- The IBD/TIPP Financial Stress Index reached its highest level since December 2008, with all 36 demographic groups experiencing elevated stress

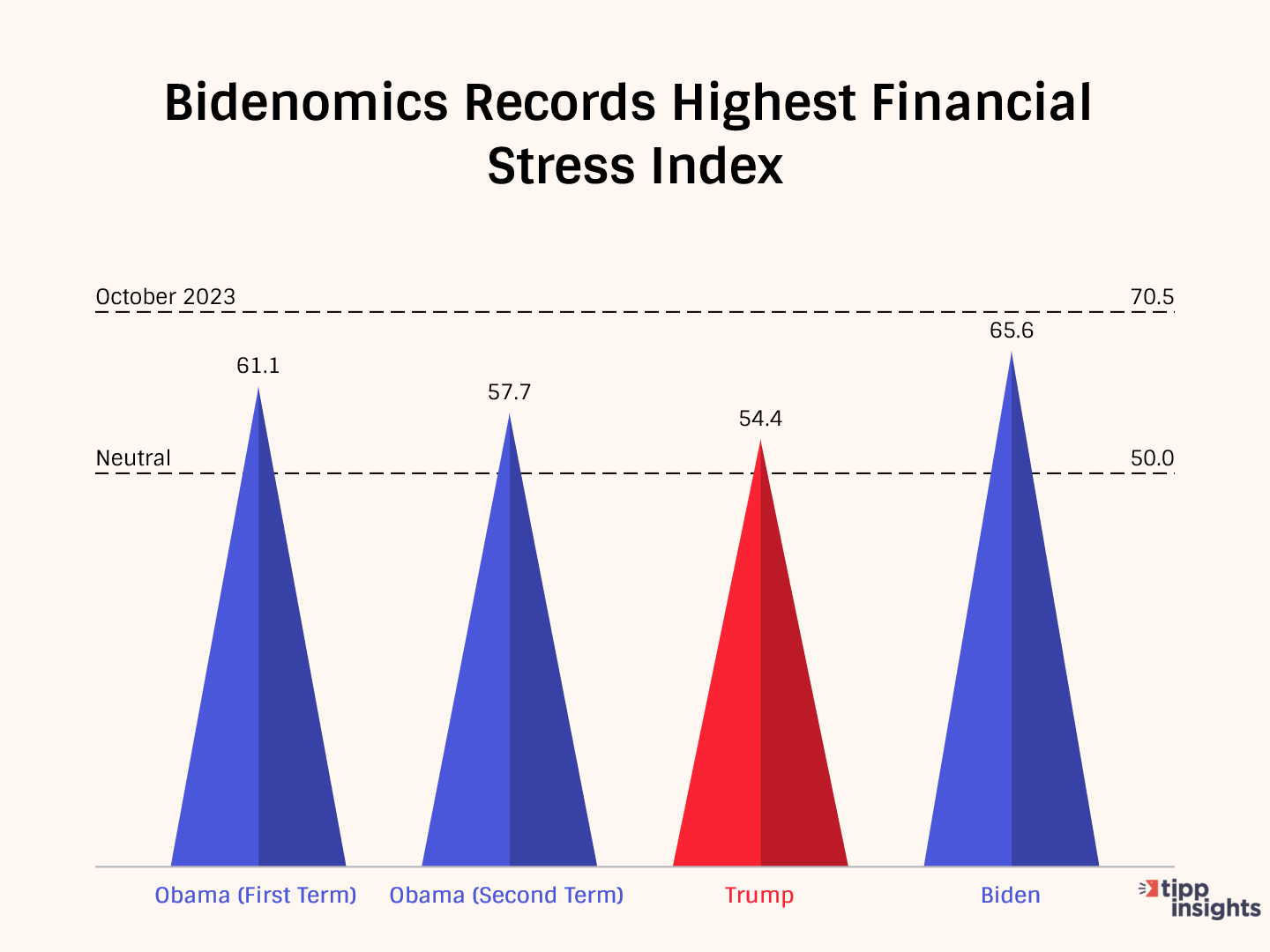

- Under Biden's policies, the average financial stress level stands at 65.6, higher than during the first and second terms of Obama and Trump's presidencies

- Multiple factors contribute to financial stress, including Bidenflation at 16.7%

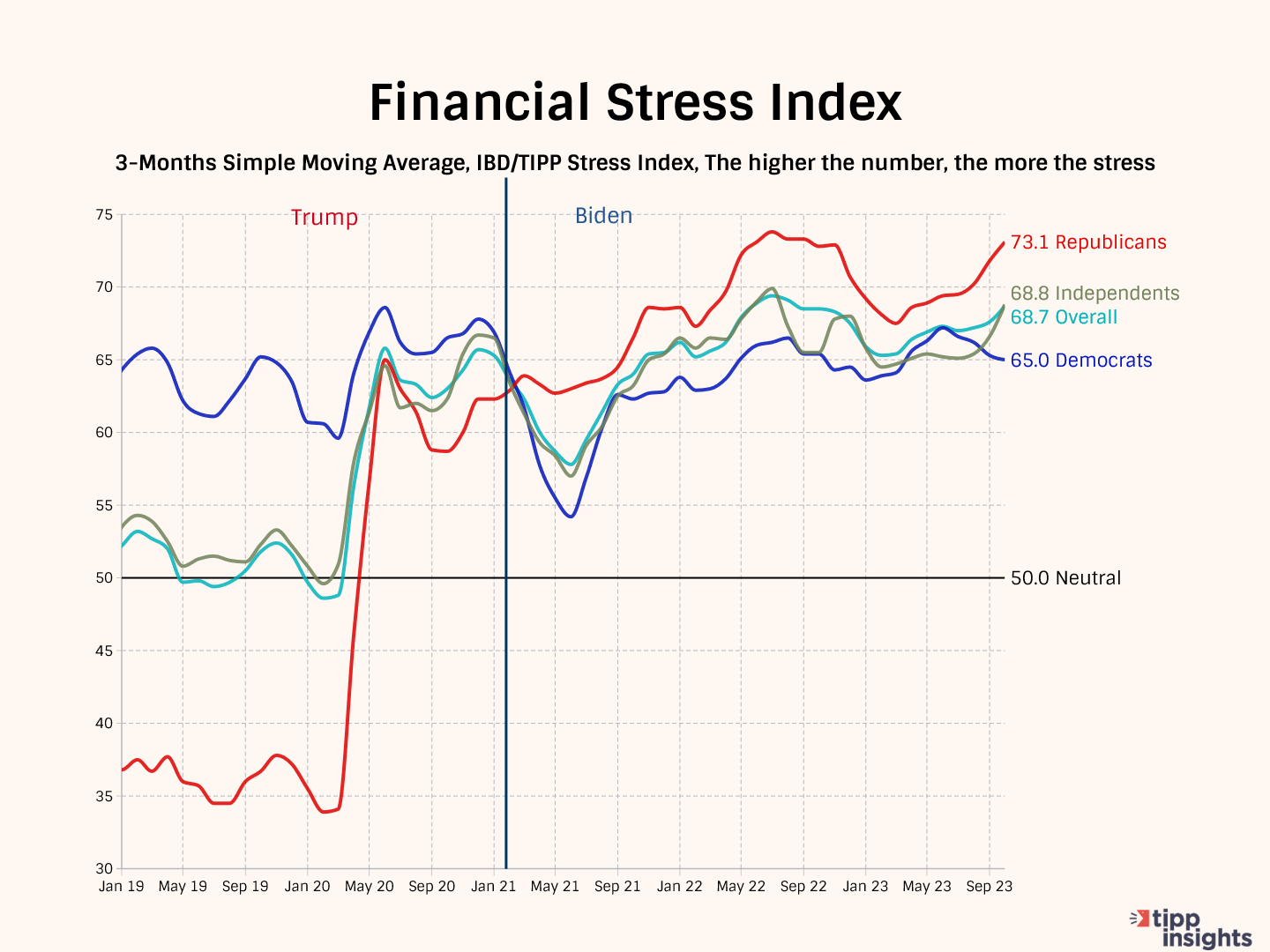

- Financial stress impacts Americans across party lines

- Public dissatisfaction with President Biden's handling of the economy is widespread, with 56% giving him failing grades

The IBD/TIPP Financial Stress Index increased for the fourth consecutive month in October, rising from September’s reading of 68.1 to 70.5 this month, a 0.7% increase. It is the highest reading on this index since December 2008.

Every demographic group we track is in the "stress zone," leading us to label the current period as a financial epidemic. Of the 36 demographic categories, 27 (75%) experience elevated stress, 15% higher than their historical average.

Here's further evidence that Bidenomics is an utter failure: the average financial stress level under President Biden's policies is the highest at 65.6, compared to the past two presidents. During Obama's first term, it was 61.1; during his second term, it stood at 57.7. The current level is also significantly higher than the financial stress level of 54.4 recorded during Trump's presidency.

Multiple factors are intensifying stress. We enumerated them in a recent editorial. To summarize, Bidenflation, as measured by the TIPP CPI, is 16.7%, leading to higher costs for Americans and increased financial stress. Many struggle to make ends meet as wages lag behind inflation, with six in ten Americans living paycheck to paycheck. Gasoline prices surpassing $3.50 per gallon further strain finances, while the return of student loan payments and concerns about government spending contribute to economic uncertainties. Additionally, the Fed's rate hikes and the ongoing Russia-Ukraine conflict compound fears of a recession, with widespread disapproval of President Biden's handling of the economy, even among Democrats.

The IBD/TIPP Financial Stress Index is a one-of-a-kind financial stress metric. In December 2007, we began using it to track financial stress. The index accurately indicates Americans' financial concerns about paying bills and making ends meet. Consumer spending drives two-thirds of the economy. When people are financially stressed, they generally hesitate to spend money.

There is another aspect too. Financial stress can lead to insomnia, weight gain (or loss), depression, anxiety, relationship difficulties, social withdrawal, and physical ailments such as headaches, gastrointestinal problems, diabetes, high blood pressure, and heart disease.

We computed the stress index from responses to the questions: Thinking of your personal finances, compared to the past three months, do you feel more stressed these days, less stressed these days, or feel the same level of stress?

The index ranges from 0 to 100; the higher the number, the more stress. A reading of 50.0 is the neutral point.

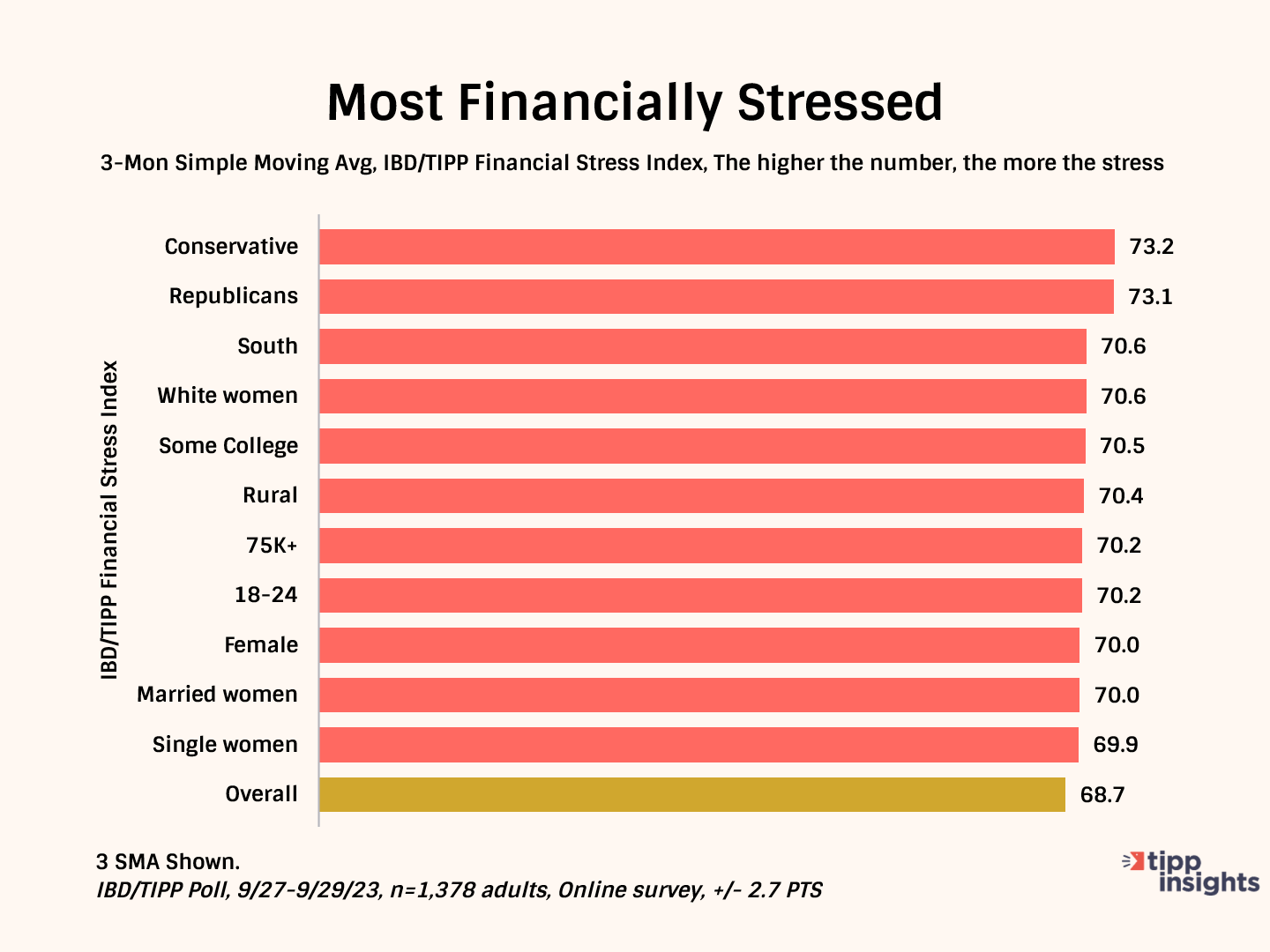

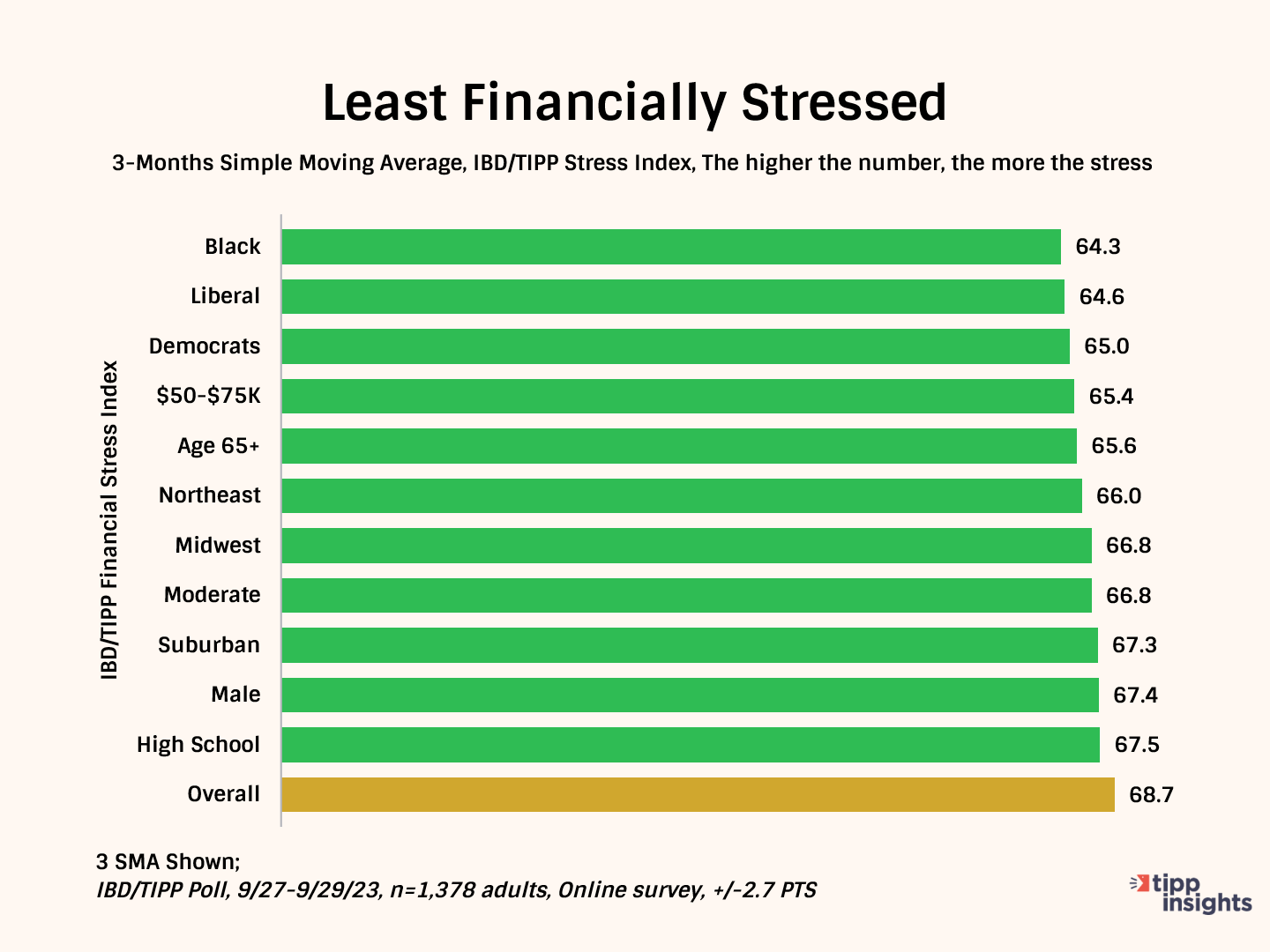

The chart below shows that financial stress affects all Americans, regardless of their party affiliation. Republicans experience the highest stress levels at 73.1, 4.4 points higher than the overall level of 68.7. In contrast, Democrats' stress level is 65.0, 3.7 points lower than the overall 68.7. Independents, at 68.8, are the closest to the overall level of 68.7

By The Numbers

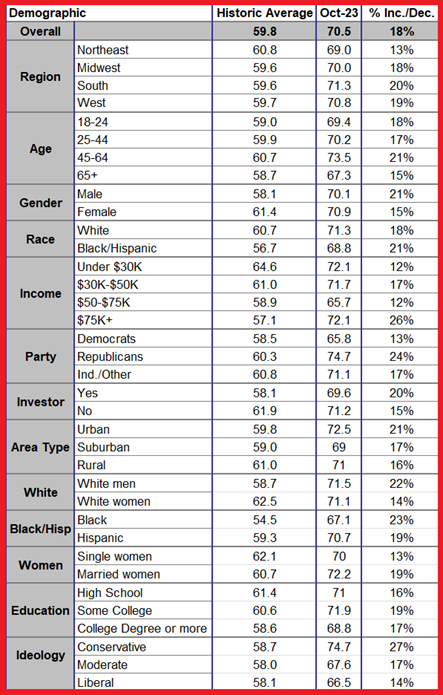

The table below displays historical averages of the index, October readings, and the percentage increase or decrease for 36 demographic groups. All 36 demographic groups exhibit stress levels above the neutral level of 50.0. Out of these 36 demographic categories, 27 (75%) are experiencing stress levels that are 15% higher than their historical averages.

For conservatives this month, the stress index posted 74.7, 27% higher than their historical average of 58.7. Similarly, Republicans recorded a stress index of 74.7, which represents a 24% increase compared to their historical average of 60.3

Here are the eleven demographic groups with the highest stress levels based on a three-month simple moving average. Conservatives are the most stressed group, followed by Republicans and Southerners.

The chart below shows the eleven demographic groups with the least stress. The least stressed groups are Blacks, liberals, Democrats, those in the $50K–$75K income bracket, and those aged 65+.

Biden’s Handling Of The Economy

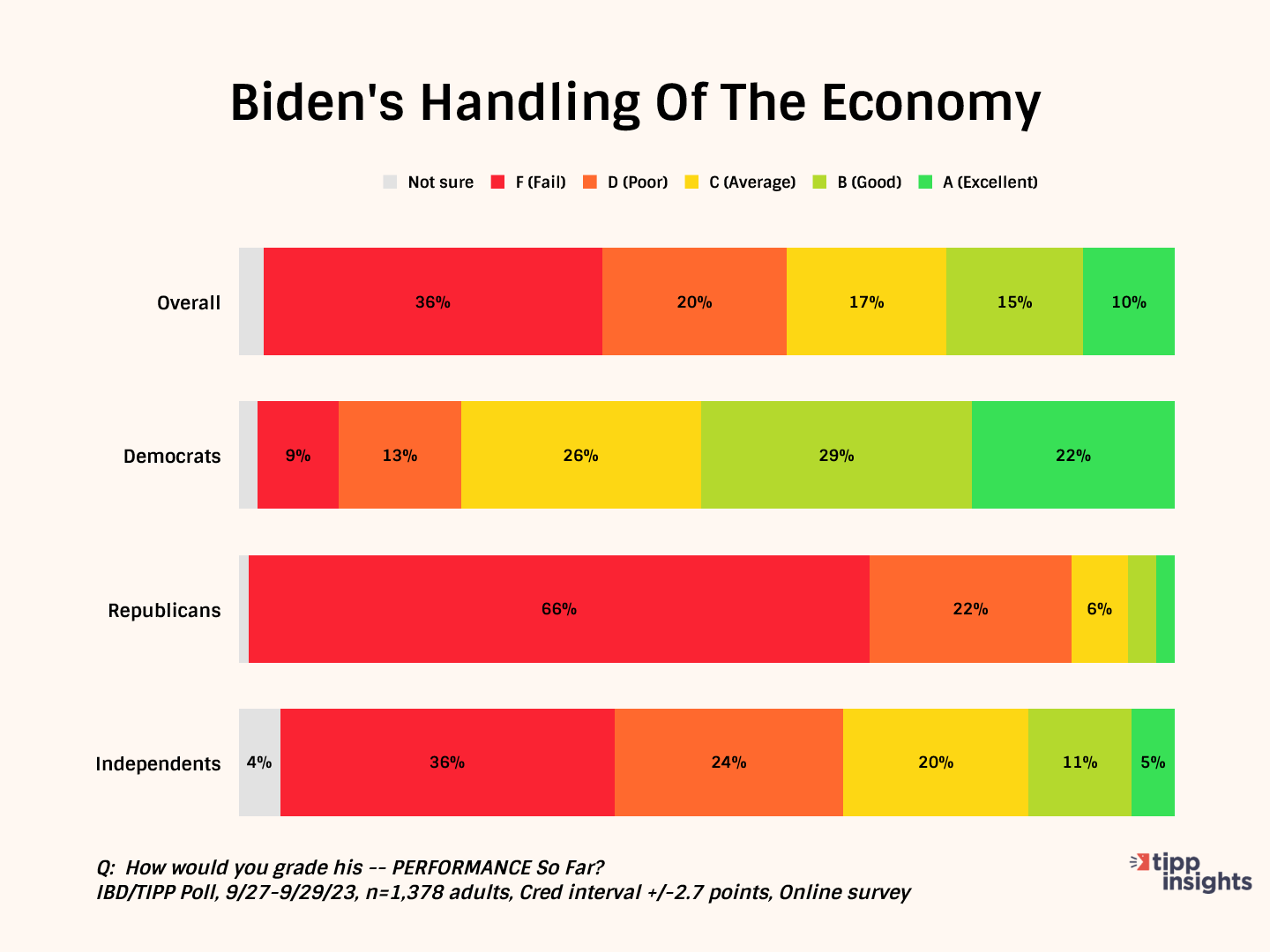

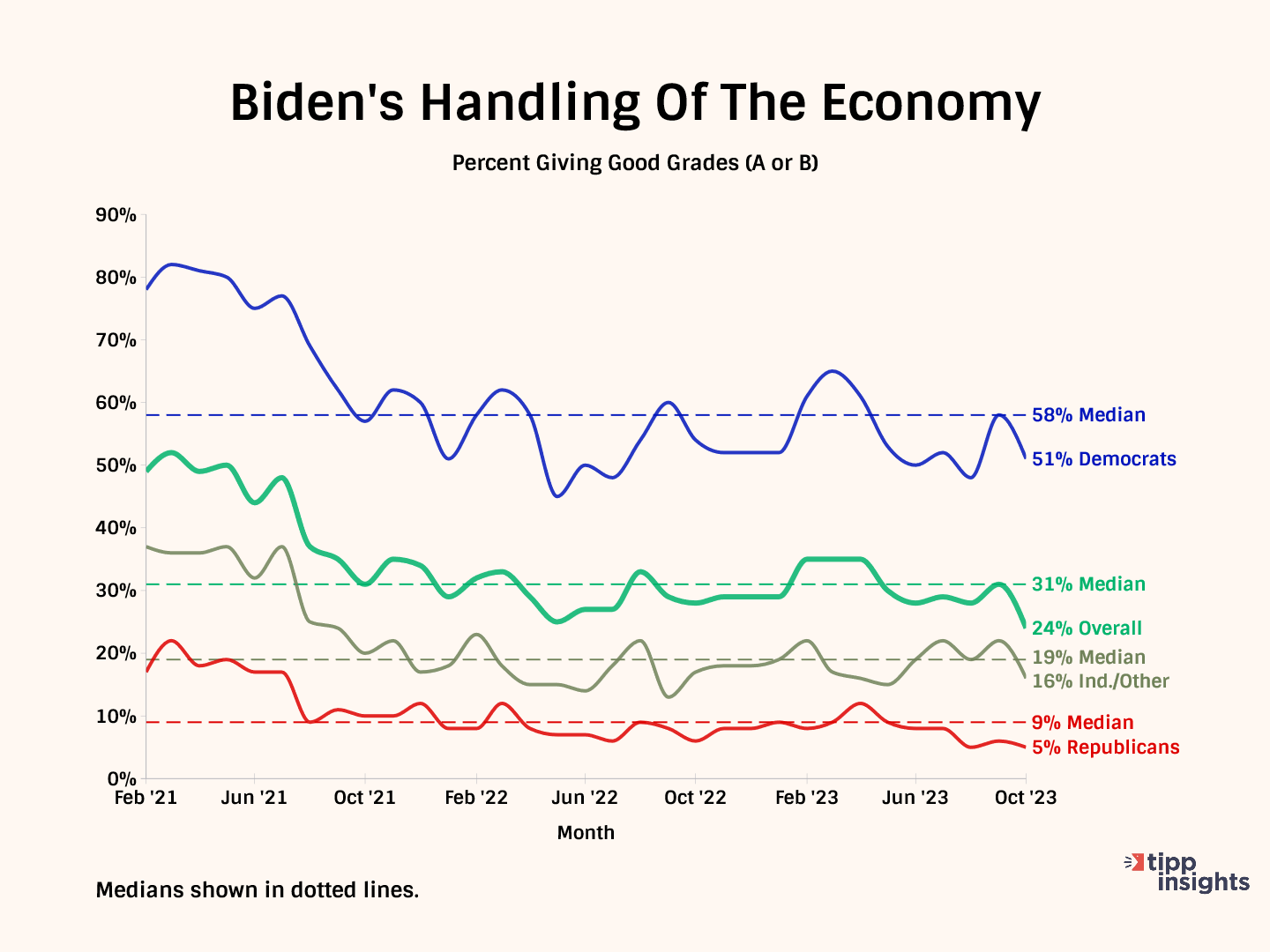

In our latest poll, most Americans (56%) give Biden a failing grade (D or F) regarding his handling of the economy. Only 25% give him an A or B.

Among Democrats, half (51%) give him positive grades, 22% believe he deserves failing grades, and another 26% rate his performance as average (C).

In contrast, Republicans are much more critical, with 88% expressing dissatisfaction with Biden's handling of the economy.

Furthermore, independents are also disappointed, with 60% giving failing grades, 16% giving good grades, and 20% rating Biden’s performance as average.

Americans are grappling with intense financial stress as wage growth fails to keep pace with rising prices. Persistent inflation will likely continue fueling this financial stress in the foreseeable future, and there are no easy answers or clear solutions.

Like our insights? Show your support by becoming a paid subscriber!