As the media and the Left continue their post-mortem on how Harris got shellacked in the election, the New York Times’ DealBook page decided to interview President Biden's Chief Economist. Jared Bernstein, the chair of the White House Council of Economic Advisers and the architect of Bidenomics, now finds himself in a down mood — dealing, he says, with "confusion, guilt" and "cognitive dissonance."

It is a little late for Bernstein to feel guilt, though. For an eminent liberal economist (whose inclusion in the Barack Obama administration his mentor Paul Krugman championed), Bernstein's qualification was that he represented the far-left fringe of the Keynesian economic doctrine. With the Democrats having chosen Biden in 2020 to neutralize the even more liberal Bernie Sanders, Biden was forced to appoint extreme leftists to senior positions in his administration.

John Maynard Keynes, a British Economist who first came to prominence in 1936, after the Great Depression, emphasized the importance of government intervention to stabilize an economy. Keynes rejected classical economic theory until that point by proposing that governments could increase public spending (by borrowing) to boost demand during economic downturns. Keynes introduced the concept of the multiplier, where an initial increase in spending (e.g., government investment) creates a chain reaction of increased consumption and production, amplifying the overall economic impact.

Bernstein, a Columbia graduate, started his career in liberal think tanks like the Economy Policy Institute during the Clinton administration and was eager to put Keynesian economics into practice. His academic qualifications to be Biden's chief of economics were suspect, as he earned his Master's and Doctorate degrees in Social Welfare, not in classical economics. Bernstein, Clinton Labor Secretary Robert Reich, Nobel Laureate Paul Krugman (who has been wrong on every policy prediction), and Treasury Secretary Janet Yellen all cut their careers from the same liberal cloth, focused on labor economics, the middle class, income inequality, and upward mobility.

Atop Biden's economic policy hierarchy, Bernstein attempted to devise a unique Keynesian policy of borrowing and spending, but one running on steroids. Berstein sought to drive demand to spur economic growth by injecting trillions into the pockets of Americans. Vice President Kamala Harris often provided the tie-breaking vote in the Senate to push through Bidenomics.

The American Rescue Plan Act of 2021 allocated approximately $1.9 trillion in additional spending. By mid-2021, total federal expenditures across all COVID-19 relief initiatives, including those passed under President Trump, exceeded $5 trillion, more than the annual federal budget. All the additional spending was borrowed.

Even this extraordinary level of additional spending did not stop Bernstein from pushing for more. In November 2021, Biden signed the Infrastructure Investment and Jobs Act to inject another $1.2 trillion into the economy.

Incredibly, Bernstein continued to push for even more federal spending. The Build Back Better Act (BBB), a significant policy initiative of the Biden administration, was initially proposed with a price tag of $3.5 trillion but later reduced to approximately $1.75 trillion after negotiations. Thanks to Joe Manchin, the West Virginia Democrat, the bill died in the Senate. Still, Manchin got a large chunk of $369 billion back into pork-barrel spending through the ridiculously named Inflation Reduction Act, which passed in the Summer of 2022.

The effects of all these spending initiatives wrecked the American economy, unlike any other time in recent memory.

On May 5, 2022, the Federal Reserve announced the first of its many interest rate hikes - a dramatic 50 basis point increase in its Funds Rate to bring it into a target range of 0.75% to 1.00%. The Fed also began tightening its balance sheet, stopping its quantitative easing policy altogether, and asking borrowers to return cash to the Fed when their securities matured.

The Federal Open Market Committee (FOMC) met four times in the next six months - in June, July, September, and November. Each time, the Fed announced a 75 basis point increase, unprecedented in modern times. On November 3, the Fed Funds target rate reached 4%. It meant that the Fed had substantially increased the cost of borrowing for the federal government to service its ever-increasing debt. In December and February, the Fed again increased rates. As of November 7, 2024, the federal funds rate is 4.50% to 4.75%. And Chairman Powell has not ruled out additional hikes.

The federal debt has climbed to nearly $36 trillion. Fed actions directly impact the federal government because it has to pay the same interest rates to service its debt as everyone else. Besides, as the Fed has steadily shrunk its balance sheet, selling off whatever Treasury securities it had bought up during quantitative easing, there's a glut of Treasury bonds in the market. Such an oversupply means that the United States Treasury has to bribe investors by promising more returns as the government attempts to fund its priorities.

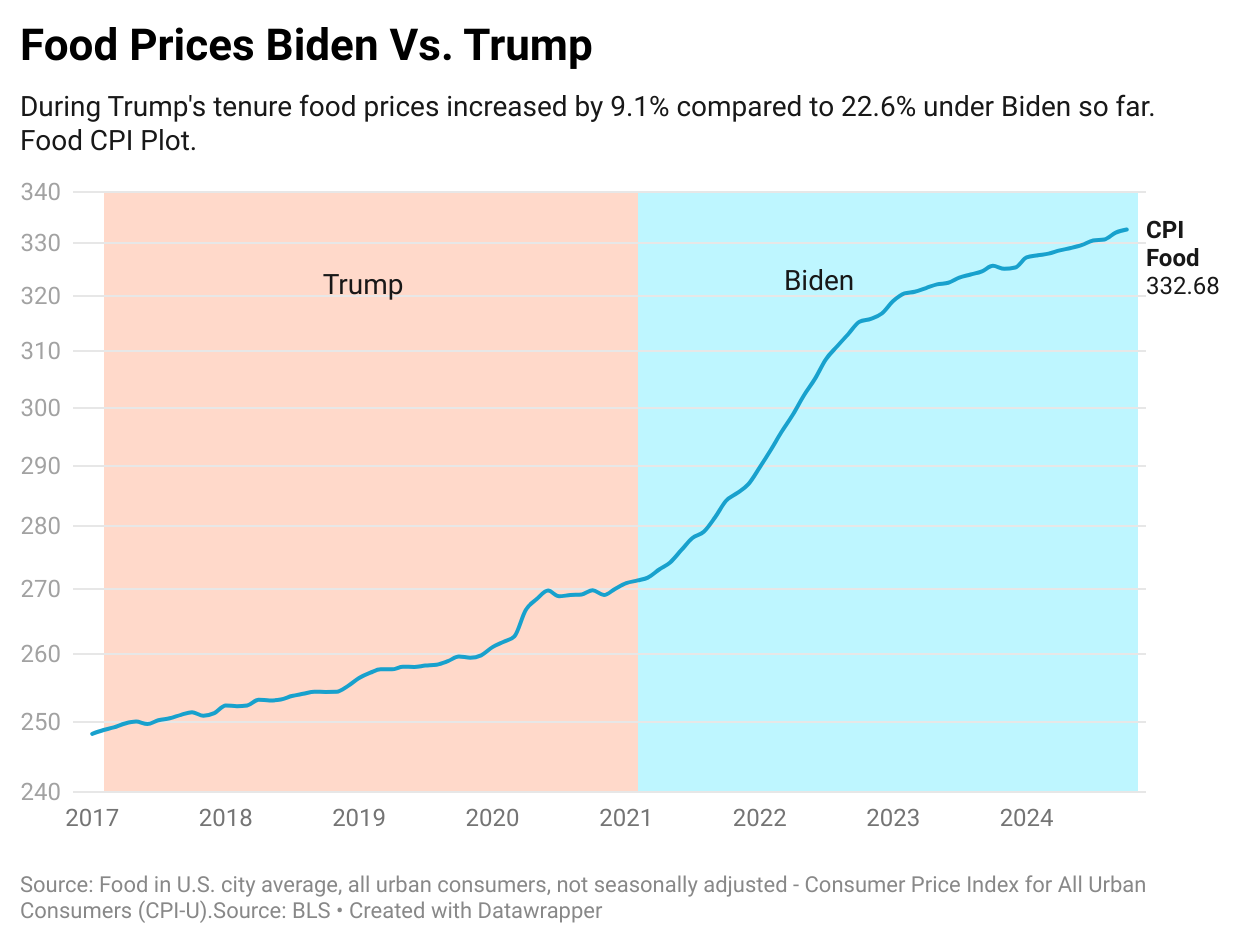

The federal debt is so large that the government spends over $1 trillion a year to service it - a budget line item greater than what America spends on defense. Biden's reckless handling of the economy has placed Americans in deep financial distress. Bidenflation, our measure of how much prices have risen since he took office, is above 20%. Everything costs more.

Leading up to the November election, polls showed that the Biden-Harris economic stewardship was the #1 issue on voters' minds. The Biden-Harris promise to lift the middle class, lower income inequality, and improve upward mobility had fallen flat. For 38 straight months, voters said the country was going down the wrong track.

When asked about the economy, Democratic candidate Kamala Harris repeatedly leaned on her experience growing up in a middle-class family as a crutch. She failed to convincingly articulate her economic policies—offering little beyond Soviet-style price controls, which even drew criticism from friendly corporate media. Her weakness in economic policy was a striking display of the vacuum of ideas among liberal economists rallying behind her.

On November 5, middle-class voters without a college degree broke decidedly for Trump across key demographic groups - Black men, Hispanic men and women, and white women.

Trump won the popular vote and 312 electoral college votes, helping flip the Senate to the GOP 53-47 while still retaining the House.

Liberal economics is dying. It is little wonder that its architect, Jared Bernstein, is confused, guilty, and facing a moment of "cognitive dissonance."