What happens in Europe generally makes it to North America eventually.

Brexit, a movement against statist control and globalization forces in Brussels, the EU capital, was the precursor to Donald Trump's rise in 2016. Norway and the Netherlands were the first to ban the sale of new cars with internal combustion engines, as soon as 2025, a move that President Biden copied for two-thirds of all U.S. automobile production by 2032, a far more relaxed schedule.

And as we warned six weeks ago, labor strikes protesting high living costs driven by inflation, have now arrived in North America and are here to stay.

Canada, with a March inflation rate of 4.3% (not as high as other Western economies), has seen multiple examples of labor unrest in its organized government sector. The vast country has a much lower population density than the United States, with about one person to every nine in America. But, the Canadian bureaucracy is large, reflecting the country's liberal vision of offering cradle-to-grave benefits in return for extremely high taxation.

On May 1, the Public Service Alliance of Canada (PSAC) union, which had been striking against the Canadian government, said it wrested a wage increase of 12.6% over four years for nearly 120,000 government workers, including a one-off payment of C$2,500 (US$1,845). But strike action continues across the country for 35,000 members at Canada Revenue Agency, a move that has delayed the processing of tax returns and providing essential services. At least a dozen more unions are in separate talks with the government.

Beginning this week, every American will feel the impact of labor strikes as many live television programs will go dark. Hollywood writers will stop working in a wage dispute with the studios. While the disagreements are more technical, involving revenue sharing for shows that stream, the underlying cause is inflation. According to the Writers Guild of America organizing the strikes, median weekly writer-producer pay has declined by 4% over the last decade. But adjusted for inflation, the decline is 23%. AFP News reported that other Hollywood unions have voiced solidarity with writers, including the actors' SAG-AFTRA, and the directors' DGA. Both will hold their own talks with studios this summer.

While those who win wage increases legitimately celebrate, Milton Friedman's warning about inflation comes to mind: "Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output."

What Friedman said was that more money in the pockets of families will tend to exacerbate the inflationary picture, not help it. Businesses attempting to recover losses from slower economic activity will try to raise the price of goods and services, knowing that families with the extra cash can afford such an increase. Central banks, attempting to slow down inflation, will tighten the money supply through higher interest rates and stricter lending, resulting in even higher costs for families. Workers will then strike again, demanding even higher wages. It is difficult to stop this cycle.

But for businesses facing labor strife, not increasing worker pay and quickly coming to a settlement is not an option either. Companies, already hit by very low service-quality levels because of worker shortages during Covid, are struggling to lure back customers. Disruptions or slowdowns from strikes turn customers away, resulting in falling revenues, profits, and share prices.

Inflation is a conundrum from which there is no escape.

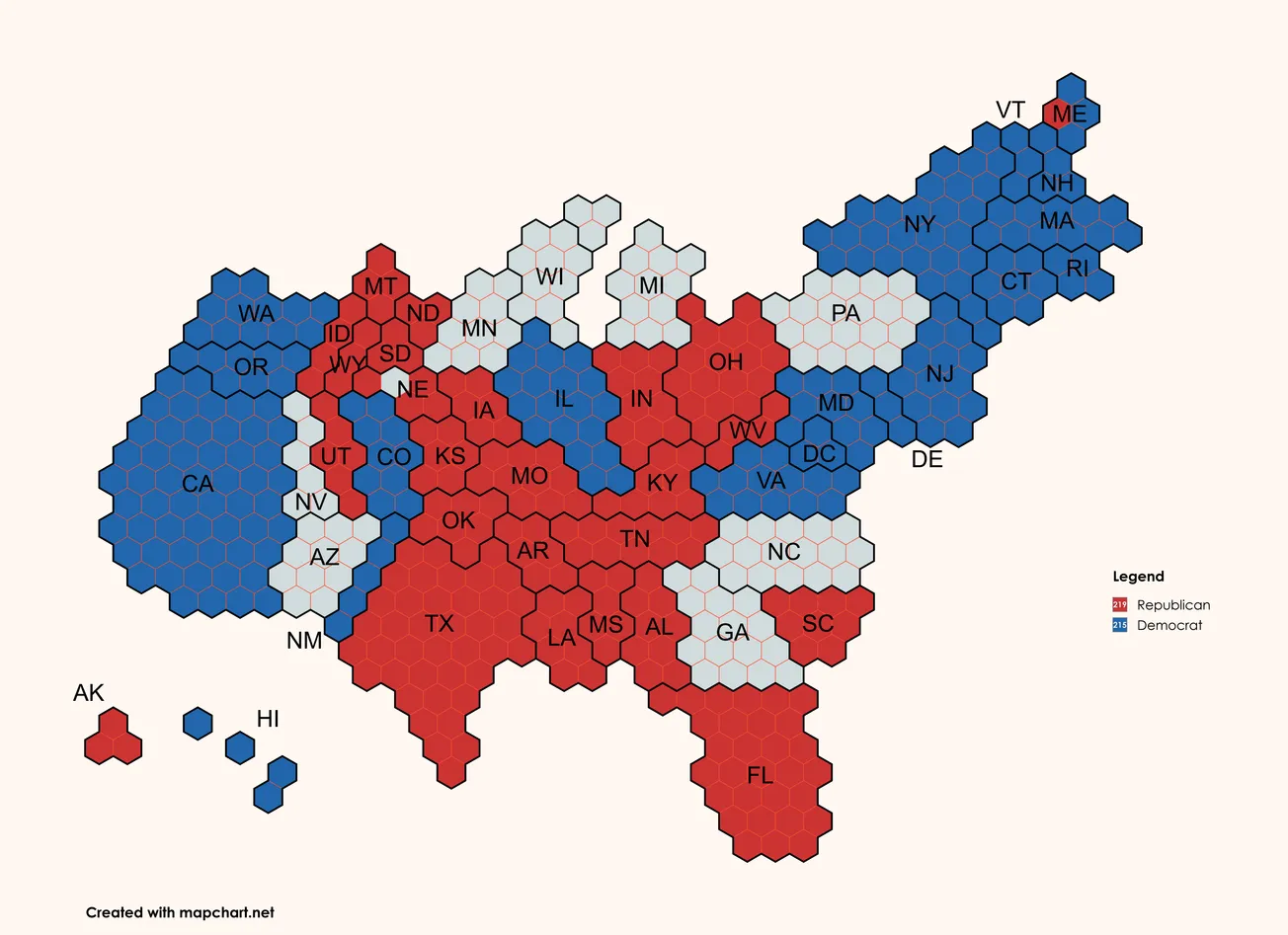

To make the macroeconomic picture worse. and to further add to woes brought about by inflation, the Biden administration warns that the Treasury will likely run out of money to honor government obligations by June 1. But President Biden is stubborn in not negotiating with the GOP House to lower federal spending as the cost to raise the debt ceiling. We do not hope the White House meeting with the four congressional leaders this week will do much as each side is digging into its position, playing with fire, as the government is heading towards default, a possibility that can have disastrous consequences.

Meanwhile, the war in Ukraine drags on as the American military spends billions of dollars each week that the government does not have and the next ten years of federal deficit spending will push America to nearly $50 trillion in debt. And on the monetary side, the Fed is expected to announce another rate increase this month to contain inflation - an increase that makes it even more difficult for families to cope.

Americans are justifiably exasperated with their Washington leaders, but are helpless to do anything about it. The 2024 elections are still 18 months away.

Want to understand inflation better? We recently wrote an explainer that sixth graders could understand. Everyone can benefit from it. Milton Friedman's Priceless Lessons On Inflation

Want to support our work? Become a paid subscriber!