They were certain from the start. The day Donald Trump returned to the Oval Office in January 2025, the alarms went off across the economics establishment. Tariffs, trade wars, policy chaos. The verdict was unanimous: Recession loomed, stagflation threatened, and America would soon pay for its electoral choice.

Project Syndicate, the high-gloss clearinghouse of elite economic anxiety, amplified the chorus. Nobel laureate Joseph Stiglitz, long the profession’s most unrelenting critic of Trump, warned that the United States had become “a scary place to invest.” Former Treasury Secretary and perennial Cassandra Larry Summers labeled the tariff agenda a “self-inflicted supply shock,” later escalating it to the “biggest self-inflicted wound in economic history.” Goldman Sachs, Barclays, and others hiked recession odds to fifty percent or more after April’s sweeping tariff announcements. This time, the models insisted, disaster was not just likely; it was inevitable.

The forecast was clear and confident. Broad tariffs of ten to twenty percent on most imports, twenty-five percent on steel, aluminum, and autos, and sixty percent on Chinese products. Prices would surge. Supply chains would fracture. Inflation would re-ignite toward four percent or higher. Growth would grind to a crawl, with some surveys pegging 2025 GDP barely above zero and recession probabilities at coin-flip levels. Immigration limits were expected to compound the damage through acute labor shortages, rising wages, and squeezed margins. Yet those shortages largely failed to materialize as enforcement ramped gradually and native-born labor force participation edged higher. It all fit the textbooks perfectly, airtight logic built on decades of macroeconomic orthodoxy.

But the economy refused to follow the script. No recession materialized; the NBER never declared one. After a weak first quarter distorted by import front-loading, growth rebounded sharply. Q2 came in near 3.8 percent. Q3 surged to 4.3 percent, the strongest pace in two years. Q4 tracked around 3 percent. Full-year growth settled near 2 to 2.5 percent. Not a boom, but far from a collapse. Inflation cooled to about 2.7 percent by November, with core measures slipping below three. Tariffs raised prices in some sectors, but the feared spiral never materialized. Unemployment ticked higher to around 4.6 percent after federal cuts and corporate caution, yet consumer spending held up, profits remained intact, and the labor market never cracked. Markets were volatile, but they did not break.

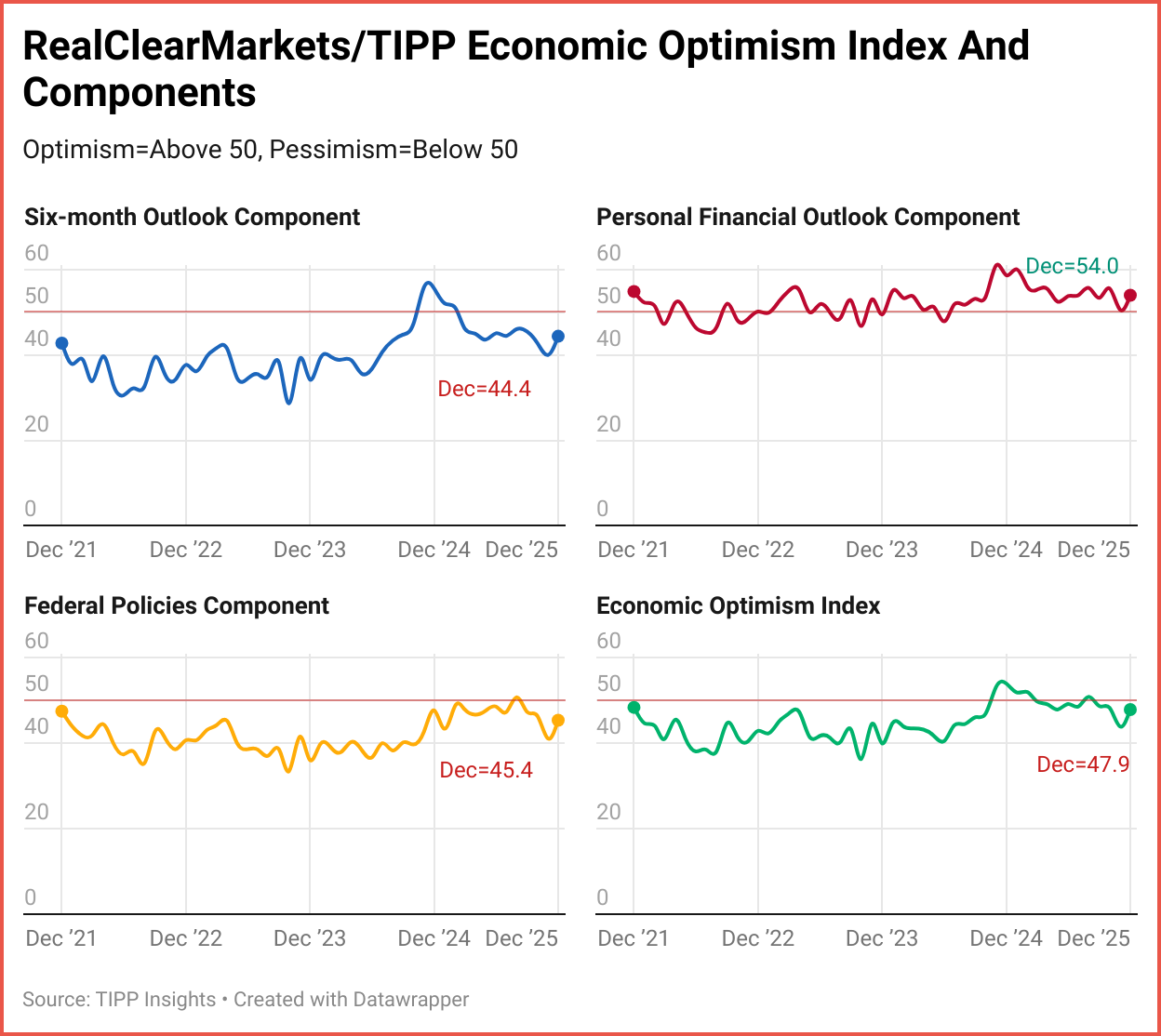

Consumer sentiment is finally turning higher. In December, the RealClearMarkets/TIPP Economic Optimism Index recorded its strongest monthly improvement in months, with gains across all three components. While overall optimism remains just below the neutral 50 mark, the direction is what matters. Rising confidence signals a shift in household mood and helps explain the resilience showing up across the economy.

Why were the experts so wrong?

Because they were modeling a museum economy. A world of static equations, frictionless trade, and obedient capital flows. Trump was operating in a universe of negotiation, leverage, timing, and political theater. Tariffs were announced boldly but implemented pragmatically. Delays were inserted. Exemptions carved out. Electronics protected. Partners accommodated through side deals. Firms stockpiled, rerouted, and adapted. The Liberation Day shock never fully landed. At the same time, AI-driven investment surged, wage gains and savings supported demand, and businesses moved faster than the models allow for. The deepest error was not technical. It was human. The forecasting class underestimated behavior, resilience, and the ability of people and markets to bend around disruption. The classroom to op-ed pipeline proved no match for a living economy.

There is another blind spot in the economists’ warnings. They have quietly redefined stagnation as normal. GDP remains the broadest measure of economic health because it captures consumption, business investment, government activity, and trade. For most of modern American history, real GDP growth averaged about 3.2 to 3.5 percent annually from the postwar era through 2000. That was not an outlier era. It was the baseline that built the middle class, expanded opportunity, and lifted incomes across the spectrum.

Over the last quarter century, that baseline collapsed. Trend growth slipped to roughly 2 percent and often lower in the 2000s and 2010s. An entire generation of economists came of age treating that as the new ceiling rather than a policy constrained floor. As a result, anything that hints at a return to a higher growth regime is now dismissed as unrealistic before it is even tested.

But the ingredients are no longer theoretical and they are showing up in the data right now. Capital spending is accelerating, with major hyperscalers such as Amazon, Microsoft, Alphabet, Meta, and others on track for roughly 400 billion dollars in AI related investment in 2025, contributing roughly 1–1.2 percentage points directly to 2025 GDP growth. Artificial intelligence is pulling forward productivity gains, with early evidence linking higher genAI exposure to extra output in affected sectors and broader estimates suggesting 0.3–1.5 percentage points added to annual productivity over the coming decade. Energy prices have fallen sharply, with Brent crude spot around 61 dollars per barrel late 2025 and the full year average in the low 70s. This feeds through hundreds of input categories across the economy and acts as a broad based cost reduction that lifts real incomes.

The last full calendar year with real GDP growth above 5 percent was 2021, a post pandemic rebound of roughly 5.7 to 6.1 percent, while the tech boom of the late 1990s delivered sustained rates of 4 to 6 percent. That distance in time is precisely why economists no longer imagine it. Not because it is impossible, but because they have forgotten what real expansion looks like.

The question for the professors is simple. When does the mea culpa begin?

👉 Quick Reads

I. AI Is Rebuilding America’s Growth Engine

After decades of settling for 2 percent growth, new AI investment is finally pushing the economy back toward a higher-productivity future.

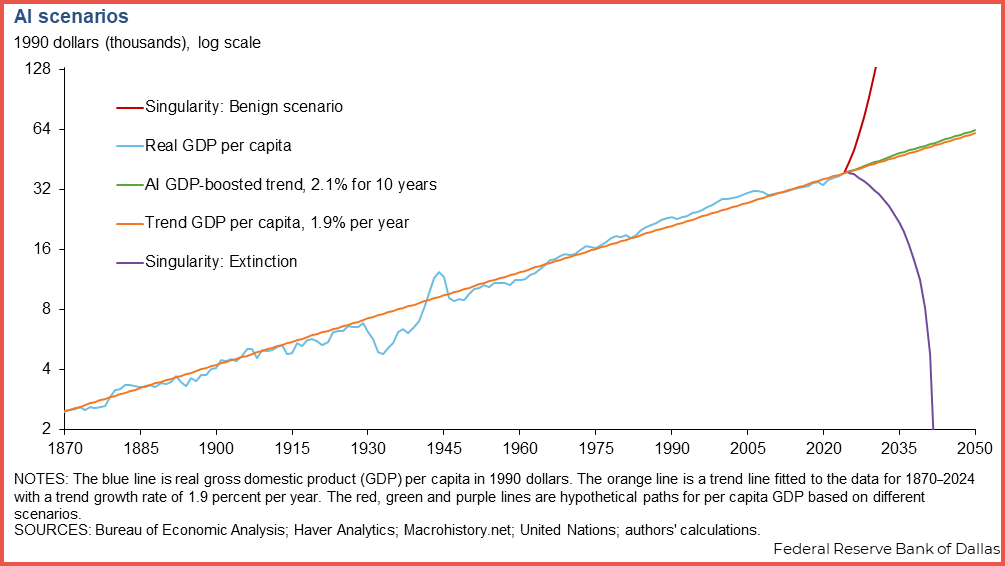

How to read this chart

This chart tracks how much the average American produces each year, which is a simple way to think about living standards.

For more than 150 years, the line has risen at about the same steady pace, roughly 2 percent a year, no matter what was happening in the world. Wars, recessions, oil shocks, computers, the internet, nothing broke the long-term climb.

- The orange line shows that steady historical path continuing into the future.

- The green line shows what happens if artificial intelligence quietly makes workers a little more productive each year. The economy grows faster and living standards rise higher over time.

- The red and purple lines show extreme science-fiction outcomes that almost nobody expects.

The message is simple. AI is not about overnight miracles. It is about adding a little extra lift to growth every year, and over time that small lift can make America meaningfully richer.

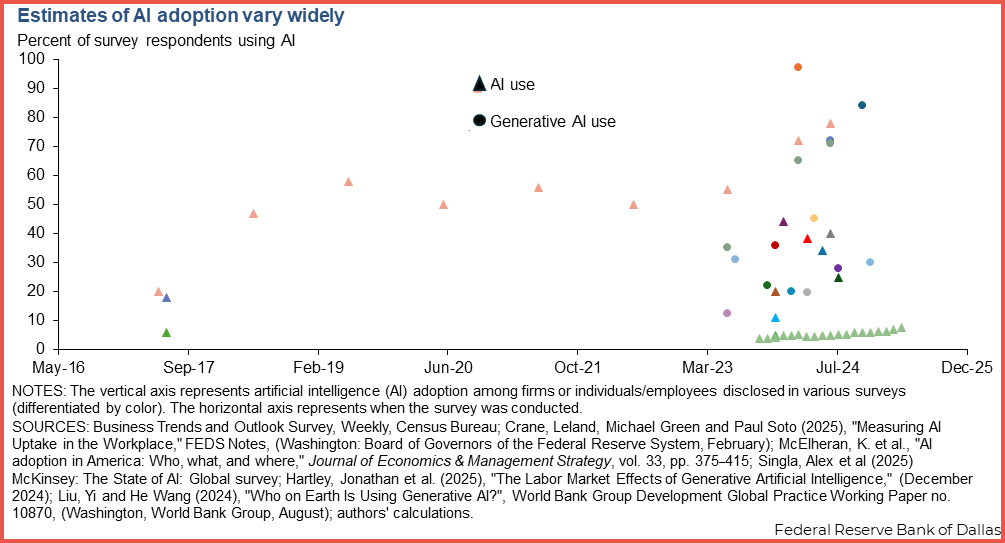

II. The AI Boom Is Still In Its First Inning

Only a minority of workers are using AI today, which means the biggest productivity gains are still ahead as adoption spreads across the economy.

The TIPP Stack

Handpicked articles from TIPP Insights & beyond

1. Minnesota Fraud Controversy Shakes Capitol Hill—George Caldwell, The Daily Signal

2. Somali Scammers Allegedly Stole Almost As Much In Minnesota As Entire Somalia GDP—Harold Hutchison, DCNF

3. 7 Big Border And Immigration Moves Of 2025—Virginia Allen, The Daily Signal

4. How Charlie Kirk’s Murder Changed Trump’s Life—Salena Zito, The Daily Signal

5. Chloe Cole On Faith And Her Newfound Wholeness—Quinn Delamater, The Daily Signal

6. Hunter Biden’s Still Lying: ‘There Is No Laptop’—Tim Graham, The Daily Signal

7. ‘Just Snapped’: Jan. 6 Pipe Bomb Suspect Brian Cole Jr.’s Confession Revealed In Court Docs—Harold Hutchison, Daily Caller News Foundation

8. Let Students Read The Whole Book—John Goyette, The Daily Signal

9. What Elias-Led Anti-Trump Group Is Now Suing Admin Over—Fred Lucas, The Daily Signal

10. Experts Talk Top Midterm Election Issues—Jacob Adams, The Daily Signal

11. When The Arbiter Becomes The Obstructor—Editorial Board, TIPP Insights

From TIPP Insights News Editor

12. Russia Deploys Nuclear-Capable Oreshnik Missiles In Belarus

13. Zelensky Rejects Territorial Withdrawal After Trump Meeting

14. Europe, Canada Review U.S.-Led Ukraine Peace Push

15. Taiwan Condemns China’s Missile Drills As Provocative

16. U.S.-Iran Tensions Rise Following Trump Remarks On Strikes

17. U.S. Military Reports Two Killed In Latest Anti-Drug Strike

18. India Surpasses Japan To Become World’s Fourth-Largest Economy

19. Copper Prices Surge As Data Centers Drive Demand

20. Hunt For Missing MH370 Flight Restarts In Indian Ocean Using Advanced Technology

21. Zuckerberg’s Meta Acquires China-Founded AI Firm Manus

22. Scientists Say 2025 Broke Key Global Warming Threshold

📊 Market Mood — Wednesday, December 31, 2025

🟩 Futures Slip Into Year-End

U.S. futures tick lower on the final trading day of 2025 as thin liquidity keeps conviction muted.

🟧 Fed Minutes Cool the Tape

Deep divisions over 2026 rate cuts in the latest Fed minutes unsettle investors, reinforcing caution after three straight down sessions.

🟦 Santa Rally Fizzles

Seasonal optimism fades as late-December profit-taking drags stocks lower instead of higher.

🟪 Light Data, Technical Trade

With little fresh data and early bond-market closures, markets are being driven by positioning and year-end adjustments.

🟫 Close the Books

It’s a quiet finish to a strong year, with traders looking past today and toward the first signals of 2026.

🗓️ Key Economic Events — Wednesday, December 31, 2025

🟩 8:30 AM ET — Initial Jobless Claims

A final read on labor-market conditions to close out 2025.

🟧 10:30 AM ET — Crude Oil Inventories

Year-end update on U.S. stockpiles, with implications for oil prices heading into the New Year.

editor-tippinsights@technometrica.com