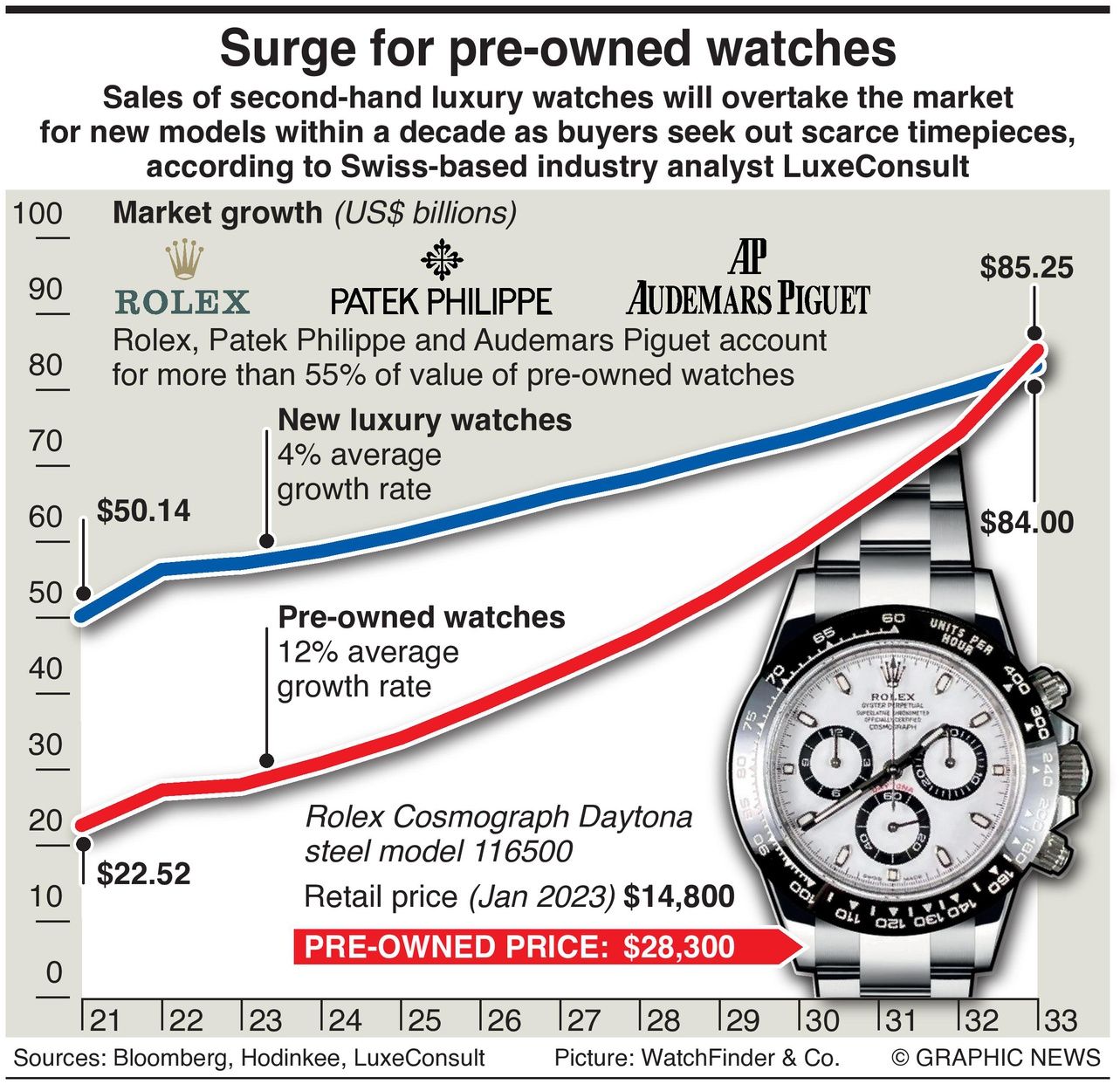

Sales of second-hand luxury watches will overtake the market for new models within a decade as buyers seek out scarce timepieces, according to Swiss-based industry analyst LuxeConsult.

As demand surges, consumers wanting to buy the most popular models from Rolex, Patek Philippe, and Audemars Piguet have been frustrated by long waiting lists due to limited production.

Some buyers have turned to the secondary market, where sellers and dealers charge a premium above retail prices for pre-owned timepieces, the most in-demand models.

Richard Smith, a manager at Blowers Jewellers, says: “Rolex is still the name that attracts the most attention from investors with models such as Daytona, Sky Dweller, Day-Date, and GMT-Master II remaining top of their want lists.”

On January 1, Rolex officially increased prices by an average of just above three percent across the brand’s lineup in the United States.

The ever-popular Rolex steel Cosmograph Daytona now retails at $14,800 -- a $250 jump. However, many watches’ value soars before they hit the shops, and buyers are willing to pay more than $28,000 to wear a pre-owned Daytona.

The value of pre-owned watch sales rose 20 percent in 2022, LuxeConsult reports, while new luxury watches rose 12 percent, topping $63 billion.

LuxeConsult expects secondary market sales to rise just three percent in 2023 and 10 percent in 2024 before averaging a 12 percent annual growth rate from 2025 until 2033. That’s compared to an average 4% growth rate in sales of new luxury watches.