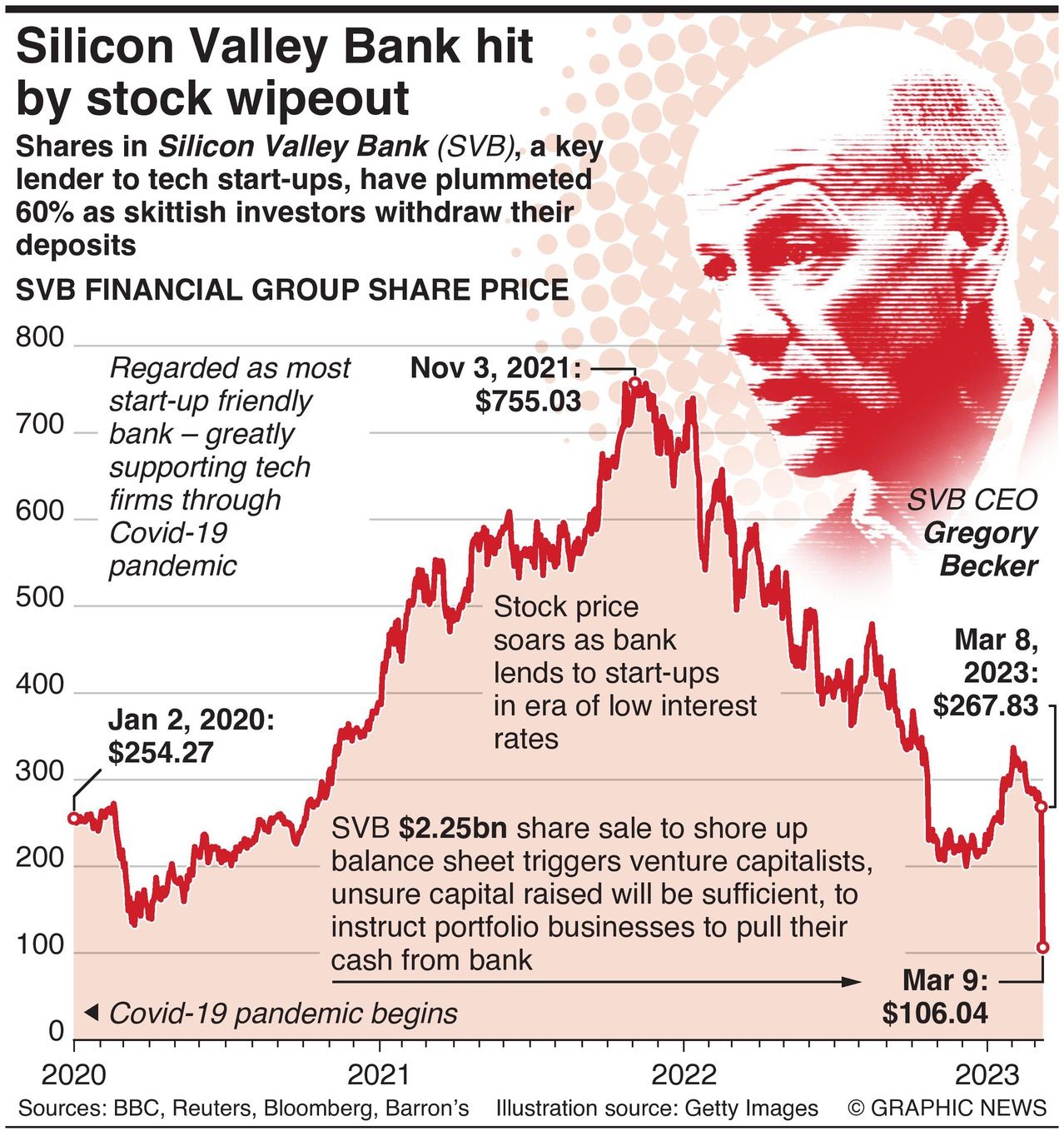

The share price of Silicon Valley Bank, a key lender to tech start-ups, has crashed by 60% – triggering the U.S. Federal Deposit Insurance Corporation to seize its assets.

United States regulators have shut down the country’s 16th largest bank, marking the biggest failure of an American bank since subprime losses felled Washington Mutual during the 2008 financial crisis.

On March 8, trouble befell the little-known Californian bank that was the lender of choice for nearly half of all U.S. venture-backed tech companies that went public in 2022, sparking panic that dragged down banking shares around the world.

The events were triggered when Silicon Valley Bank (SVB) launched a $2.25 billion share sale on March 8 to shore up its balance sheet after selling a $21 billion loss-making bond portfolio.

Anxious about whether the capital raised would be sufficient, venture capitalists instructed portfolio businesses to pull their cash from the bank.

The resulting chaos caused 60% of SVB’s stock price to be wiped out, leading to SVB CEO Gregory Becker calling clients to assure them their money was safe.

But it was too late. The U.S. Federal Deposit Insurance Corporation (FDIC) seized its assets on March 10.