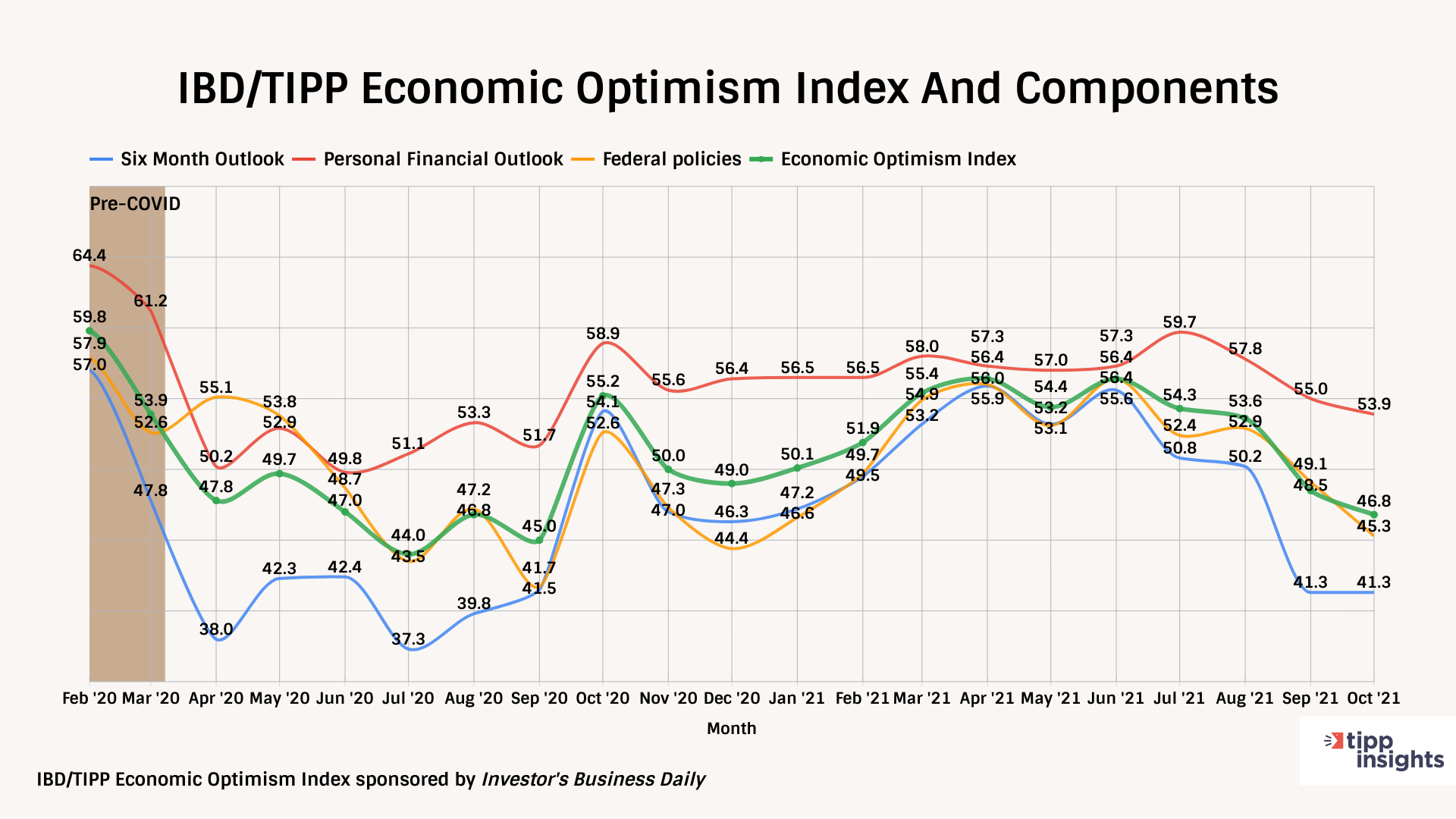

The IBD/TIPP Economic Optimism Index, a leading measure of consumer confidence, declined 1.7 points or 3.6%, from 48.5 in September to 46.8 in October. The current drop follows a steep 5.1-point decline in September.

After eight consecutive months in the positive territory, the index entered the negative territory in September.

Confidence in October is 21.7% below its pre-pandemic level of 59.8 in February 2020.

The IBD/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It accurately predicts monthly changes in sentiment reflected in other well-known surveys conducted by The Conference Board and the University of Michigan.

Consumer spending drives two-thirds of the economy. Optimistic consumers spend money on automobiles, home improvements, new homes, and other large-ticket items.

The TIPP Economic Optimism Index is the most well-known of our TIPP indexes. Investor's Business Daily publishes the IBD/TIPP economic optimism index every month.

Multiple factors are behind the decline of the index and its components.

- The trajectory of the virus is uncertain, and the end is elusive.

- Pandemic relief measures such as eviction moratoriums and augmented unemployment payments expired in September.

- The recent vaccine mandate is having an unintended economic impact. Many Americans are quitting or being laid off, which adds a new dimension to the job market, puts pressure on wages, and exacerbates inflation.

- In August, the U.S. economy added 235,000 jobs, a half-million less than expected by Wall Street. The slowdown in job creation is not encouraging.

- The stock market is wobbly and under correction.

- The real estate market is likely to cool due to increased supply and less demand. The expiration of mortgage forbearance will also impact the market.

- Washington is working overtime to pass a $3.5 trillion social spending bill and a $1.1 infrastructure bill. Americans expect profligate spending to worsen inflation.

- Last but not least, macroeconomic factors like unemployment, wage growth, inflation, money supply, and new taxes weigh heavily in Americans' minds. They don't see the outlook as bright.

IBD/TIPP Economic Optimism Index

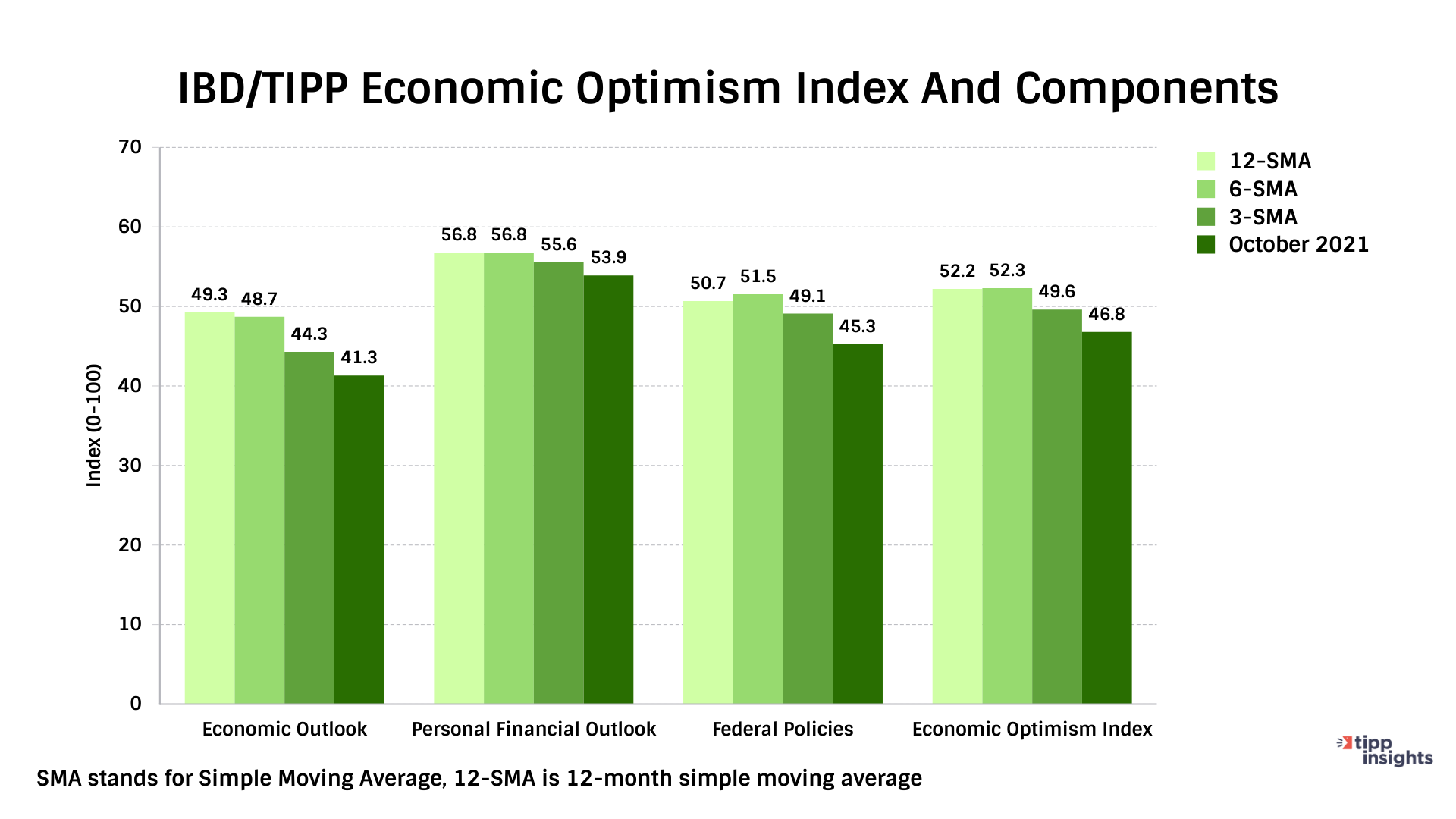

This flagship index has three equally weighted components. For the index and its components, a reading above 50.0 signals optimism, and below 50.0 indicates pessimism.

Two of the three index components fell in September, and one did not change.

The Six-Month Economic Outlook, a measure of how consumers feel about the economy's prospects in the next six months, did not change from its reading of 41.3 in September. In September, it had declined by 8.9 points or 17.7%, dropping to current levels from 50.2. The current reading has been the component's 12-month low.

The Personal Financial Outlook, a measure of how Americans feel about their finances in the next six months, dropped 1.1 points or 2.0% to 55.0 this month. It is also the index's 12-month low.

Confidence in Federal Economic Policies, a proprietary IBD/TIPP measure of views on how government economic policies are working, declined 3.8 points or 8.4% to 45.3 in October.

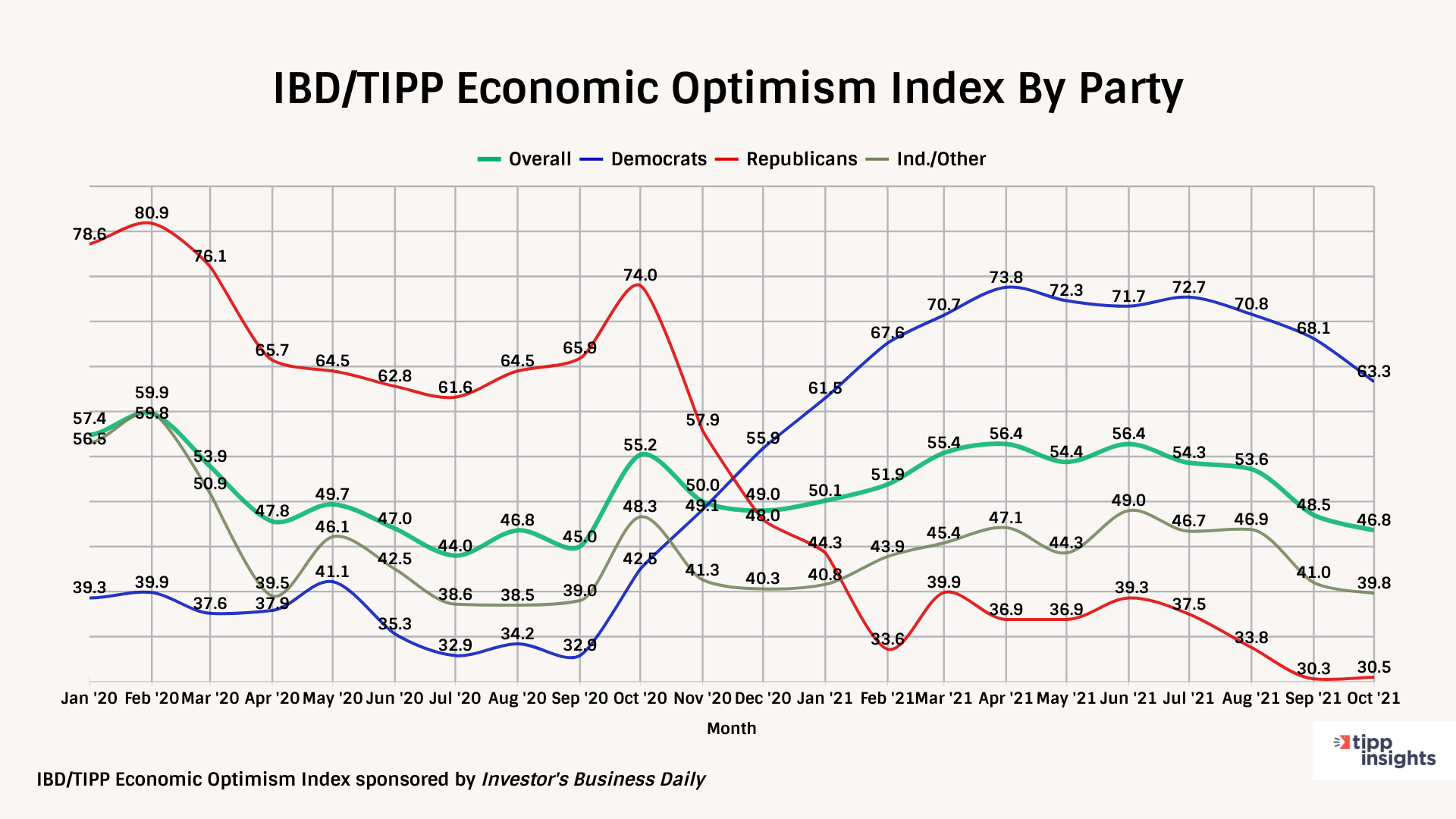

Party Dynamics

Republicans' confidence edged up to 30.5, and it is 50.4 points lower than in February 2020.

Democrats have the highest confidence level in August, at 63.3, followed by Independents at 39.8.

After climbing from 32.8 in September 2020 to 73.8 in April 2021, over the last six months, Democrats' confidence has dropped to 63.3.

For the past 13 months, independents' confidence has ranged between 40 and 50.

Investor Confidence

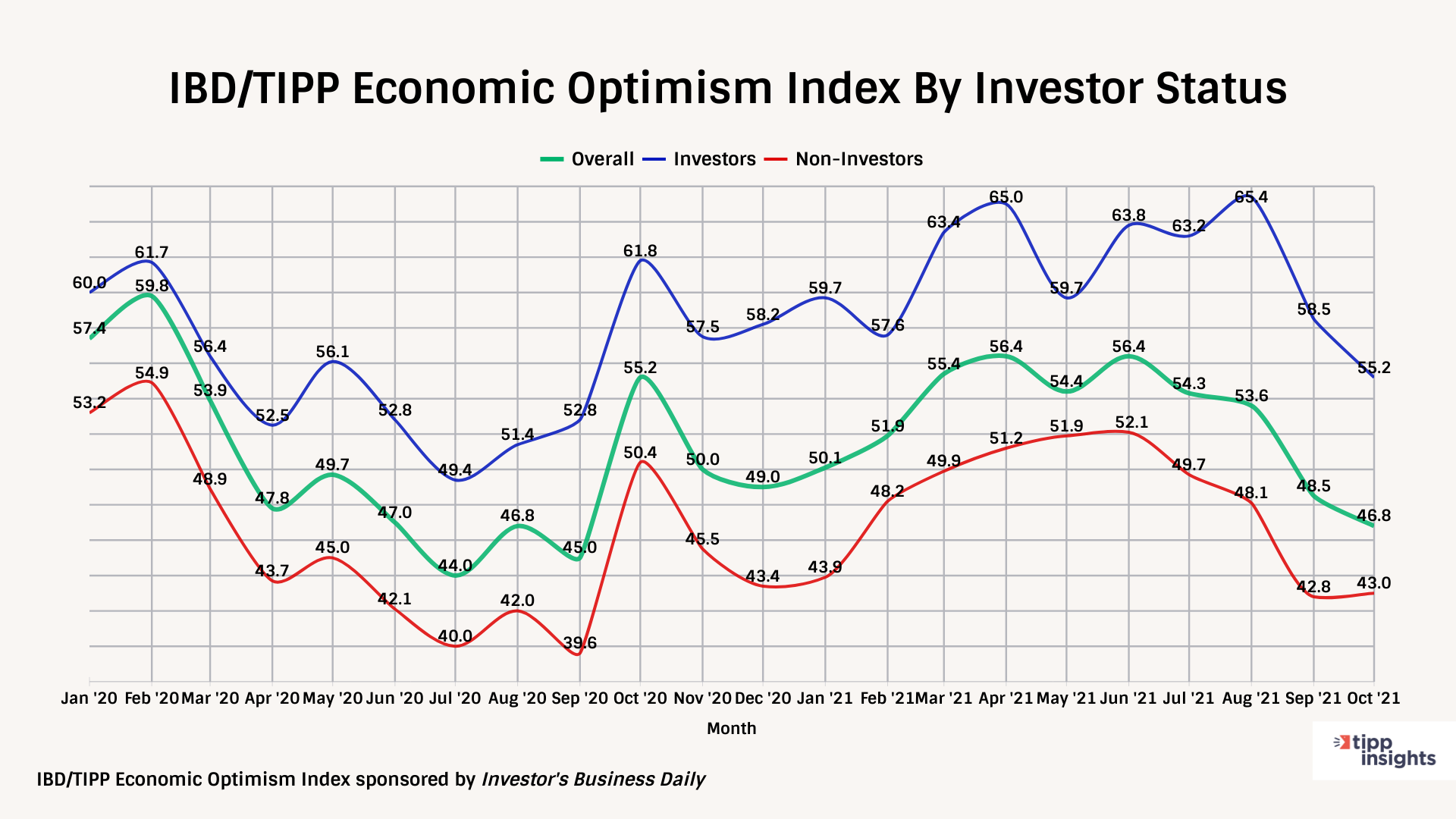

IBD/TIPP considers respondents to be "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan. We classified 30% of respondents who met this criterion as investors and the remaining 65% as non-investors. We could not ascertain the status of 5% of respondents.

The economic optimism gap between investors and non-investors is 12.2 in October, down from 15.7 in September. The current wobbly stock market is dampening investors' confidence. In September, the Dow Jones index fell nearly 4.3 percent due to concerns about inflation and China's soft economy.

In August, the economic optimism gap between investors and non-investors was 17.3 points, a record high in the 20-year history of the IBD/TIPP Economic Optimism Index.

In October, non-investors increased from 42.8 to 43.3, which implies the overall decline can be attributed to a 3.3-point drop in investor confidence.

Momentum

Comparing a measure's short-term average to its long-term average is one way to detect its underlying momentum. For example, if the 3-month average is higher than the 6-month average, the indicator is bullish. The same holds if the 6-month average exceeds the 12-month average.

In October, all three index readings were lower than their three-month moving averages, indicating a slowdown. Furthermore, the three-month moving averages for all the components and the Economic Optimism Index are lower than the six-month moving average.

As a result, the data presents a convincing picture of a slowdown.

Demographic Analysis

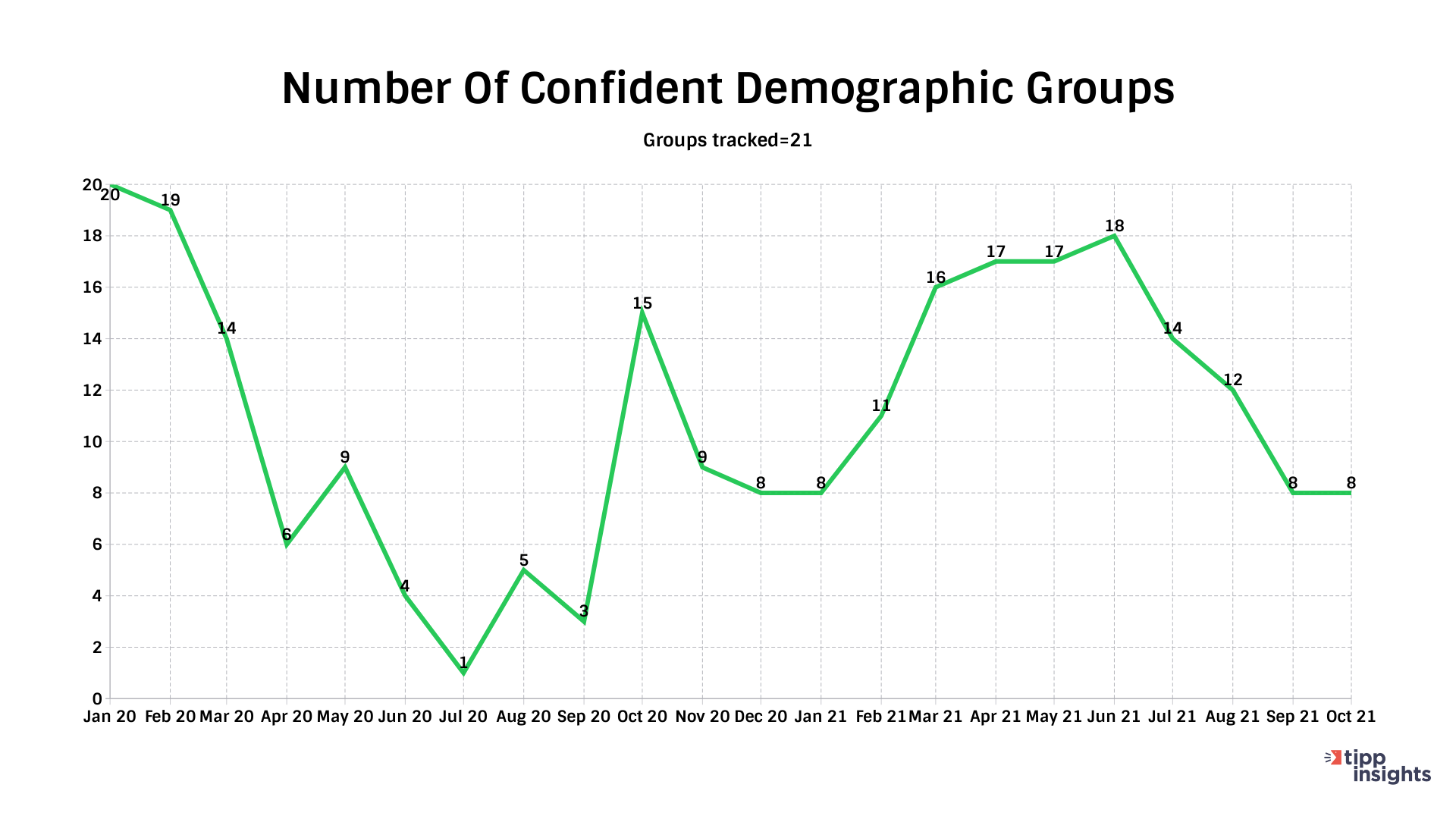

The number of groups in the positive zone indicates the breadth of optimism.

This month, eight of the 21 demographic groups we track — such as age, income, education, and race — are above 50.0, indicating optimism on the Economic Optimism Index.

Starting with eight groups in January 2021, we saw steady improvement, peaking at 18 groups in June, and then a steady decline to return to eight groups in September.

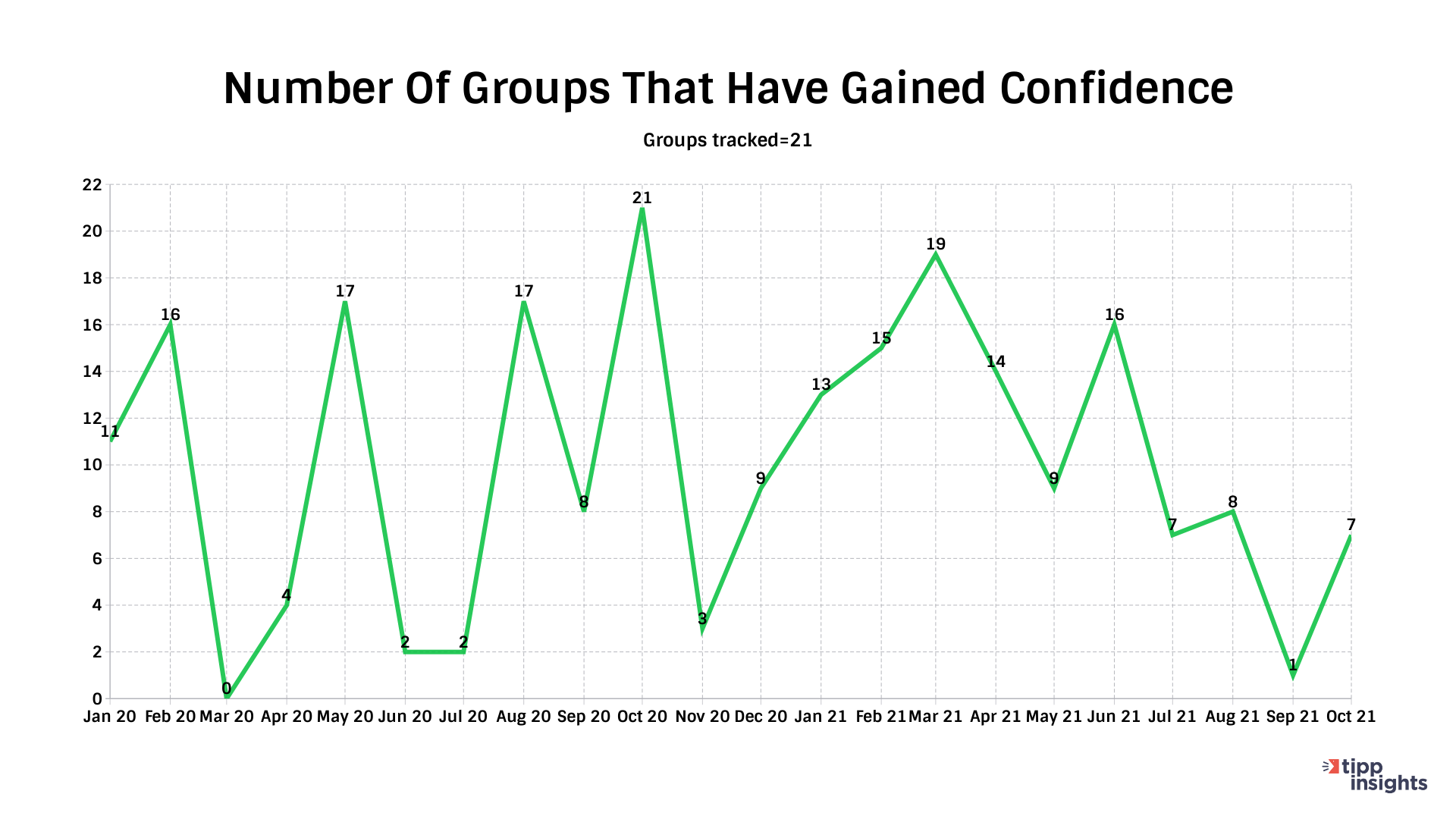

Seven of the 21 groups increased in confidence in October compared to one in September.

Inflation

Personal Consumption Expenditure (PCE) stands at 4.2 percent, with PCE excluding food and energy at 3.6 percent. Inflation acts as a form of indirect tax on American households.

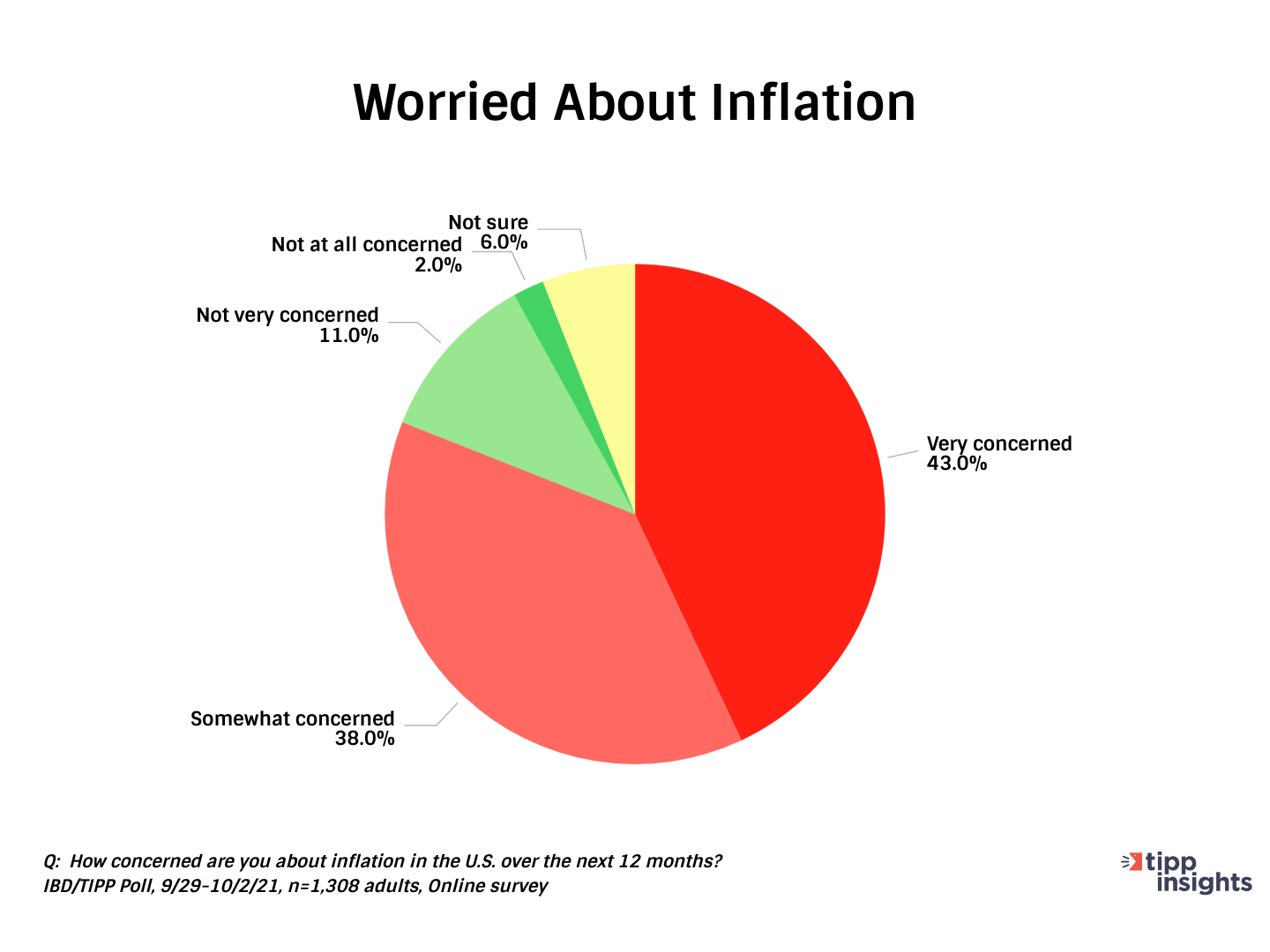

According to the IBD/TIPP Poll, 81% are worried about inflation. Price increases in energy, food, and groceries can cause a perceptual shift, causing consumers to cut back on their spending.

Some think that inflation is likely to peak. But others believe that it will persist in the foreseeable future. In a recent I&I/TIPP Poll, 68% believed that inflation would be a long-term problem that will be with us for a while.

The Federal Reserve believes that long-run inflation of 2%, measured by the annual change in the price index for personal consumption expenditures, is most consistent with its maximum employment and price stability mandate.

Federal Reserve Chairman Jerome Powell told lawmakers last week that the Fed still expects the high inflation to end, but it is difficult to predict when that will happen. "We have an expectation that high inflation will abate because we think the factors that are causing it are temporary and tied to the pandemic and the reopening of the economy," Powell said.

To boost liquidity, the Fed has been purchasing $120 billion in government-backed bonds each month -- $80 billion in Treasury debt and $40 billion in mortgage-backed securities. Fed may announce in November its intention to start tapering the bond purchase program.

Recession

In July, the National Bureau of Economic Research's Business Cycle Dating Committee determined that the recession started in March 2020 and ended in April 2020. The recession lasted just two months, making it the shortest on record in the United States. May 2020 was the first month of the expansion.

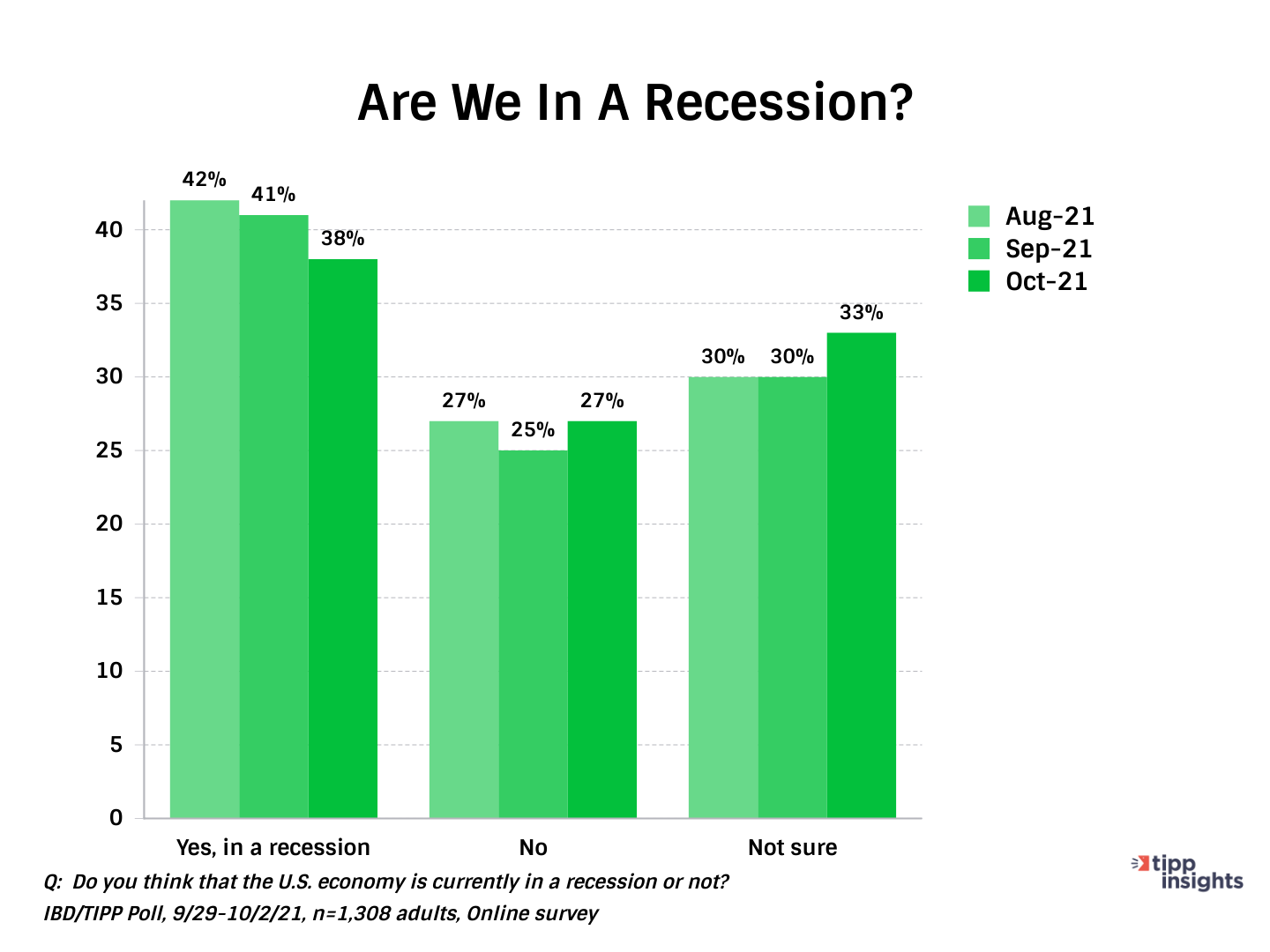

However, the economy has not yet returned to normalcy, as evidenced by our data. 38% of Americans believe we are still in a recession and another 33% are unsure. 27% believe we are not in a recession.

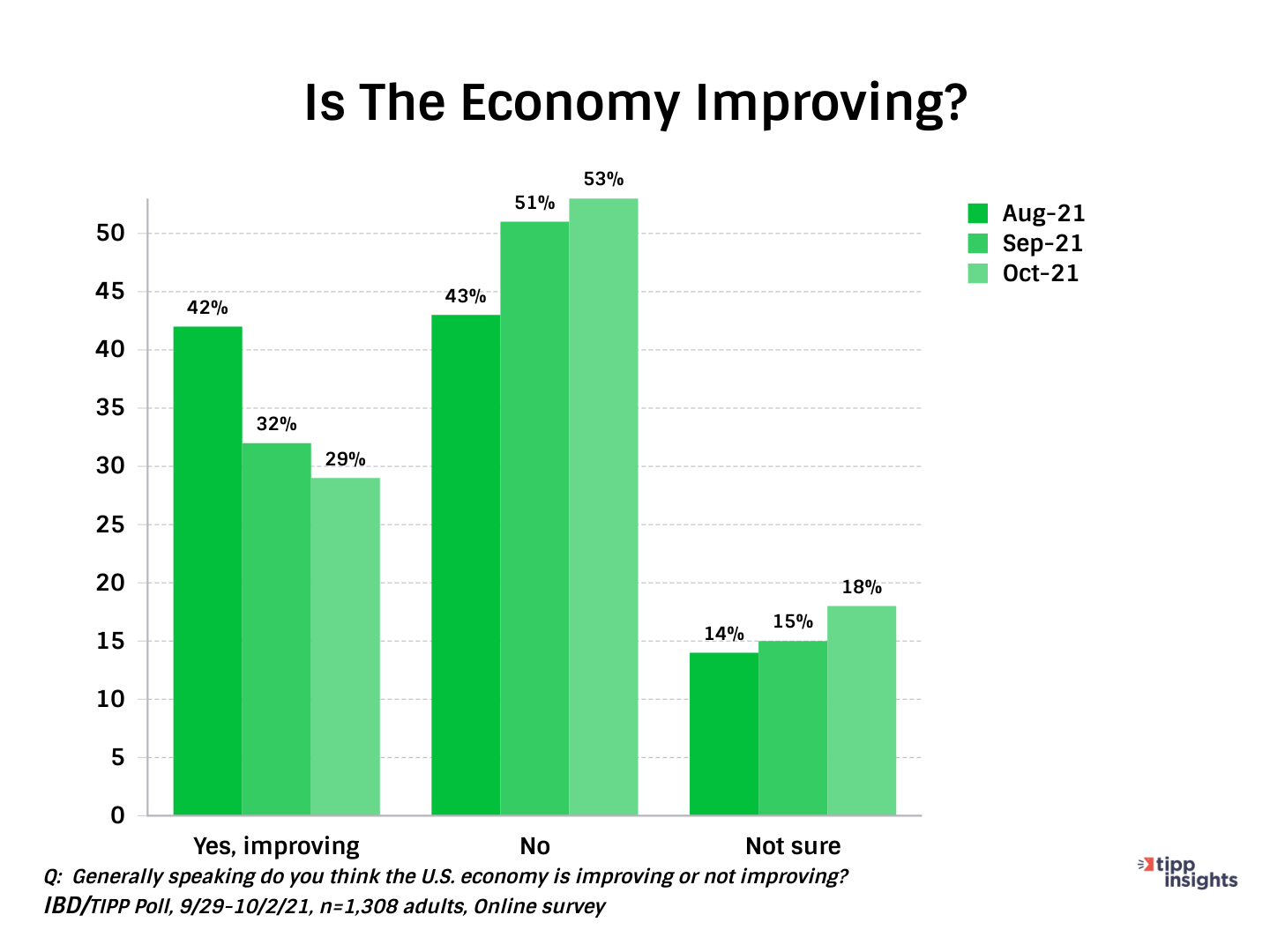

Those who believe that the economy is improving dropped precipitously from 42% in August to 32% in September to 29% in October. Over one-half (53%) think the U.S. economy is not improving.

Fiscal Profligacy

Washington is busy deliberating a massive $3.5 trillion social spending package with tax increases and a $1.1 trillion infrastructure plan. A recent I&I/TIPP poll found that most Americans want the government to cut spending to rein in inflation.

The overall economic confidence is gloomy. We are at a pivotal junction, and October will be a critical month for the economy.

The risks on the downside outweigh those on the upside. Watch the real estate market, the stock market, the job market, and if Washington can pass spending bills.

Inflation is here to stay for the foreseeable future. Whether wage growth will keep pace with inflation remains to be seen. If inflation intensifies, it could dampen economic confidence further.

TIPP polled 1,308 adults nationwide from September 29 to October 2 via an online survey.

ICYMI

Larry Kudlow, former Director of the National Economic Council, Discusses TIPP Poll Results