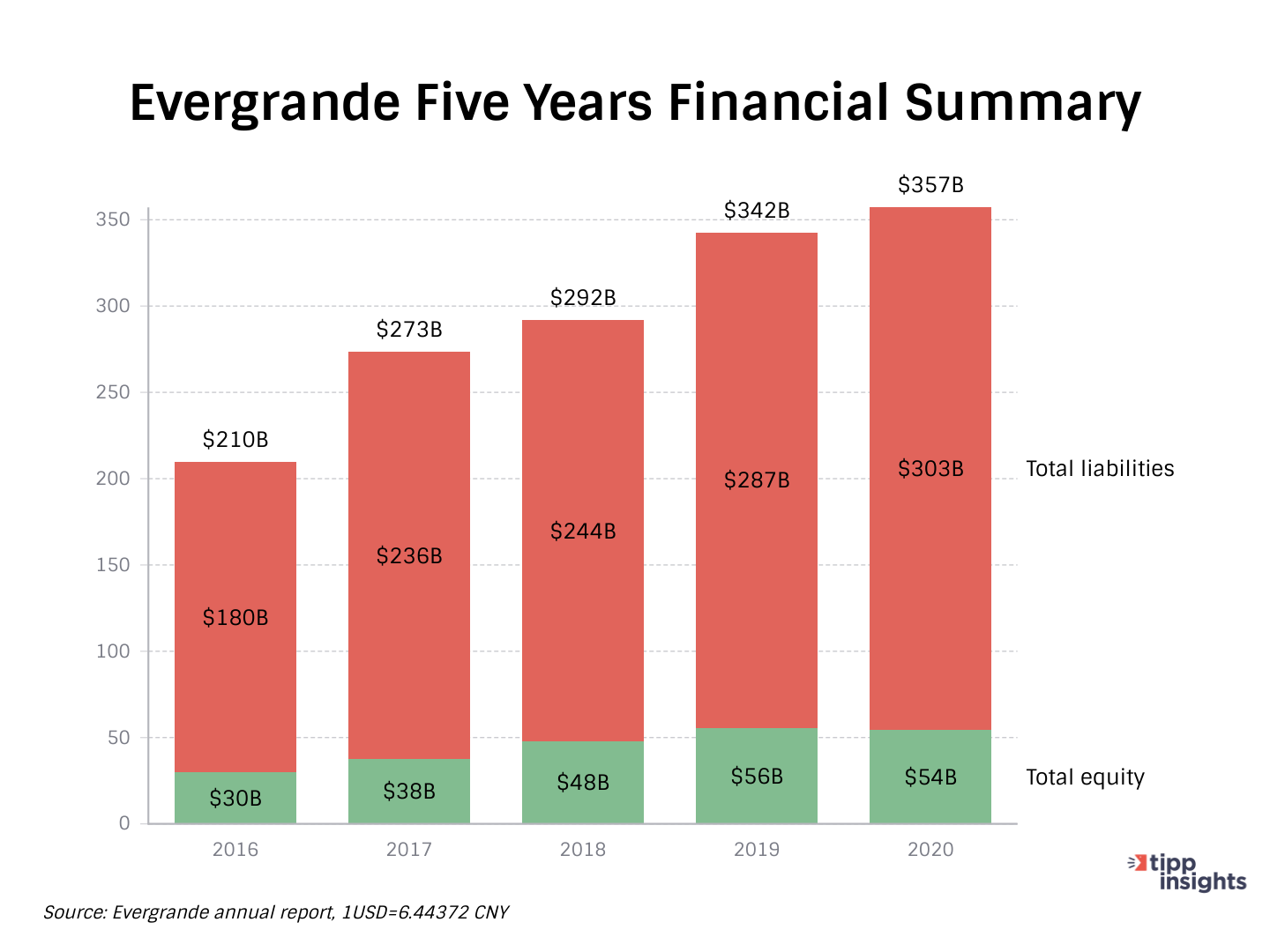

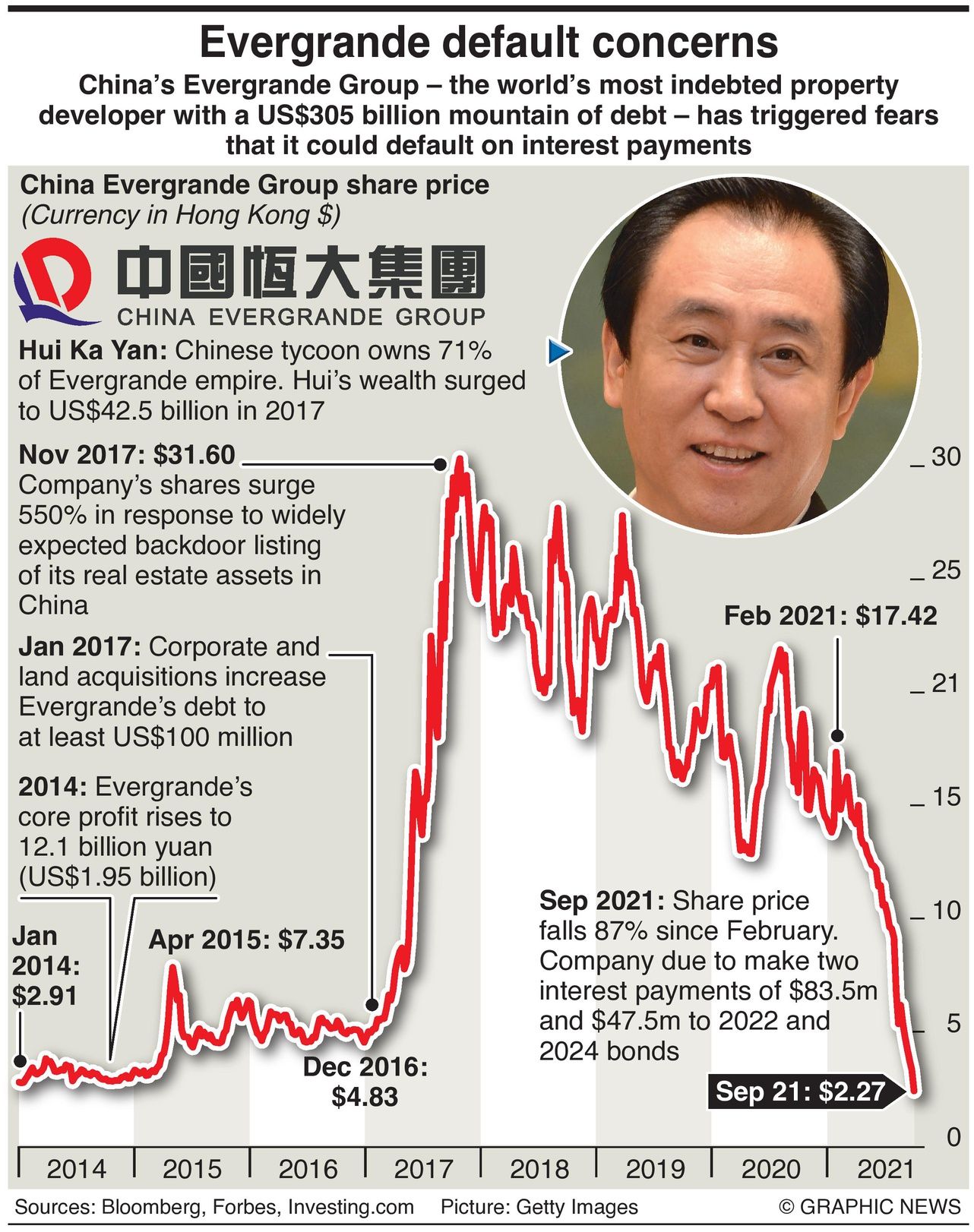

It is safe to say that the world's financial markets are holding their breath. All eyes are on the Chinese real estate developer Evergrande and Beijing. The company described as the 'most indebted developer,' to the tune of 300 billion dollars, came perilously close to defaulting on its interest payment and is riding out a grace period.

The Evergrande Group is the second-largest property developer in China by sales. Founded in 1996 by Xu Jiayin, the company is incorporated in the Cayman Islands and headquartered in the Houhai Financial Center in Nanshan District, Shenzhen, China. As of 2018, the group was estimated to be the most valuable real estate company globally.

Besides real estate, the private conglomerate owns the football club Guangzhou Evergrande F.C. and has a 45% stake in electric vehicle company Faraday Future. The group owns major theme parks; has investments in the entertainment and health sector; owns shares in Shengjing Bank, and sells wealth management products.

The questions surrounding the Evergrande fiasco are many. Is it shocking that a company leveraged to the extent of hundreds of billions of dollars went bust? Why were matters allowed to get this bad? What is Beijing going to do about the crisis? And, how will the global financial markets absorb the shock?

To those familiar with matters, Evergrande woes do not come as a surprise. China's over-inflated real estate and land development market makes up more than a quarter of the Chinese economy. The country's emergence as the global manufacturing hub producing a quarter of all goods globally fuelled large-scale urbanization.

Utilitarian concrete jungles sprung up around industrial hubs, and real estate became a driving force in the country's growth. Local governments rely heavily on proceeds and levies from land transactions for their revenue. Some estimates suggest that land development contributes close to half of the provincial revenues. Local authorities encourage speculation and mega projects to fund their schemes ranging from infrastructure projects to social welfare. Analysts suggest that it could be one of the reasons why those in power turned a blind eye to the ballooning real estate crisis, despite widespread reports of ghost cities and millions of vacant apartments dotting its landscape.

Comparisons have been made to the subprime lending crisis that rocked the US markets a decade ago. As Evergrande stands poised to fall, millions of middle-class Chinese could suffer immense losses. Close to one-half of household assets are vested in properties. Real estate was considered a lucrative investment. Some estimates suggest that the company has to deliver around 1.6 million apartments. The possibility that these homes may never be built or handed over now looms large.

Many more have invested in debt-fuelled Evergrande's wealth management products. Moreover, the group employed over 120,000 across its various concerns. It is daunting to consider the numbers employed at its various construction sites, the potential job losses, and the impact on the labor market. The collapse of the real estate sector could trigger an employment crisis in the most populous country in the world, recovering from the pandemic.

One could argue that Evergrande is a casualty of Beijing's attempts to deleverage and restructure its economy. Chinese administration is aware that the country's debt is estimated at around 200% of its GDP. Confident in the country's growth trajectory, Xi Jinping announced measures to rectify the debt situation. For instance, the "three red lines," drafted by People's Bank of China last year, for property developers stipulated a maximum debt-to-asset ratio of 70%, a 100% cap on net debt to equity ratio, and cash at least equal to short-term borrowing. Those who fail to meet the criteria face restrictions on borrowing further from financial institutions.

Evergrande has reportedly been shedding some of its assets to restructure its debt. But, the firm cannot easily cover the colossal sums it has borrowed from 171 domestic banks and 121 other financial institutions. Many of these with extensive exposure to Evergrande will be forced to restructure or close if Beijing does not prop up the tottering giant.

A complete collapse of the real estate behemoth will have repercussions far beyond the Chinese shores. The domino effect will affect global players like suppliers, bond investors, and financial institutions integrated into the Chinese market. For instance, more than a quarter of the profits of companies like Daikon and TOTO come from China. Chinese manufacturing is shrinking and reeling under the worst energy crisis in decades. Coupled with plummeting demand from the housing sector, the situation could drastically impact raw materials prices and could lead to a slowdown in commodity demand.

Surprisingly, as the news broke, Beijing did not rush to mitigate fears or quell speculation. As is the norm in the country, authorities crushed public protests by disgruntled investors. Many believe Premier Xi Jinping could carry on with his broader agenda of restructuring the country's core sectors and reigning in private players the Communist Party sees as growing too big.

Evergrande is unlikely to be liquidated; drastic restructuring would likely be the course ahead for the company. The Chinese government could step in to ensure the health of its banking system, thus fending off a financial meltdown. China can ill afford to set off a global financial crisis on the heels of the pandemic it unwittingly exported from its shores.

Evergrande is a classic example of a problem intrinsic to the Chinese economy. In pursuit of spectacular economic growth and world power status, the country is built on shaky foundations. Restructuring the way businesses are built and run will cause waves in the economy, at least in the short term. Over a million ordinary citizens are likely to lose their hard-earned money and the dream of owning a home.

But, ultimately, the authoritarian government's agenda will prevail. Above all, China is a communist country. Private wealth goes against the very ethos of the establishment. Private entities and individuals may be given room to create jobs and wealth. Secrecy and opacity are inherent in the country's dealings with the world making it difficult to gauge situations and risks accurately. It is best that no one – those who invest or trade with the Chinese – forget this.

ICYMI