It’s that time of year again, a time that many, if not most, Americans deeply dread: April 15, the U.S. federal income tax deadline. With that day now upon us, the I&I/TIPP Poll asked Americans whether they pay too much in federal taxes each year. The answer came back loud and very clear: Yes.

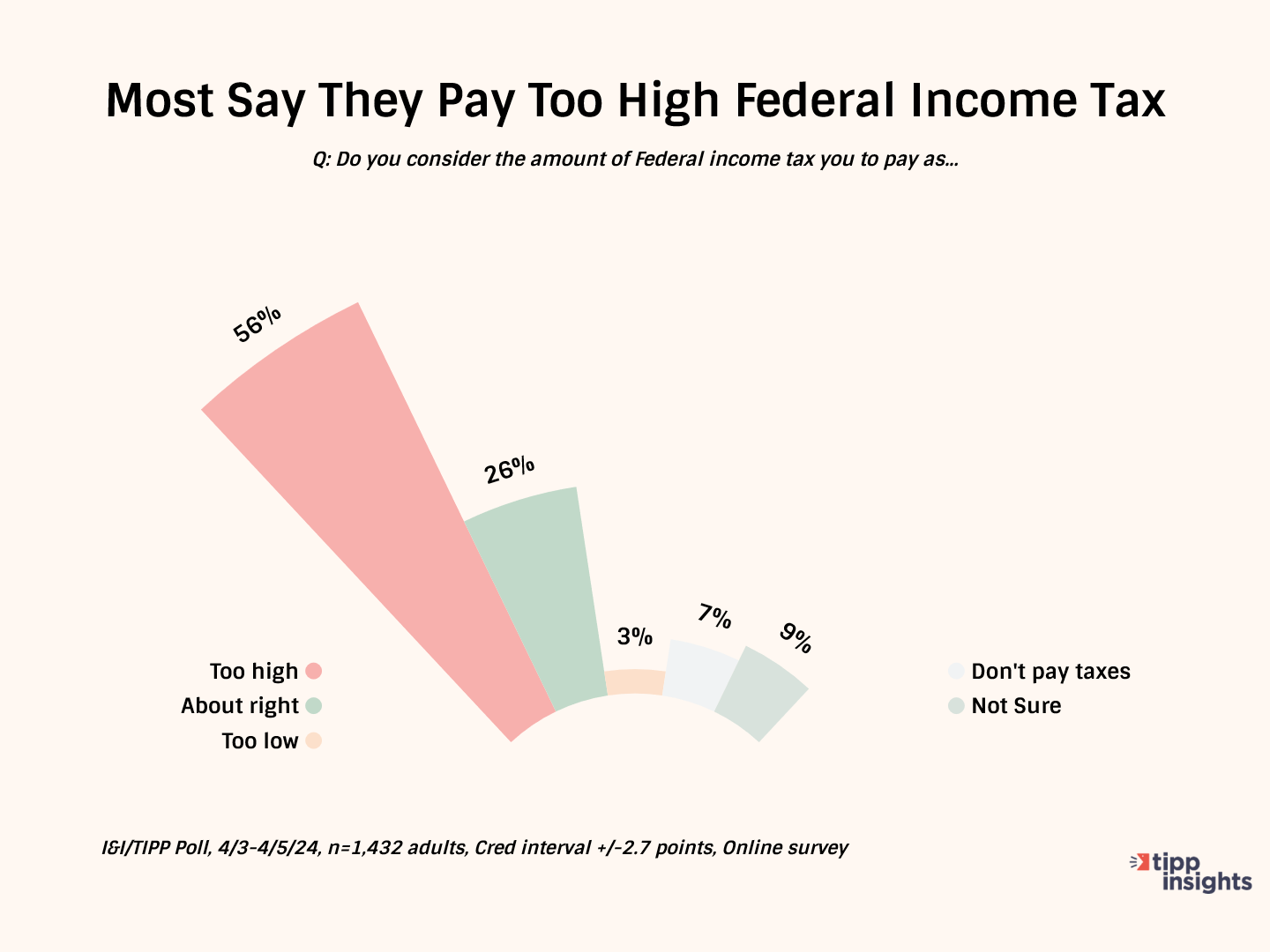

Specifically, the online national I&I/TIPP Poll of 1,432 voters asked the following question: “On the topic of taxes, do you consider the amount of federal income tax you pay as …”, followed by five possible answers: “Too high,” “about right,” “too low,” “don’t pay taxes,” and “not sure.” The poll, taken from April 3-5, has a +/-2.7 percentage point margin of error.

To anyone following today’s tax debate, the answers will come as little surprise: 56% of Americans believe they pay too much in taxes, while less than half (26%) say what they pay is “about right.” Only 3% say their taxes are too low, with another 7% saying they pay no taxes at all. And 9% say they aren’t sure.

So U.S. taxpayers are overwhelmingly convinced they pay too much in taxes. It isn’t even close.

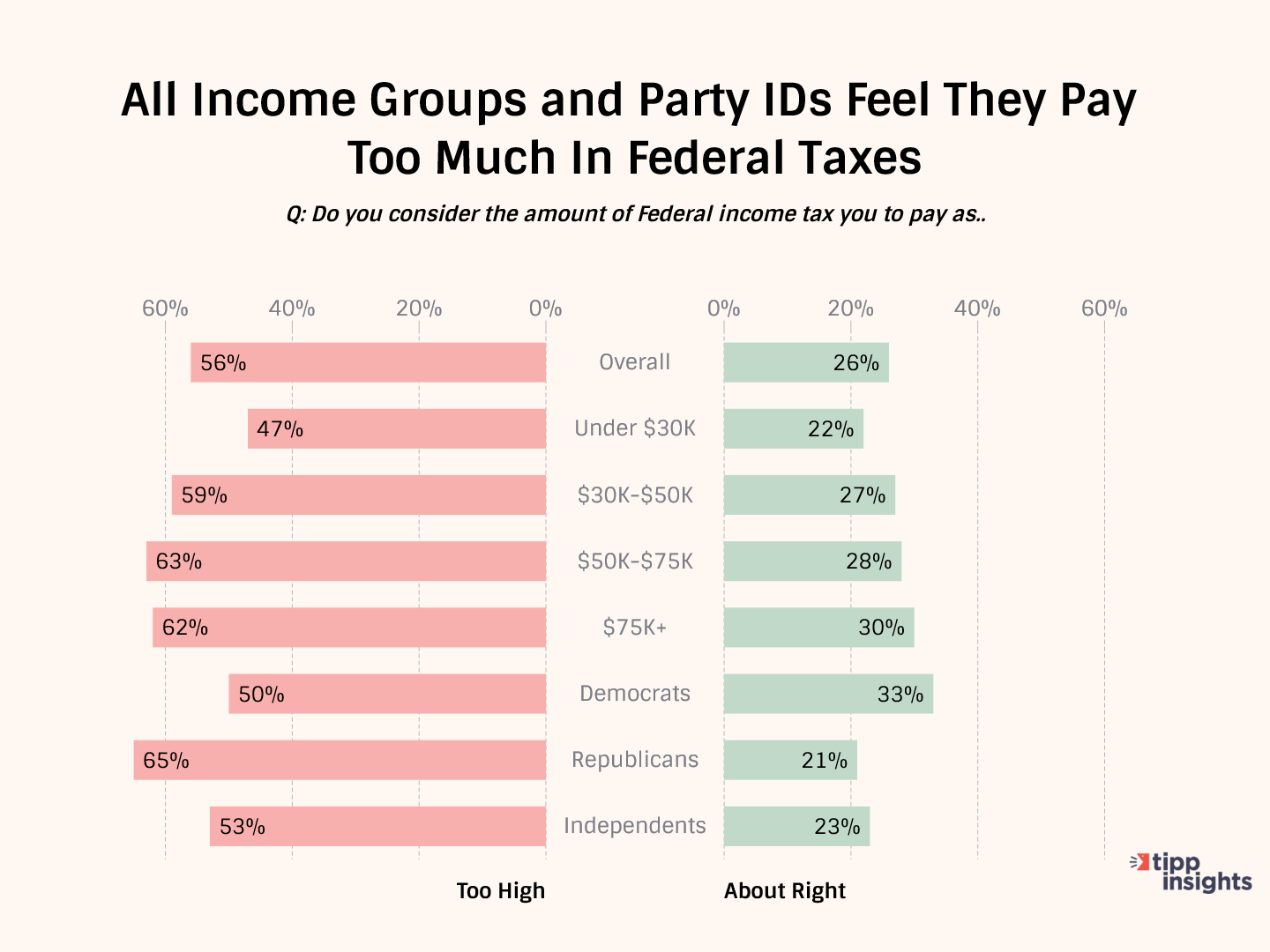

While there are differences among groups, a majority of virtually all of the 36 demographic categories tallied each month in the I&I/TIPP Poll think they pay too much in taxes.

Not surprisingly, for instance, there’s a gap by income, though not as large as might be suspected. Among those earning under $30,000 a year, who pay less than 3% of their income in taxes, 47% still say they pay too much. That compares with 59% of those who earn $30,000-$50,000, 63% of those who earn $50,000-$75,000, and 62% of those who earn $75,000 or more.

In short, everyone thinks they’re overtaxed. That includes, by the way, a bipartisan consensus. Among Democrats, 50% say they’re overtaxed, while 65% of Republicans and 53% of independents agree.

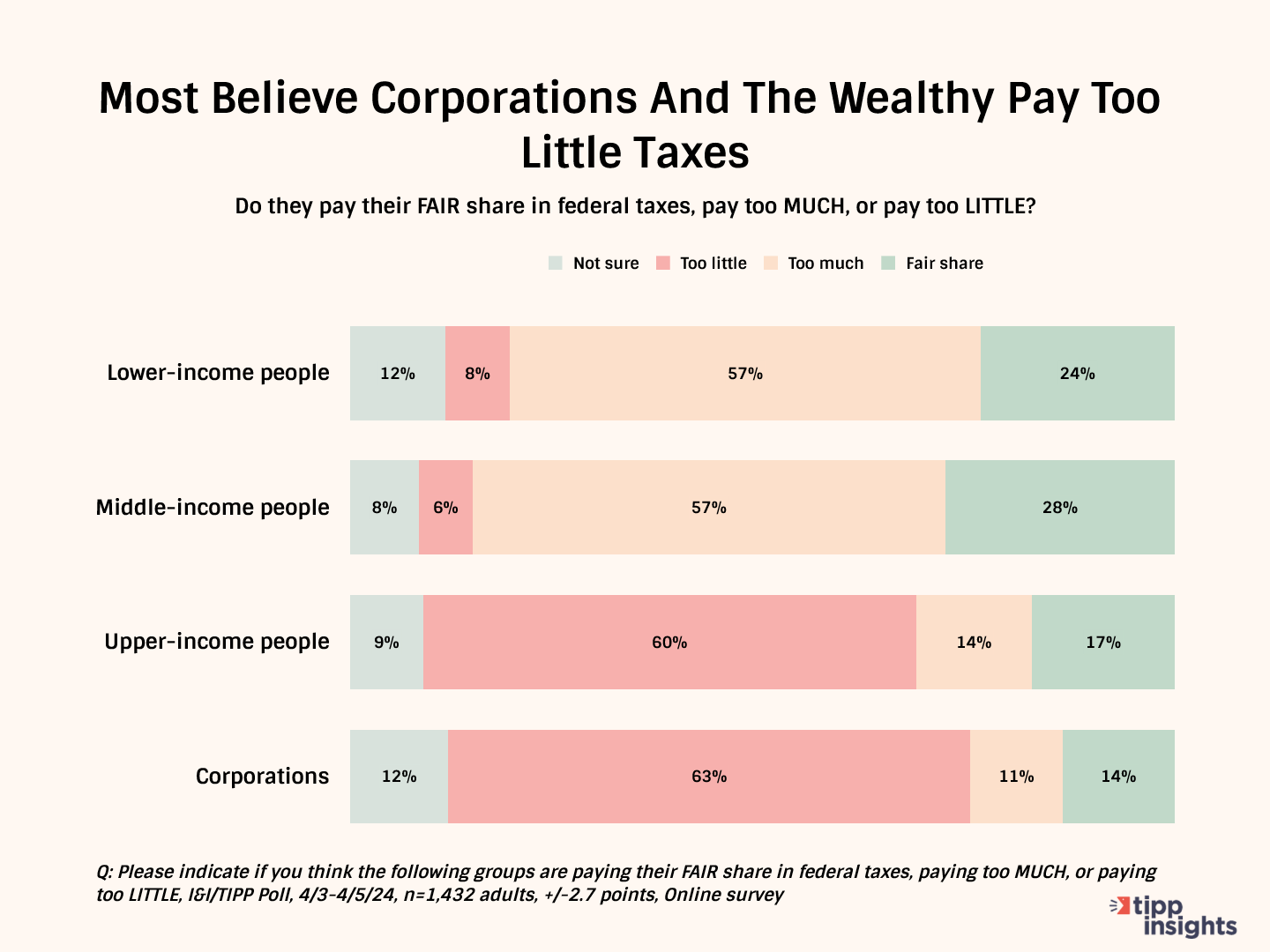

We asked a follow-on question: “Please indicate if you think the following groups are paying their fair share in federal taxes, paying too much, or paying too little.” The choices included “lower-income people,” “middle-income people,” and “upper-income people” and “corporations.”

The responses were interesting, to say the least.

Just 24% said that lower-income people were paying their fair share of taxes, while 57% said they were paying too much. Another 8% said they were paying “too little,” while 12% weren’t sure.

The responses to “middle-income people” were fairly similar: 28% said they were paying their fair share, while 57% said they were paying too much and only 6% said they were paying too little.

The big shift in public sentiment comes with assessing how much in taxes are paid by upper-income Americans. Just 17% said they were paying their fair share, while an even smaller portion – 14% – said they were paying “too much.” But a whopping 60% said the higher-income folks were paying too little. Not surprisingly, corporations elicited similar responses, consistent with the perception that they pay too little taxes.

Again, there was a surprising accord among both major political parties and independents on this issue. Among Democrats, 18% said the highest incomes were paying their fair share, compared to 21% of Republicans and 11% of independents. Another 11% of Democrats, 19% of Republicans, and 11% of independents said the upper-income folks were paying too much.

But 67% of Democrats, 49% of Republicans, and 63% of independent voters agreed that those in the upper reaches of the income brackets are “paying too little.”

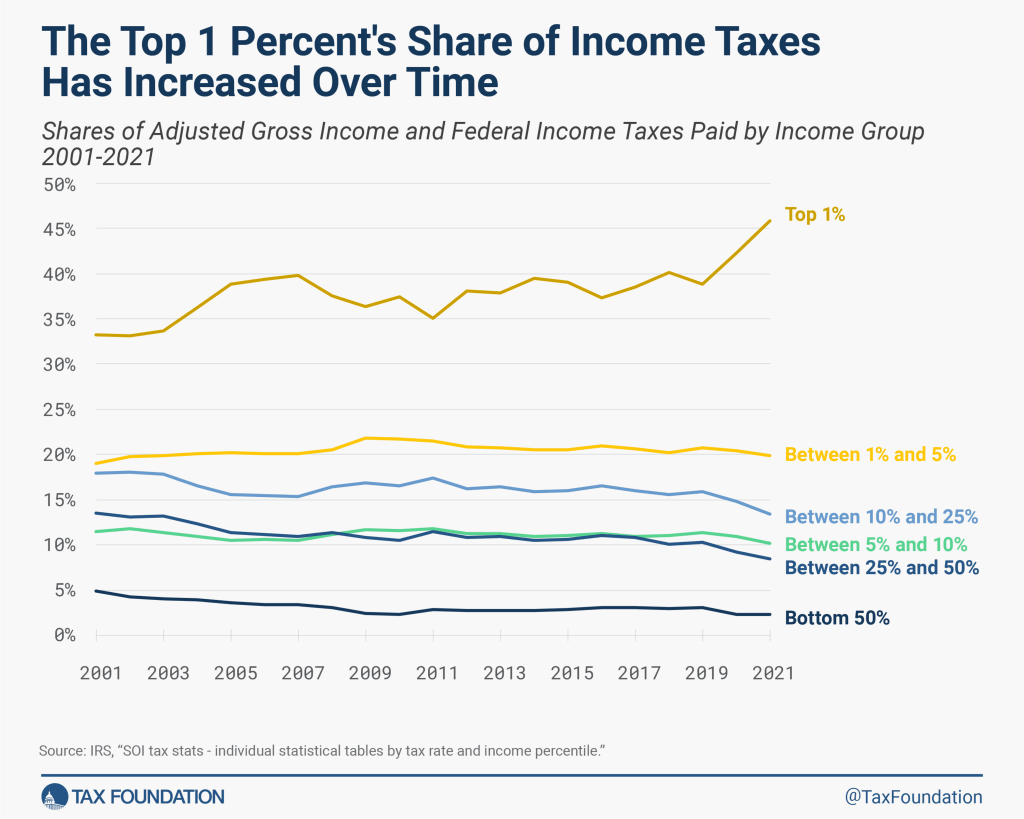

Of course, the image of the wealthy getting even richer while paying no taxes, as the poor and middle class bear the burden is not exactly accurate. So the definition of “fair” needs to be considered.

The truth is, “fair” is entirely subjective. One person’s fair, is another’s unfair. But there are objective ways to gauge whether an argument over tax fairness is valid or not. It’s simple: What do people pay in taxes compared to others? And what did they pay before?

A look at the last couple of decades reveals a shocking result: “Tax cuts for the rich,” the supposed result of efforts to boost the economy through lower taxes, has in fact led to the wealthiest Americans paying the highest levels of taxes as a share of the total in history.

The latest data, which go through the 2021 tax year, tell the tale in a single image (from the nonpartisan Tax Foundation):

As the chart shows, the richest 1% among us now earn 26% of all income but pay more than 45% of all taxes, while the bottom 75% of all Americans earn 28% of all income but pay just under 11% of all taxes.

The chart also shows a recent steep rise in tax revenue from the wealthiest taxpayers. Why did this happen? Credit the 2017 Tax Cuts and Jobs Act, which is set to expire at the end of next year. If the law expires, it could be bad news.

“If the tax cuts are not extended, the U.S. economy will be hit by a $3.5 trillion tax increase, and most of the tax increase will fall on individual taxpayers and working families,” writes former assistant Treasury secretary and Merrill Lynch executive Bruce Thompson in RealClearMarkets.

Thompson adds:

According to the Joint Committee on Taxation, more than three-quarters of the individual tax cuts went to taxpayers earning less than $500,000 a year. Taxpayers earning under $100,000 will face an average tax increase of 16% a year.

Would that be tax unfairness? Or should those in the highest income brackets pay higher taxes no matter what, even if it leads to less tax income overall? Would that be fair?

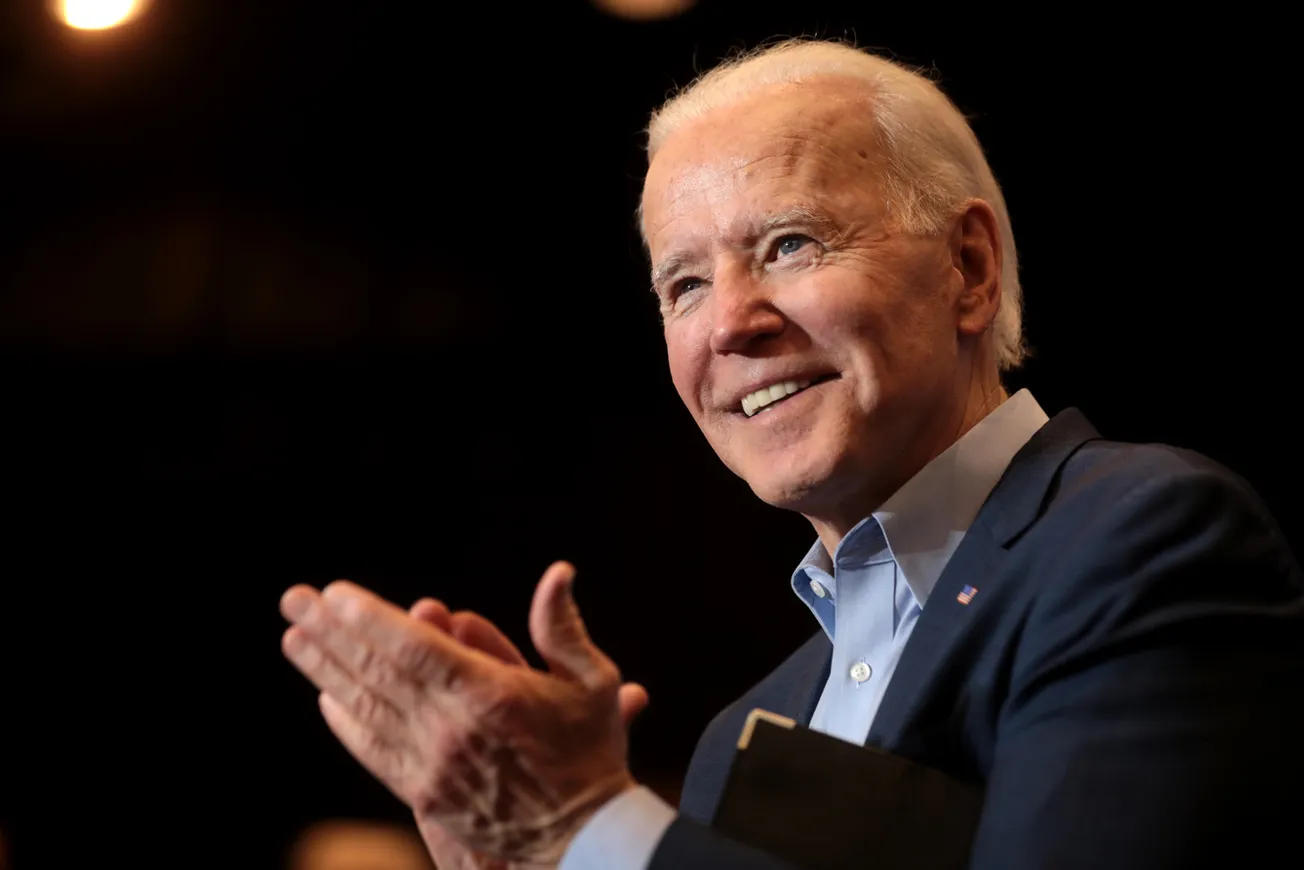

As Americans this week ponder their hefty 2023 tax bills, and who’s paying what, they might want to know the truth that the I&I/TIPP Poll and IRS data reveal: That despite concerns over “fairness” and what President Joe Biden has called “tax giveaways,” tax cuts are sometimes the best way to boost the economy, lift wages, raise tax revenues, all while actually making taxes fairer.

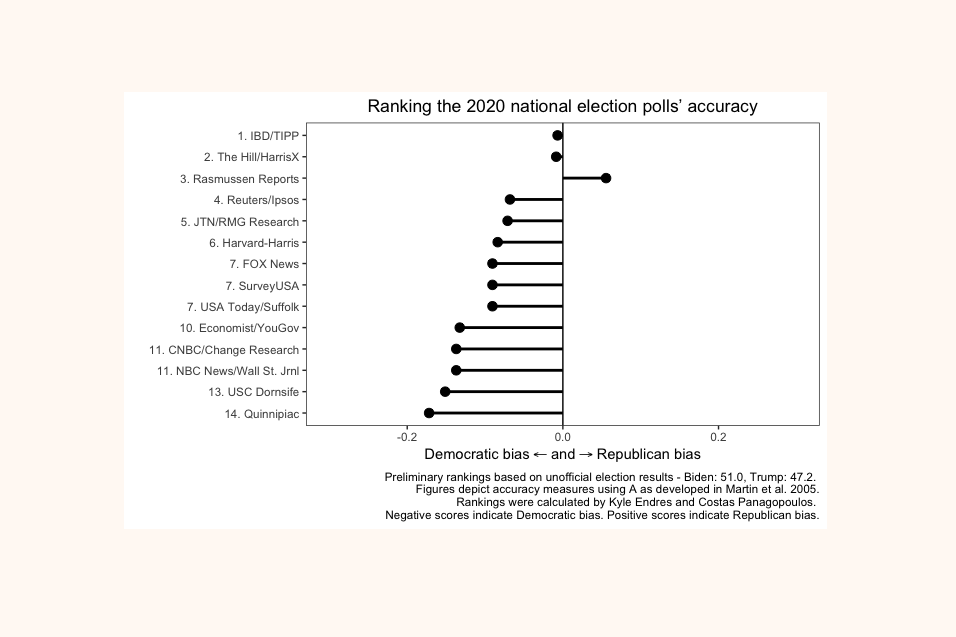

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Want to dig deeper? Download crosstabs from our store for a small fee!

Our performance in 2020 for accuracy as rated by Washington Post: