In recent years, we've learned to approach the opinions of leading economists, scientific experts, and talking heads with a healthy dose of skepticism. One notable exception is Jamie Dimon, the CEO of JP Morgan Chase, with whom we often find ourselves in agreement.

Since the beginning of the year, Jamie Dimon has offered three important insights for the nation.

Recession Warning

First, in early January, unlike many others who were rosy about the economy, Jamie was a "bear" like us. He warned of a potential recession. We agreed with him 100% and wrote about it in our monetary policy coverage. Here’s a recap of Dimon’s wisdom:

Credit is normalizing, but it's still lower. Stock prices are up. The consumer is in good shape. But the extra money that they got during COVID, trillions of dollars, that's kind of running out… It runs out this year. The government has a huge deficit, which will affect the markets. But I'm a little skeptical in this kind of Goldilocks scenario.

It might be [a] mild recession or heavy recession. I think they did the right thing to raise rates. I think it was a little late, and I think they're doing the right thing just to wait and see what happens... It takes a while to see the full effect of that... but all of those factors may very well push us to recession as opposed to a soft landing.

MAGA-Trump Lesson For Democrats

Dimon then went to Davos, Switzerland, to attend the World Economic Forum, where he had a wake-up call for Democrats. The Democratic leadership, which has nothing to show, was demonizing Trump as part of its reelection strategy. Dimon, who can’t be canceled, spoke reality to them:

I wish the Democrats would think a little more carefully when they talk about MAGA. I think this negative talk about MAGA is going to hurt Biden’s election campaign. When people say MAGA, they're actually looking at people voting for Trump, and they think they're voting — they're basically scapegoating them, that you are like him. But I don't think they're voting for Trump because of his family values.

He's kind of right about NATO. Kind of right about immigration. He grew the economy quite well. Tax reform worked. He was right about some of China.

Nation’s Debt

The third insight came in a recent panel discussion with the Bipartisan Policy Center this past Friday when he made news about his warnings about the nation’s debt.

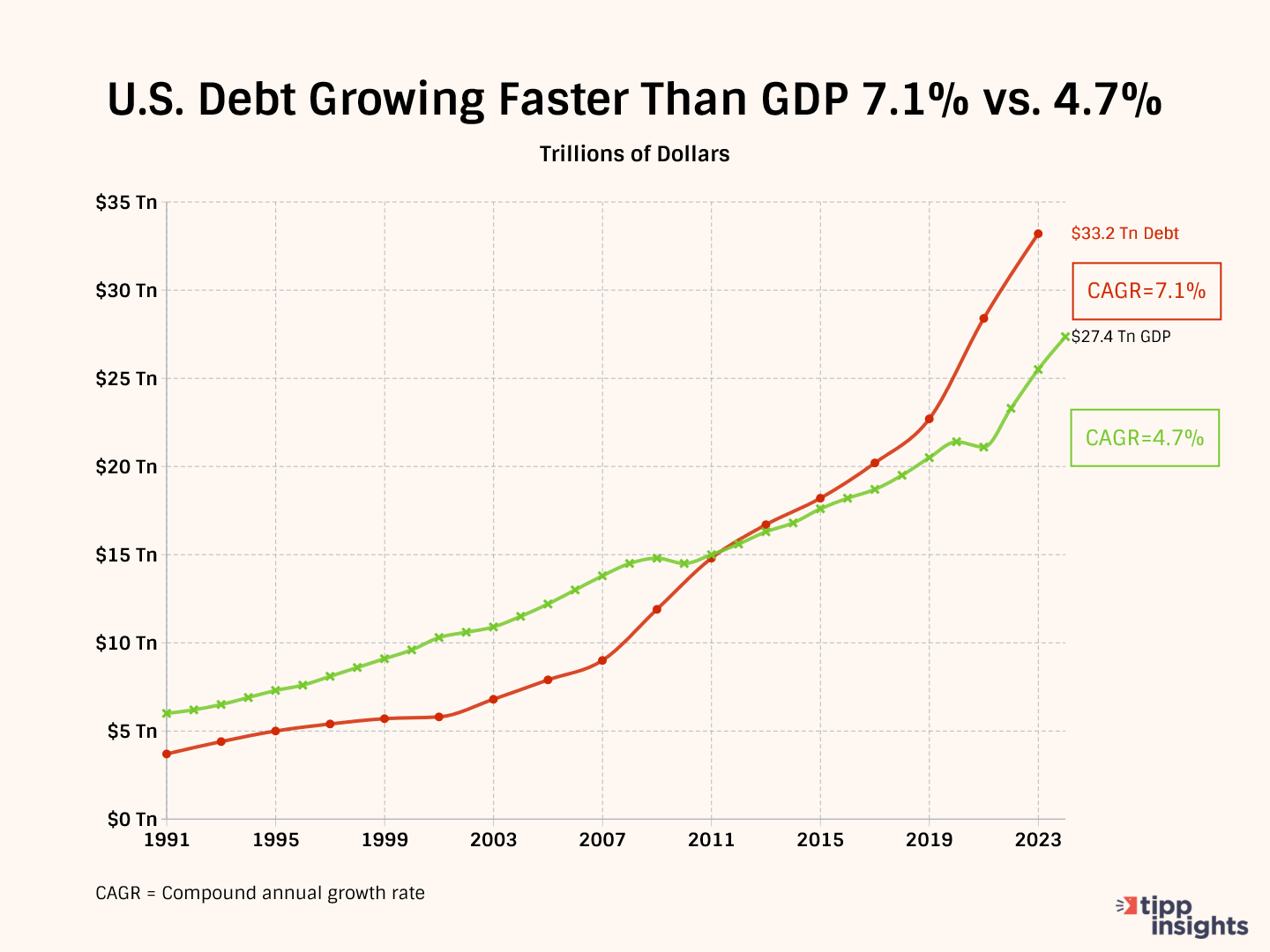

The U.S. is the most indebted nation in the world, with a debt load of $34 trillion. The current debt-to-GDP ratio is 120%, expected to reach 130% by 2035. We reported the dire straits here.

Dimon sees the debt situation as a looming crisis, comparing it to a "cliff" about ten years away, and warns that it will disrupt global markets when it hits.

It is a cliff. We see the cliff. It's about ten years out. We're going 60 miles an hour.

To drive home his point, Dimon compared the rising debt trajectory to a hockey stick that starts slow but eventually spikes up sharply.

That hockey stick doesn't start yet. We kind of got time. But when it starts, markets around the world ... there will be a rebellion.

Dimon warned America’s high level of debt endangers not only the U.S. economy but also global security:

This is about the security of the world. We need a stronger military; we need a stronger America. We need it now. So, I put this as a risky thing for all of us.

How?

Foreign entities, including countries like Japan and China, hold $7.6 trillion of US government debt, making it a global concern. The biggest lenders are:

- Japan - $1.1 trillion

- China - $782 billion

- U.K - $716 billion

- Luxembourg - $371 billion

- Canada - $321 billion.

A U.S. default would weaken these countries and could have geopolitical consequences, especially for military allies like Canada, the UK, and Japan.

Dimon compared the current situation to 1982, when high inflation, soaring interest rates, and economic challenges were prevalent, suggesting that the current high debt-to-GDP ratio and deficit during a strong economy are concerning.

So, in 1982, when inflation was 12%, and Paul Volcker had to do some of the really tough medicine, when I graduated school, the prime rate was 21.5%.

Unemployment, I think, was around 10%. So, stagflation is kind of the worst thing. The stock market hadn't gone up for 15 to 20 years. So, just, and then we had the Vietnam War, you know, we had all the guns and burden, and debt to GDP was 35%.

Today, it's over 100%. Back then, the deficit during the recession, so you do spend money in the recession, was, I'm going to say, 4% or 5%; today, it's 6.5% in a boom time.

America's wars since 9/11 have cost the nation over $8 trillion and were mostly paid for with borrowed money, which makes up a big part of the country's debt.

The interest to service the debt is expected to rise dramatically, with projections indicating that the U.S. will have to pay $2 trillion in interest alone by 2030, rising to $6.5 trillion by 2050 if not handled correctly. As interest payments rise, we must borrow more to finance them or cut our spending, including in crucial areas like education and health care programs.

Of course, our leaders in Washington feel no urgency and have suspended the debt ceiling until 2025 after the election, thanks to the deal passed in the summer of 2023.

We thank Jamie Dimon for talking sense and calling a spade a spade.

May God Bless America!