President Joe Biden's economic policies have recently found strong support within his own Democratic Party and among the big media. Yet, despite the push by Biden's most ardent supporters, a majority of average voters disagree that the president's policies are turning the economy around, according to the latest I&I/TIPP Poll.

The president in recent weeks has maintained that his economic policies are "turning things around" and "delivering for the American people," and has made other comments intended to boost support for Bidenomics.

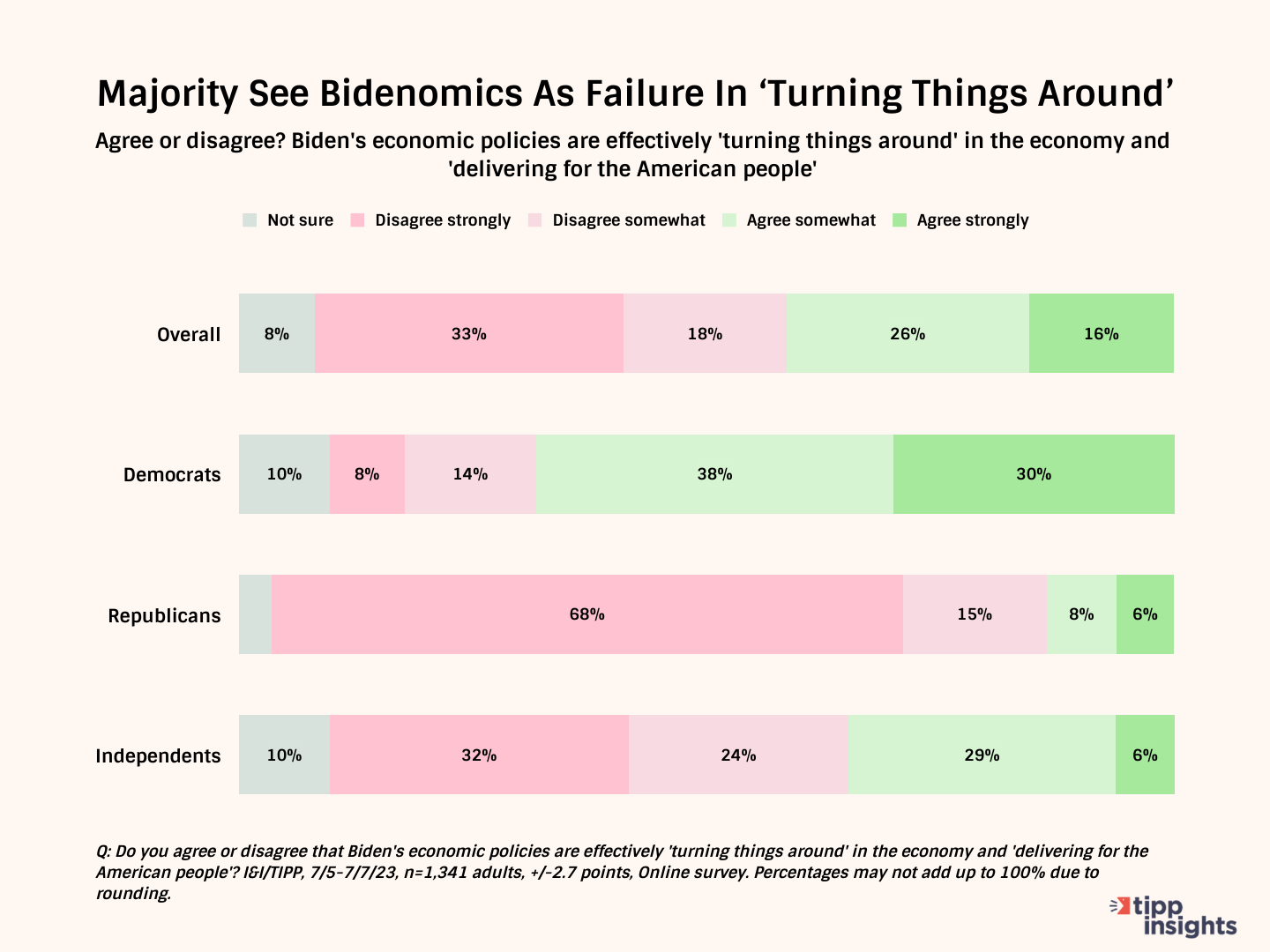

But by 51% to 42%, Americans disagree with those assessments, based on the online I&I/TIPP Poll, taken July 5-7 from 1,341 adults. The poll has a margin of error of +/-2.7 percentage points.

Among the majority, 33% said they disagreed "strongly," while just 18% said they disagreed "somewhat." Results were weaker for the minority opinion, with just 16% saying they agreed "strongly" that Biden's policies were turning things around, while 26% said they only "somewhat" agreed.

Once again, the political chasm is wide. For Republicans, 83% disagreed that Biden's policies were working, while just 14% agreed. Independents came in with 56% disagreeing, 35% agreeing. Only Democrats were enthused about Biden's stewardship, with 68% agreeing that his policies were working while 22% disagreed.

But politics wasn't the only dividing line. Blacks and Hispanics, by 56% to 37%, agreed Biden's economic plans were working. For white Americans, responses were a near mirror image to that: Just 34% agreed, 58% disagreed.

Another interesting split emerged by age, with younger Americans far more likely than older ones to see Bidenomics as a nascent success.

For example, those 18-24 split, as 51% agreed and 37% disagreed. And among those 25-44, the numbers were fairly similar: 50% agree to 42% disagree. But those 45-64 (33% agree, 59% disagree), and 65 and over (35% to 58%) viewed Biden's policies as a failure.

How can it be that different age groups see the economy so differently?

Well, for one, they are at different places in the economic lifecycle, which provides a different perspective depending on where one is on the continuum. Those who are younger still have an entire work and earning career ahead of them.

For older Americans, many living on fixed incomes, recent bouts of inflation have been devastating, cutting into their standards of living. As TIPP Insights recently noted, since Biden entered office, overall inflation has soared 16%, as measured by TIPP's proprietary CPI data.

But prices for food and energy, which affect all consumers, have soared by 18.9% and 33.1%, respectively, since Biden took office, with real average weekly earnings declining for 26 of 29 months. On the brighter side, June was the first month since March 2021 that real average weekly earnings rose.

Nor is inflation a thing of the past. It's still with us, and will be until we get a series of year-over-year readings close to the Fed's long-term 2% inflation target.

"Demand for labor continues to outstrip supply, firms are still hiring and raising compensation while companies find relative ease in passing price increases to customers," noted Alyce Anders of Bloomberg Markets.

Biden talks a lot about helping the beleaguered middle class, which as a group saw its standard of living upended in recent years.

"Yet it is precisely those people who’ve been hurt most: With wages rising slower than prices, the average American family, in effect, has lost $10,000 under Biden," as the New York Post recently observed.

At the same time, the fiscal side of the economy has been devastated by two and a half years of runaway government spending, leaving a gaping $1 trillion annual hole in the nation's budget that can be filled only in the future by massive spending cuts, enormous tax hikes, or more damaging inflation.

As Issues & Insights recently noted, citing a just-released Congressional Budget Office report:

The topline number is that the federal deficit so far this fiscal year has already topped $1.4 trillion, which is $875 billion higher than the same months last year and bigger than the deficit for all of fiscal year 2022.

The CBO finds that overall spending this year is running 10% higher than last year. At the same time, revenues are down 11% compared with last year, which defies claims by the administration that the economy is strong.

Meanwhile, the fiscal hole from entitlement spending and pandemic shutdowns only gets bigger, helping to swell government spending as a share of the entire economy by 40% over the next two decades, according to recent projections.

The Social Security program will run out of money to pay its promised benefits in 2033, while Medicare will run dry in 2031, new forecasts by the trustees for both programs show. That's a year earlier than predicted just last year.

So, after nearly three years marked by disastrous inflation and a sharp economic contraction, there's a reason why Americans are now questioning boldly optimistic economic prognostications emanating from the White House. And why the scandal-plagued president has now become the second-most unpopular president in modern history.

Or, as the Bill Clinton campaign used to say, "It's the economy, stupid."

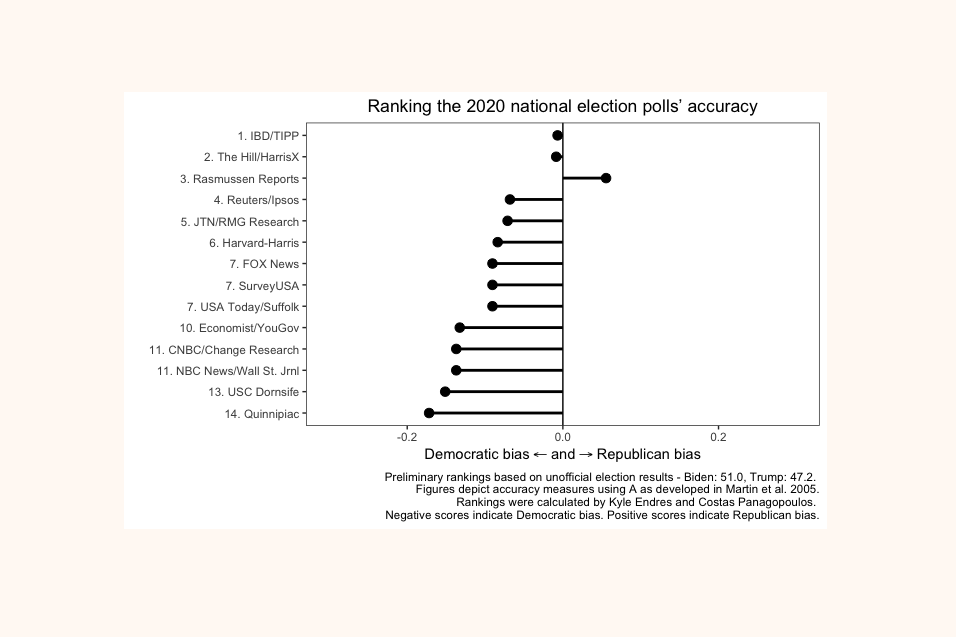

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Hey, want to dig deeper? Download data from our store for a small fee!

Our performance in 2020 for accuracy as rated by Washington Post:

Like our insights? Show your support by becoming a paid subscriber!