The RealClearMarkets/TIPP Economic Optimism Index, a leading gauge of consumer sentiment, dropped 1.6% in February to 44.0. The index has remained in negative territory for 30 consecutive months since September 2021.

RealClearMarkets (RCM) is the new sponsor of the TIPP Economic Optimism Index.

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It accurately captures monthly changes, as reflected in other well-known surveys by The Conference Board and the University of Michigan.

RCM/TIPP Economic Optimism Index

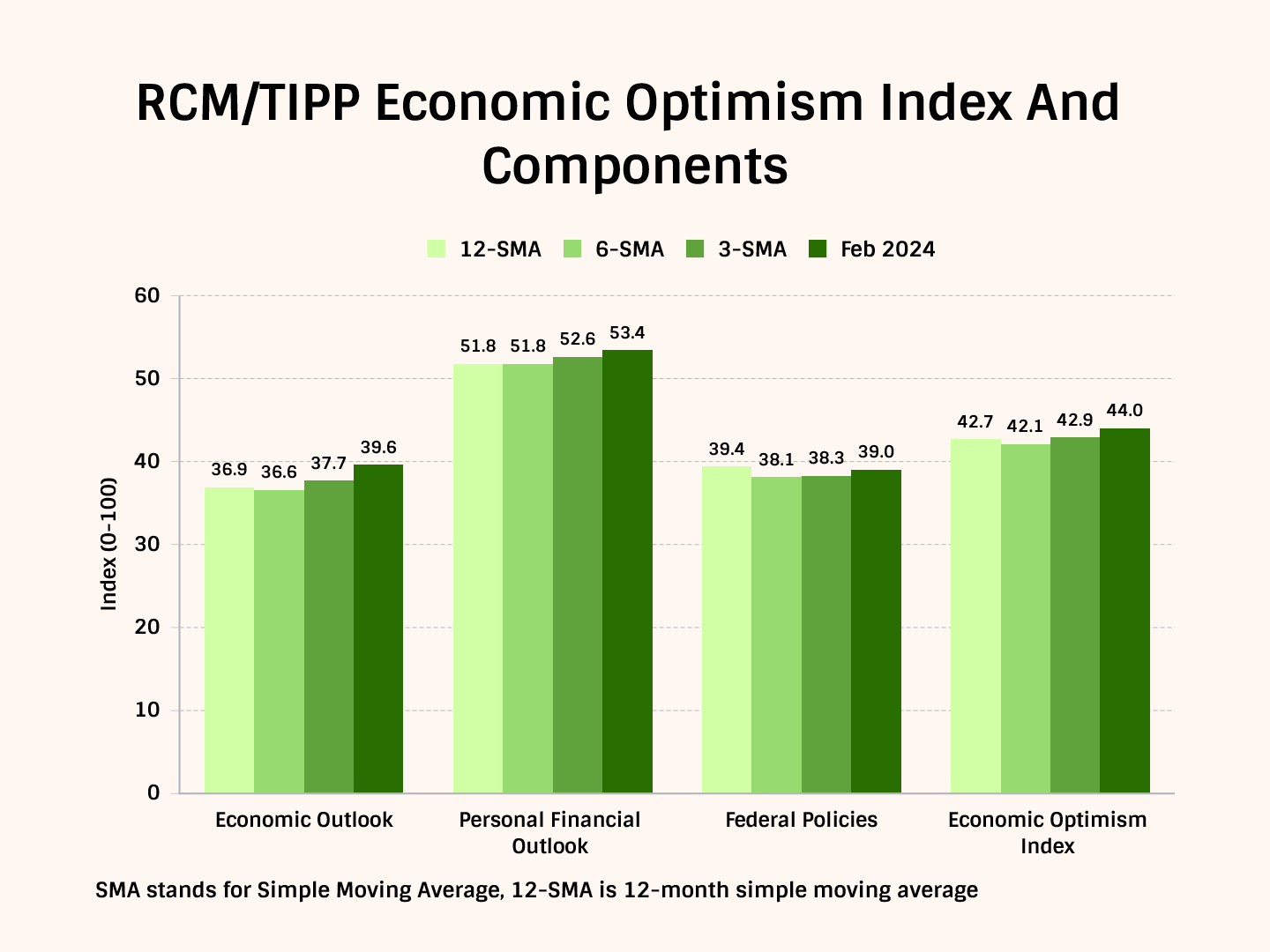

The RCM/TIPP Economic Optimism Index has three key components. For the index and its components, a reading above 50.0 signals optimism, and a reading below 50.0 indicates pessimism.

In February, two of these components declined, while one showed improvement.

- The Six-Month Economic Outlook, which measures how consumers perceive the economy's prospects in the next six months, improved from 39.3 in January to 39.6 in February, marking a 0.8% increase. (In October 2023, this component posted 28.7, its lowest reading since the index debuted in February 2001.)

- The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, dropped 2.9% from its previous reading of 55.0 to 53.4 this month. In January, the component crossed above the neutral reading of 50.0 and remained in positive territory for the second month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, declined from 39.8 in January to 39.0, reflecting a 2.0% drop.

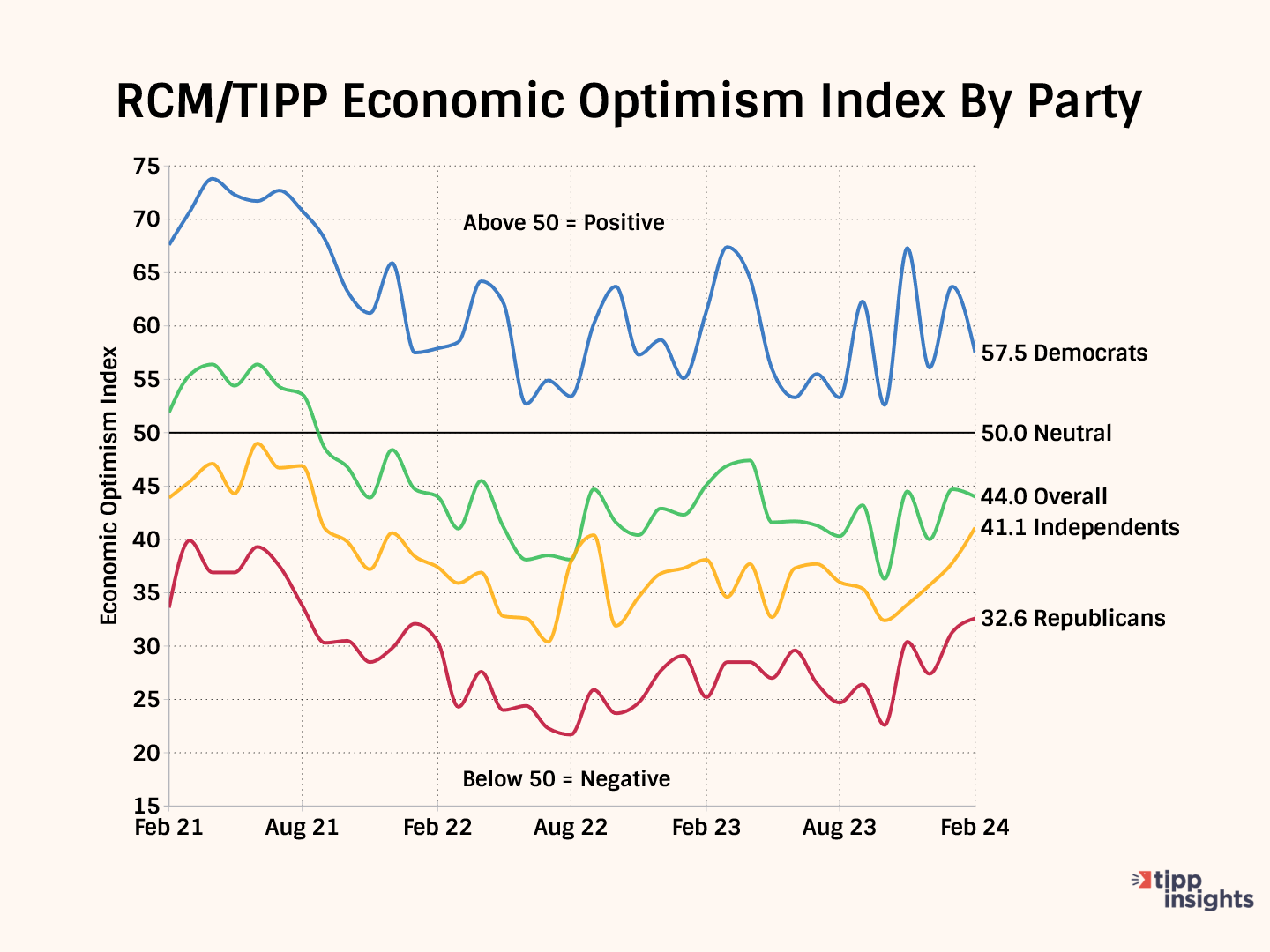

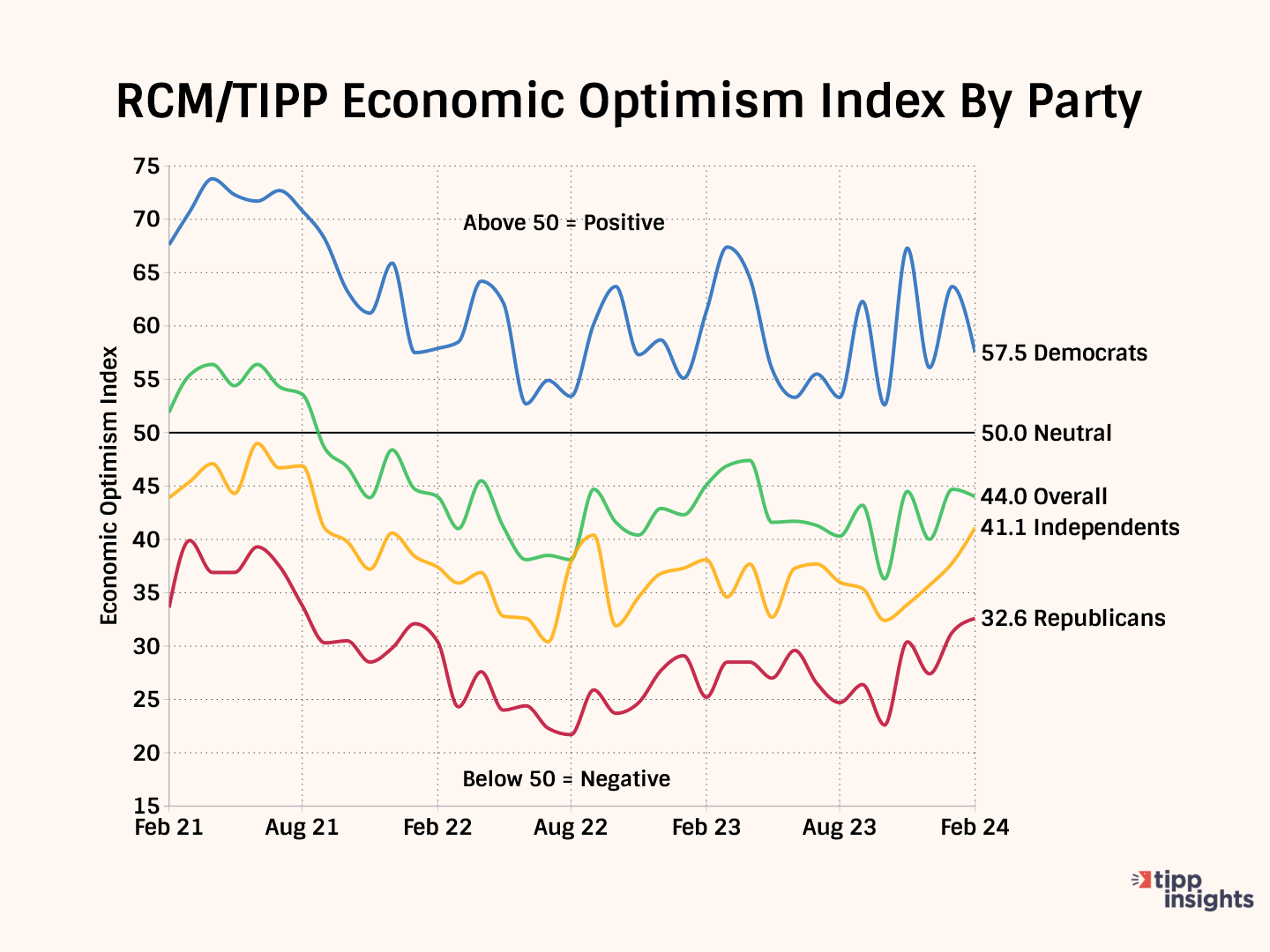

Party Dynamics

Democrats posted the highest confidence levels in February, at 57.5, despite a 6.2-point decline.

Meanwhile, Republicans' confidence gained 1.3 points to 32.6 this month. It has stayed in the pessimistic zone for 39 consecutive months since December 2020, after the presidential election.

Independents’ confidence has been in pessimistic territory for 47 months since April 2020, the month after the onset of the pandemic. But, they gained 3.3 points and posted 41.1 on the index in February.

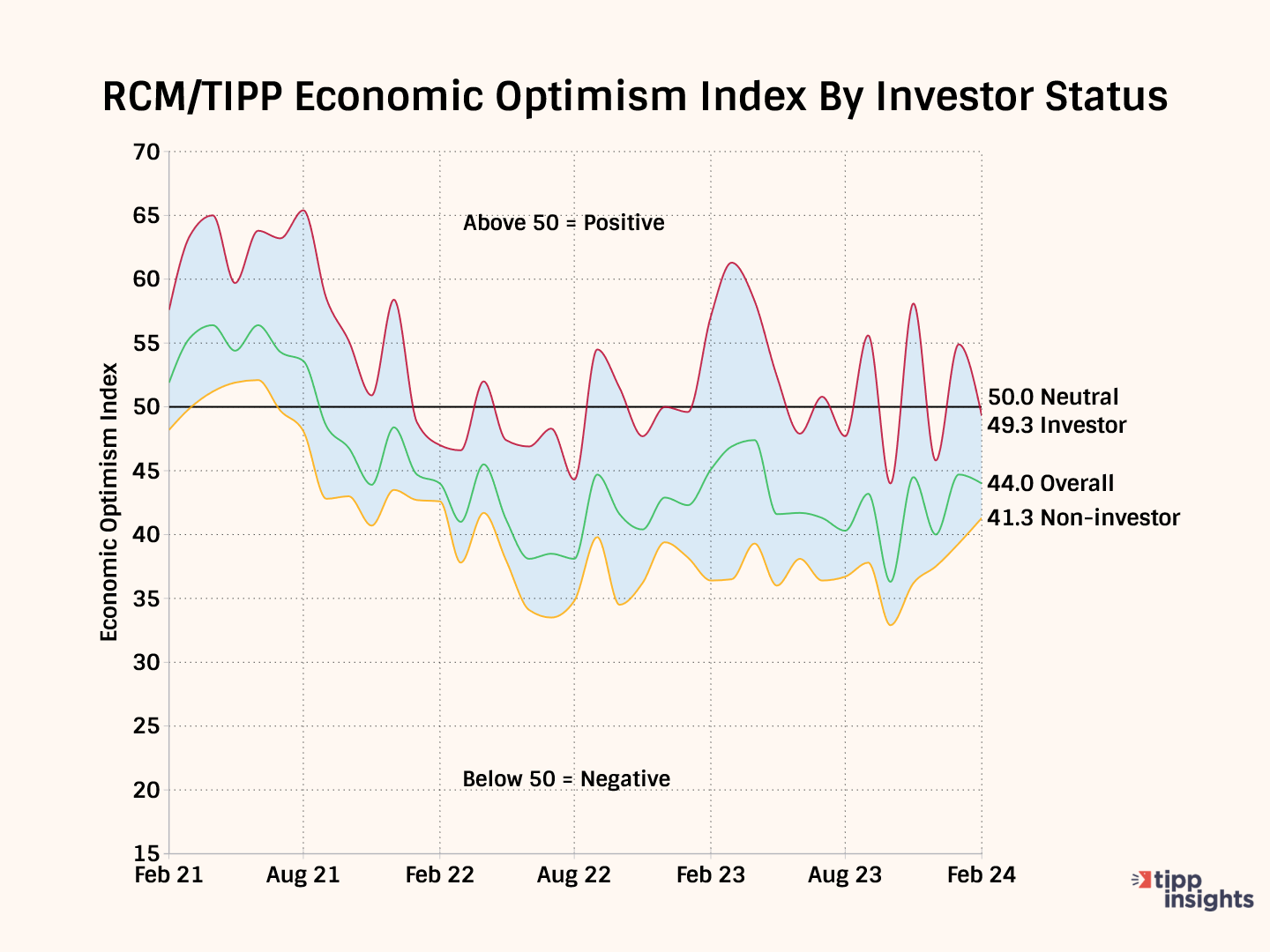

Investor Confidence

RCM/TIPP considers respondents to be "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan. We classified 36% of respondents who met this criterion as investors and 59% as non-investors. We could not ascertain the status of 5% of respondents.

Boosted by stock market gains, optimism among investors had gained 20% from 45.8 in December to 54.9 in January. However, it moderated in February and undercut the neutral level of 50.0 to record 49.3, a 10% drop.

Non-investor confidence has steadily climbed for four months since November, increasing from 32.9 in October to 36.2 in November, 37.5 in December, 39.3 in January, and 41.3 in February.

The economic optimism gap between investors and non-investors was 15.6 in January, widening from 8.3 in December. However, it narrowed back to 8.0 points this month.

Momentum

Comparing a measure's short-term average to its long-term average is one way to detect its underlying momentum. For example, if the 3-month average is higher than the 6-month average, the indicator is bullish. The same holds if the 6-month average exceeds the 12-month average.

In February, all three components and the Economic Optimism Index are higher than their three-month moving averages. Furthermore, the three-month moving averages for all the components and the Optimism Index are higher than the six-month moving average. As a result, the data shows a positive momentum.

Demographic Analysis

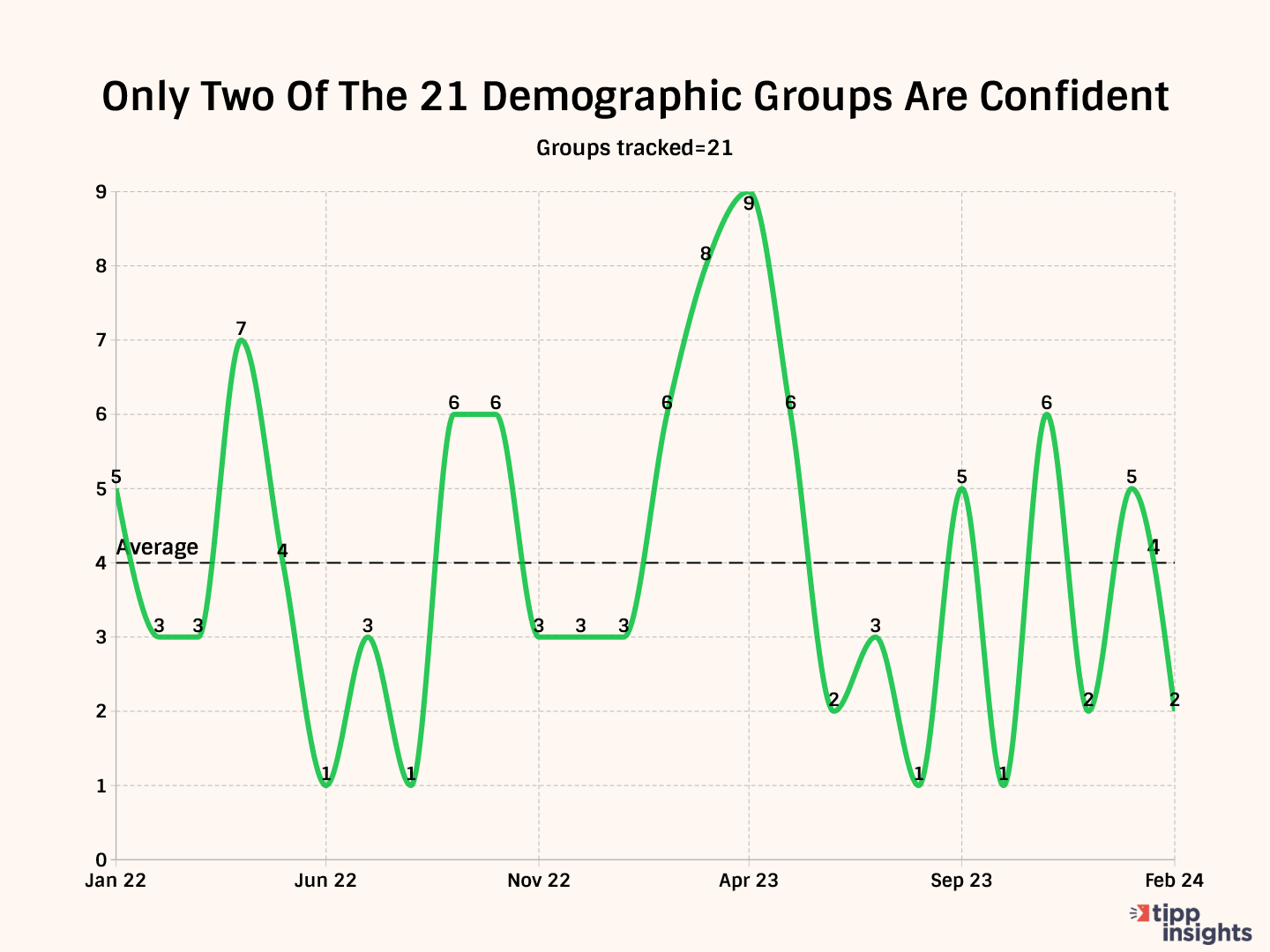

The number of groups in the positive zone indicates the breadth of optimism in American society. This month, two of the 21 demographic groups we track—such as age, income, education, and race—are above 50.0, indicating optimism on the Economic Optimism Index. Starting with three groups in January 2023, we saw steady improvement, peaking at nine groups in April and then declining to one group in August. Since August, it has moved in the range of one to six. Meanwhile, ten of the 21 groups showed increased confidence in February, compared to 19 in January and eight in December.

Inflation

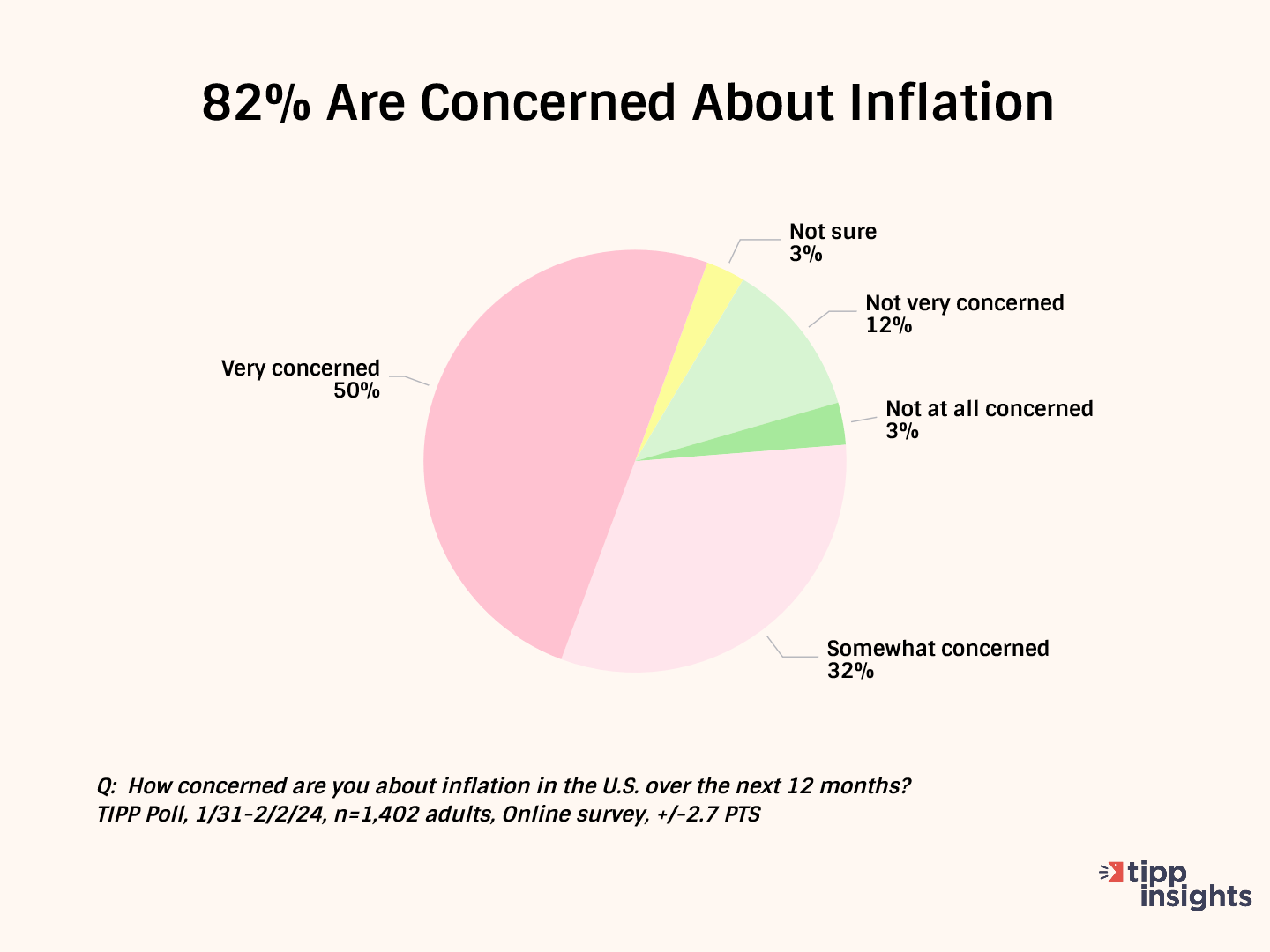

Inflation acts as a form of indirect tax on American households. According to our survey, 82% are worried about inflation. One-half (50%) are very concerned, and another 32% are somewhat concerned.

Even though the CPI rate has declined from a 40-year high of 9.1% in June 2022 to 3.4% in December 2023, Americans continue to be hurt because real wages have not improved.

The Federal Reserve believes that long-run inflation of 2%, measured by the annual change in the price index for personal consumption expenditures, is most consistent with its maximum employment and price stability mandate.

We will cover inflation in greater depth after the upcoming release of the CPI on February 13 next week.

Recession

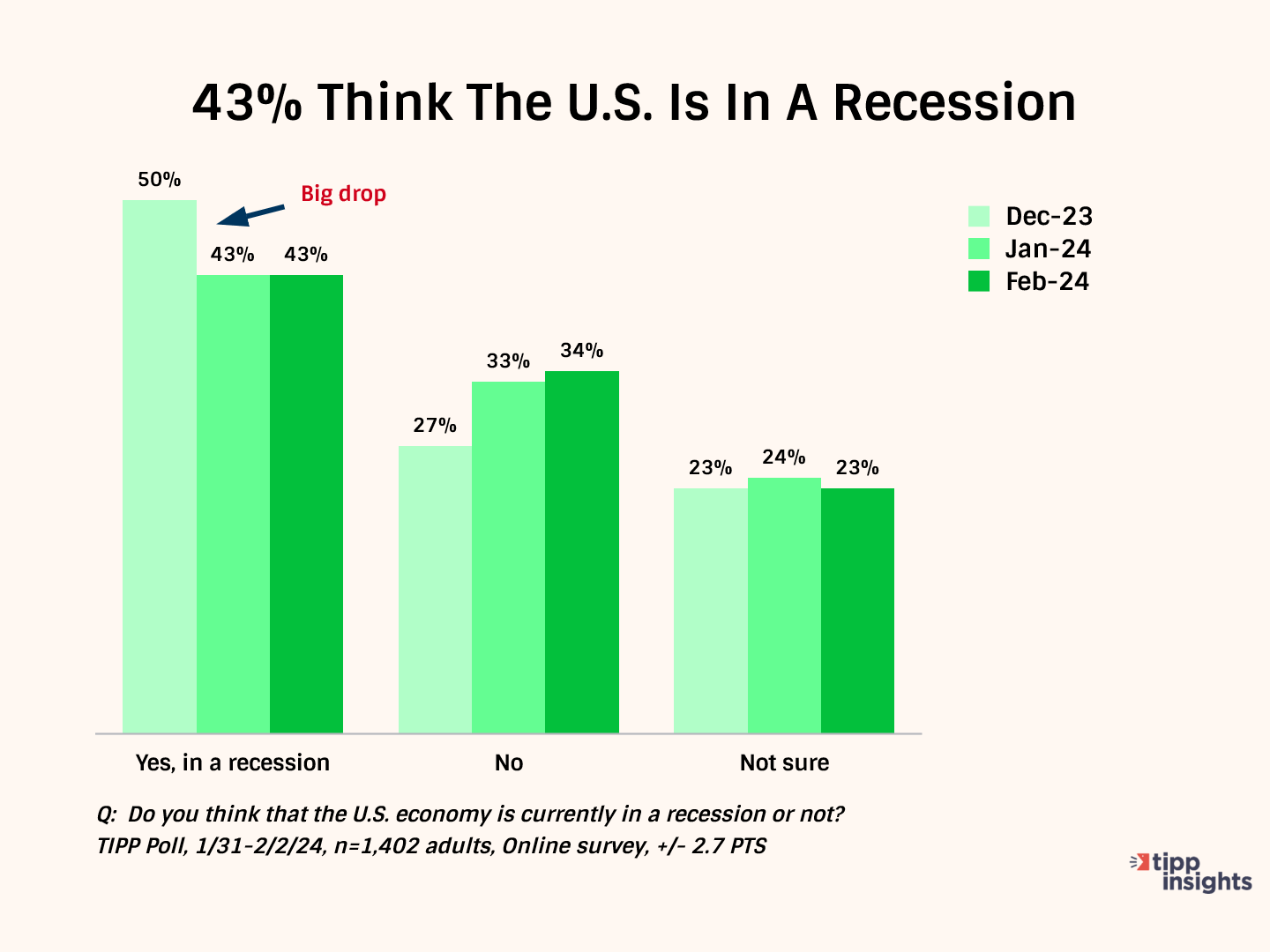

Four in ten (43%) Americans believe we are in a recession, while 23% are unsure. 34% believe we are not in a recession. Note that those who believe we are in a recession showed a notable seven-point drop from 50% to 43% in January. Again, in February, 43% said the U.S. is in a recession.

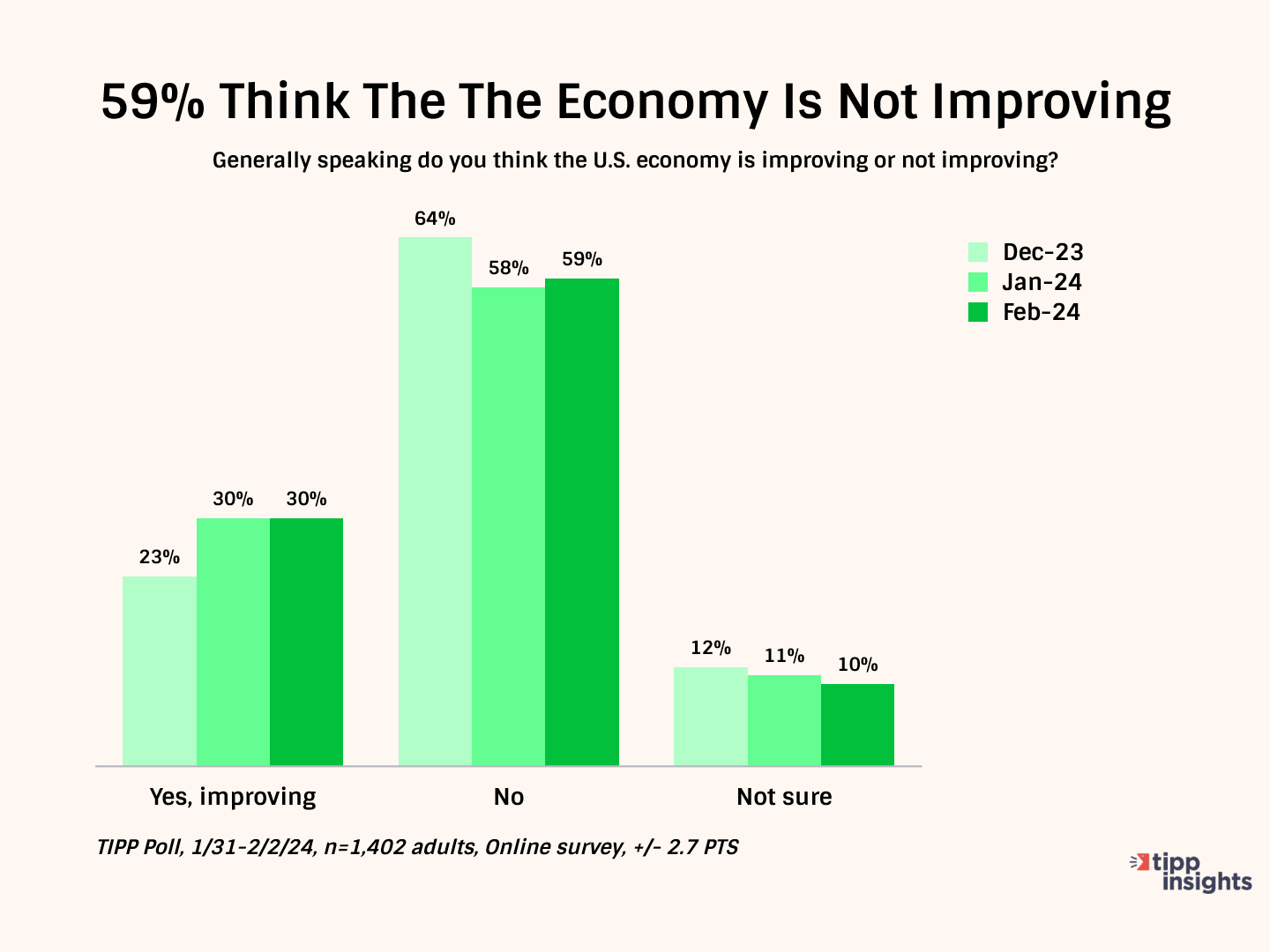

Further, over one-half (59%) think the U.S. economy is not improving, while 30% believe it is improving.

Fiscal Profligacy

The national debt crossed $34 trillion in January. On average, the government has borrowed $250,000 for each American household and is paying upwards of $1 trillion annually in interest—more than the allocation for national defense.

One downside of ballooning federal debt is that refinancing becomes challenging. Supply and demand in the bond market will drive interest rates. If there is a high supply of government bonds (due to high debt levels), interest rates may need to stay high to attract investors and ensure that the government can continue borrowing money.

Most Americans are concerned about the sustainability of this trajectory. The high interest rates are also hurting Americans and sapping their confidence.

Despite our positive report, the economic outlook and confidence are, at best, mixed. We anticipate a stagflationary economy in 2024. The risks on the downside outweigh those on the upside. Watch the real estate market, the stock market, and the job market, and see if Washington can pass spending bills.

Using an online survey, TIPP polled 1,402 adults nationwide from January 31 to February 2. Our next report will be released on Tuesday, March 5.

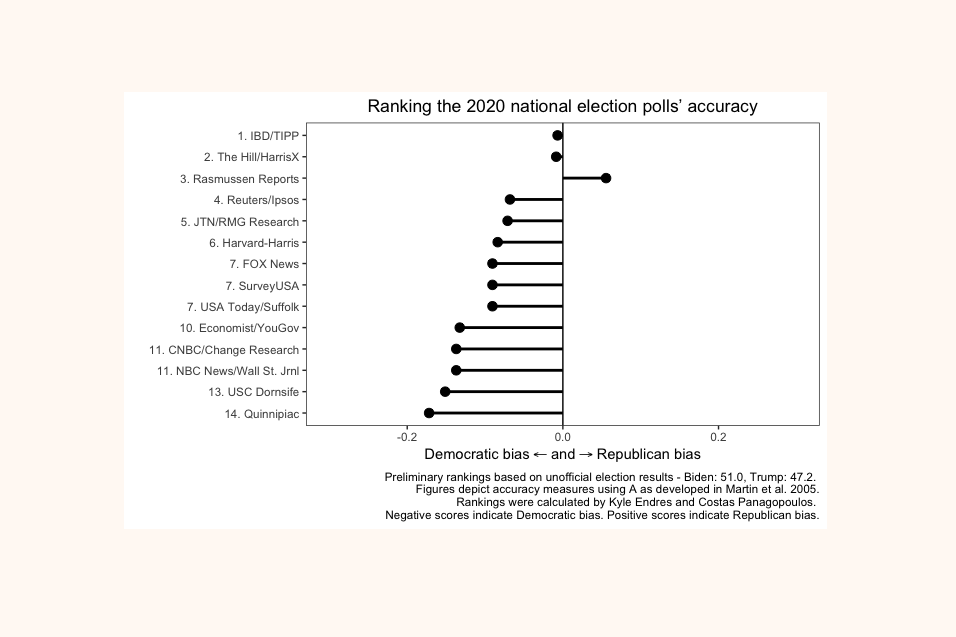

Our performance in 2020 for accuracy as rated by Washington Post: