By Steve Cortes, Patria with Steve Cortes | January 16, 2025

Polling proves that Americans remain understandably anxious about Biden’s inflation nightmare. That gloom is well-founded, as evidenced by recent tumult in bond markets, which send fixed income prices plunging, meaning soaring interest rates across the economy, from mortgages to credit card debt.

As interest rates leap higher, the biggest market on earth – US Treasuries -- signals that the economic handoff from Biden to Trump will present the biggest challenge for the 47th president’s incoming administration.

Biden’s legacy of failure is marked by astounding collapses, including America’s open border and the disastrous Afghanistan withdrawal. But the most painful Biden legacy of all revolves around pernicious inflation that punishes citizens everyday, especially those of modest means. After years of fiscal profligacy and reckless mismanagement of the federal debt by Treasury Secretary Janet Yellen, America now faces a fulcrum moment for fiscal policy.

The consequences for everyday Americans are far-reaching, and the potential political ramifications could last for several election cycles going forward. It is imperative, therefore, that Trump’s entire team plus Republican leaders on Capitol Hill rise to the urgency of this economic moment. This mess was not created by the America First movement, but the task of clean-up nonetheless falls upon the populist Right.

Americans grasp this reality, as revealed in my latest nationwide survey of voters. My advocacy group the League of American Workers commissioned polling firm TIPP Insights which queried 1,510 voters who split for Trump by +1% nationally. When asked about the top priorities for the incoming administration, “controlling inflation” represented the number one issue, even ahead of “border and immigration enforcement” at number two priority. Women are especially insistent on this issue, with 55% naming inflation as the first or second highest priority for Trump. As the shoppers and CFO’s for many households, women are keenly aware of the inflationary ravages of so-called Bidenomics.

Regarding that persistent inflation, today’s bond market world harkens back to the 1990’s, when bond investors revolted against the leftist, big-spending ways of President Bill Clinton. His top political advisor James Carville remarked: "I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody."

Thankfully for America, those ‘intimidating’ bond traders did get their way. Clinton dialed back his mammoth spending agenda, including his wife’s attempted takeover of national healthcare, and he pivoted to the center and governed mostly as a moderate. Clinton had inclinations to reign in a far more radical way, yet the bond market collared him, ultimately ensuring that he would become the last reasonable national Democratic leader.

In this present era, Biden adds a staggering $1 trillion in new debt every 100 days. Combine that mountain of debt with steadily rising interest rates, and America risks entering a doom loop, a vicious and self-reinforcing cycle where just servicing the debt actually consumes the federal budget, rendering the nation unable to defend the homeland or care for the elderly.

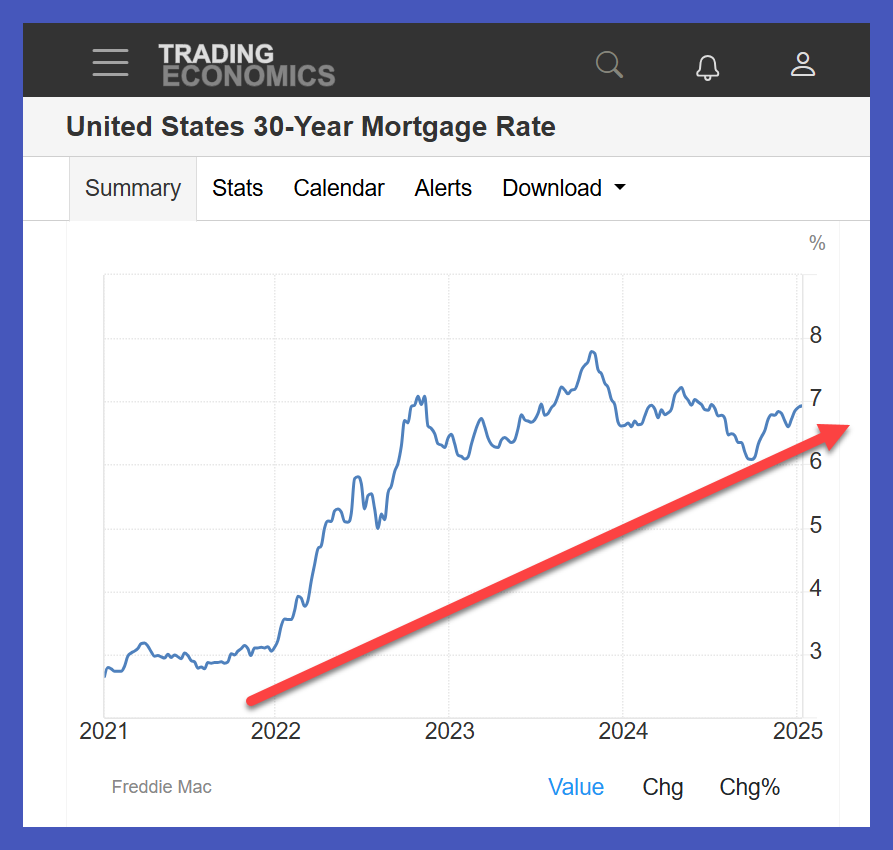

The recent spike in interest rates sends 30-year fixed mortgage rates again testing 7% on the upside, a level not seen in two decades until Biden inflicted such economy pain on America:

But it’s not just the sky-high present rates that should concern the incoming administration, it is also the trajectory of bond market expectations for inflation. These expectations can be quantified through real-world dollars, not just through sentiment gauges. Using ETF’s (exchange traded funds), where stock tickers represent bond holdings, see this trend of massive outperformance for inflation protected Treasuries via TIPS vs. regular Treasuries via IEF.

This uptrend shows that bond investors price-in more inflation and more pain ahead.

So, the situation is dire.

The economic baton pass is a dumpster fire. So, how can Trump and his very able team manage these risks, rein-in inflation, and restore broad prosperity?

First, fiscal restraint must take priority, including resetting discretionary spending back to pre-pandemic baselines. Initiatives like the Department of Government Efficiency, led by Elon Musk, can lead the effort to permanently cut wasteful programs and expenses, leading to long-term fiscal sanity.

But without touching entitlement programs, bigger structural reforms become a necessity to manage the mountain of debt already incurred. Specifically, a surge in productivity must unfold to forge a viable debt escape pathway. That kind of productivity explosion can flourish if the regulatory burdens of government are slashed at a truly historic pace, with an earnestness that meets the necessity of the economic moment.

If those kinds of structural reforms coincide with a true unleashing of America’s potential for full-spectrum energy dominance, then America can begin the tough task of fiscal reckoning. These processes grow in importance as Trump takes office, because of the possible near-term reflationary aspects of immigration control and tariffs. Those moves remain central as foundational pillars of the populist right movement, but they could also stoke a near-term inflation spike, unless offset by the disinflationary benefits of aggressive deregulation and an energy renaissance.

President Trump has earned incredible political capital through the most astounding electoral comeback in US history. But that momentum could be derailed without aggressive action to defang the inflationary handoff from Joe Biden. America is counting on its incoming “entrepreneur-in-chief” to rescue the country from this inflationary spiral and to restore broad prosperity.

Steve Cortes is former senior advisor to President Trump and JD Vance, former commentator for Fox News and CNN, and president of the League of American Workers, a populist right pro-laborer advocacy group.

Original article link