The Xi–Putin axis is growing stronger. China buys Russian oil, filling Moscow’s war chest and funding its war in Ukraine. In return, the Kremlin offers favors in the form of flight lessons for a future war. Russia trains, equips, and imparts know-how, preparing Beijing for Taiwan. Analysts speculate that China will strike in 2027. Reports suggest that Xi has promised to wait out the Trump presidency and strike when the time is right.

Last week, around 800 pages of Russian documents surfaced, leaked by a group calling itself Black Moon. They outline the training and equipment Moscow has promised to China and were analyzed by the Royal United Services Institute in London. The Associated Press reviewed the files and deemed them credible but could not confirm them independently.

On the whole, the files reveal more than routine contracts. They point to a blueprint for war.

The leaked Russian papers reveal that Moscow is training Chinese paratroopers and selling them the necessary equipment to do so. The deal is valued in the hundreds of millions and includes vehicles that can be dropped from the sky, as well as new parachute systems that enable troops to glide for miles before landing.

China’s airborne force is young and untested, while Russia’s paratroopers have been in action since the Second World War. With Moscow’s help, Beijing could, in a few years, gain what it would otherwise take a decade to learn.

In the context of Taiwan, China’s enhanced paratrooping skills are ominous. An amphibious landing across the Taiwan Strait is hard to pull off. Adding paratroopers changes the equation. Airborne forces could slip past coastal defenses, seize airfields, or disrupt command centers inland. With Russian help, Beijing could strike the island from both sea and sky.

Behind the drills lies a marriage of convenience, not of trust. They call it a “no-limits partnership.” In truth, it has limits everywhere. Russia relies on China to purchase its oil, but bristles at being portrayed as the junior partner. China welcomes cheap energy, but remembers the centuries when Russia carved up its territory. Old grudges and new mistrust still lurk behind the polite smiles and photo-op handshakes.

For now, Putin calls the shots in Ukraine, and Xi looks away. Meanwhile, Moscow flirts with North Korea, stirring up tensions in the Korean Peninsula, China’s own backyard. For all the talk of unity, each side eyes the other warily. What binds them is not trust, but the opportunity to weaken America.

Taiwan is no distant, inconsequential island. It is the linchpin of global trade and technology. The Strait carries a large share of the world’s container traffic. Any conflict there would choke supply lines and send shockwaves through global markets.

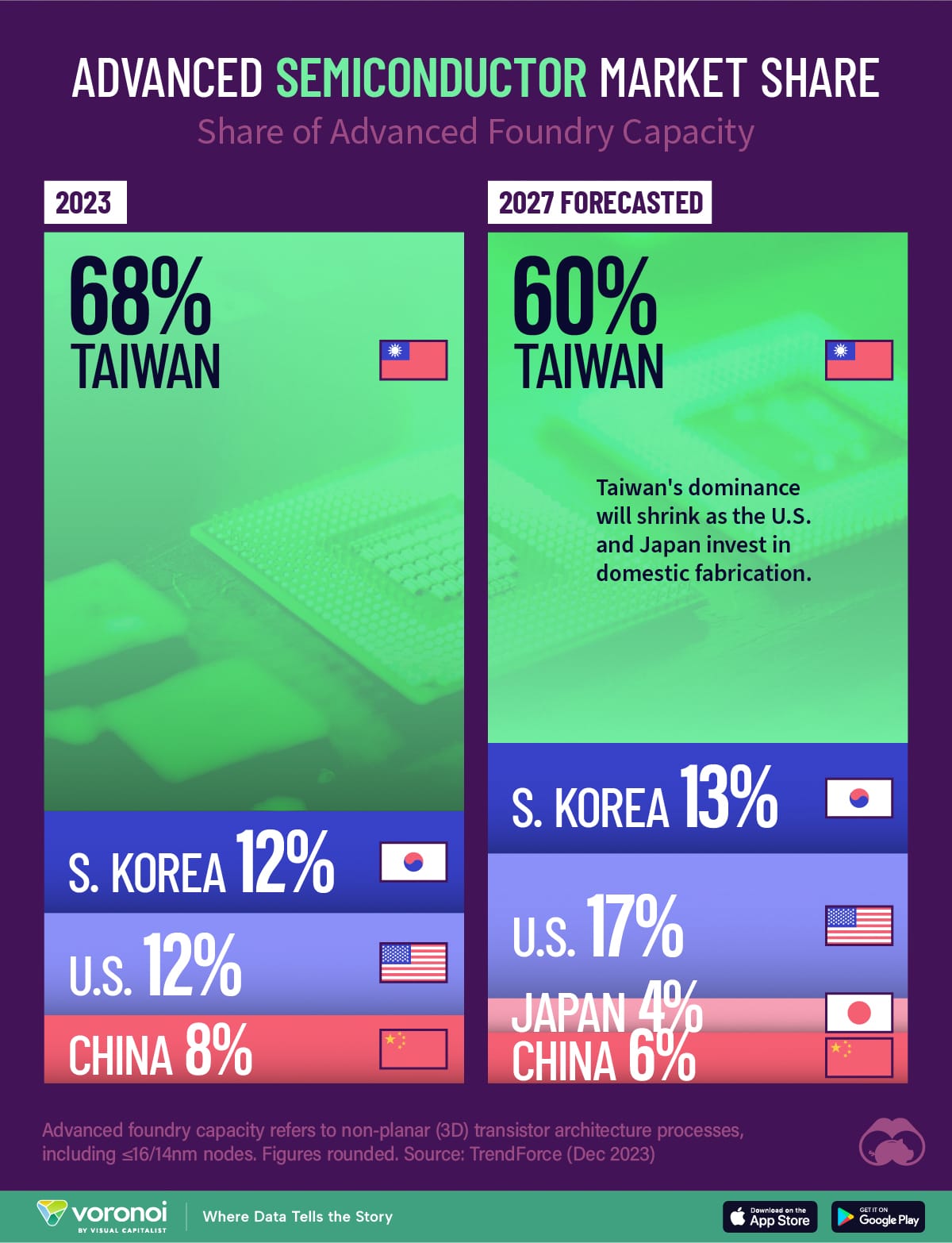

Even more critical are semiconductors. Taiwan produces more than 90 percent of the world’s most advanced semiconductors, the building blocks of artificial intelligence, modern weapons, data centers, and everyday electronics. Washington is trying to insulate itself by funding new factories at home, but those plants will take years to come online. For now, the United States and much of the world remain dependent on Taiwan’s silicon lifeline.

American policy remains bound by the ‘One China’ framework. Washington does not recognize Taiwan as an independent state and avoids language that could rattle Beijing. Even symbolic gestures spark fury. Each time an American lawmaker lands in Taipei, China responds with threats, sanctions, or military drills in the Strait. To manage this tension, Washington has embraced “strategic ambiguity.” The United States promises to help Taiwan defend itself, but never explicitly states whether its own forces would engage in combat. The aim is to deter Beijing without giving Taipei a blank check for independence. It is a delicate balance, but one that becomes increasingly challenging as China’s strength grows and Russia provides more support.

📊 TIPP Insights Exclusive

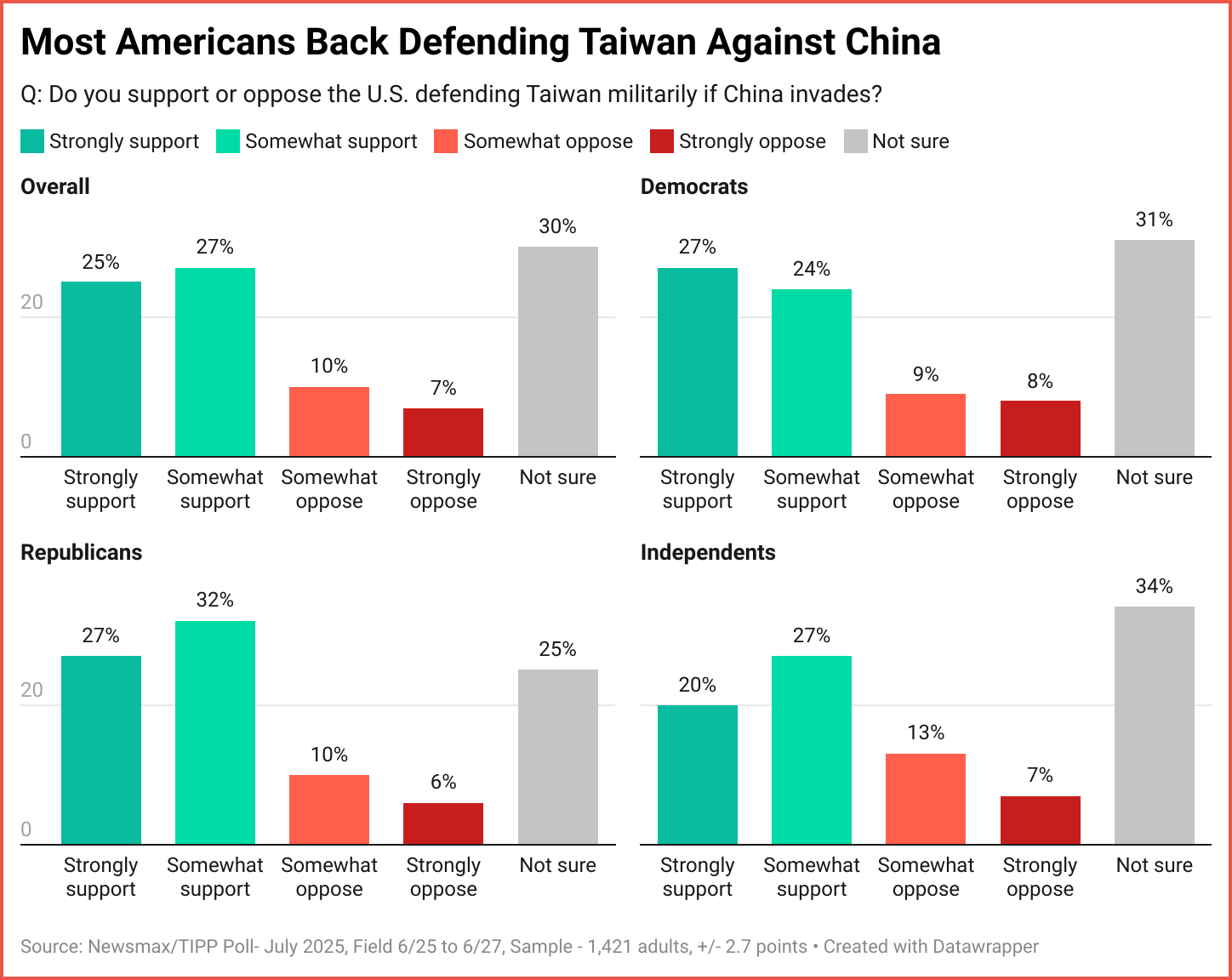

America’s view on Taiwan is unsettled. Our latest Newsmax/TIPP Poll finds just over half would back U.S. troops if China invaded, while nearly a third remain unsure.

👉 Get the gold standard in polling and sharp China coverage. Subscribe today for $99/year.

Public opinion mirrors Washington's stance. A Newsmax/TIPP Poll found just over half of Americans, 52 percent, would support using U.S. forces to defend Taiwan if China invaded, while nearly a third were unsure and 17 percent opposed.

Beijing may read it as weakness, a sign that America’s will to fight is not settled.

The contrast could not be sharper. Taiwan updates its civil defense manuals and prepares its citizens for blackouts and blockades. China, with Russia’s help, rehearses an invasion. One side girds for survival, the other dreams of conquest. History shows where such hubris leads. The bear may lend its wings, but the dragon’s flight path ends in ruin.

Related: Watch US Air Force Very Special Technique to Airdrop Humvees at Extreme Altitude

TIPP Top-20 Stock Picks

Each weekend, TIPP Insights spotlights 20 actively traded stocks, all priced above $20 with a 50-day average trading volume greater than 500,000 shares. These names are drawn from themes of innovation, energy, technology, and financial strength.

Think of the Top-20 as your weekend market compass. It is not investment advice, but a disciplined screen to help you focus on liquid, high-quality opportunities as you plan the week ahead.

1. NBIS – Nebius Group N.V. – $107.70 – Cloud services

2. IREN – IREN Ltd. – $41.86 – Crypto mining

3. OKLO – Oklo Inc. – $110.53 – Clean energy

4. IONQ – IonQ Inc. – $67.28 – Quantum computing

5. LEU – Centrus Energy Corp. – $305.35 – Nuclear fuel

6. QURE – uniQure B.V. – $54.31 – Biotechnology

7. RGTI – Rigetti Computing Inc. – $31.18 – Quantum computing

8. APLD – Applied Digital Corp. – $21.71 – Data centers

9. CLS – Celestica Inc. – $243.79 – Electronics

10. NKTR – Nektar Therapeutics – $58.50 – Biotechnology

11. QUBT – D-Wave Quantum Inc. – $26.76 – Quantum computing

12. APP – Applovin Corp. – $669.86 – Software

13. BMNR – BitMine Immersion Tech Inc. – $50.50 – Crypto infrastructure

14. HOOD – Robinhood Markets Inc. – $121.78 – Brokerage/Fintech

15. PSIX – Power Solutions International Inc. – $103.72 – Industrial machinery

16. WDC – Western Digital Corp. – $106.88 – Storage hardware

17. STX – Seagate Technology Holdings – $217.51 – Storage hardware

18. CIEN – Ciena Corp. – $141.93 – Telecom equipment

19. SATS – EchoStar Holding Corp. – $73.45 – Telecom equipment

20. MP – MP Materials Corp. – $68.63 – Rare earth mining

We’ll be back tomorrow with our look at the week’s best performing stocks and ETFs. Stay tuned.

Disclaimer: These stock picks are for informational purposes only and are not investment advice. Please do your own research before investing.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.