After much marketing and promotion, Vice President Kamala Harris sat down with MSNBC's Stephanie Ruhle in Pittsburgh for a one-on-one interview. Again, the discussion was taped and edited. We are still awaiting a live interview that Harris would grant to someone a little less media-friendly and more objective than Ruhle, but this may never happen in the few short weeks left before November 5.

How anti-Trump and pro-Harris is Ruhle? As we said in a recent editorial, Ruhle effectively said that Harris doesn't have to answer any questions because Trump was such a terrible choice on Friday's taping of Bill Maher's HBO show.

Stephanie Ruhle: "If you don't like her answer, are you going to vote for Trump? Kamala Harris is not running for perfect, she is running against Trump. We have two choices. There are some things that you might not know her answer to. In 2024, we know exactly what Trump will do, who he is, and the kind of threat he is to democracy."

Bret Stephens of the New York Times, another anti-Trumper: "The problem that a lot of people have with Kamala is that we don't know her answer to anything."

Ruhle: "But you know his answer to everything."

Stephens: "People are also expected to have some idea of what program you're supposed to vote for. I don't think it's a lot to ask for her to sit down for a real interview."

Ruhle: "When you move to Nirvana, I'll be your next-door neighbor. We don't live there."

The Harris campaign watched this exchange and agreeing to a sit-down with Ruhle was a good idea. Nothing could possibly go wrong with an interviewer who was so out-and-out pro-Harris.

But what a disaster the interview turned out to be. Harris seemed clueless as she attempted to answer basic questions on the economy. She employed a new word three times in under 15 seconds —holistic—to describe her housing policy.

Looking holistically at the connection between that and housing and looking holistically at the incentives we in the federal government can create for local and state governments to actually engage in planning in a holistic manner that includes prioritizing affordable housing.

Holistic is a term used by management consultants, college admissions officers, and some doctors. It means considering the whole thing and not just pieces of a puzzle. When a college looks at a high school student's application, it will examine not just the SAT scores but also other elements of the student’s profile, such as grades, essays, recommendation letters, extracurricular activities, and community service. WebMD describes a new type of medicine - holistic medicine - which considers the whole person: mind, spirit, and body.

We suppose some bright staffer on her campaign told her to use the word “holistic” because the federal government can't directly influence developers to build homes—bringing in local and state governments would make it whole.

When asked how Harris would pay for her $1.8 trillion boondoggle, which promises $25,000 in retail housing down payment assistance and tax breaks to real estate developers (we wondered, cheekily, if the Trump organization would also receive these tax breaks), she resorted to the usual, tried and tested mantra: The big corporations and the wealthiest billionaires "have to pay their fair share."

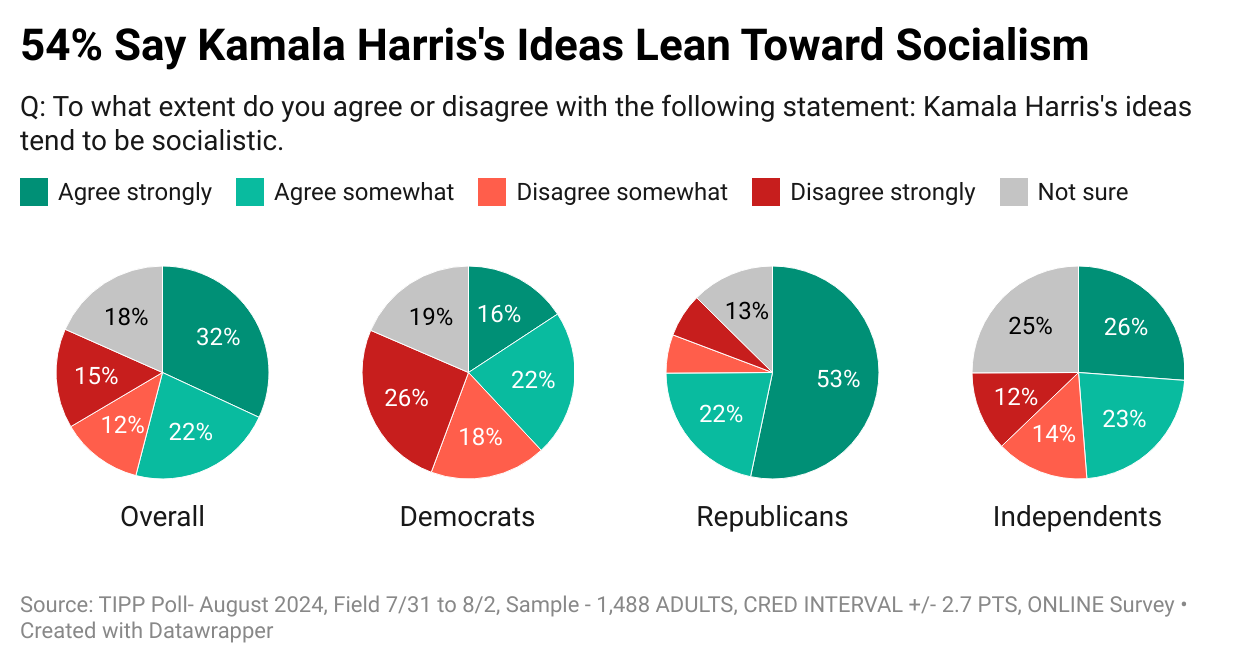

Her reliance on such rhetoric aligns with public perceptions. Fully 54% of Americans believe that Kamala Harris’s ideas tend toward socialism, as shown in a recent TIPP Poll:

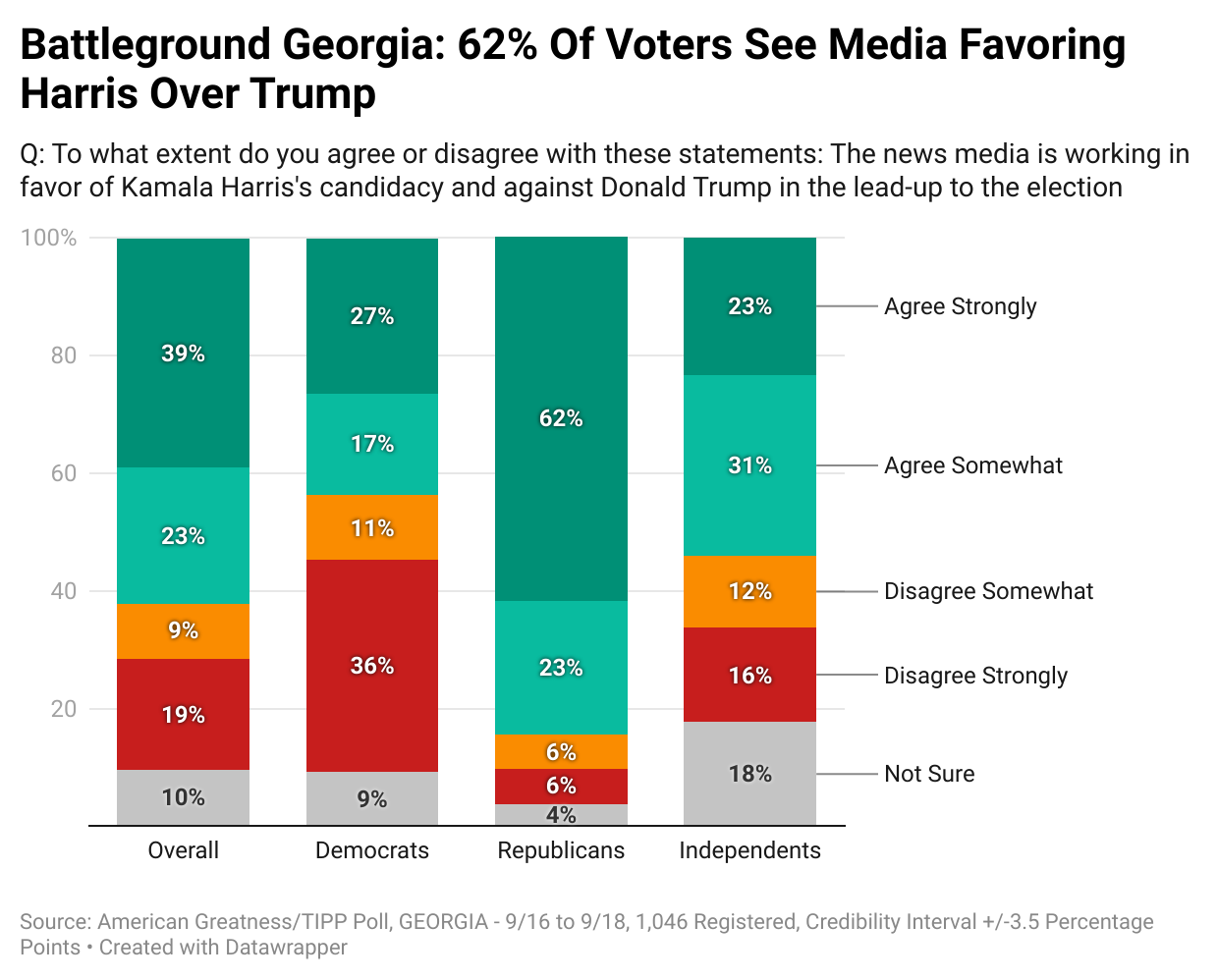

Similarly, in battleground states like Georgia, voters believe that the media is working in favor of Harris and against Donald Trump, as a recent TIPP Poll shows:

Ruhle: "Expanding that tax credit, or you mentioned housing before, giving that extra money for a first home. If you can't raise corporate taxes, or if the GOP takes control of the Senate, where do you get the money to do that? Do you still go forward with those principles and borrow?"

Kamala Harris: "Well — but we're going to have to raise corporate taxes, and we're going to have to raise — we're going to have to make sure that the biggest corporations and billionaires pay their fair share. That's just it. It's about paying their fair share. I am not mad at anyone for achieving success, but everyone should pay their fair share, and it is not right that the teachers and the firefighters that I meet every day across our country are paying a higher tax than the richest people in our country."

Let us unpack the numbers.

According to SmartAsset, an online resource for consumer-focused financial information and advice, the top 1% of earners make $787,712 nationally. [In 2021, nearly 1.5 million tax returns in the U.S. met this criteria]. These families pay a whopping 40% of all federal income taxes. Households making above $400,000 but less than $787,712 contribute about 30% of federal income taxes. [Harris repeated that she would not raise taxes on any household making less].

In effect, the top 3% of income earners already pay 70% of federal income taxes. Still, Kamala Harris says that these families are not paying their fair share. How much more can she sock them for? And even if she did, wouldn't those additional funds first go to pay our existing annual two-trillion-dollar deficits, then retire the existing $35 trillion debt, and only then be used for new government spending? As expected, Ruhle did not pose any of these follow-up questions.

Harris repeated her charge on tariffs saying that Trump's tariffs would amount to a $4,000 sales tax increase. Last week, our columnist debunked Harris's false charge with a detailed analysis, including an example of how retail purchases happen in the real world.

Harris also showed how profoundly ignorant she was about capitalism, although she claimed in an earlier speech that she was a capitalist: "Well, listen, I work with a lot of CEOs; I have spent a lot of time with CEOs. And I'm going to tell you that the business leaders who are actually part of the engine of America's economy agree that people should pay their fair share."

No, they don't. An individual CEO may agree to pay more, but talk is cheap. Given the tax laws today, why do wealthy CEOs not voluntarily contribute to the IRS more than what they legally owe in taxes?

In capitalism, the CEO's role is to satisfy the stakeholders— investors, employees, customers, and suppliers. [The government is not a stakeholder unless it is a customer]. CEO pay is directly related to the company's performance on the stock market, which is directly related to profits and revenue growth.

To this end, CEOs are always looking to cut costs, and one way to do this is to move their companies to jurisdictions that tax less. Kamala Harris should know. Some of the largest and most profitable companies based in highly taxed California—Oracle, Tesla, Charles Schwab, Palantir, HP Inc, Toyota Financial, McKesson, and Chevron—have all recently moved or announced a move to Texas, a state with no corporate income tax or personal income tax for employees. The average CEO wants to pay less in tax, not more.

America is ready to vote on November 5. But Harris shows again that she is woefully unprepared to take over as the leader of the Free World.