- Consumer confidence, as measured by the IBD/TIPP Index, dropped to 36.3 in October, the lowest since 2011

- The Six-Month Economic Outlook component reached an all-time low of 28.7, signaling a bleak outlook

- Low confidence stems from factors like high inflation (16.7% since Biden took office), stagnant wages, expensive gas, student loans, and concerns about government spending

- The Federal Reserve's actions to combat inflation and stock market volatility contribute to the gloomy outlook

- Worries persist about the Russia-Ukraine conflict and the possibility of an economic recession

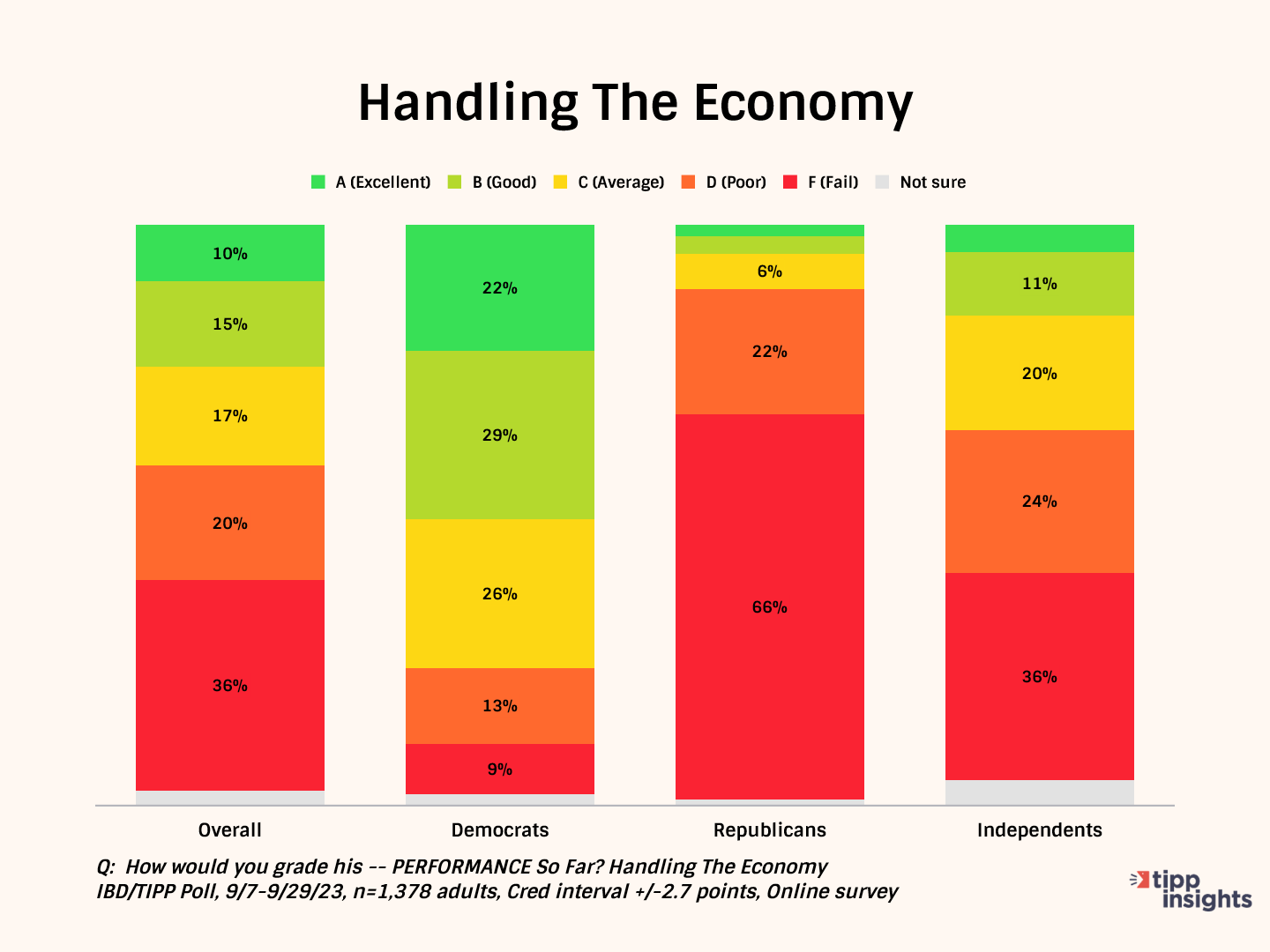

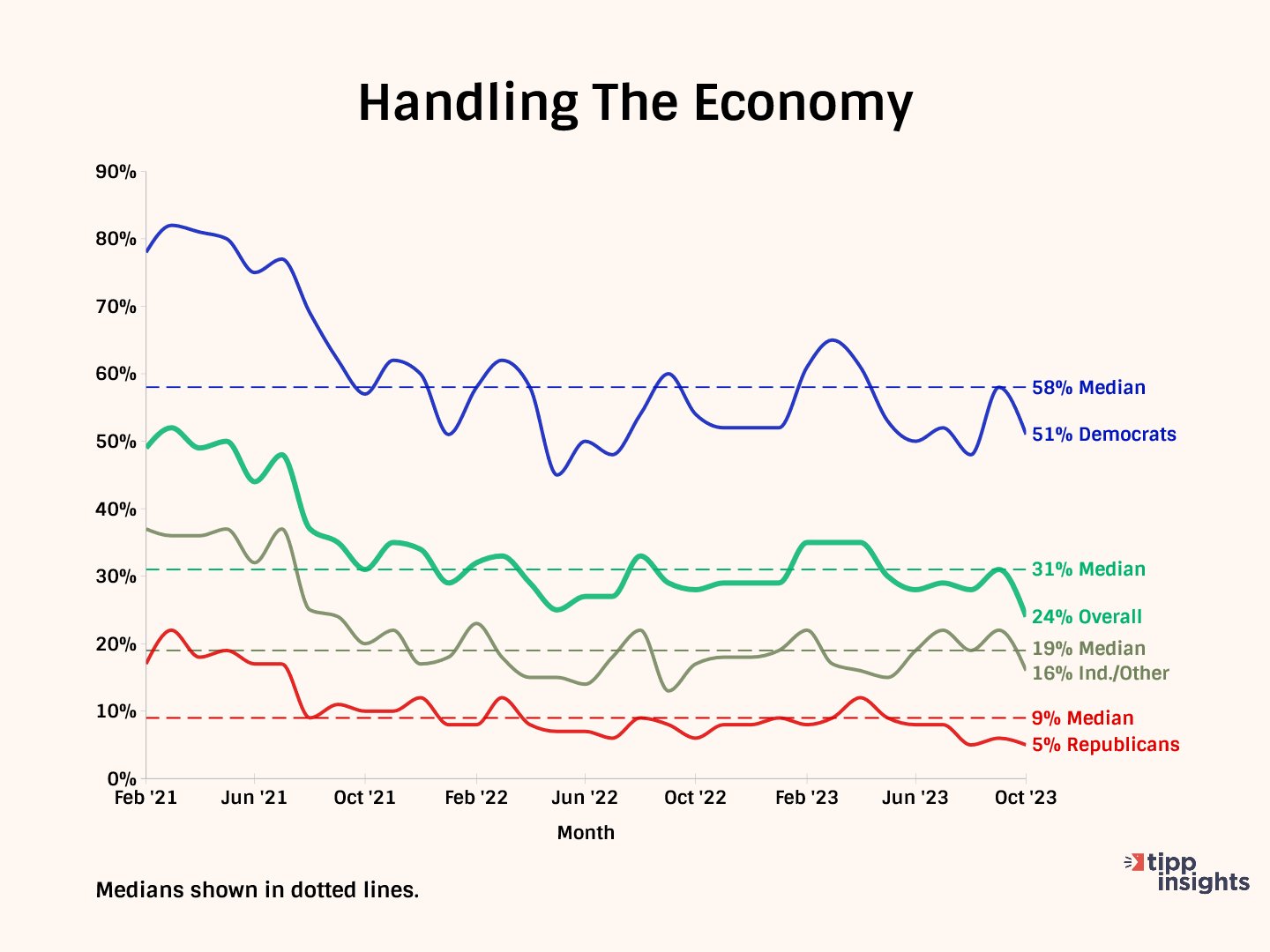

- Only 25% of Americans approve of President Biden's handling of the economy

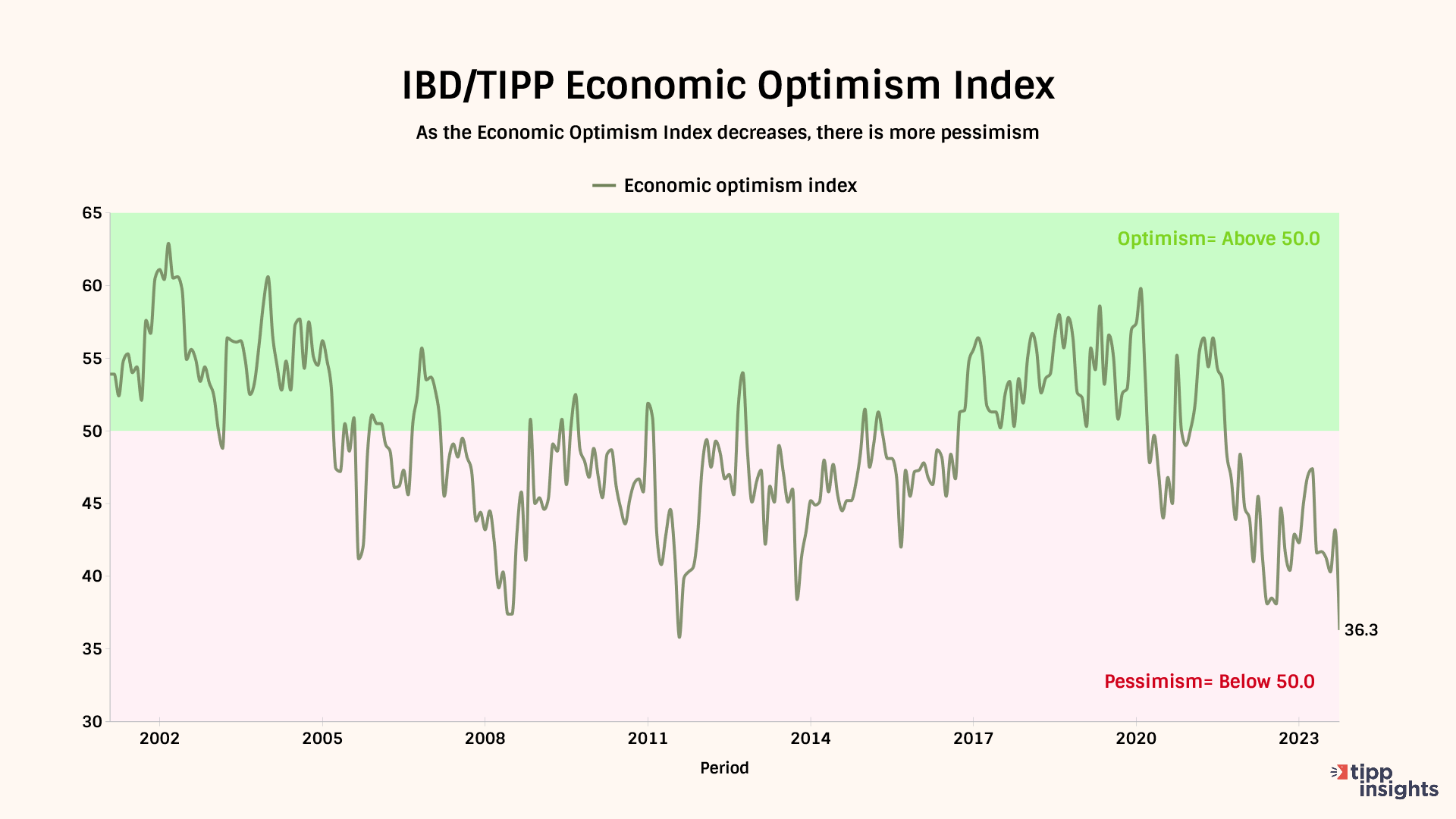

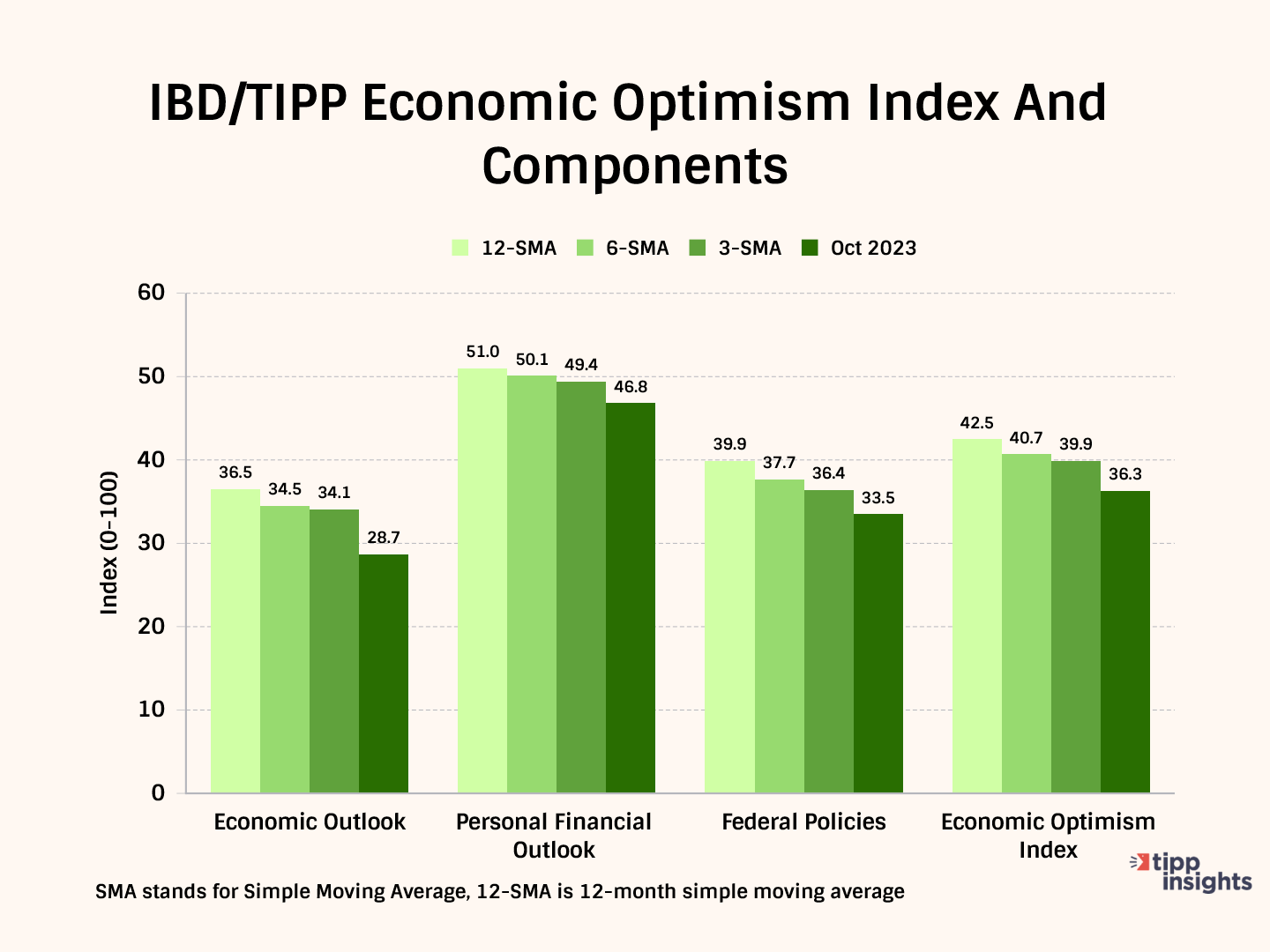

The IBD/TIPP Economic Optimism Index, a leading measure of consumer confidence, declined 6.9 points, or 16.0%, from 43.2 in September to 36.3 in October. This month’s reading undercut the previous low of 35.8 posted in August 2011.

In September of 2021, the eighth month after President Biden took office, the index fell below 50.0, defined as the pessimistic zone, and has remained there for 26 consecutive months.

Further, confidence this month is 39% below its pre-pandemic level of 59.8, recorded in February 2020.

Why is economic confidence a big deal?

Consumer spending accounts for two-thirds of the economy. Optimistic consumers spend money on automobiles, home improvements, new homes, and other large-ticket items.

The IBD/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It accurately predicts monthly changes in sentiment reflected in other well-known surveys by The Conference Board and the University of Michigan.

Multiple factors are behind the country’s dark mood, reflected in our index and its components.

- Bidenomics is not working. Bidenflation, as measured by the TIPP CPI, stands at 16.7%. Prices have surged by 16.7% since Biden assumed office. Paying bills and making ends meet are major concerns for Americans. Inflation is an additional tax, with each household spending an extra $700 monthly.

- Americans' wages have not kept pace with inflation. Six in ten Americans live paycheck to paycheck. Many Americans have to rely on credit cards or take on a second job to make ends meet.

- Gasoline prices, with a national average above $3.50 per gallon, are draining more money from wallets.

- After a hiatus, student loan payments are due again, likely putting more strain on pocketbooks.

- Americans face yin-yang dynamics. While the Fed is raising rates to curb inflation, Biden is increasing spending that fuels inflation. The net result is prolonged stagflation.

- Americans are concerned about government spending. Although a government shutdown was averted, it could still be on the horizon in another 45 days.

- To combat inflation, the Fed has been raising interest rates. While some Americans may not be sensitive to interest rate hikes, most people feel the pinch of these increases.

- The yo-yo stock market's volatility contributes to the prevailing gloom.

- The Russia-Ukraine conflict remains a wildcard. The U.S. has committed over $100 billion to the war and the reconstruction efforts to follow. With a $33.5 trillion debt, many feel that Biden is not doing enough to achieve peace.

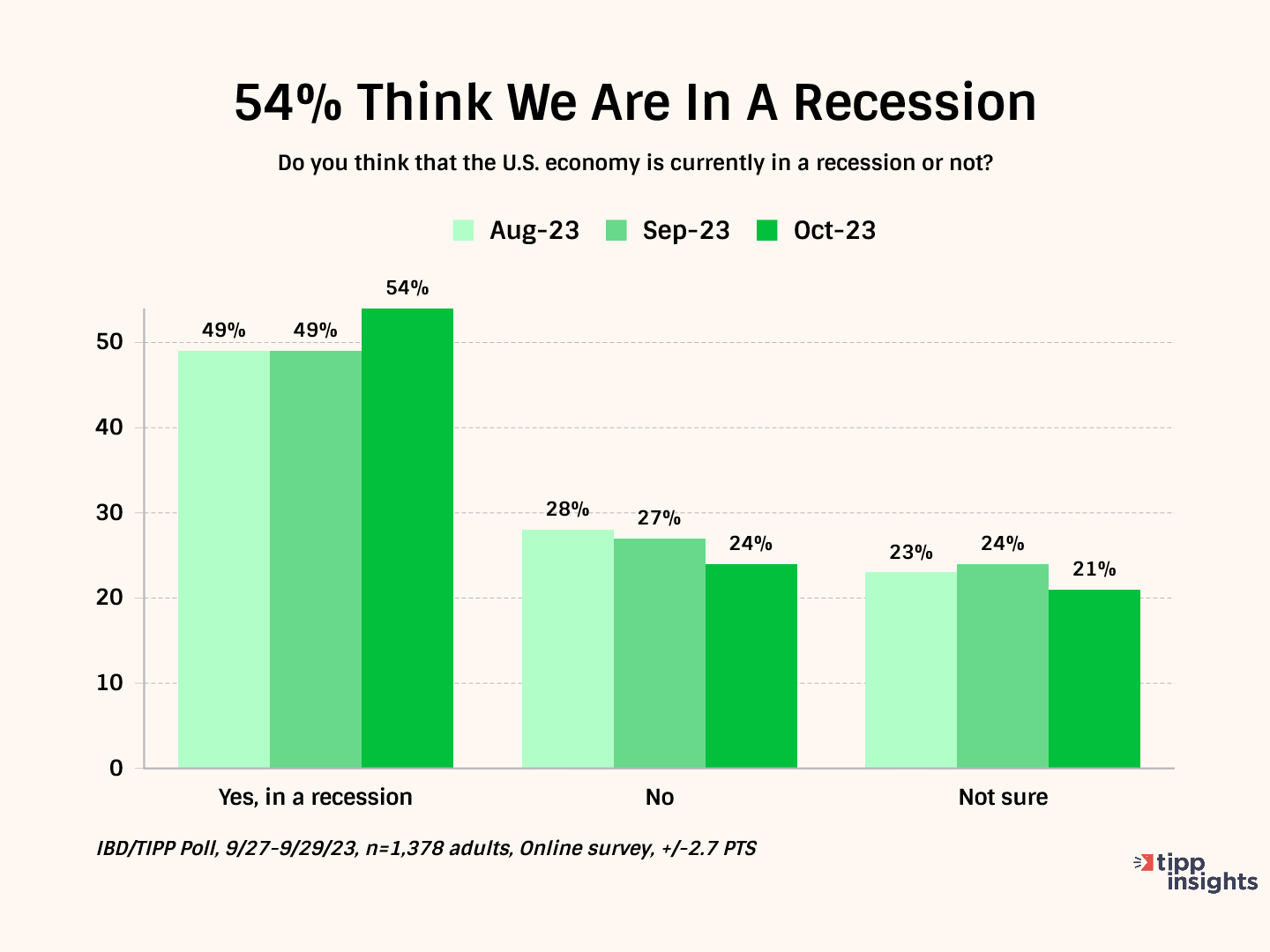

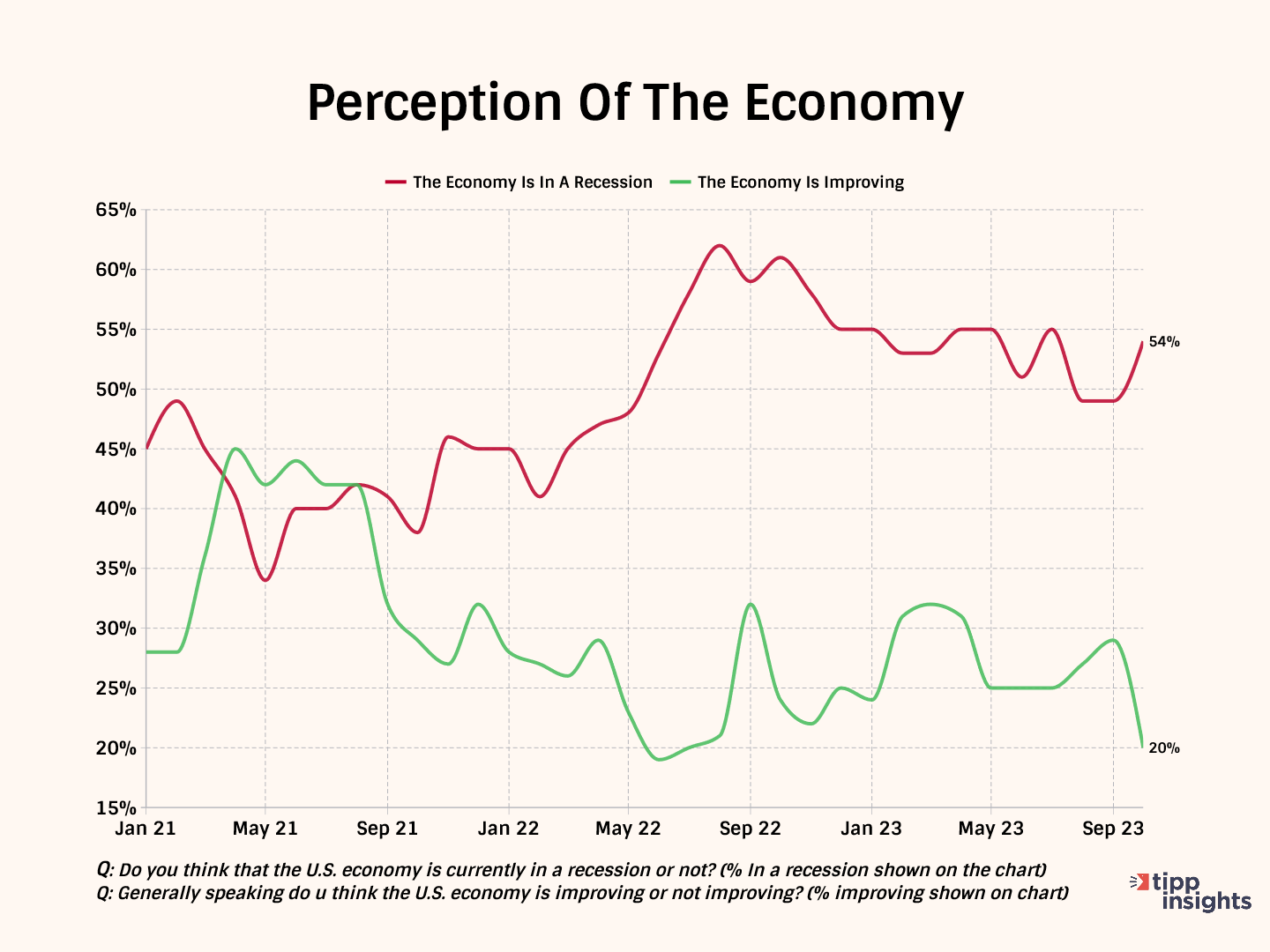

- Fears of an economic recession are high. Americans are facing the possibility of prolonged stagflation, with 54% believing the country is in a recession.

- Due to decades of globalization and reliance on China, the American and Chinese economies are strongly interconnected. China's economic slowdown could have global repercussions.

- Americans disapprove of Bidenomics. Only a quarter (25%) give President Biden positive marks for handling the economy. Surprisingly, only 51% of Democrats approve, while 88% of Republicans and 60% of independents give Biden failing grades.

In summary, Americans’ economic outlook is dark.

IBD/TIPP Economic Optimism Index

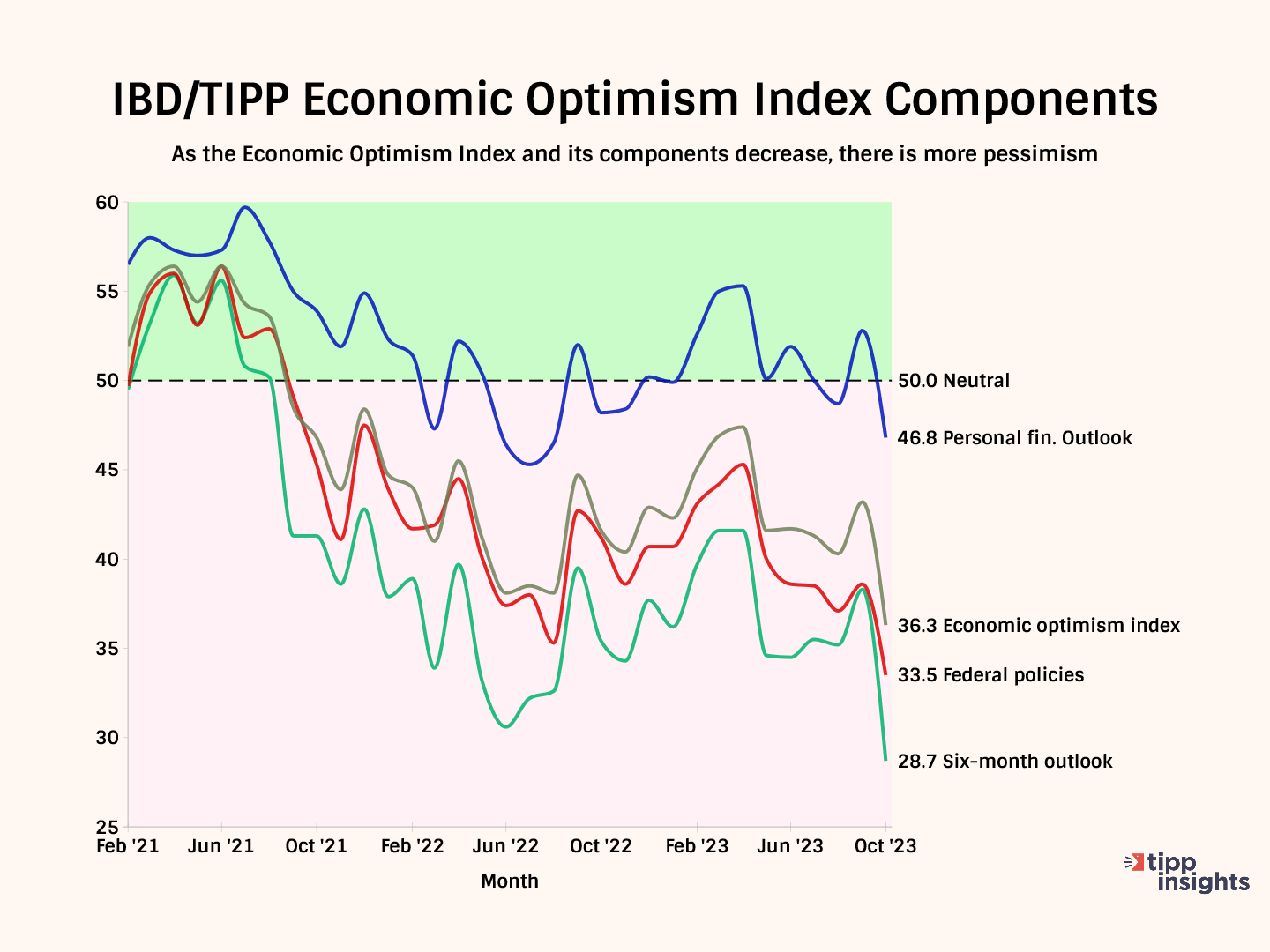

The flagship index has three equally weighted components. For the index and its components, a reading above 50.0 signals optimism, and a reading below 50.0 indicates pessimism. All three index components fell in October.

The Six-Month Economic Outlook, a measure of consumers' feelings about the economy's prospects in the next six months, declined 9.6 points, or 25.1%, to 28.7 in October. This marks the lowest reading for this component in the index's nearly 23-year history. In the past, sharp changes in this component have marked the start or end of recessions.

The Personal Financial Outlook, a measure of how Americans feel about their personal finances in the next six months, dropped 6.0 points, or 11.4%, to 46.8 this month and entered the negative territory.

Confidence in Federal Economic Policies, a proprietary IBD/TIPP measure of how government economic policies are working, according to Americans, declined 5.1 points, or 13.2%, to 33.5 in October.This latest reading of 33.5 represents the lowest recorded since October 2013 (31.2).

Party Dynamics

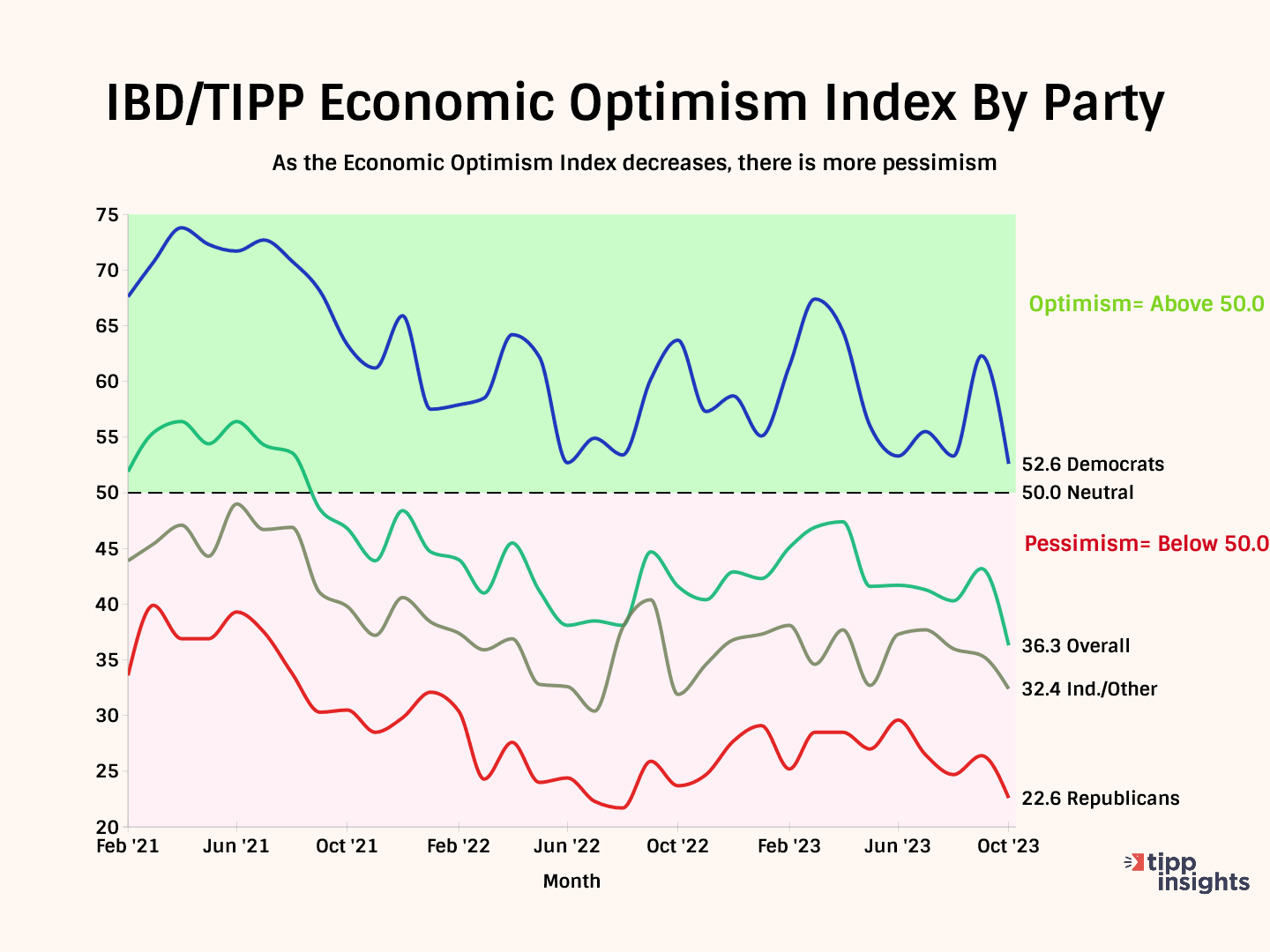

Generally, people who belong to the president's party are more optimistic about the economy than those who belong to the opposition.

Democrats have the highest confidence level at 52.6, followed by independents at 32.4 and Republicans at 22.6.

Democrats have remained in the positive zone for 35 consecutive months since December 2020, which followed Biden's election victory. Confidence surged from 32.9 in September 2020 to 73.8 in April 2021 but has since declined steadily, dropping by 21.2 points or 29% over the last 33 months. This month's reading of 52.6 is the lowest score for Democrats during Biden's tenure.

Republicans have stayed in the pessimistic territory for the 35 months since Biden was elected.

Independents have stayed in pessimistic territory for 43 consecutive months since April 2020.

Investor Confidence

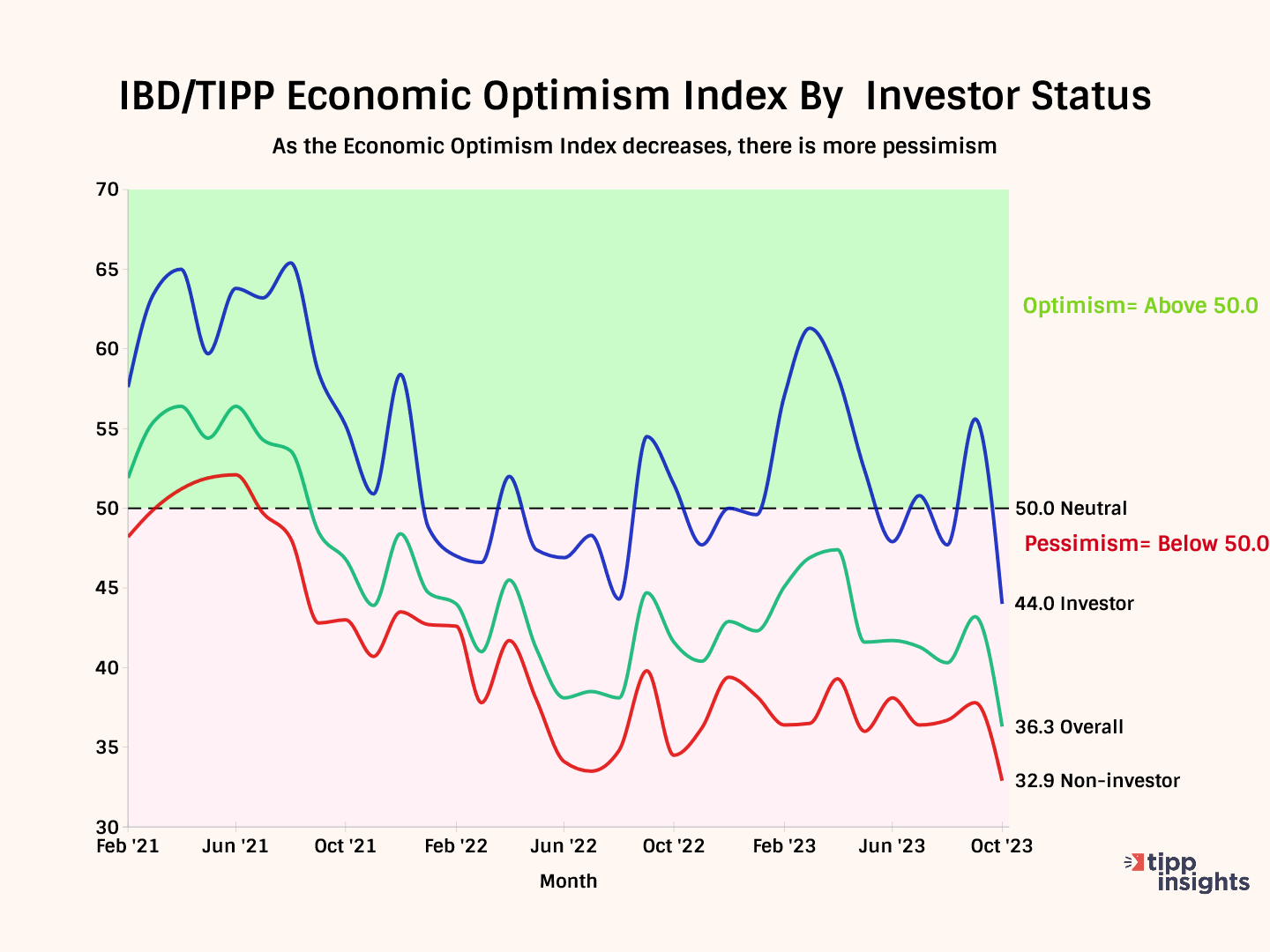

IBD/TIPP considers survey respondents to be "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan. We classified 32% of survey respondents who met this criterion as investors and the remaining 63% as non-investors. We could not ascertain the status of 5% of respondents.

In October, investors declined sharply from 55.6 to 44.0, 11.6 points or 20.8%, and non-investors dropped from 37.8 to 32.9, 4.9 points, or 13%. The economic optimism gap between investors and non-investors is 11.0 points in October, narrowing from 17.8 in September.

As of Friday's close, the S&P 500 has gained 484.36 points, or 12.67% year-to-date, and the Dow has gained 271.21 points, or 0.82%. The tech-heavy Nasdaq index has gained 3,044.35 or 29.31% year-to-date.

Momentum

Comparing a measure's short-term average to its long-term average is one way to detect its underlying momentum. For example, the indicator is bullish if the 3-month average is higher than the 6-month average. The same holds if the 6-month average exceeds the 12-month average.

In October, all index readings were lower than their three-month moving averages, signaling a slowdown.

Furthermore, the three-month moving averages are lower than their six-month moving averages in all cases. And the six-month moving averages are lower than their 12-month counterparts.

As a result, the data presents a convincing picture of weakening economic confidence.

Recession

Over half (54%) believe we are in a recession, and 21% are unsure. 24% think we’re not in a recession. In August and September, only 49% believed the U.S. economy was in a recession.

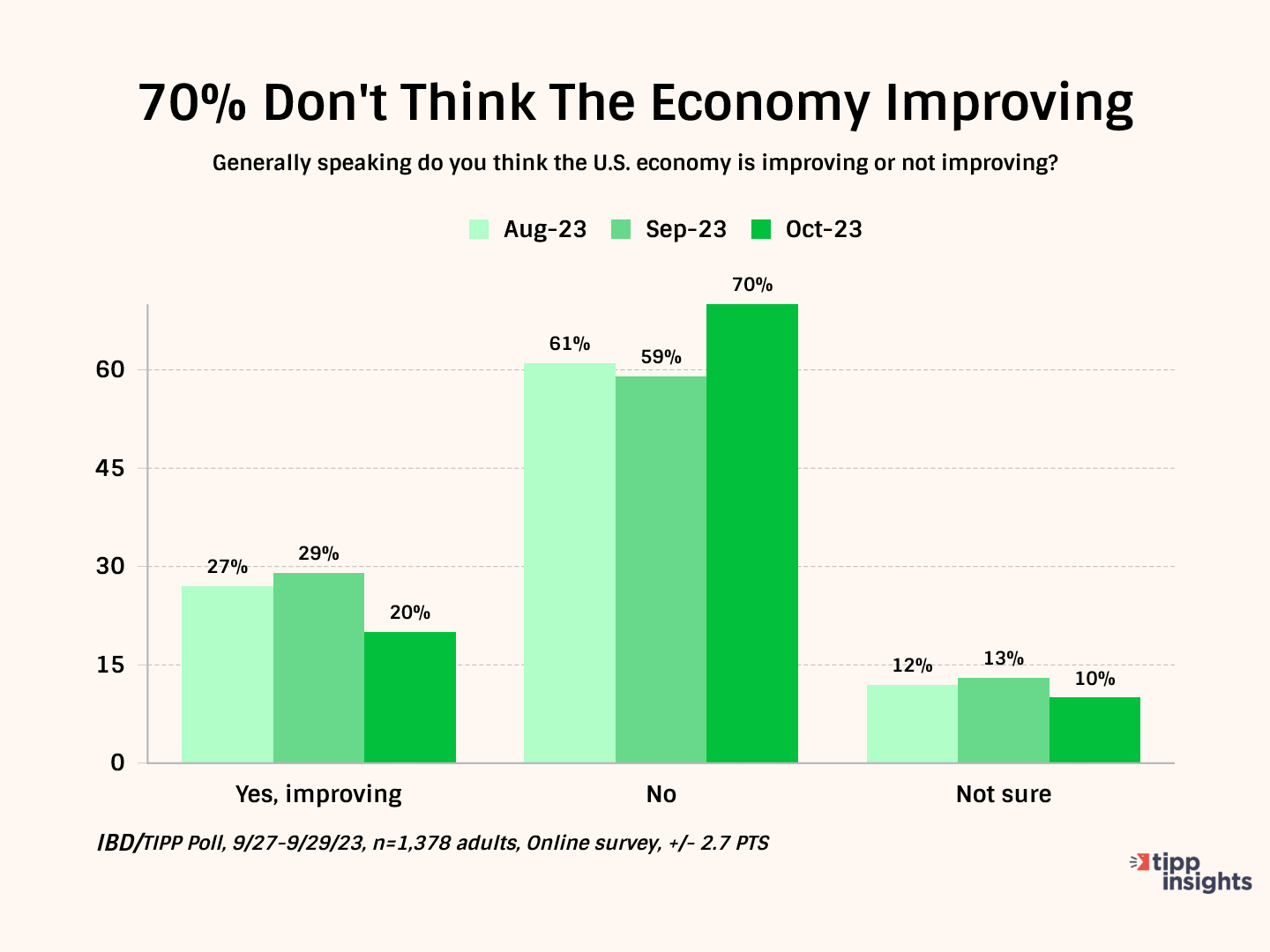

While most (70%) think it is not improving, about one-fifth (20%) believe that the U.S. economy is improving.

President Biden Policies

Americans lack confidence in President Biden’s ability to handle the economy. A majority (56%) give Biden failing grades of D (20%) or F (36%). Only 25% give him an A or B, while 17% give him an average C.

By party, 51% of Democrats give Biden good grades. Republicans (88%) and independents (60%) give failing grades.

In summary, economic confidence is low. Geopolitical uncertainties persist, threatening global economic equilibrium. The risks of stagflation, or high inflation with a recession, are significant. The wage growth is not keeping pace with rising prices. Persisting inflation is likely to weaken economic confidence further. The data signals a recession around the corner; how soon is the question?

TIPP polled 1,378 adults nationwide via an online survey from September29 to September31.

Like our insights? Show your support by becoming a paid subscriber!