Catholics have been some of Trump’s most important voters. But right now, 55% of Catholics give Trump a D or F grade on handling inflation. Affordability is the central issue for most Americans, especially swing voters. Patriotic middle-class Catholic families feel the squeeze, so this new populist coalition is being tested.

Back in 2016 Trump won the Catholic vote by 8 points, but in 2020 he split the Catholic vote nationally with Biden. Last November, Trump surged to a 12-point win among the faithful in 2024. That massive shift within the largest denomination in America drove the popular vote victory.

Now, this determinative group of voters watches closely, increasingly disenchanted with the state of the economy. So, we commissioned a survey of 1,483 registered voters in Wisconsin, the consummate swing state and one of the most Catholic states in America.

Overall, the Wisconsin economic outlook is grim. When asked to give a letter grade on Trump and the economy, here is the Badger State breakdown:

- A - 10%

- B - 18%

- C – 17%

- D – 19%

- F – 33%

On inflation specifically, Midwest women deliver some harsh marks, with only 6% giving an A vs. 45% an F grade. Those grades are notable because women are disproportionately the CFOs and shoppers in households.

Trump’s job approval in Wisconsin is -11% net: 41% approve vs. 52% disapprove. Trump remains very popular among Republicans, with 82% approval, but sinks to only 28% approval among independents. For Wisconsin Catholics, Trump remains more popular at only -4% net, with 45% job approval vs. 49% disapproval.

So … what can be done?

There are fixes, both in policy and in framing/messaging, beginning with blunt honesty with the American people, from Wisconsin Catholics to California agnostics. Recognize and acknowledge the very real angst out there.

The pain of cumulative inflation for five years takes a material toll on both the psyche and the bank accounts of hard-working Americans. The pain is especially acute for the masses of modest earners who have not enjoyed the benefits of asset inflation via stocks and real estate. Culturally, Catholics embrace a very middle-class mindset, even those who have achieved material financial success. They still identify with the mores and habits of their Irish, Mexican, and Italian grandparents.

So, empathy is crucial. Many on the right routinely – and understandably – mock Bill Clinton for his insincere “I feel your pain” tagline, but guess what? It is effective in politics. People need to believe that their leaders care.

So, here are the three points:

- Level with people and show authentic concern. Communicate clearly that the present angst is real and justified, after years of economic hardship for regular citizens.

- Detail the current positive trajectory of some key metrics, backed by data and evidence. President Trump and other Republicans can rightly claim serious early progress, using real world numbers.

-Real Wages jump higher, meaning pay adjusted for inflation.

-Residential rents finally trend lower.

-National gasoline prices dipped below $3/gallon for the first time in four years.

- Accelerate these wins! How? Continue to negotiate for the best possible trade deals for America. Continue to attract massive flows of foreign capital into America. And keep pushing to get illegal aliens out of America, raising wages for citizens and easing the pressure on the scarce supply of housing.

Taken together, these strategies will work for all Americans, including the crucial Catholic population. Catholics are not locked-in partisans. They are practical and patriotic. Appeal to their common sense and persuade them of the efficacy of the plan, from the businessman leader who created the amazing first Trump Boom during the first term into 2019.

The faithful rallied big to Trump in 2024. They now have valid concerns. Repay their loyalty with honest, clear messaging … confirmed by tangible kitchen-table results. Then, Trump and his allies can once again earn robust Catholic support for the 2026 midterms, and beyond.

Steve Cortes is president of the League of American Workers, a populist right pro-laborer advocacy group, and senior political advisor to Catholic Vote. He is a former senior advisor to President Trump and JD Vance, and a former commentator for Fox News and CNN.

👉 Quick Reads

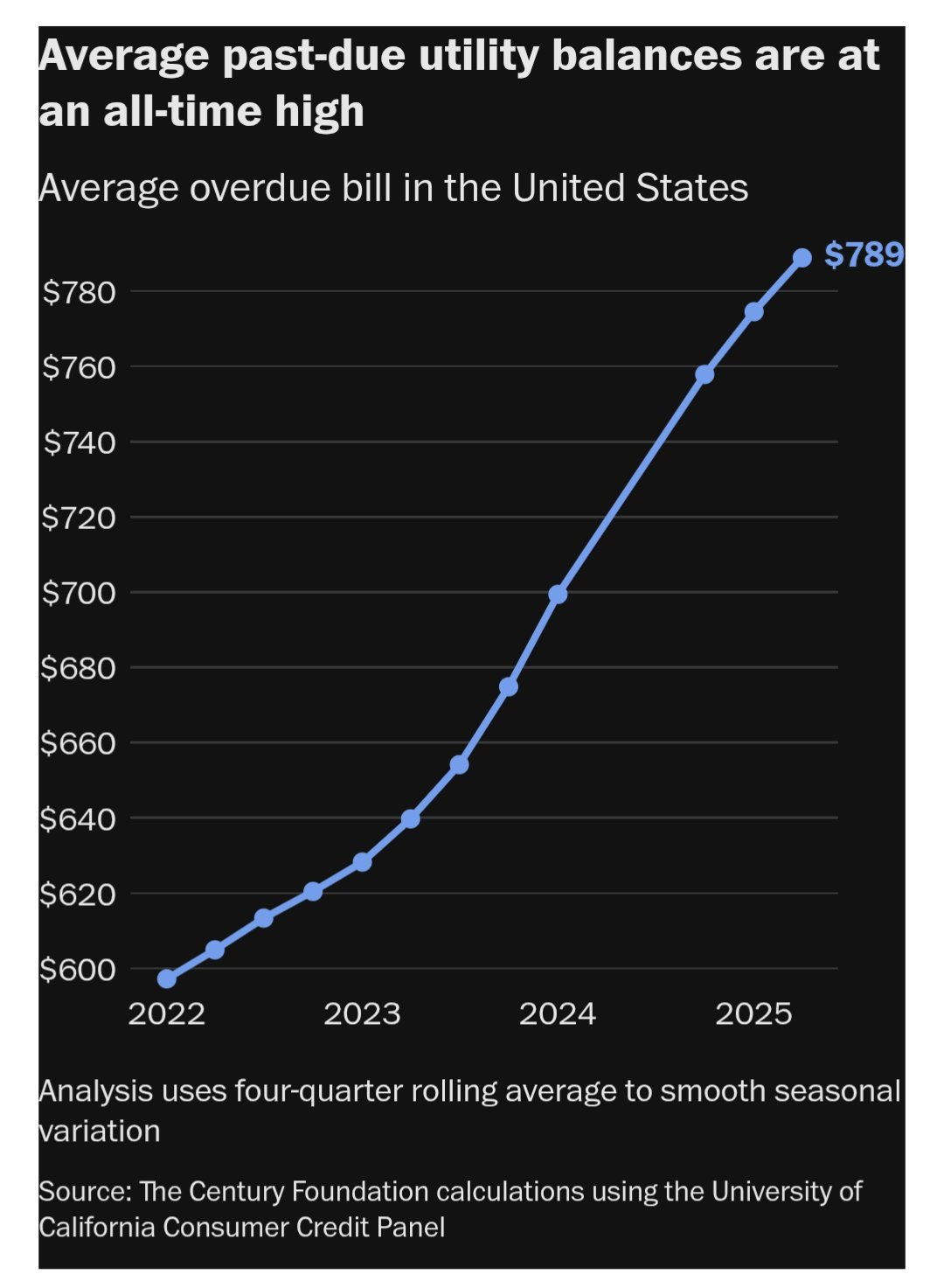

I. Past-Due Utility Bills Hit a Record High

The average overdue utility balance in the U.S. has climbed to nearly $800, underscoring mounting financial strain on households.

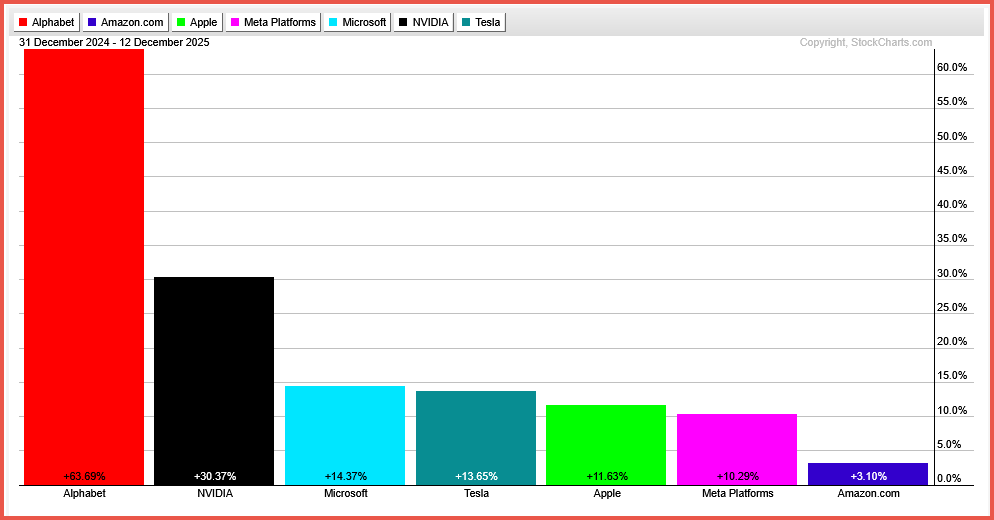

II. Alphabet Leads The Magnificent Seven In 2025

Alphabet is up nearly 64% year-to-date, far outpacing NVIDIA and leaving the rest of the Magnificent Seven well behind.

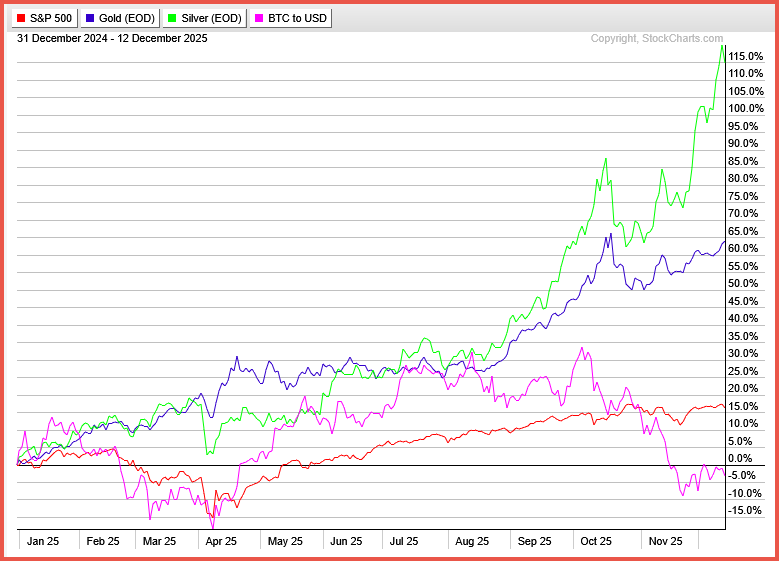

III. Silver Steals The Spotlight

Silver is up more than 110% year-to-date, far outpacing gold’s roughly 60% gain and the S&P 500’s 16% rise, while Bitcoin is down on the year.

📊 Market Mood — Monday, December 15, 2025

🟩 Futures Edge Higher as Markets Brace for Data Deluge

U.S. stock futures moved modestly higher to start the week, with investors positioning ahead of one of the final full trading stretches of 2025. Sentiment was dented recently by underwhelming updates from AI-exposed firms, reviving questions about the scale and payoff of massive AI investment.

🟧 Delayed U.S. Jobs and Inflation Data Take Center Stage

Attention this week turns to a backlog of U.S. economic data delayed by the record-long government shutdown. Tuesday brings a combined October–November jobs report, with payroll growth expected at a subdued ~35,000. A fresh unemployment rate and updated inflation readings are also due. Markets are sensitive to any downside surprises, which could pull forward expectations for the next Fed rate cut, as labor-market cooling has become the Fed’s primary concern.

🟦 China Property Fears Resurface After Vanke Setback

Shares of China Vanke fell after the state-backed developer failed to secure bondholder approval to delay a 2B yuan ($280M) repayment. The company now faces a narrow grace period, raising fears of a renewed—and potentially larger—property-sector default. Losses spread across Chinese real estate stocks, rekindling concerns about systemic stress in the world’s second-largest economy.

🟪 SpaceX Takes Early Steps Toward Potential IPO

According to the Wall Street Journal, SpaceX executives have begun fielding Wall Street banks for a possible IPO that could value the company north of $1 trillion. Founder Elon Musk recently confirmed IPO preparations. Investor interest is fueled by SpaceX’s government contracts and the rapid growth of its Starlink satellite internet business.

🟫 Oil Ticks Higher After Steep Weekly Losses

Oil prices edged up modestly, with Brent at $61.24 and WTI at $57.39, rebounding from last week’s more than 4% decline. Traders are weighing oversupply concerns against potential disruptions tied to U.S.–Venezuela tensions and uncertainty surrounding a possible Russia–Ukraine peace deal.

Bottom Line:

Markets open the week cautiously constructive, balancing hopes for softer U.S. data and future Fed easing against renewed global risks—from China’s property market to AI investment doubts. The tone is tentative, data-dependent, and late-cycle aware as 2025 winds down.

🗓️ Key Economic Events — Monday, December 15, 2025

None scheduled today

editor-tippinsights@technometrica.com