- President Biden's plans to raise taxes and increase spending on social programs will exacerbate Americans' economic challenges

- The Federal Reserve's interest rate hikes affect government debt servicing, with annual interest payments exceeding $1 trillion

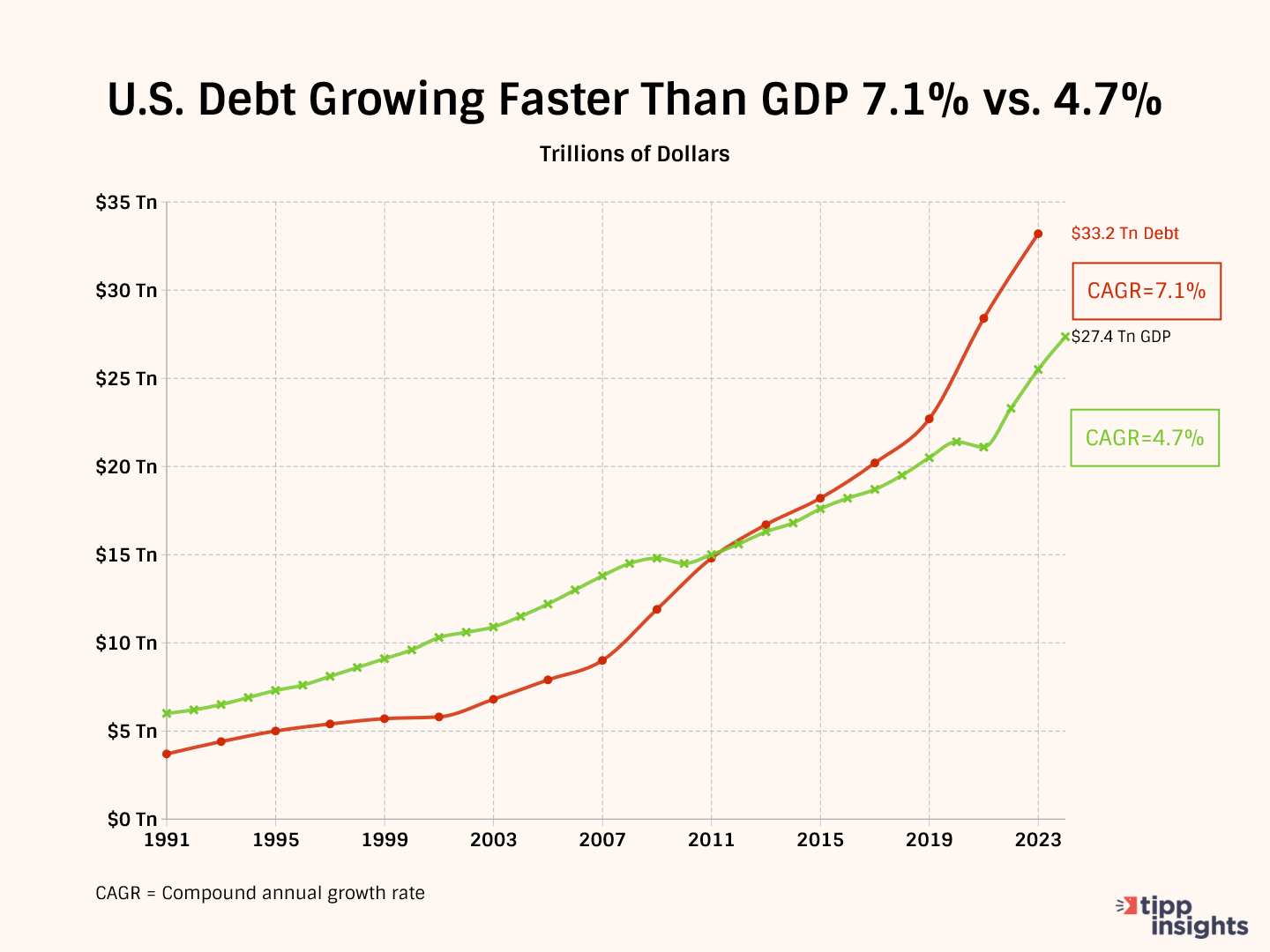

- Biden's unchecked spending leads to growing federal debt, prompting concerns about the sustainability of the current fiscal path

- Rising inflation and interest rates are squeezing household budgets, resulting in higher delinquencies and increased financial stress

- RELATED: The Misery Index Shows Bidenomics is Failing

- RELATED: Would-Be Homeowners Need 80% More Income to Buy Than 4 Years Ago, Study Finds

- RELATED: Bidenflation Hits 18.0%, Hurting Americans

- RELATED: Blame Washington, Not Grocery Stores, for Food Price Hikes

- RELATED: Government Gets Fatter As Americans Rack Up Record Credit Card Debt

As President Biden unveiled a budget that raises the tax rate on anyone making over $400,000 to 39.6% from the current 37% and corporate tax rates to 28% from 21%, while he continues to spend more for social programs (a national program of paid leave for workers, expanded child tax credit, and new tax credits for some home buyers), voters are reminded of how disastrous his economic stewardship has been.

The Left's only mantra is to tax more and spend more. At the State of the Union, Biden employed the clever word Democrats have been using for decades to avoid the dreaded "spend" word: Invest. He said:

A fair tax code is how we invest in things that make this country great: health care, education, defense, and so much more.

The President seems unfazed three years after he took office and pushed through trillions of dollars in spending. Running an administration that refused even to consider that inflation was rising - remember Janet Yellen's insistence that inflation was "transitory" - the stubborn Biden has learned nothing and is driving America to the precipice.

On May 5, 2022, the Federal Reserve announced the first of its many interest rate hikes - a dramatic 50 basis point increase in its Funds Rate to bring it into a target range of 0.75% to 1.00%. The Fed also began tightening its balance sheet, stopping its quantitative easing policy altogether, and asking borrowers to return cash to the Fed when their securities matured.

The Federal Open Market Committee (FOMC) met four times in the next six months - in June, July, September, and November. Each time, the Fed announced a 75 basis point increase, unprecedented in modern times. On November 3, the Fed Funds target rate reached 4%. It meant that the Fed had substantially increased the cost of borrowing for the federal government to service its ever-increasing debt. In December and February, the Fed again increased rates. Today, the Funds rate stands at 5.33%. And Chairman Powell has not ruled out additional hikes.

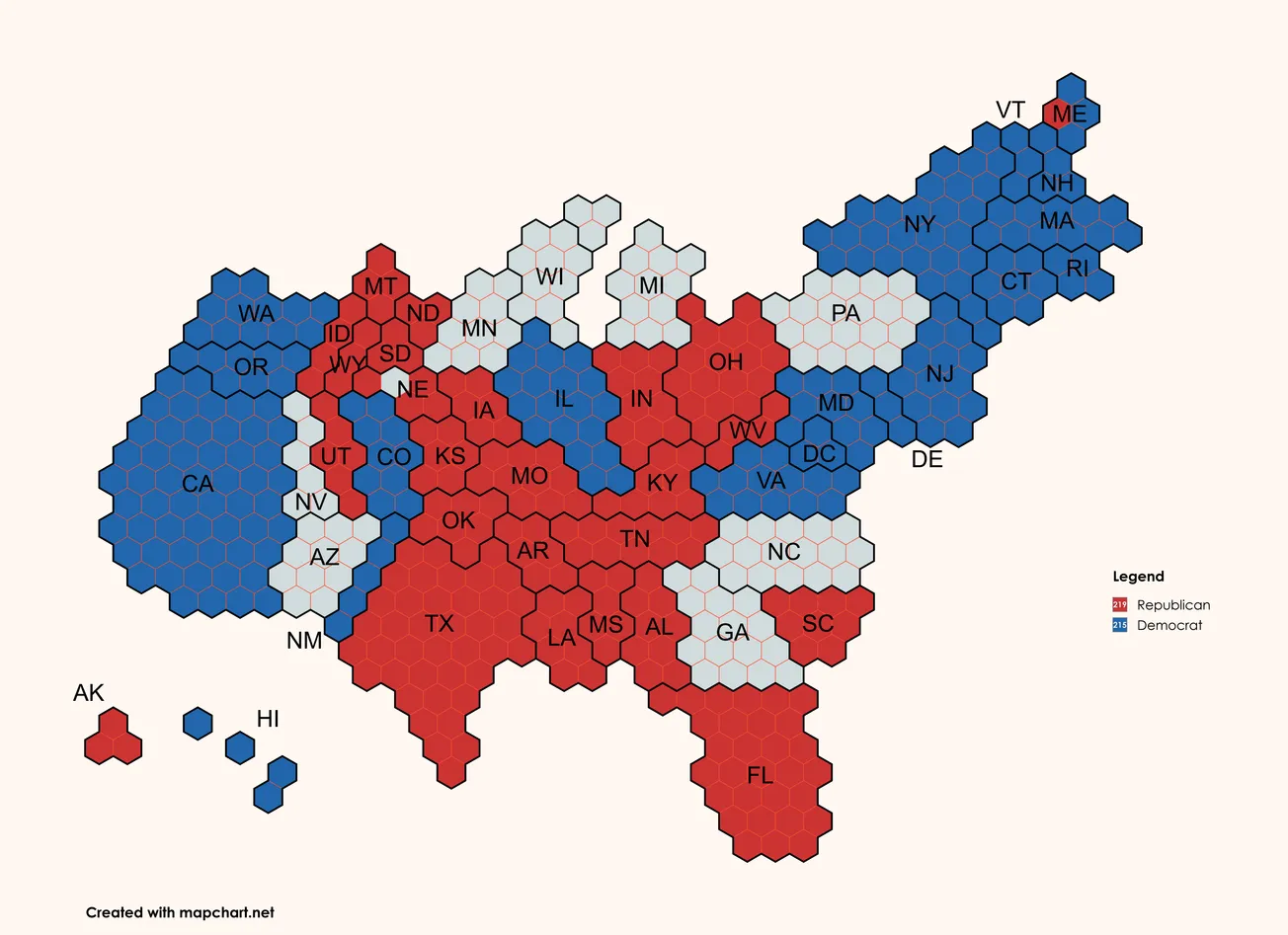

Meanwhile, federal debt has climbed to over $34.5 trillion, and all Biden can think about is promoting the same old tax and spending policies. Fed actions directly impact the federal government because it has to pay the same interest rates to service its debt as everyone else. Besides, as the Fed has steadily shrunk its balance sheet, selling off whatever Treasury securities it had bought up during quantitative easing, there's a glut of Treasury bonds in the market. Such an oversupply means that the United States Treasury has to bribe investors by promising more returns as the government attempts to fund its priorities.

The federal debt is so large that the government spends over $1 trillion a year just to service it. This is a budget line item greater than what America spends on defense. To satisfy deficit hawks, Biden claims that his budget will pay down $3 trillion in debt over the next ten years, which most respected economists say is too ambitious. Even if we were to take it at face value, the total debt would have climbed to over $54 trillion by then. So, is Biden ok with America having a 51 trillion dollar debt burden ten years from now? What would the debt servicing costs be, then?

Biden's reckless handling of the economy has placed Americans in deep financial distress. Bidenflation, our measure of how much prices have risen since he took office, is above 18%.

Experian says that "the average monthly payment for a new vehicle increased $25 year-over-year, reaching $726. The average interest rate for a new vehicle was 7.03% in Q3 2023, up from 5.26%. The average interest rate for a used vehicle was 11.35%, up from 9.38% last year." These loans were for a five-year term. The price of cars has increased so much that most Americans cannot finance their purchase in just five years. So, they extend the loan term to six or even seven years. Finance companies then increase the interest rate to nearly 9%.

"Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels," said Wilbert van der Klaauw, economic research advisor at the New York Fed. "This signals increased financial stress, especially among younger and lower-income households."

When so many Americans are feeling impoverished and with America inundated by over 8 million illegal aliens, it is extraordinarily irresponsible for Biden to continue to push for nearly $95 billion in aid to Ukraine, Israel, and Taiwan.

Let us fix our own house first before helping others with money that we do not have.