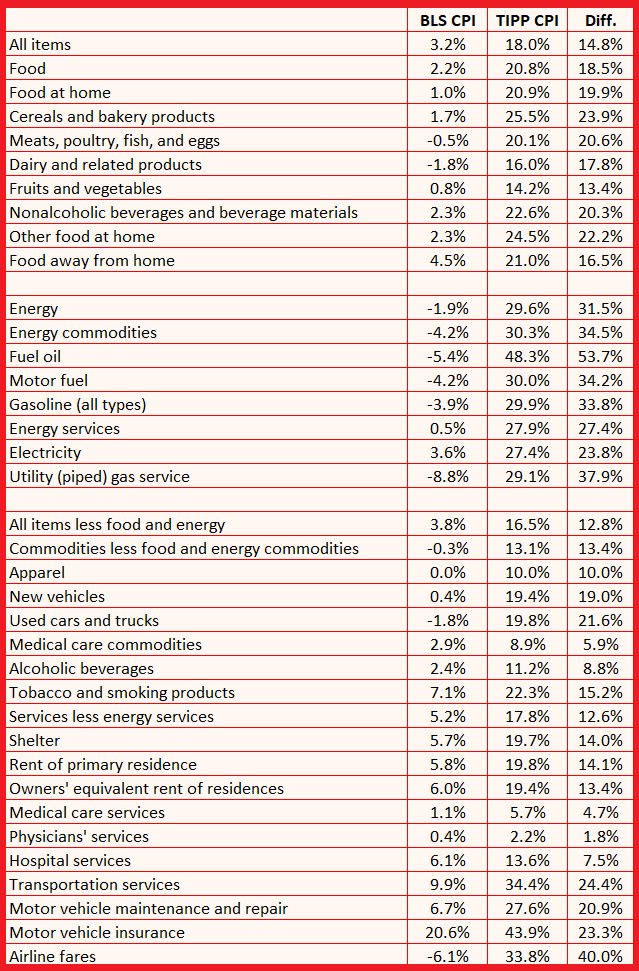

TIPP CPI vs. BLS CPI

The following four charts present details about the new metric.

For February 2024, the BLS reported a 3.2% annual CPI increase. Compare this to the TIPP CPI of 18.0%, a 14.8-point difference. Prices have increased by 18.0% since President Biden took office. On an annual basis, TIPP CPI is 5.9%.

Food prices increased by 20.6% under Biden compared to only 2.2% as per BLS CPI, a difference of 18.5 points.

TIPP CPI data show that Energy prices increased by 29.6%. But, according to the BLS CPI, energy prices improved by 1.9%. The difference between the two is a whopping 31.5 points.

The Core CPI measures the price increase for all items, excluding food and energy. In the year-over-year measure, the Core TIPP CPI is 16.5% compared to 3.8% BLS CPI, a 12.8-point difference.

Further, gasoline prices have increased by 29.9% since President Biden took office, whereas the BLS CPI shows that gasoline prices have improved by 3.9%, a difference of 33.8 points.

Shelter costs rose by 19.7% under Biden’s watch, compared to the BLS reading of 5.7%, a difference of 14.0 points.

TIPP CPI finds that Used car prices have risen by 19.8% during this President’s term. Meanwhile, the BLS CPI reports that the prices have dropped 1.8%, a difference of 21.6 points.

Inflation for air tickets is at 33.8% compared to the BLS CPI’s finding of an improvement of 6.1%, a difference of 40.0 points.

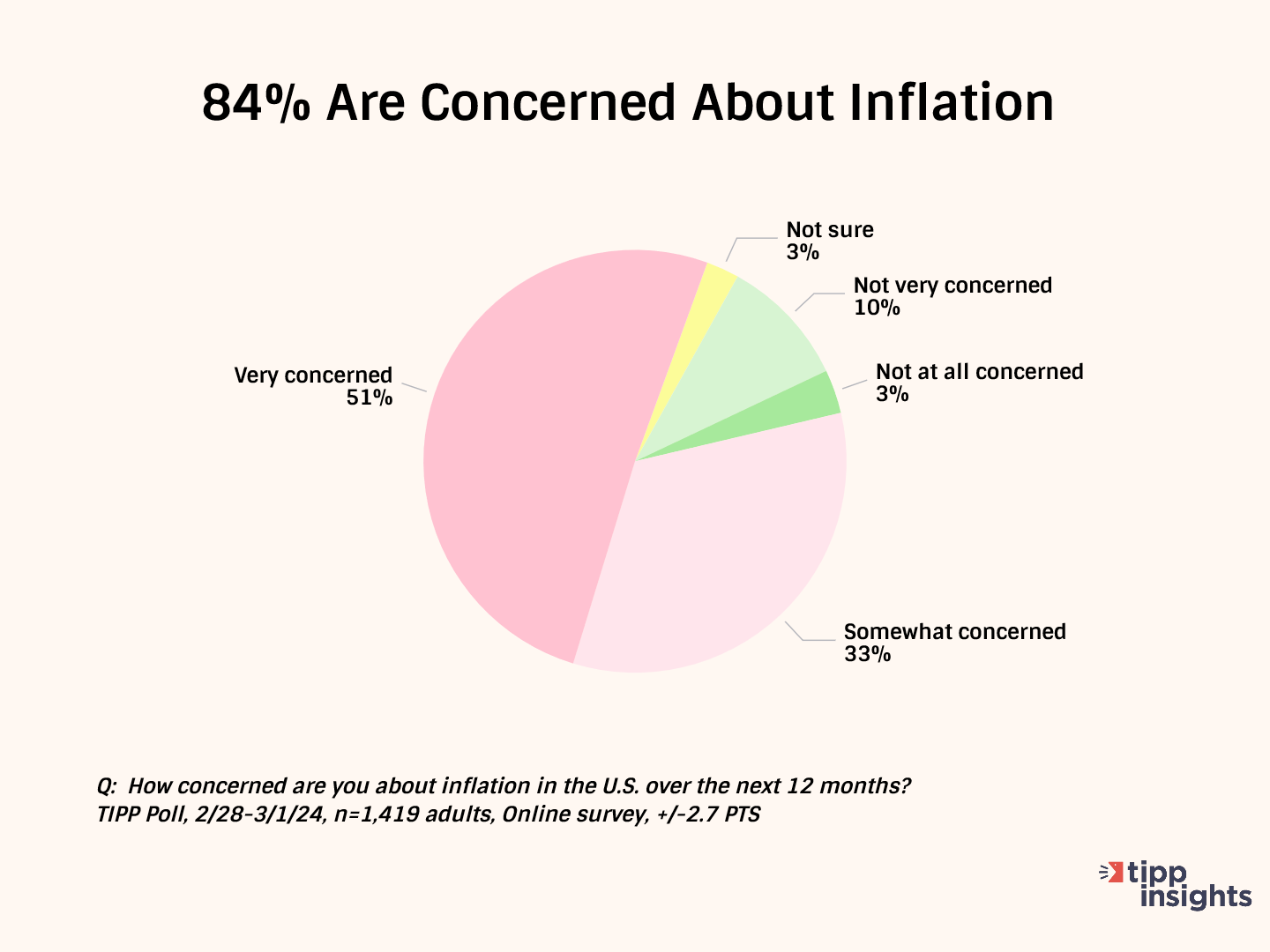

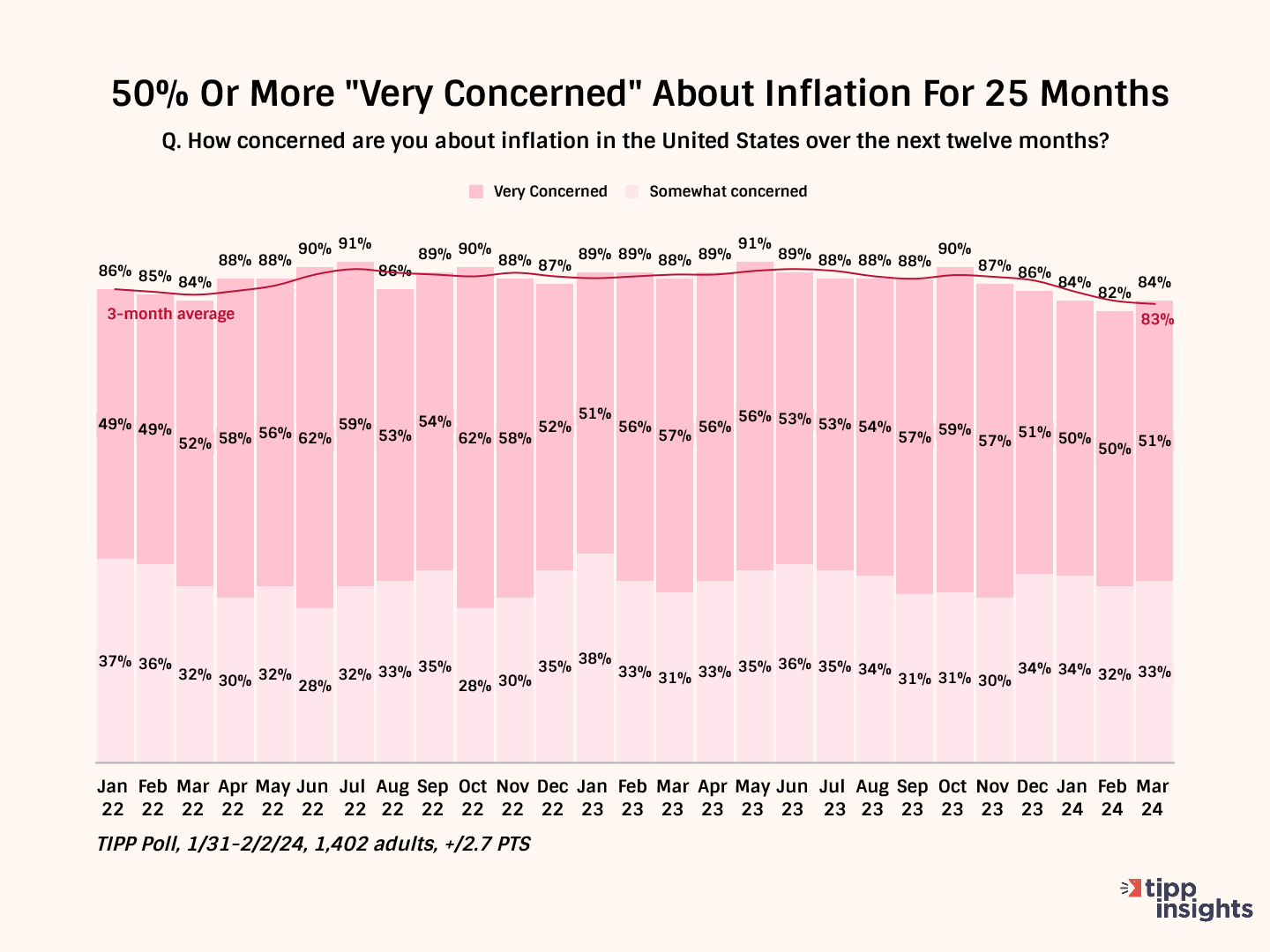

The latest TIPP Poll, completed earlier this month, shows over eight in ten (84%) survey respondents are concerned about inflation. Since January 2022, inflation concerns have stayed above 80%. The "very concerned" share has been at least 50% for twenty-four months.

Why do we track this measure?

It shows that despite the decline in the CPI rate, Americans still feel the pinch of high prices without wage increases. It also fact-checks President Biden’s claims that Bidenomics is working.

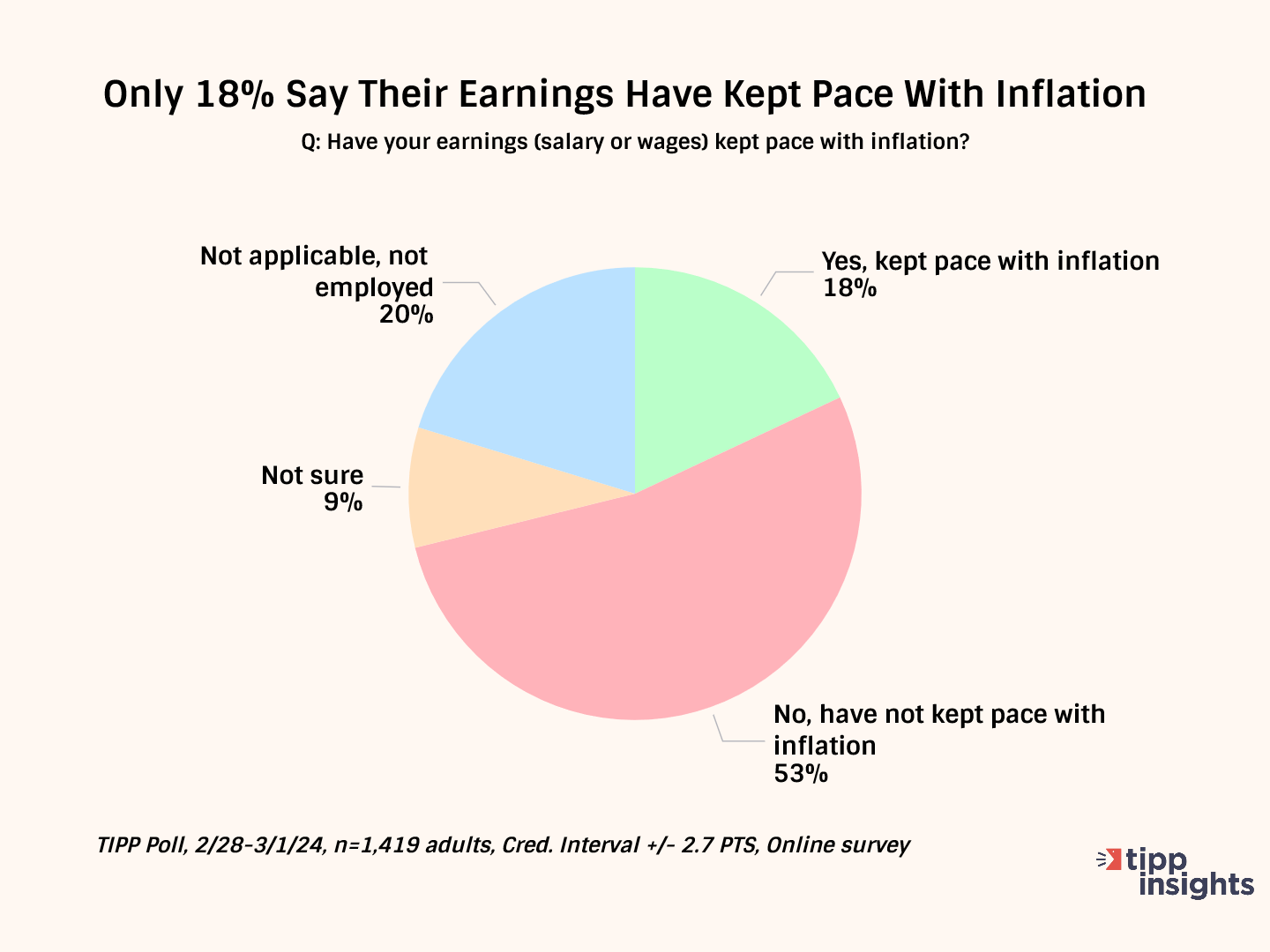

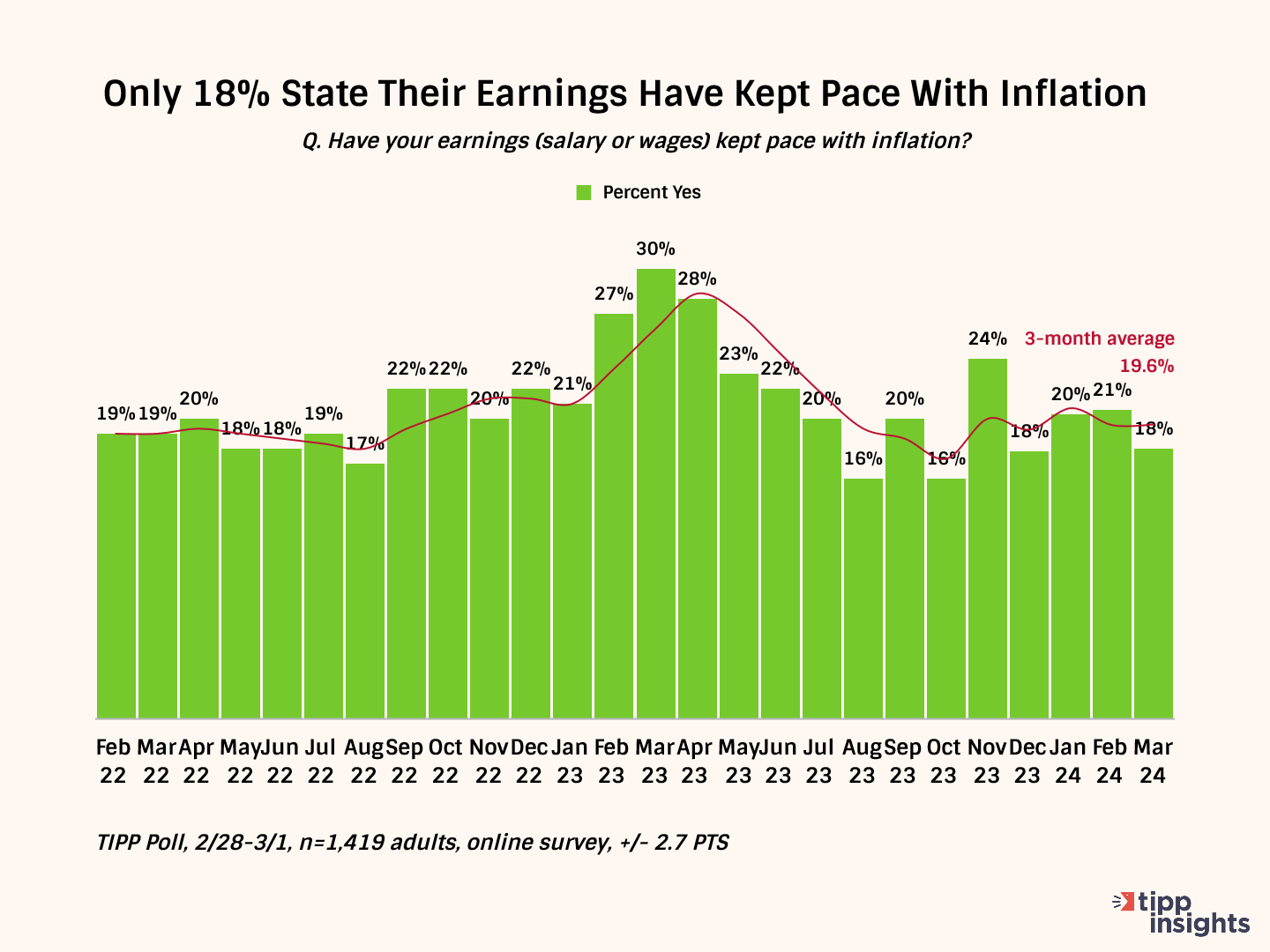

Over half (53%) say their wages have not kept up with inflation. Only one in five (18%) say their income has kept pace with inflation.

This statistic hovered in the low twenties for most of 2022. The positive change between January 2023 and March 2023 has petered out since May 2023. Notice the steady descent from March last year. It dropped to 18% in March 2024, with a three-month average of 19.6%.

Nominal wages represent the amount of money one earns without considering changes in the cost of living. On the other hand, real wages consider inflation and measure the purchasing power of wages. Real wages provide a more accurate reflection of what is affordable with the income earned by factoring in the changes in the cost of living.

Real weekly wages, measured year-over-year, showed negative readings for 26 out of the 37 months during the Biden presidency from February 2021 to January 2024. The 26-month negative streak was broken in June. The measure posted positive readings for eight months between July 2023 and January 2024.

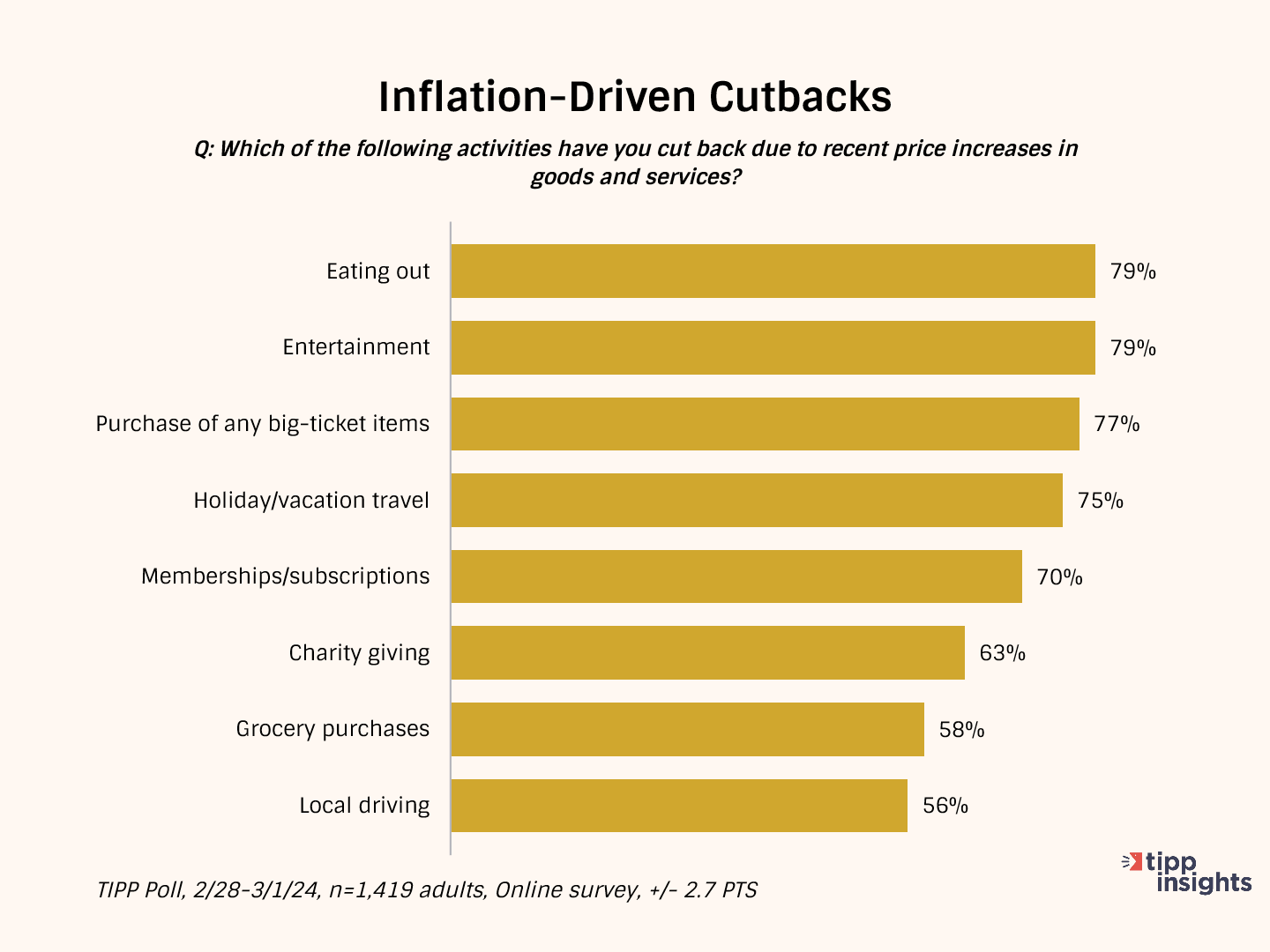

As a result of inflation, Americans are cutting back on household spending.

They are cutting back on eating out (79%), entertainment (79%), purchasing big-ticket items (77%), holiday/vacation travel (75%), and memberships/subscriptions (70%).

Nearly two-thirds (63%) are cutting back on charity giving. Over one-half (58%) of households spend less on groceries. The high gasoline prices forced 56% to cut back on local driving.

Inflation Direction

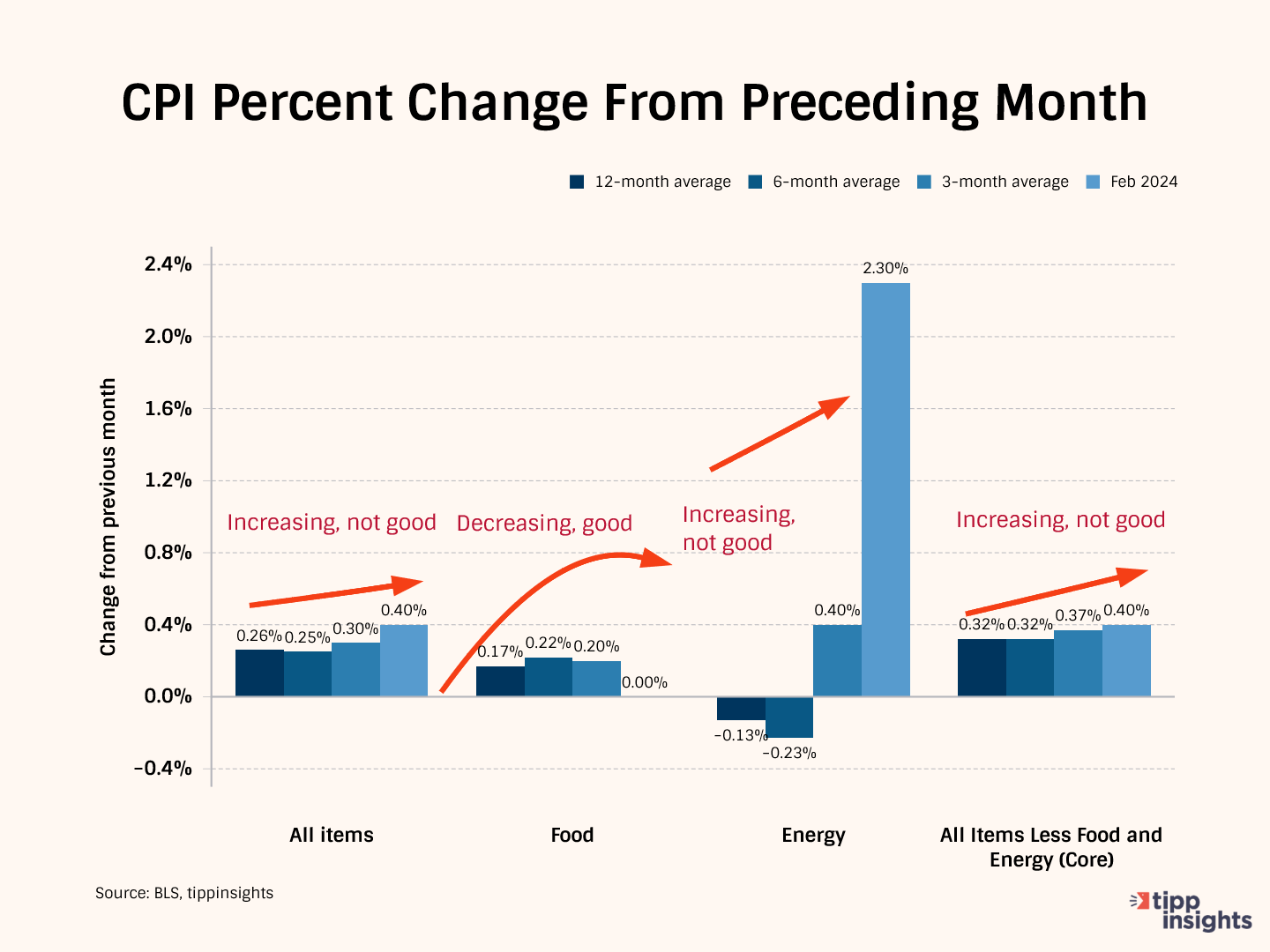

The chart below compares the 12-month average of monthly changes against the 6-month and the 3-month averages. We also show the reading for February 2024.

The 12-month average considers 12 data points and presents a long-term reference, while the six-month and three-month averages consider recent data points.

Typically, we compare the data from February 2024 to the three-month average to gain a clearer perspective. In February 2024, the price increase for All items was 0.40%, bigger than the three-month average of 0.30%. This shows a significant deterioration in February.

Meanwhile, the three-month average of 0.30% is larger than the six-month average of 0.25%, indicating a recent acceleration in the rate of increase over the last three months.

This pattern suggests that price increases sharply accelerated in February, a cause for concern.

In January, Food prices held steady and did not change (0%), which is smaller than the 3-month average of 0.20% and the 6-month average of 0.22%. The slowdown suggests food prices are not increasing, which is welcome news.

Meanwhile, Energy prices increased by 2.30%, much bigger than the three-month average of -0.40%, indicating acceleration. Further, the three-month average increased compared to the 12-month average of -0.13% and the six-month average of -0.23%. In summary, the energy situation is deteriorating.

All items less food and energy, known as "core inflation," was 0.40%, higher than the three-month average of 0.37%, indicating deterioration for the month. Meanwhile, the three-month average of 0.37% was greater than the six-month average of 0.32%. The recent sharp increase in February is worrisome.

In summary, apart from food, we witnessed a deterioration in the prices of energy, core items, and all items in February. Typically, there is a lag between the increase in energy and food prices. Consequently, we anticipate a rise in food prices in the coming months due to the spike in energy prices.

Monetary Policy

Since March 2022, the Fed has raised interest 11 consecutive times, bringing its benchmark interest rate to 5.25%, the highest level in 22 years.

With the core CPI entrenched at 3.8% and geopolitical tensions that could lead to volatility in the energy markets, we are unsure of what lies ahead. We believe it won't be easy to bring CPI inflation down to the Fed's target of 2.0%, and more rate hikes may be needed. Further, the Fed has to strike a delicate balance between election-year pressures and achieving its goals.

The national debt was $34.7 trillion at the end of February. For the current fiscal year, which began in October 2023, the U.S. is expected to pay over $1 trillion in interest costs, more than the U.S. defense budget.

One downside of ballooning federal debt is that refinancing becomes challenging. Supply and demand in the bond market will drive interest rates. If there is a high supply of government bonds (due to high debt levels), interest rates may need to stay high to attract investors and ensure that the government can continue borrowing money.

Most Americans are concerned about the sustainability of this trajectory. The high interest rates are also hurting Americans and sapping their confidence.

To access the TIPP CPI readings each month, you can visit tippinsights.com. We'll publish the TIPP CPI and our analysis in the days following the Bureau of Labor Statistics (BLS) report. The upcoming release of TIPP CPI is on April 11, 2024. We'll also post a spreadsheet in our store for download.

Hey, want to dig deeper? Download data from our store for a small fee!

Want to understand better? We wrote an explainer on inflation that sixth graders could understand. Everyone can benefit from it. Milton Friedman's Priceless Lessons On Inflation.

We could use your help. Support our independent journalism with your paid subscription to keep our mission going.

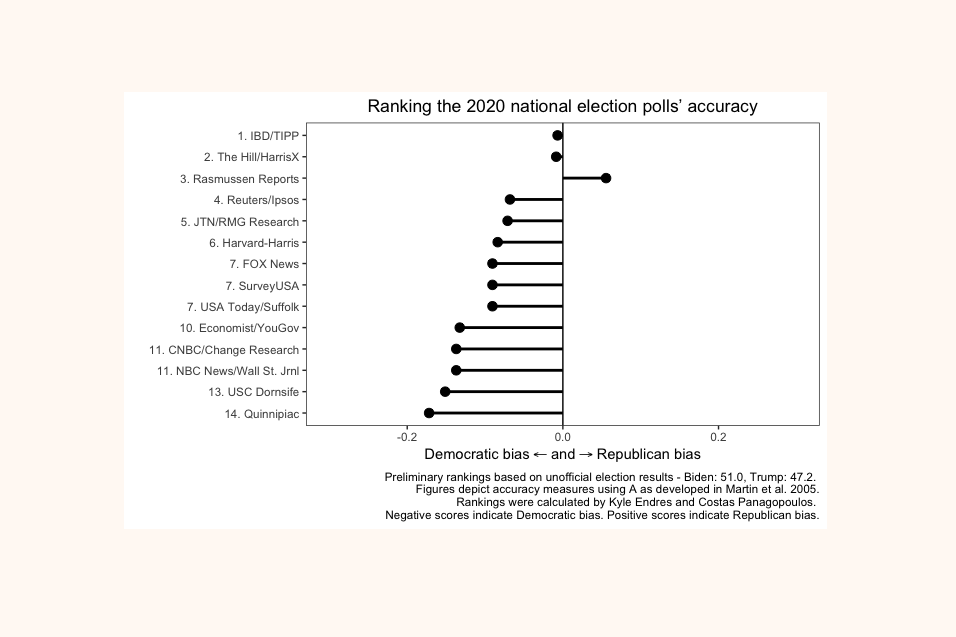

Our performance in 2020 for accuracy as rated by Washington Post: