Consumer sentiment edged down in January, as the RealClearMarkets/TIPP Economic Optimism Index, the first monthly read on U.S. consumer confidence, slipped from 47.9 in December to 47.2, a 0.7-point or 1.5 percent loss. The index stayed below the neutral 50 level for the fifth straight month, keeping the nation in what we classify as the pessimistic zone.

January’s reading of 47.2 is 3.9% below the 300-month historical average of 49.1, indicating that confidence remains subdued and not yet fully restored.

This release marks 25 years of uninterrupted tracking of U.S. consumer sentiment, one of the longest-running independent economic confidence series in the country. Developed by Raghavan Mayur through a lifetime of dedication, the model remains one of the best kept secrets in economic measurement, with insights in this report quietly relied upon by many who shape markets and policy, from economists at the Fed to traders on the Nikkei floor in Japan.

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board. (From February 2001 to October 2023, TIPP released this Index monthly in collaboration with its former sponsor and media partner, Investor's Business Daily.)

RCM/TIPP surveyed 1,478 adults from January 6 to 9 for the January Index, using TIPP’s panel network; results have a range of 0–100, with readings above 50 indicating optimism, below 50 signaling pessimism, and 50 considered neutral. A more detailed methodology is available here.

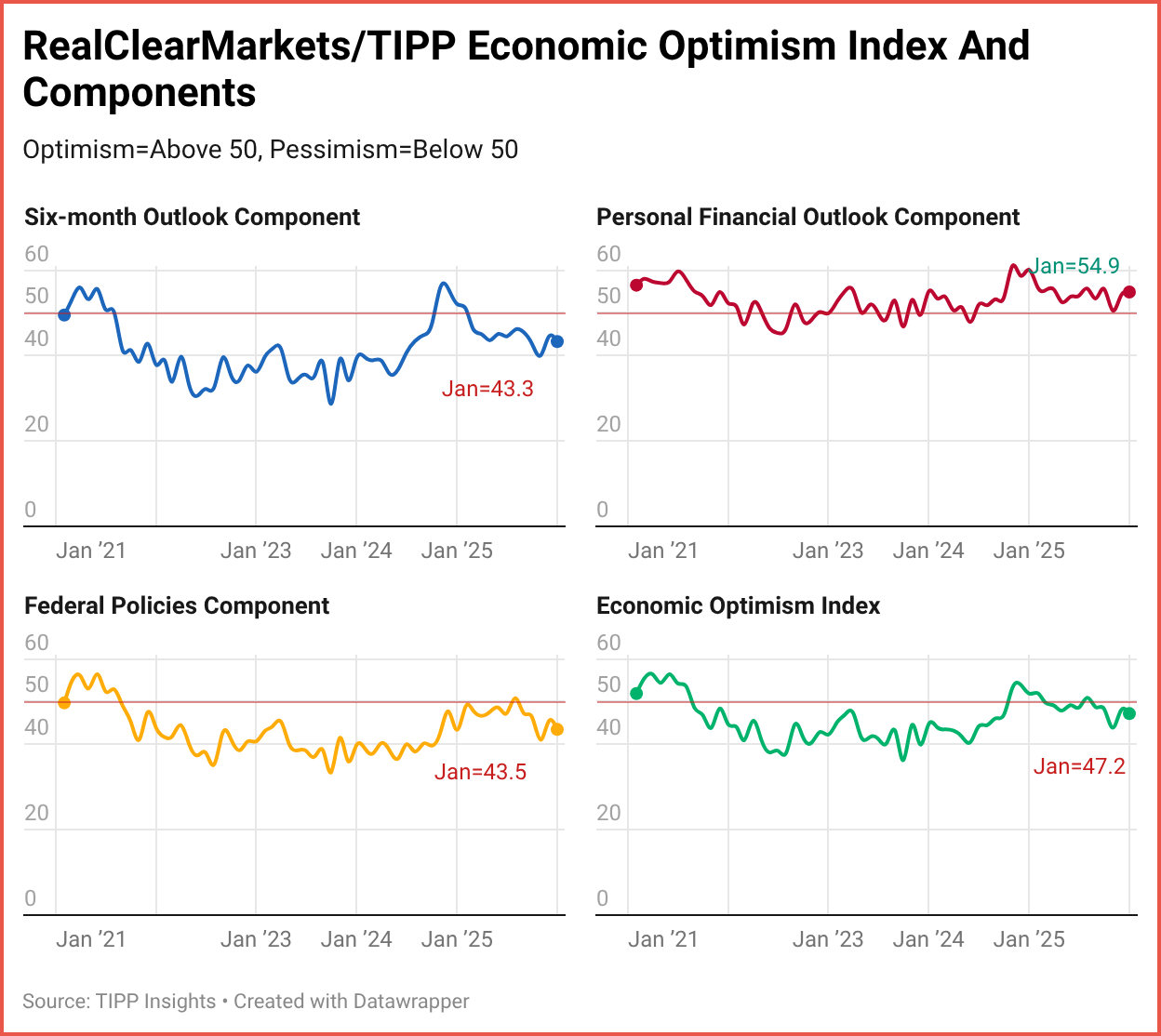

The RCM/TIPP Economic Optimism Index has three key components. In January, only one of them improved.

- The Six-Month Economic Outlook, which measures how consumers perceive the economy's prospects in the next six months, declined 2.5%, from 44.4 in December to 43.3 in January.

- The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, rose 1.7% from its previous reading of 54.0 in December to 54.9 this month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, slipped to 43.5 in January from 45.4 in December, a 4.2% loss.

Explore the data in real time: Track the RCM/TIPP Economic Optimism Index on RealClearMarkets. View monthly trends, compare components, and analyze shifts in sentiment across demographics.

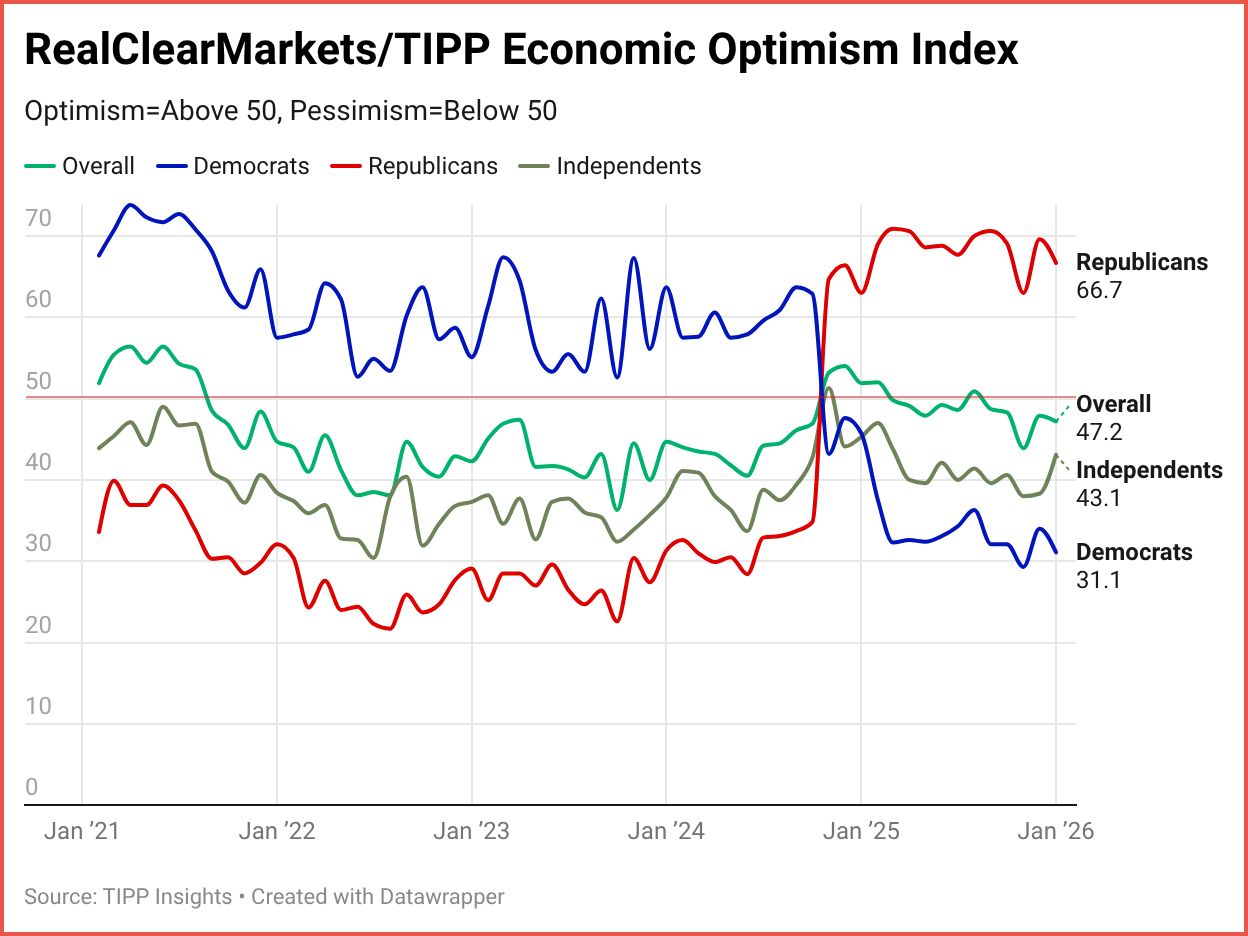

Party Dynamics

Since President Trump’s election as the 47th President, Democrats’ confidence has plunged to 31.1, Republicans’ confidence has soared to 66.7, and independents, after briefly turning optimistic for the first time in nearly five years, have slipped back to 43.1.

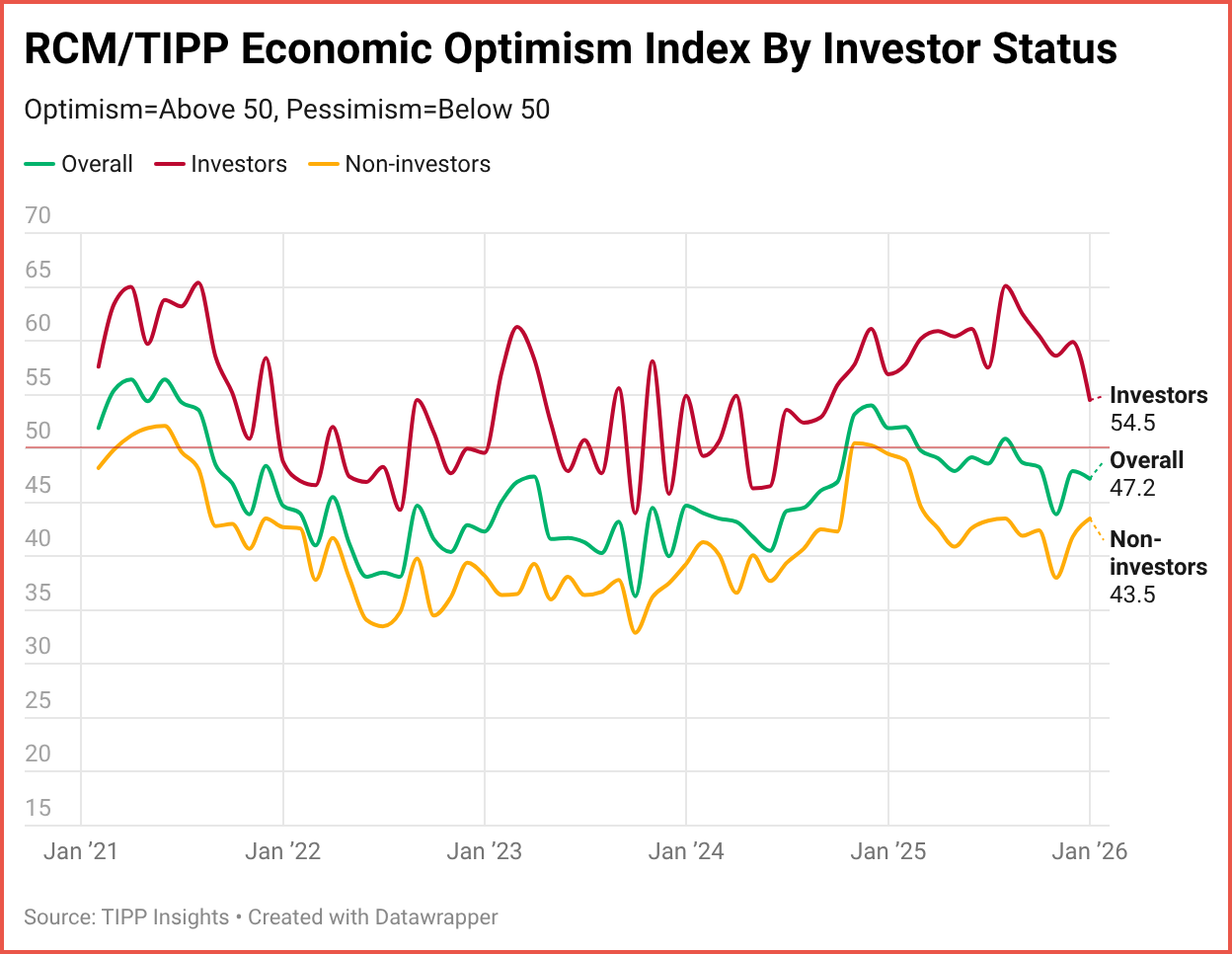

Investor Confidence

Respondents are considered "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, directly or through a retirement plan. One-third (33%) of respondents met this criterion, and 62% were classified as non-investors. We were unable to determine the status of five percent of respondents.

Investor confidence weakened 9.0% (5.4 points) to 54.5 in January, while non-investor confidence gained 4.1% (1.7 points) to 43.5. The confidence gap between investors and non-investors narrowed from 18.1 to 11.0 points.

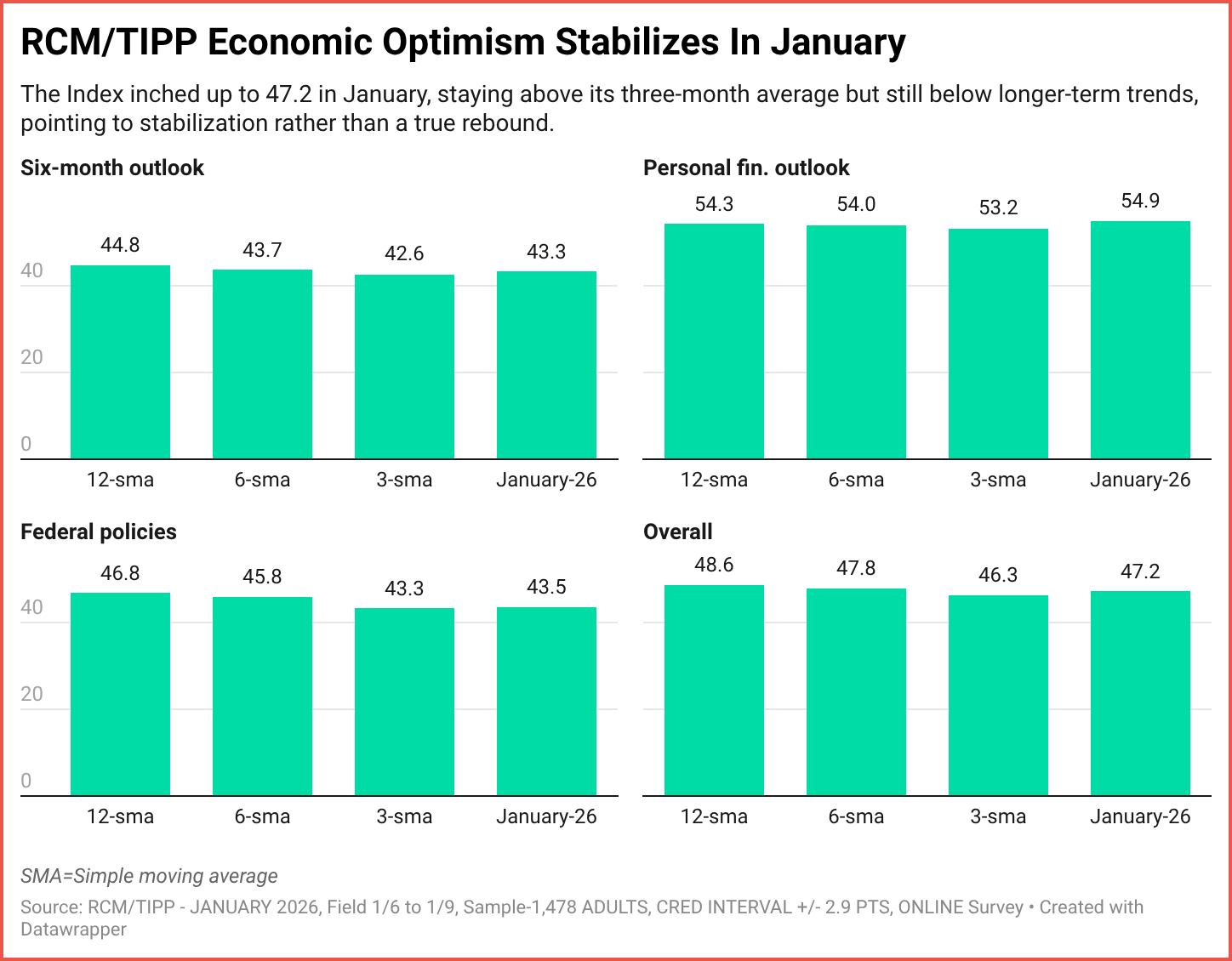

Momentum

The RCM/TIPP Economic Optimism Index edged up to 47.2 in January, holding above its three-month average (46.3) but remaining below longer-term trend levels, signaling stabilization rather than a rebound. The Six-Month Outlook remains subdued at 43.3, still well under both its six- and twelve-month averages, pointing to lingering caution about the economy’s direction.

The Personal Financial Outlook firmed to 54.9, now above all short- and medium-term benchmarks, suggesting households feel better about their own finances even as macro confidence lags. Meanwhile, confidence in federal economic policies is stuck near recent lows at 43.5, underscoring that improved personal sentiment has yet to translate into broader faith in policy or growth prospects.

Get sharp, original analysis on investor confidence and market trends. Full access → $99/year.

Demographic Analysis

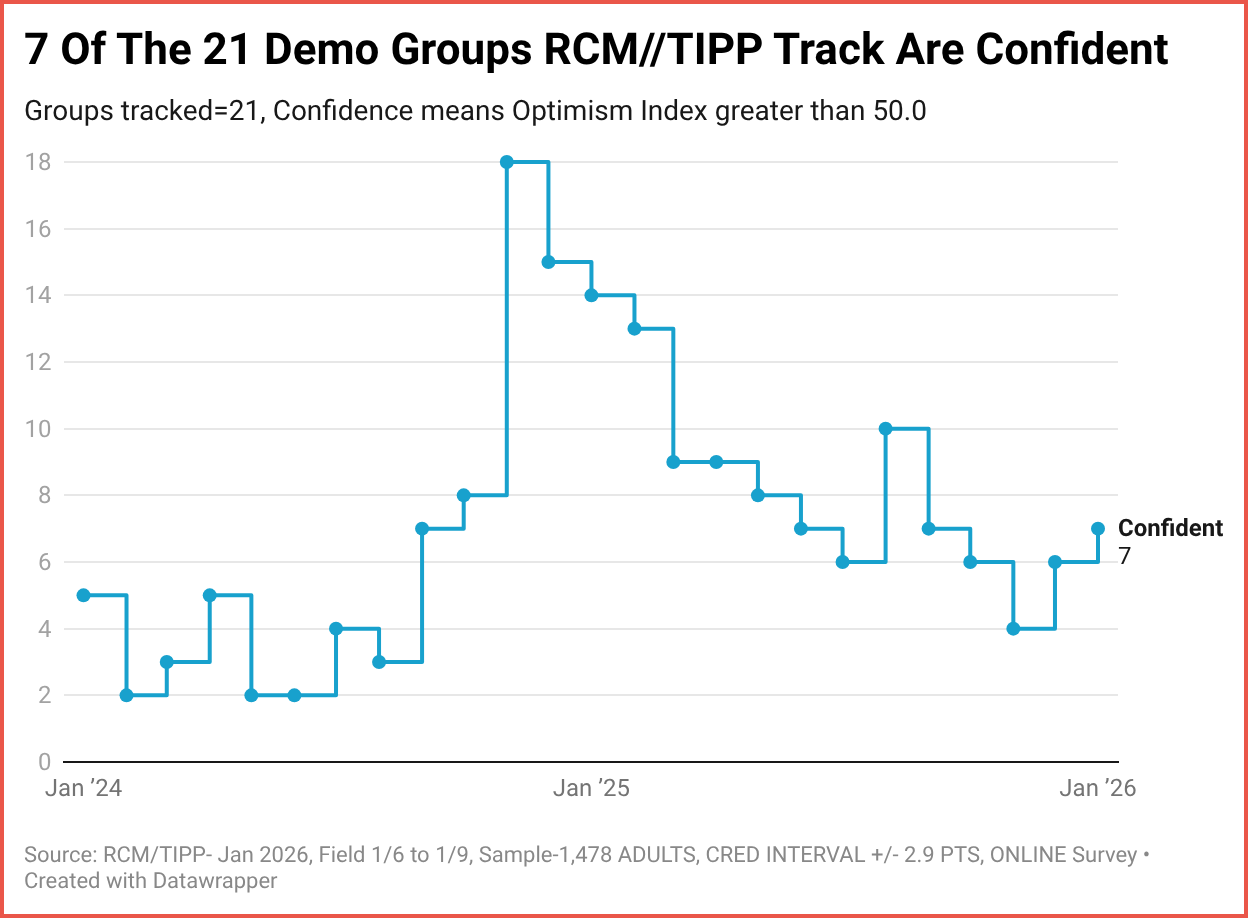

The number of groups in the positive zone indicates the breadth of optimism in American society.

This month, only seven of the 21 demographic groups we track are in positive territory, with scores above 50 on the Economic Optimism Index. For comparison, there were six in October, seven in September, and 10 in August.

In the immediate aftermath of the election, the number of groups in the optimistic zone had jumped from eight in October 2024 to 18 in November, indicating widespread optimism.

Nine groups improved on the index, compared to 21 in December, none in November, and nine in October.

Economic optimism levels for 16 of 21 demographic groups are lower in January 2026 than the historical average over the 300 months since we began tracking in February 2001.

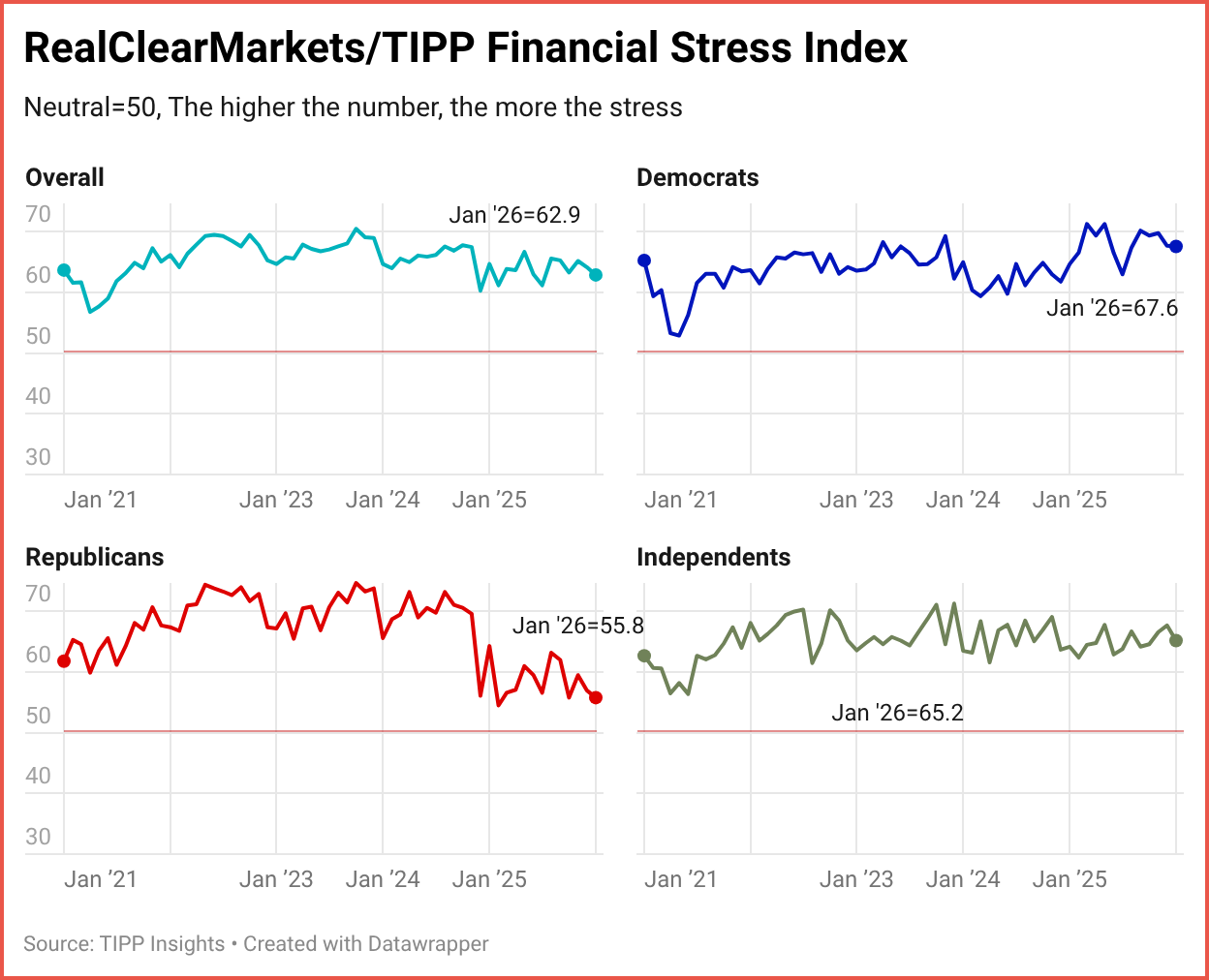

RCM/TIPP also releases our companion index, known as the RCM/TIPP Financial-Related Stress Index, the only metric that tracks the financial stress felt by Americans on a monthly basis.

The higher the number, the more the stress. Readings above 50 signal increased stress, while those below 50 indicate lower stress, with 50 considered neutral.

The RCM/TIPP Financial-Related Stress Index fell 1.3 points (2.0%) from 64.2 in December to 62.9 in January, indicating a decline in financial stress among Americans. This reading remains 4.0% above the long-term average of 60.5, underscoring elevated financial strain. The last time the Index posted below 50.0 was before the onset of the pandemic in February 2020, when it stood at 48.1.

RealClearMarkets website will release the next report at 10 a.m. EST on Tuesday, February 3.

👉 Quick Reads

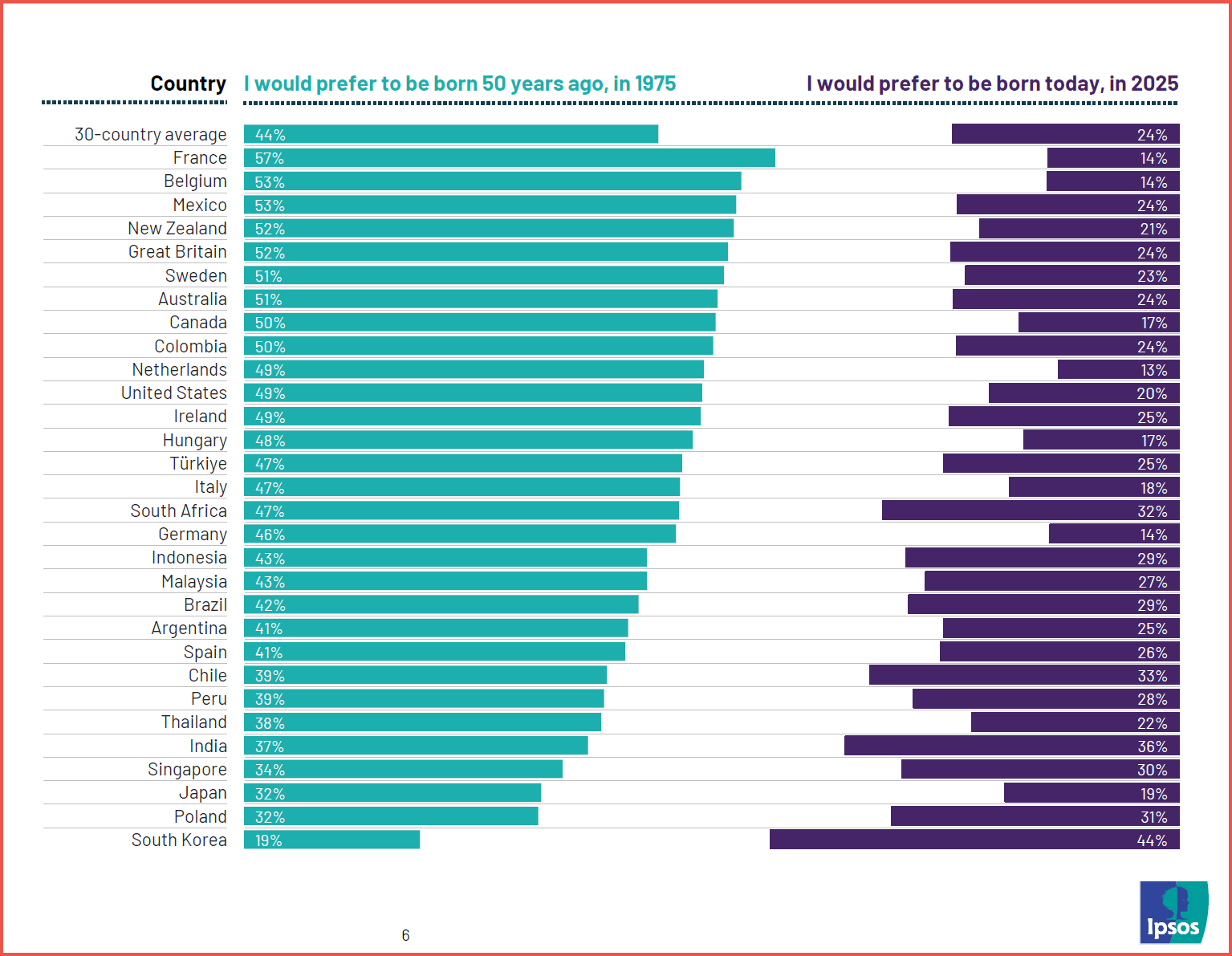

I. Half The World Would Rather Be Born In The Past

When asked, “If you had to choose between being born 50 years ago or being born today, which would you choose?” people across 30 countries overwhelmingly picked the past. In the United States, nearly one in two would rather have been born in 1975 than in 2025, while only one in five prefer being born today, reflecting a deep global loss of optimism about the future.

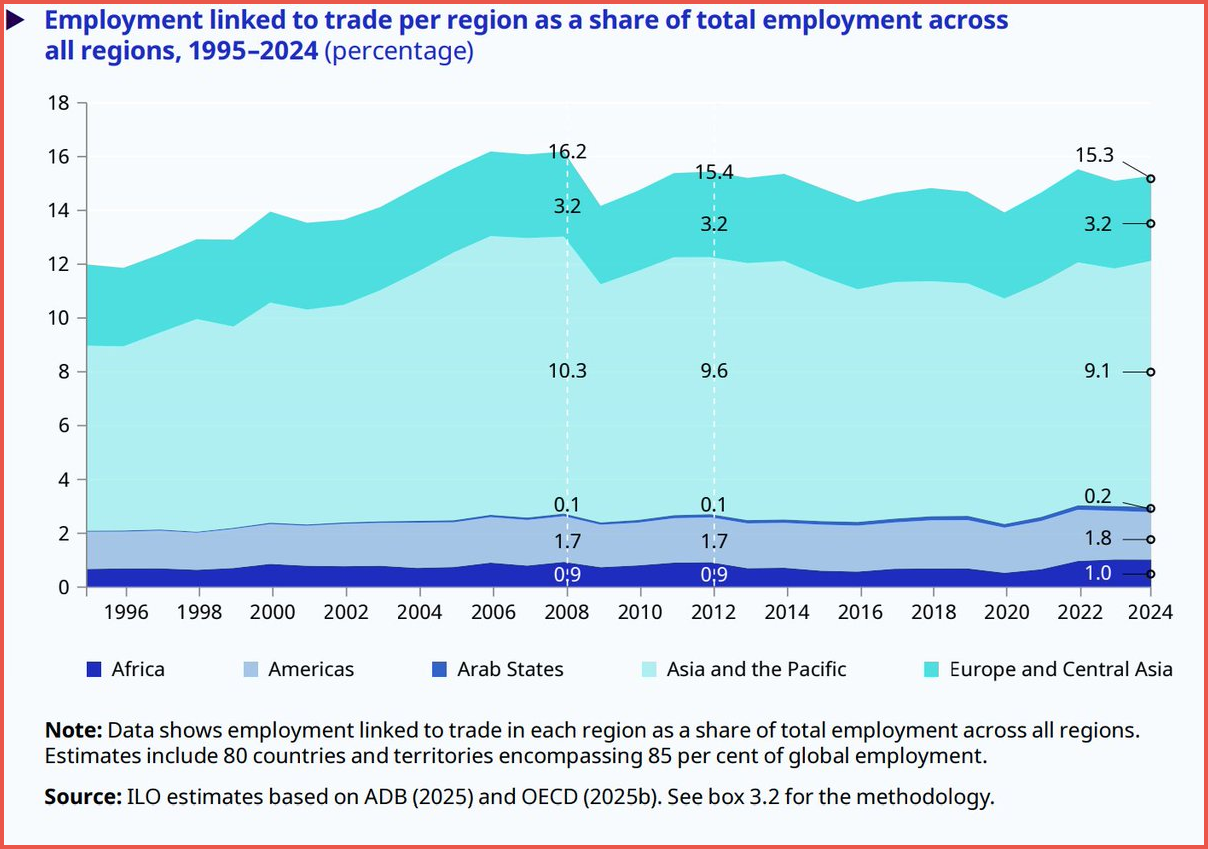

II. More Of The World’s Jobs Depend On Foreign Buyers

The chart shows the share of all global jobs that exist because people in other countries are buying goods and services. Today, about 15 out of every 100 jobs worldwide are supported by foreign demand, up sharply since the 1990s. Most of these trade-linked jobs are now in Asia and Europe, showing how deeply global employment has become tied to international supply chains.

editor-tippinsights@technometrica.com