The latest U.S. jobs report delivered a welcome surprise: the labor market continues to add jobs at a steady pace, easing fears that the economy might be slipping toward a sharp slowdown.

According to the Bureau of Labor Statistics, employers added 130,000 jobs in January, more than twice the expected 55,000. The unemployment rate ticked down to 4.3% from 4.4%, extending a modest but encouraging improvement.

The data, delayed nearly a week due to the partial government shutdown, suggests that hiring momentum remains intact despite concerns over interest rates, global uncertainty, and political turbulence.

Yet the real story lies beneath the headline numbers.

Several analysts identified a particularly constructive shift in hiring. Most of the employment gains appear to come from full-time work rather than part-time positions, indicating a stronger labor demand and potentially higher job quality. Construction employment also rose sharply despite winter weather conditions, suggesting ongoing strength in infrastructure and private-sector investment.

Meanwhile, government payrolls declined even as private-sector hiring strengthened, a reversal of patterns seen in previous periods when public-sector jobs often offset private-sector weakness. Wage income measures also improved, with hours worked rising alongside pay, boosting household earning power.

Taken together, these trends indicate a labor market that is stabilizing rather than overheating, strong enough to support economic growth, but not so hot as to necessitate immediate monetary tightening.

But government data tells only part of the story.

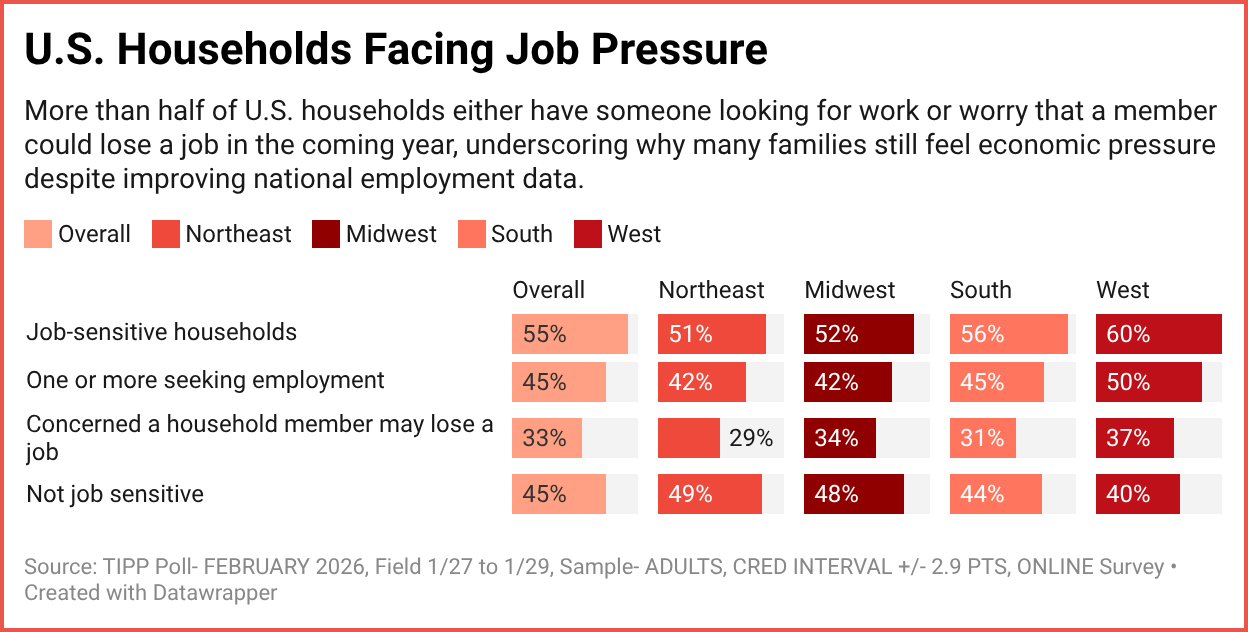

The latest TIPP Poll provides insight into how Americans experience the labor market, revealing a more nuanced picture.

According to TIPP Poll data, no one in half (50%) of surveyed households is currently unemployed and seeking full-time work. However, 45% say at least one member is actively job hunting—underscoring the uneven reach of the economic recovery.

Perhaps more telling is layoff sentiment: a majority of the adults (56%) who took part in the survey are not concerned about job loss for themselves or a household member in the coming year, while one-third (33%) are concerned. Republicans and conservatives show the highest confidence, but even among Democrats and liberals, such fears are far from widespread.

This divergence between improving macroeconomic data and mixed household experiences explains why public sentiment about the economy is often conflicted. Conditions are better than many feared, but not everyone feels fully secure.

We define a household as job-sensitive if a family member is seeking work or if the household fears that a member could lose their job in the coming year. When we combine these two metrics, 55% of households meet the “job-sensitive” definition.

Another factor complicating the picture is last year’s benchmark revision, which reduced prior job counts by nearly 900,000 positions. While largely anticipated by Wall Street, the adjustment reminds observers that recent job growth may have been overstated.

For policymakers, the report likely supports continued caution. The Federal Reserve, already signaling patience on interest rate changes, may see little urgency to shift course given steady hiring and moderate wage pressures. For markets, stable employment supports consumer spending and corporate earnings expectations, key pillars of ongoing economic expansion.

Politically, the labor market will almost certainly become a central theme as the election season intensifies. Economic optimism often translates into electoral strength for incumbents, but voters ultimately judge based on personal experience rather than headline statistics. Households still struggling to find work or rebuild financial security may be slower to embrace the recovery narrative.

In that sense, January’s report offers reassurance without declaring victory.

The labor market appears neither collapsing nor overheating. Employers continue to hire; unemployment remains low by historical standards; and most Americans feel reasonably secure in their jobs. Yet millions still experience employment pressures, reminding policymakers that economic improvement does not reach everyone at the same pace.

The coming months will show whether hiring continues to broaden and whether household confidence catches up with national data.

For now, the message is one of cautious optimism: the U.S. job market remains on a stable footing, even if the recovery still feels incomplete to many Americans.

👉 Show & Tell 🔥 The Signals

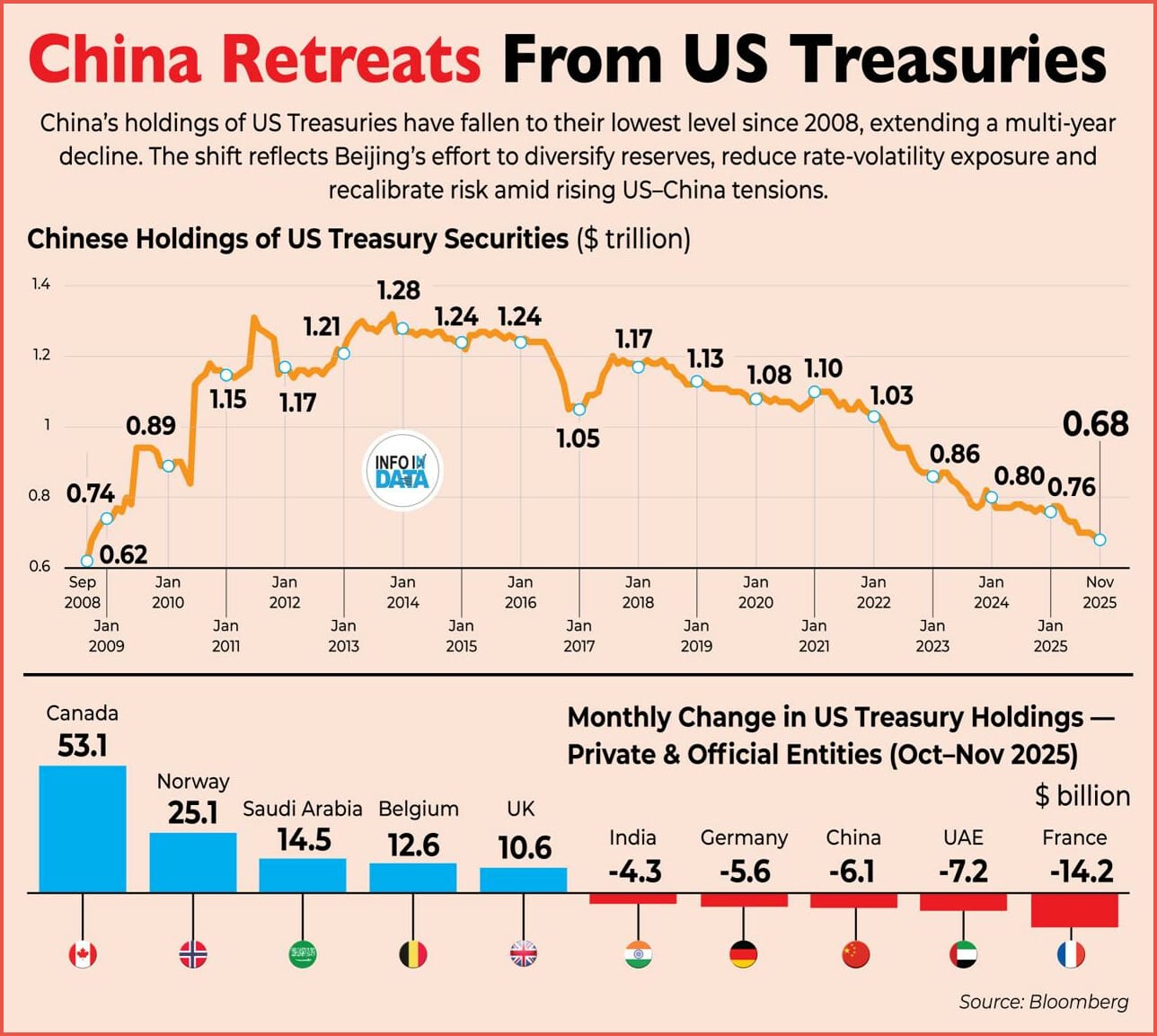

I. China Treasury Holdings Hit 2008 Low

China’s holdings of U.S. Treasury securities have fallen to their lowest level since the global financial crisis, continuing a multi-year decline as Beijing diversifies reserves and reduces exposure to U.S. debt.

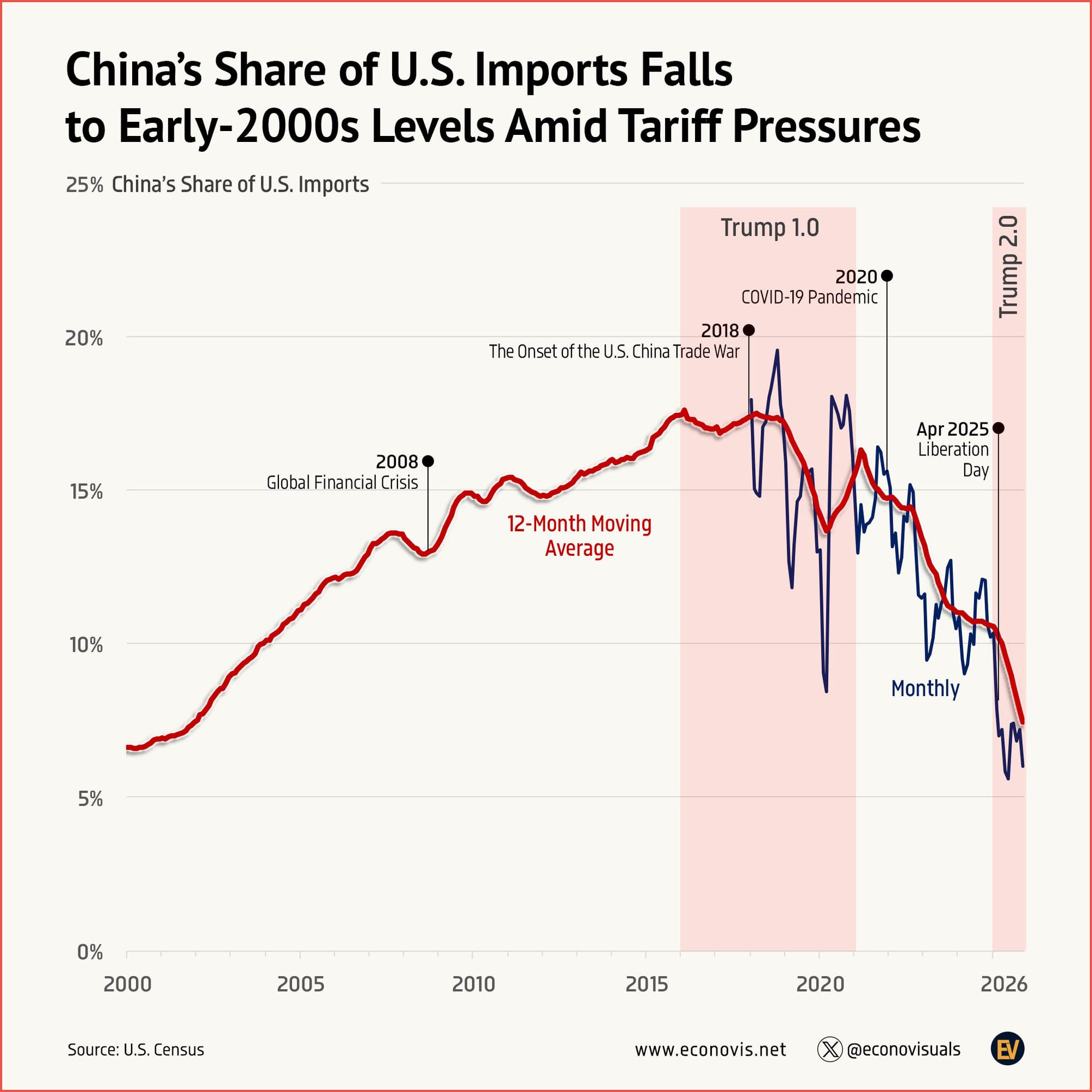

II. China’s Share of U.S. Imports Hits 20-Year Low

China’s share of total U.S. imports has fallen to around 7–8%, the lowest level since the early 2000s, reflecting years of tariffs, supply-chain diversification, and companies shifting production to other countries.

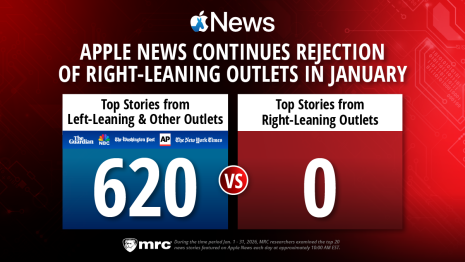

III. Apple News Criticized Over Outlet Selection

A media watchdog group says right-leaning outlets were absent from top Apple News story selections in January, raising fresh debate about platform curation practices.

The TIPP Stack

Handpicked articles from TIPP Insights & beyond

1. The New Nuclear Challenge—Richard Haass, Project Syndicate

2. Democrats’ Demographic Doom Spiral Has No Exit—Victor Joecks, The Daily Signal

3. Even CNN Is Questioning Hakeem Jeffries Shutdown Strategy—Hailey Gomez, Daily Caller News Foundation

4. Heritage Action Makes SAVE America Act ‘Key Vote’—Pedro Rodriguez, The Daily Signal

5. Conservatives Rally For SAVE America Act—Daily Signal Staff, The Daily Signal

📊 Market Mood — Thursday, February 12, 2026

🟩 Futures Rise as Markets Digest Jobs Shock

U.S. futures move higher as investors shift focus from a strong jobs report to earnings and inflation data ahead.

🟧 Strong Payrolls Push Rate Cuts Further Out

Robust job gains delay expectations for Fed rate cuts, with markets now pricing easing only in the second half of the year.

🟦 Cisco Slides as Chip Costs Hit Margins

Cisco shares fall after rising memory-chip prices squeeze margins despite strong AI-related demand.

🟨 Gold Slips While Oil Holds Firm on Tensions

Gold eases as rate-cut hopes fade, while oil remains supported by lingering U.S.–Iran supply concerns.

🗓️ Key Economic Events — Thursday, February 12, 2026

🟨 8:30 AM — Initial Jobless Claims

Weekly unemployment claims provide an early signal on layoffs and labor market conditions.

🟦 10:00 AM — Existing Home Sales (January)

Tracks activity in the housing market, offering insight into consumer demand and mortgage-rate impact.

🟧 1:01 PM — 30-Year Treasury Bond Auction

Investor demand for long-term government debt influences bond yields and broader rate expectations.

editor-tippinsights@technometrica.com