In the 1992 presidential election, James Carville, the chief strategist for the Bill Clinton campaign, advised his team that despite all of Clinton's troubles, the candidate had a clear path to victory if the campaign focused on the economy. "It's the Economy, Stupid!" became one of modern American history's most glorified campaign strategies. Carville's laser-like focus denied George Bush 41 a second term, thanks partly to independent candidate Ross Perot, who siphoned off nearly 19% of the popular vote.

Thirty-two years later, President Biden finds himself in the same awful bind as former President Bush. For as long as presidential polling data has been kept, an incumbent with economic stewardship numbers this bad has never been reelected. Worse for Biden, his absence of foreign policy leadership, two uncontrollable wars simultaneously fought with American military and financial assistance, and recklessness over the southern border have haunted his campaign's messaging. [In contrast, President Bush's approval ratings in March 1991 after the first Gulf War had reached 90%, the highest on record].

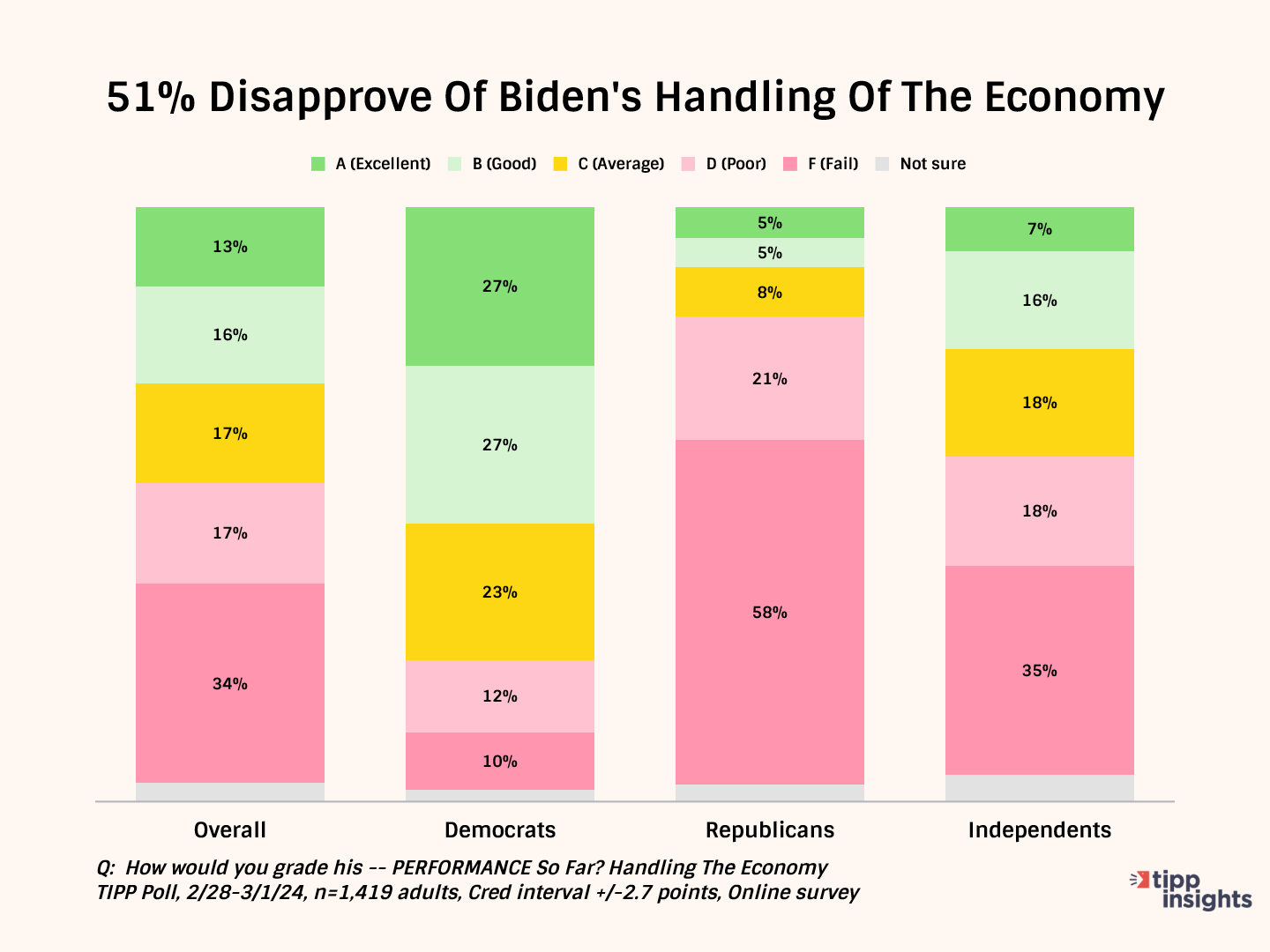

Overall, one-half (51%) give Biden a “D” or “F” for his handling of the economy. Only 29% give him good grades. 54% of Democrats give him good grades. Meanwhile, most Republicans (79%) and independents (53%) give him failing grades.

Spring is here, and you will know it not because of the way flowers in your garden are beginning to bloom but because of prices at the fuel pump. Just a month ago, the average national gasoline price was $3.27. Today, retail prices for a gallon of unleaded gasoline are $3.53, an increase of eight percent in weeks. The AAA says this price increase is expected as refiners switch to summer blends in anticipation of the heavy summer season. Still, it stings bitterly for consumers already hurt by Bidenflation (inflation tracked since Biden took office) of over 18%. Rising prices at the pump automatically translate into higher prices for everything. Americans do not need the Federal Reserve Board to tell them that inflation increased last month. They can see it daily when they stop by the grocery store to pick up food and essential supplies. Biden has a history of treating the Strategic Petroleum Reserve as his Strategic Political Reserve, and we expect him to make the announcement soon to further empty it to lower the gasoline prices in an election year as he did in 2022.

Fed officials concluded two days of meetings in Washington, and Chairman Powell announced that he would hold interest rates unchanged at 5.25 to 5.50%, the highest level since 2001. He said:

Today the FOMC decided to leave our policy interest rate unchanged and to continue to reduce our securities holdings. Our restrictive stance of monetary policy has been putting downward pressure on economic activity and inflation.

The last time the Fed raised rates was at its July 2023 meeting, after lifting them from near zero levels in April 2022 and increasing them steadily. The Fed funds rate affects short-term loans, such as credit card rates, new home equity loans, and lines of credit. Powell also admitted:

Inflation has eased notably over the past year but remains above our longer-run goal of 2%.

Experian says the average monthly payment for a new vehicle increased $25 year-over-year, reaching $726. Unable to make such large payments, many Americans are walking away from their loan obligations. “Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels," said Wilbert van der Klaauw, economic research advisor at the New York Fed. "This signals increased financial stress, especially among younger and lower-income households."

The White House boasts about the unemployment rate, which rose slightly to 3.9% in February. While the official numbers show this to be historically low, the truth is very different. According to a CNBC report based on data from the outplacement firm Challenger, Gray & Christmas, layoff announcements in February hit their highest level for the month since the global financial crisis in 2009. The total of 84,638 planned cuts showed an increase of 3% from January and 9% from the same month a year ago, with technology and finance companies at the forefront. Tech and finance workers are among the most highly compensated, and when their spending slows down, it can lead to more layoffs in the services sector, such as hospitality and tourism, as economic activity shrinks.

The latest Biden budget shows how unserious the president is about fixing these systemic issues plaguing the economy. The president calls for new federal spending, like for child tax credits, of up to $600 billion. Biden knows that even some Republicans will not hesitate to spend money on something as important as the welfare of children. Biden also has additional sweeteners, such as a national paid leave program for workers, expanded Pell Grants, and new tax credits for some home buyers - not all of which will receive bipartisan support.

To pay for the additional spending, Biden proposes aggressive increases in taxes for the wealthy and corporations. The corporate tax rate is currently at 21% thanks to President Trump's 2017 tax cuts, set to expire in 2025. It is expected to go up to 28% in the Biden budget. But Biden knows that such a proposal will never pass, requiring 60 votes in the Senate and with projections that the Republicans might take over the chamber. Biden also proposes increasing the personal tax rate to 39.6% for families earning $400,000 or higher, again likely to face stiff opposition.

If history is any indication, many of Biden's spending plans will go through, but the tax increases will not happen.

America is currently nursing a debt of $34 trillion. The federal government has to borrow at the same interest rate as everyone else, and today, the debt service line item is costing American taxpayers more than $1 trillion a year, larger than the Pentagon budget. Under the Biden budget, the debt will reach a whopping $54 trillion in ten years. No one knows the interest rate then, but Americans should get used to paying over $1.5 trillion a year in debt interest for the foreseeable future, an astounding amount.

In a recent TIPP Poll, 58% of Americans said they weren’t better off than they were four years ago, before the COVID-19 pandemic, while only 34% said they were. Furthermore, two-thirds live paycheck to paycheck under Biden's administration, and 24% of Americans have $0 for financial emergencies. Of course, neither Professor Krugman nor TV talking heads can relate to the struggles of Americans.

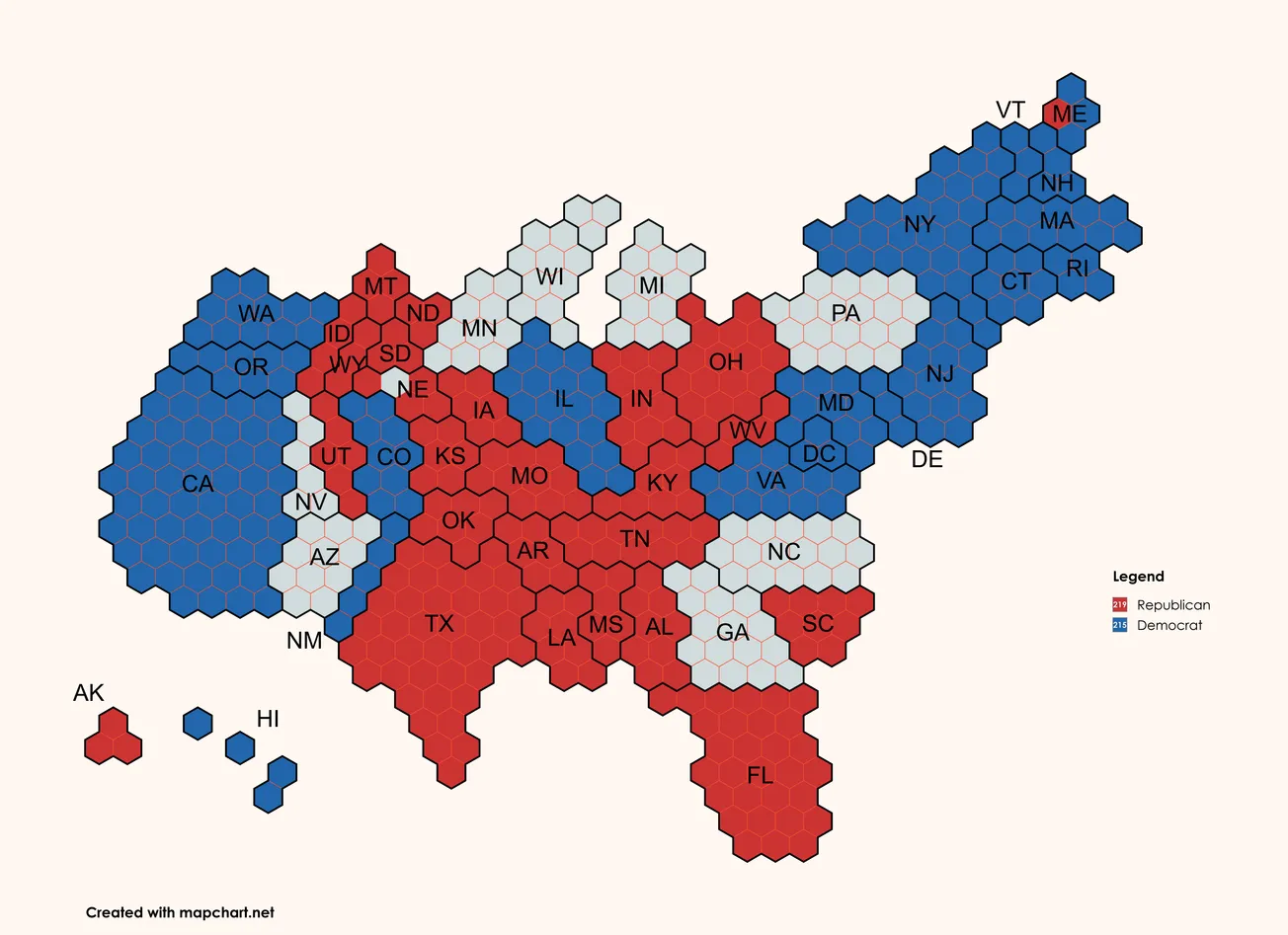

America's economy is in trouble, and President Biden is to blame. Voters have consistently ranked the economy as the #1 factor bothering them, just like Carville had predicted. And again, if history is an indication, Biden will likely lose his reelection bid, just like Bush 41.