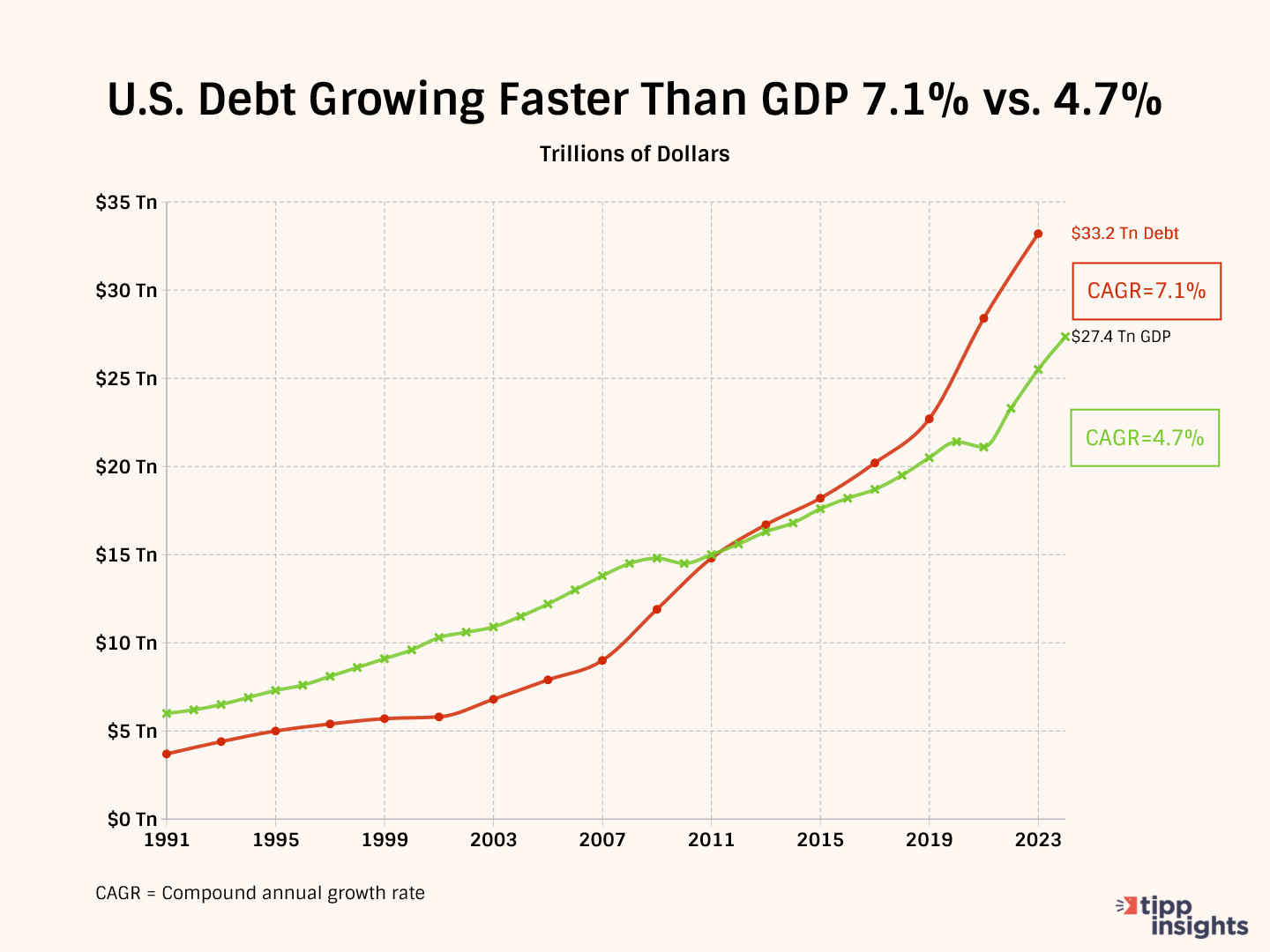

Between September 19, 2023, and January 3, 2024, the U.S. national debt increased by one trillion to $34 trillion in just 106 days. That is at a rate of $9.3 billion a day.

The government is paying more than $1 trillion annually in interest—more than it spends on the nation’s defense.

On average, the government has borrowed $250,000 for each American household. Compare this to the average household consumer debt of $103,358 towards mortgages, auto loans, credit cards, and other types of loans. Roughly, the government has borrowed 2.5 times the consumer debt.

The government took about $4.4 trillion in taxes, fees, and other receipts but spent nearly $6.13 trillion. As a result, the annual deficit approached $2 trillion in FY 2023.

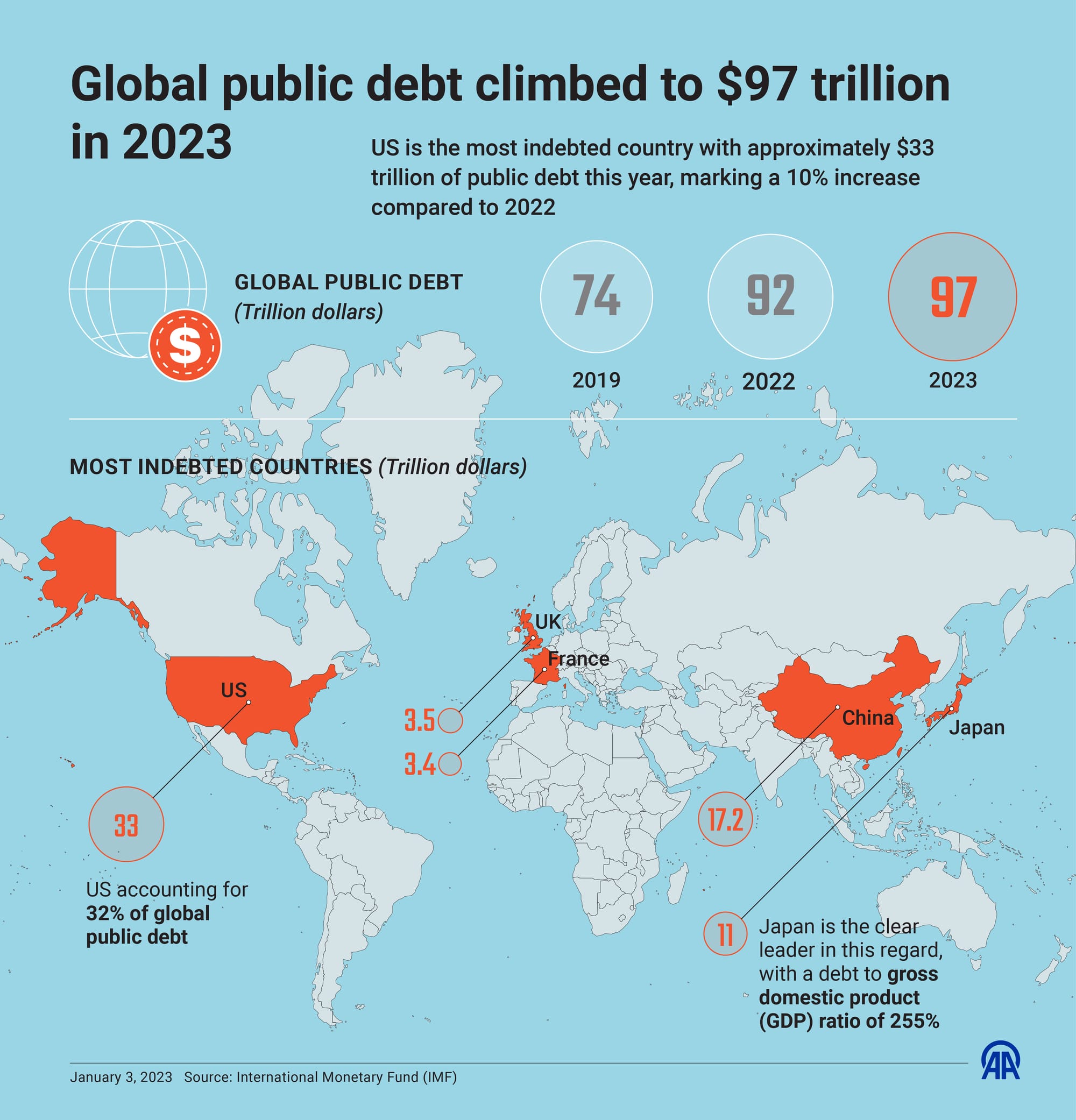

And how does the U.S. stack up against other nations? The ranking based on the IMF Outlook from October 2023 shows the U.S. debt-to-GDP ratio is 127%, compared to 87% for China and 252% for Japan.

As the infographics below shows, the U.S. is the most indebted country at the end of 2023.

As the debt rises, American businesses are worried. The Conference Board's C-Suite Outlook 2024 survey of American CEOs and C-Suite executives showed that business leaders are primarily worried about the ballooning U.S. national debt. Here’s their ranking of geopolitical risks to their businesses:

- National debt of the United States

- Cyberattacks on databases and systems

- Israel-Gaza conflict and possible regional expansion

- Energy prices resulting from the war in Ukraine

Meanwhile, the credit rating agencies are unhappy:

- Moody’s lowered its outlook on the U.S. credit rating from “stable” to “negative” in November 2023 while maintaining AAA status.

- Fitch downgraded the U.S. credit rating from “AAA” to “AA+” in August 2023.

- Standard & Poor’s lowered its grade to AA+ back in 2011 after an earlier debt-ceiling crisis.

What about consumers?

The latest TIPP Poll of 1,401 Americans nationwide sheds light on what people think about the country’s debt situation. The credibility interval for the survey is +/- 2.6 percentage points.

Broad Consensus Among Americans That National Debt Is Unsustainable

Two-thirds (66%) believe the debt situation is unsustainable. Only 18% believe it is sustainable.

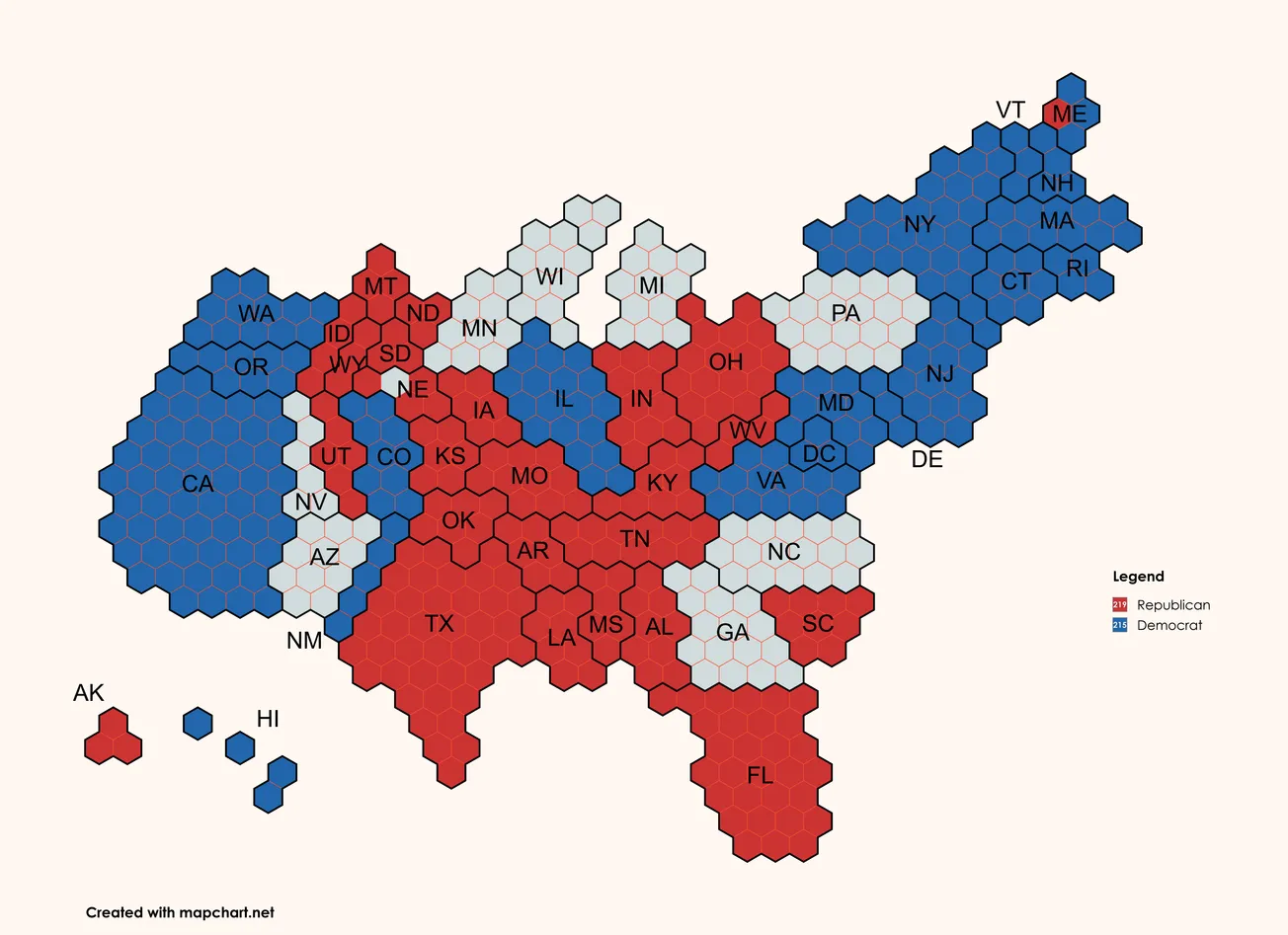

We analyzed the results of 36 demographic groups such as gender, race, party, etc. Of the 36 groups, 35 recorded concern levels greater than 50%, with the only exception being Democrats.

By party, while three-fourths of Republicans (75%) and independents (74%) think it is unsustainable, a relatively smaller share, albeit nearly one-half (48%) of Democrats, share the opinion.

Similarly, over two-thirds of conservatives (70%) and moderates (69%) say the debt situation is unsustainable, but only 55% of liberals concur.

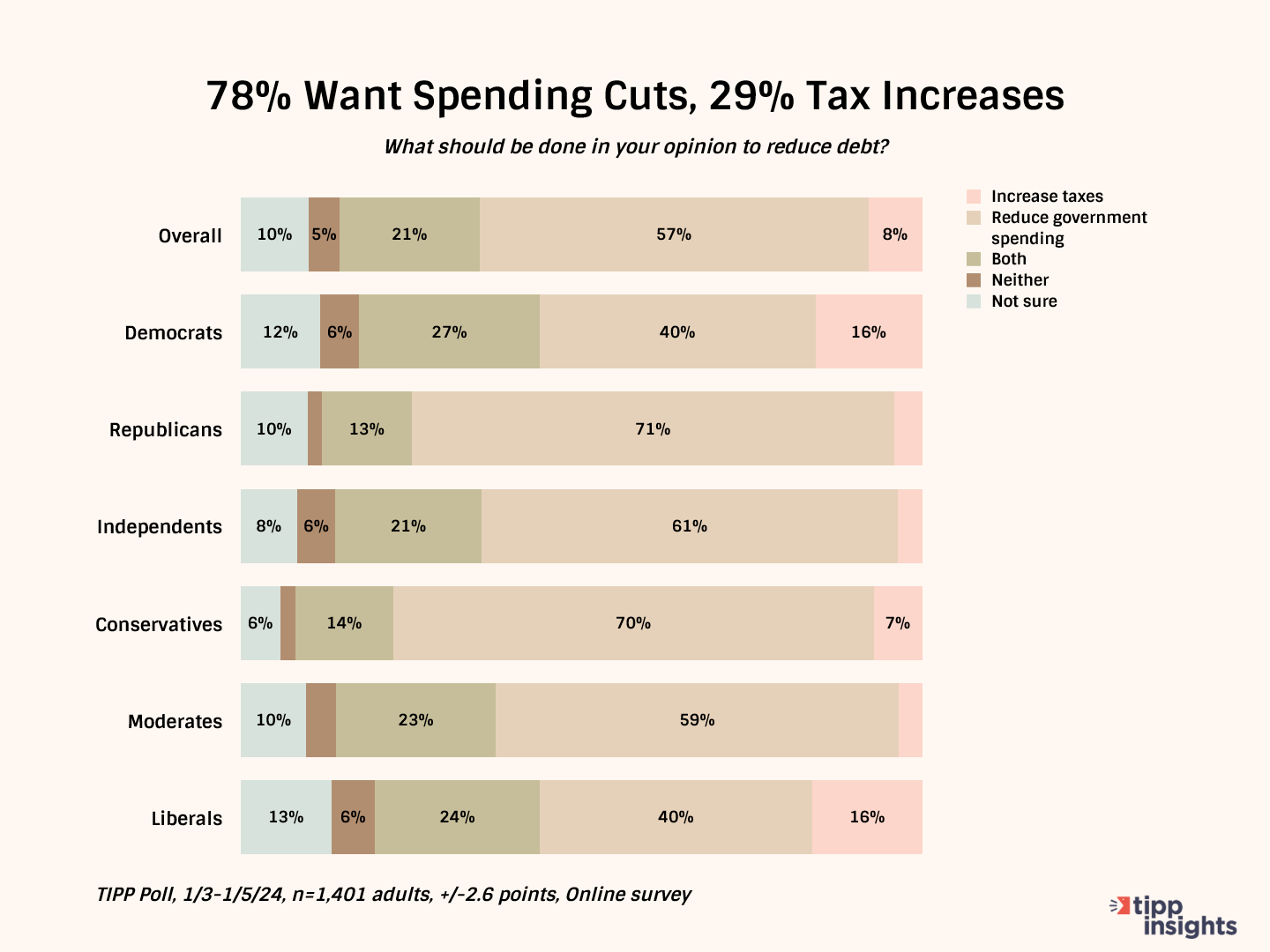

We asked Americans, 'What should be done to reduce debt?.' The responses were as follows:

- 57% want to reduce government spending

- 8% want to increase taxes

- 21% desire both tax increases and reduced government spending

- 5% said 'neither.'

- 10% were unsure.

When we combine those who want both tax increases and reduced government spending, the percentage of those favoring tax increases rises to 29% (8% + 21%), while the percentage favoring reduced government spending increases to 78% (the majority plus the 21% who desire both).

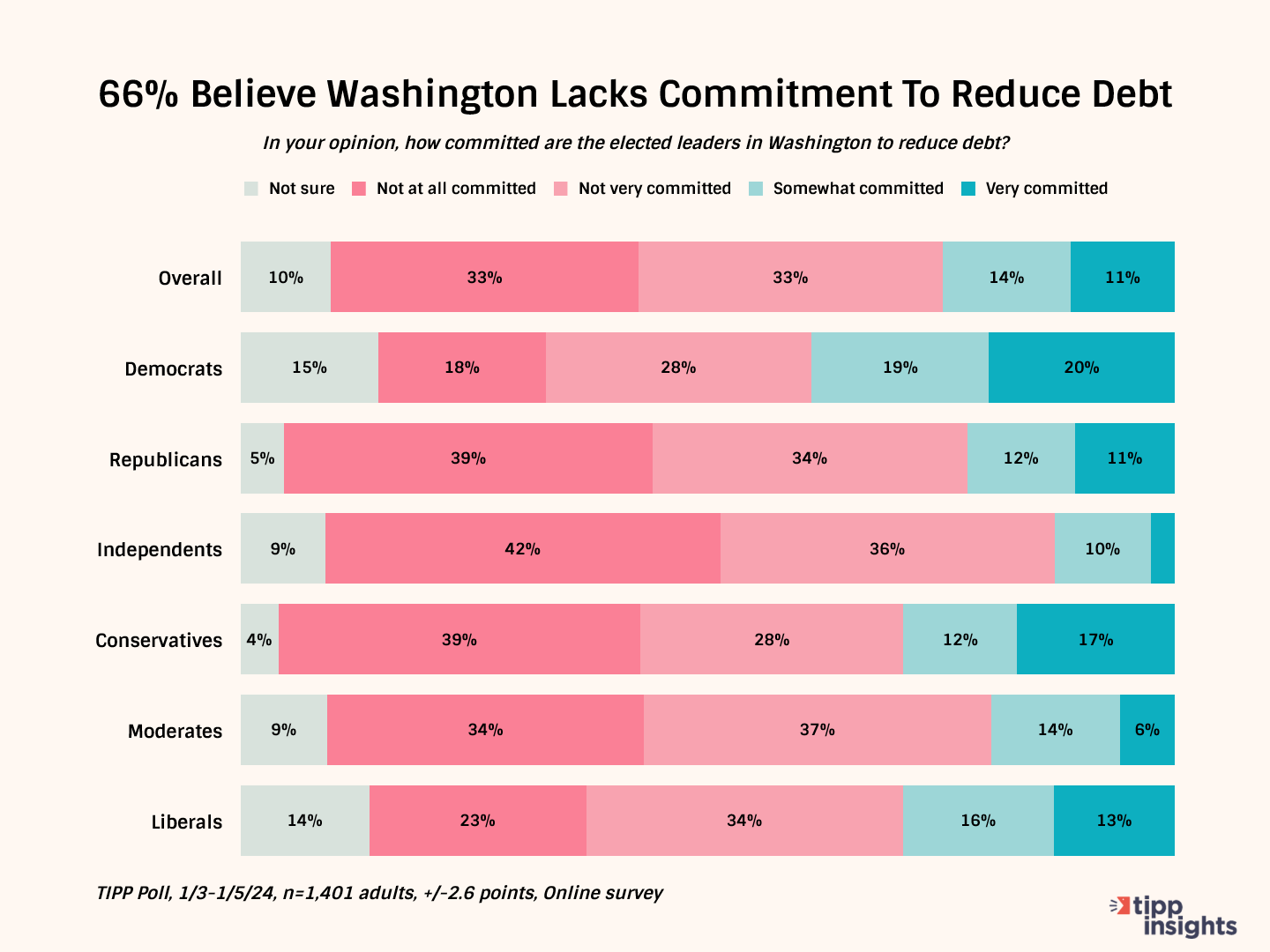

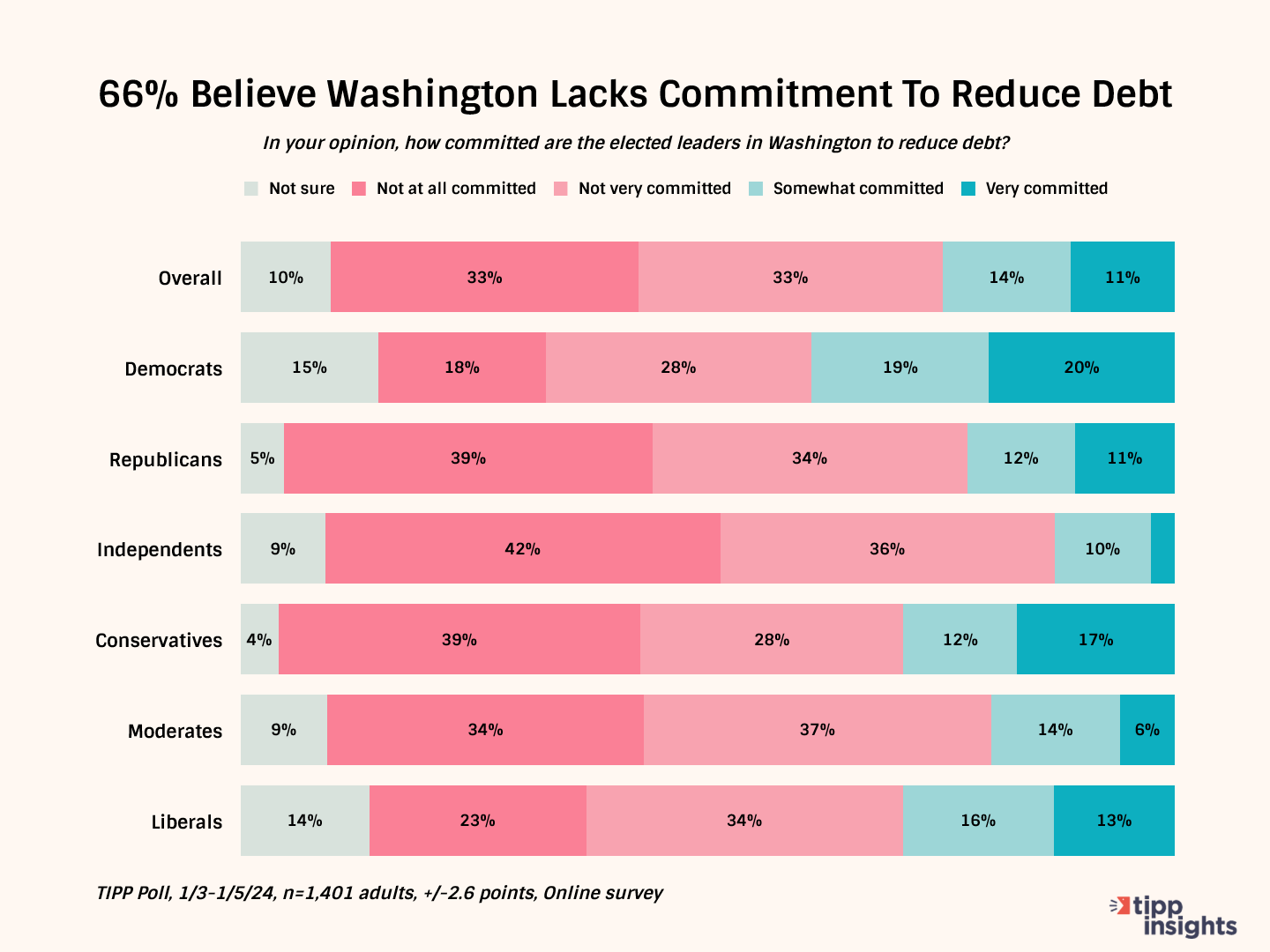

Washington Lacks Commitment

Only one-fourth (25%) believe Washington is committed to reducing debt. Two-thirds (66%) believe elected leaders in Washington lack commitment. They divide equally, with 33% stating that they are “not at all committed” and another 33% “not very committed.” Another 10% were unsure.

By party, eight in ten (78%) of independents and 73% of Republicans say Washington lacks commitment. Roughly one-half (47%) of Democrats share the feeling.

A similar pattern shows in the ideological break-up, with 71% of moderates, 67% of conservatives, and 57% of Democrats stating that the administration’s efforts are inadequate.

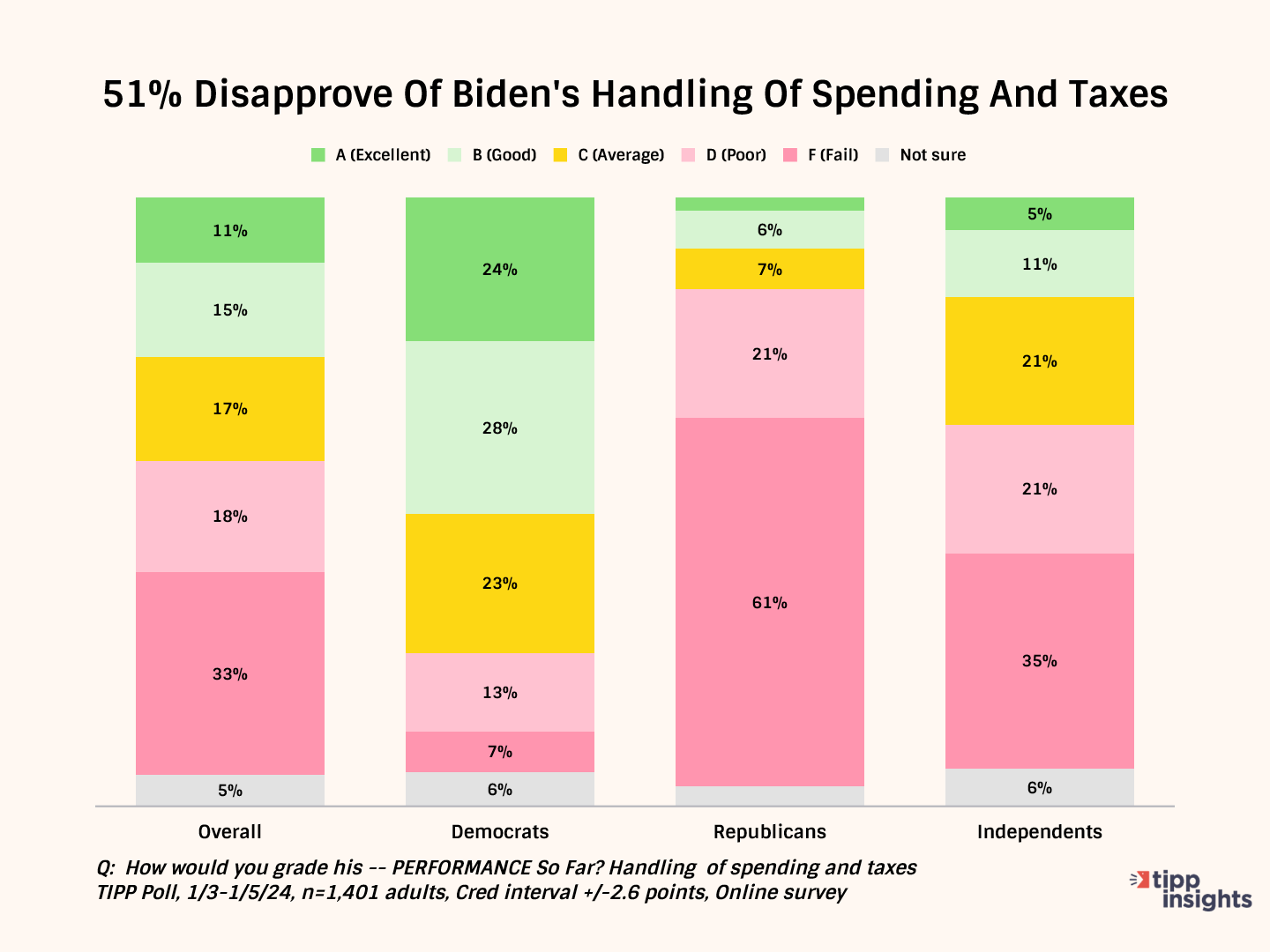

President Joe Biden gets poor grades for his handling of spending and taxes. Overall, one-half (51%) give Biden a “D” or “F.” Only 26% give him good grades.

While 52% of Democrats give him good grades, Republicans (82%) and independents (56%) give him failing grades.

The downside of ballooning federal debt is that refinancing becomes challenging. Supply and demand in the bond market will drive interest rates. If there is a high supply of government bonds (due to high debt levels), interest rates may need to stay high to attract investors and ensure that the government can continue borrowing money.

Reducing spending and reducing debt are top priorities for American voters. Elected leaders from each generation borrow and spend on behalf of Americans, ultimately passing the debt on to future generations. As interest payments rise, the government may need to reduce services and allocate less funding to critical areas such as defense, potentially weakening national security.