The state of Mississippi is rarely in the news, and so it was today when a landmark change to state law, signed by Governor Tate Reeves, barely received a mention in the liberal press. Mississippi became the tenth state in the nation to abolish the income tax. In doing so, the Magnolia State joined Alaska, Florida, Nevada, New Hampshire (which does not tax earned income but does tax interest and dividends), South Dakota, Tennessee, Texas, Washington, and Wyoming.

Reeves, who campaigned on the issue, delivered in a big way by convincing voters, the state House, and the Senate to join him in his mission. It was not easy. Signing the legislation in Jackson, the state capital, to make it law, Reeves legitimately took a victory lap.

We did it, Mississippi! We just eliminated the income tax! Today is a day that will be remembered — not just for the headlines, not just for the politics, but for the profound, generational change it represents.

Today, I was proud to sign into law the complete elimination of the individual income tax in the state of Mississippi. Let me say that again: Mississippi will no longer tax the work, earnings, or ambition of its people.

This is more than a policy victory. This is a transformation. And it's a transformation that I have believed in, fought for, and worked toward for many years. From my days as lieutenant governor to my first campaign for this office — and every legislative session since — I have made this my mission. Because I believe in a simple idea: that the government should take less so that you can keep more... that our people should be rewarded for hard work, not punished.

Mississippi has the potential to be a magnet for opportunity, investment, talent, and families looking to build a better life. We are telling job creators across America: If you want to build, come to Mississippi. We are saying to families across the South: If you want to grow, come to Mississippi. We are saying to entrepreneurs, workers, and dreamers: Mississippi is open for business—and we won't penalize your success.

We are going to compete — and we're going to win.

Mississippi had a flat state income tax rate of 4%, having abandoned its progressive tax system on January 1, 2023. Moving to a flat tax structure, the state eliminated lower brackets and set a single 4% rate on all taxable income over $10,000.

Mississippi is a relatively poor state, reflecting generations of its citizens enjoying a largely rural lifestyle. Its budget for 2025 is about $31 billion, a fraction of the budgets of larger, wealthier states (California: $322 billion; New York: $250 billion). Mississippi relies heavily on federal appropriations, receiving significantly more in federal funds than it contributes in federal taxes. According to a 2022 analysis, for every $1 paid in federal income tax, Mississippi receives approximately $2.53 in federal funding, the second-highest ratio among states. After the disruptions brought about by COVID-19, a 2023 report indicated this ratio has increased to $2.73 received for every dollar paid. The state reports that the five most significant sources of revenue are sales tax (45%), individual income tax (27%), corporate, use, and gaming taxes.

Reeves's problem would be to backfill over $2 billion that residents have paid as individual income taxes with other sources of revenue. Or, as President Ronald Reagan did, attempt to starve the government of revenue and live on less.

Critics would say that Mississippi is hardly a state that other capitals should emulate. Its sales taxes are regressive on its low-income population, the state depends heavily upon federal transfer payments, and its lack of investment in education and government services shows.

Mississippi consistently ranks among the states with the highest poverty rates. As of 2023, approximately 18.8% of Mississippi's population lived below the poverty line, making it the state with the highest poverty rate in the country.

However, wealthier states don't have it any better. Consider California, which has the highest and most progressive income tax structure (13.3%) and sales taxes of nearly 10% in some areas, the highest in the country.

With the state collecting so much revenue and distributing it as it sees fit, the lifestyle of the average California voter still leaves a lot to be desired. The median home price in California is around $800,000, more than double the national average. Even modest homes are out of reach for many middle-class families. The average rent for a one-bedroom apartment in cities like San Francisco or Los Angeles often exceeds $2,500 per month. California has over 170,000 homeless people, the highest number in the U.S., due to high housing costs and a lack of affordable options.

Small businesses face strict regulations, high minimum wages, and costly operational expenses. Cities like Los Angeles, San Francisco, and San Diego rank among the worst in the nation for traffic, and the state hasn't been able to address transportation issues for decades. California ranks near the bottom in terms of controlling retail theft, property crime, and public safety. For a wealthy state, California ranks below average in K-12 education quality despite high spending per student.

So, money is not the issue. How it is spent and how the state's resources are managed become far more consequential. This is where Reeves's bet is admirable - by eliminating the individual income tax, he is making a bold statement to businesses looking to relocate to the state, enjoy its vast rural, beautiful landscape and low cost of living, and bring jobs and prosperity.

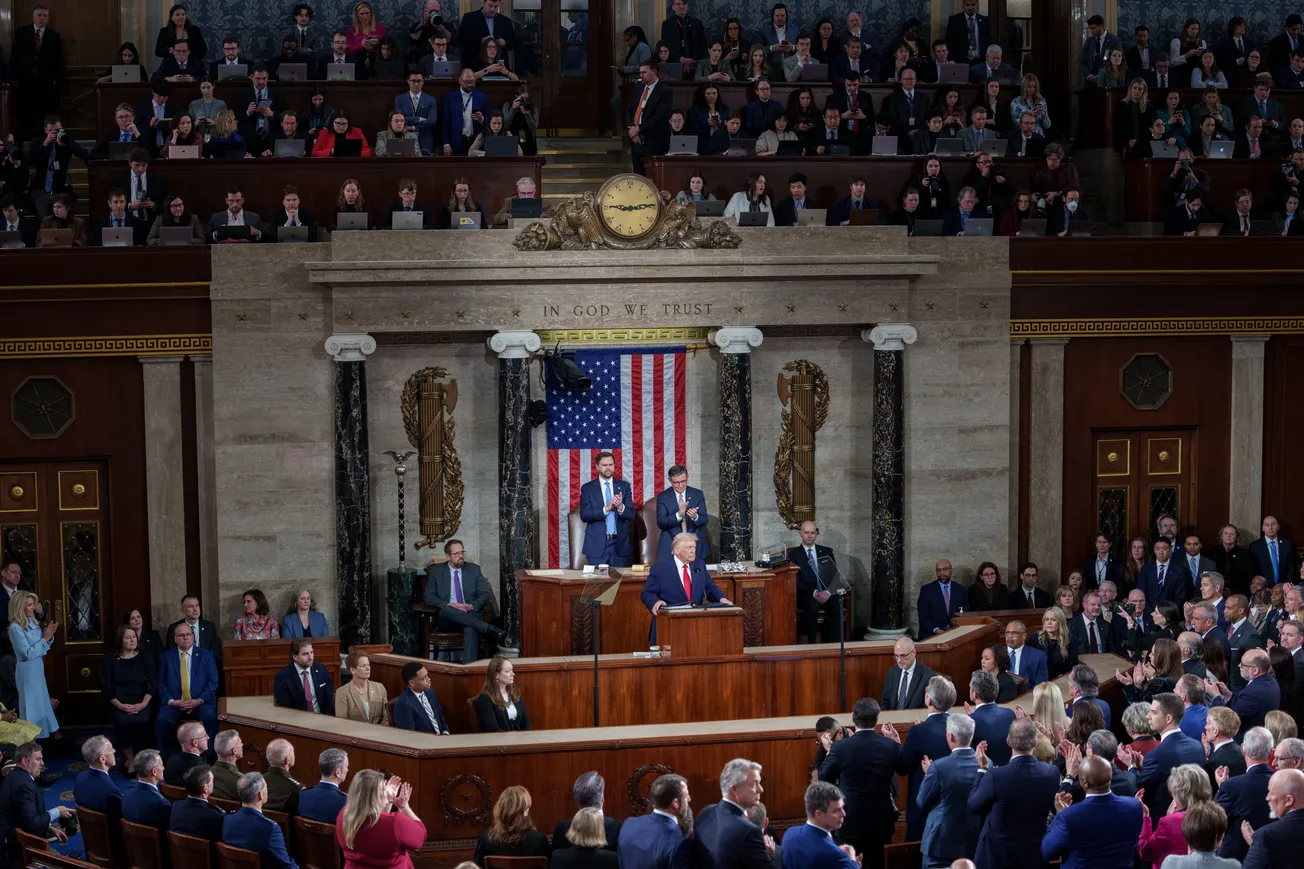

If Reeves considers running for the GOP nomination in 2028, his leadership on the income tax issue immediately makes him a leading economic conservative. At just 50 years of age from a deeply red state—President Trump won Mississippi with 61.0% of the vote compared to Kamala Harris's 38.2%, giving him a nearly 23-point victory margin—Reeves could catapult to become an attractive Vice Presidential nominee to JD Vance, Marco Rubio, or Ron DeSantis.

TIPP Picks

Selected articles from tippinsights.com and more

Trump 2.0

1. Trump Chaos Or The Gales Of Creative Destruction?—Editorial Board, Issues & Insights

2. ‘We Are Ecstatic’: Union Boss Who Backed Harris Says He’s Thrilled With One Major Trump Policy—Harold Hutchison, DCNF

3. Trump Administration Hit by Record Number Of Injunctions From Partisan Courts—S.A. McCarthy, The Daily Signal

4. Trump Admin Moves To Stifle China’s Ability To Weaponize American Tech Against Americans—Ireland Owens, DCNF

5. Trump Targets DC Law Firm Wilmer Hale Next—TIPP Staff, TIPP Insights

6. Trump Withdraws Elise Stefanik As His Pick For UN Ambassador—TIPP Staff, TIPP Insights

7. President Trump Hosts Iftar Dinner, Thanks Muslim Americans—TIPP Staff, TIPP Insights

8. Trump Officials Assured Skeptical Senator Dr. Oz’s Views On Transgenderism Have Changed—Elizabeth Troutman Mitchell, The Daily Signal

9. Leavitt Slams ‘Sensationalist’ Journalist Added To Signal Chat About Bombing Houthis—Elizabeth Troutman Mitchell, The Daily Signal

World Affairs

10. Why China’s Marriage Crisis Matters—Yi Fuxian, Project Syndicate

11. Washington Rejects Putin’s Proposal for UN-Controlled Ukraine—TIPP Staff, TIPP Insights

12. The High Price Of War With Iran: $10 Gas And The Collapse Of The US Economy—Dennis J. Kucinich, Ron Paul Institute for Peace and Prosperity

13. South Africa Denies Elon Musk’s Accusations Of Racial Genocide—Elizabeth Troutman Mitchell, The Daily Signal

14. Senate Intelligence Panel Hearing Focuses On Mexican Cartels’ Fentanyl, Chinese Suppliers—Jacob Adams, The Daily Signal

15. Old US-Canada Relationship Is Over: Canadian Prime Minister—TIPP Staff, TIPP Insights

16. Vances Arrive In Greenland With A Revised Itinerary—TIPP Staff, TIPP Insights

17. ‘Surprised Me’: Angus King Bewildered As Tulsi Gabbard Explains Why ‘Climate Change’ Omitted In 2025 Threat Report—Jason Cohen, DCNF

18. 'A Productive Call With Canadian PM Carney:' Trump—TIPP Staff, TIPP Insights

Economy

19. EPA’s Zeldin Unshackles American Energy Potential—Bonner Cohen, Ph. D., CFACT

20. ‘Make America Wealthy Again’: A Digital, Youth-Driven Economy—Duggan Flanakin, CFACT

21. ESG Ruling Puts New Pressure On Public Pension Funds And BlackRock—Fred Lucas, The Daily Signal

22. What Might Austerity Look Like In 21st-Century America?—Jane L. Johnson, Mises Wire

23. Big Spending Republicans Out Of step With Trump On Repealing Energy Subsidies—Kevin Mooney, CFACT

24. IRS Official Involved In Obama-Era Tea Party Scandal Quietly Running Key Tax Division—Nick Pope, DCNF

25. Economic Illiteracy Handicaps Britain’s New Right Wing Party—George Pickering, Mises Wire

Politics

26. Real Election Reform At Last?—Editorial Board, Issues & Insights

27. Money For Nothing And Liberal Propaganda For Free—Defund NPR And PBS, Nirvanize The Taxpayer—Editorial Board, TIPP Insights

28. ‘BLATANTLY UNCONSTITUTIONAL’: Mike Lee Takes Action To Restrain ‘Whims’ Of Judges Blocking Trump Orders—Tyler O'Neil, The Daily Signal

29. Supreme Court Should Uphold State’s Rights To No Taxpayer Funding of Abortion Businesses—Macy Petty, The Daily Signal

30. Billion Dollars In Funding—Zack Smith, The Daily Signal

31. Republican Voters Sound Alarm On Chinese Ownership Of US Farmland—Robert McGreevy, DCNF

32. Democrats’ Circular Firing Squad: Infighting And Purity Tests Are Handing Republicans 2026—Cooper Rummell, The Daily Signal

33. Rep. Ilhan Omar Reportedly Laying Groundwork To Impeach Trump’s Top Nat Sec Officials—Wallace White, DCNF

34. 7 Changes Congress Should Make Before Restoring DC’s Bloated Billion Dollars In Funding—Zack Smith, The Daily Signal

35. ‘You’re A Rabid Progressive’: CEO Of Taxpayer-Funded NPR Skewered For Left-Wing Statements, ‘Pro-Censorship’ Views—Jason Cohen, DCNF

36. Elon Musk Promises $2 Million to Wisconsin Voters Amid Supreme Court Election—TIPP Staff, TIPP Insights

General Affairs

37. Yes, Let’s Give An America ‘Without A Meaningful Government’ A Try—Editorial Board, Issues & Insights

38. The Global Warming Scare Hits Rock Bottom—Editorial Board, Issues & Insights

39. The 5 Biggest Threats To America’s Principles And Way Of Life—Jeffrey H. Anderson, The Daily Signal

40. Making Our Rights Disappear: The Authoritarian War On Due Process—John W. And Nisha Whitehead, The Ron Paul Institute for Peace and Prosperity

41. A Brief History Of The Freedom Of Speech—Andrew P. Napolitano, Ron Paul Institute for Peace and Prosperity

42. The Far-Left’s Violent Attacks On Tesla Are Revealing—Connor O'Keeffe, Mises Wire

43. Ex-Obama Campaigner Got Board Seat At EPA ‘Gold Bars’ Winner After His Green Org Failed To Deliver On Big Promises—Nick Pope, DCNF

44. The Left Has No Respect For God, Country, Or History–Including Patrick Henry—Hans von Spakovsky, The Daily Signal

45. Skin Tone Products, Markets, And “White Privilege”—Joshua Mawhorter, Mises Wire

46. Washington DC Must Become Clean And Safe Again: Trump—TIPP Staff, TIPP Insights